By Alex Cole

1/ $USCI: U.S. Commodities Index Enters “Go” Trend

2/ GoNoGo Commodities RelMap

3/ Copper: A Base Metal

4/ Silver: A Precious Metal

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

$USCI: U.S. Commodities Index Enters “Go” Trend

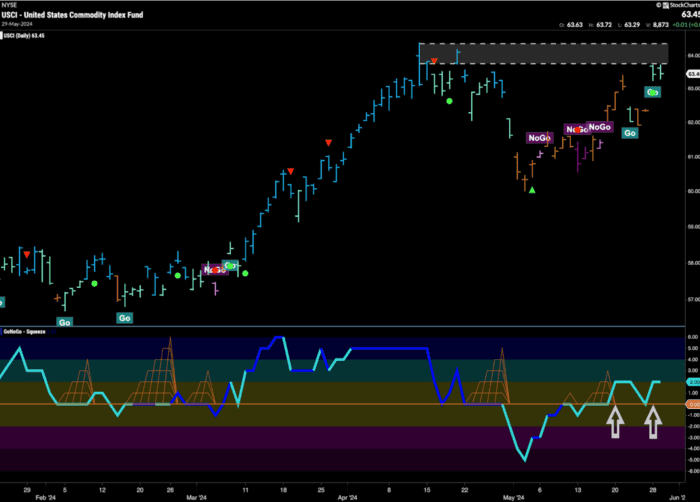

Yesterday we took a broad look across the asset classes to assess the technical environment in terms of trend, momentum, volume, and volatility. Today, we’ll dive a little deeper into the commodities space, and use GoNoGo methodology and new relative strength visualizations to look for leadership. The chart below shows the U.S. Commodities Index fund, $USCI, and we’ll use our three questions from yesterday to give ourselves a robust overview of the technical analysis.

- What is the trend?

- Where is momentum?

- Is there anything interesting happening around the zero line?

Courtesy of StockCharts

- GoNoGo Trend has recently flagged a new “Go” trend albeit with weaker aqua bars as price rallies after a period of amber “Go Fish” and “NoGo” bars

- Momentum is at a value of two, confirming the direction of the underlying “Go” trend

- GoNoGo Oscillator broke above the zero line several bars ago and has since retested and found support at that level. This was a leading indication of the trend change that we now see

2/

GoNoGo Commodities RelMap

Relative strength is an incredibly powerful concept in the study of technical analysis and price action. It allows the investor to generate alpha, by investing in areas of the market that are outperforming, and staying away from those that are underperforming. The GoNoGo Commodities RelMap below applies the GoNoGo Trend methodology to several relative strength ratios and plots the trend colors in a panel with no regard for price action. This allows us to focus on the trend itself and uncover areas of leadership.

Courtesy of StockCharts

What we can see clearly is that when looking at a broad spectrum of commodities relative to the larger equity index, the leadership (blue and aqua panels) is coming from a select few areas. With the exception of natural gas (in a relative “Go” trend in the third panel from bottom) all of the other panels painting blue and aqua relative “Go” colors are base and precious metals.

3/

Copper: A Base Metal

Given what we discovered above, we’ll look at copper, a base metal, and use the GoNoGo Chart to give us a complete understanding of the technical environment. We can see that $CPER, the copper fund, has been in a “Go” trend since February of this year and has made a series of higher highs and higher lows. Below, we’ll answer our three questions.

Courtesy of StockCharts

- GoNoGo Trend tells us that the weight of the evidence suggests a “Go” trend remains in place, although we do see weaker aqua bars as price falls from its most recent high

- A Go Countertrend Correction Icon (red arrow) just after the high suggested that as momentum waned price may struggle to go higher in the short term and now the oscillator is resting at the zero line

- As GoNoGo Oscillator rides the zero line, we see the beginning of a GoNoGo Squeeze build and we note the reduced volatility. GoNoGo Oscillator is also a dark blue indicating increased relative volume on this pullback. It will be important to pay attention to the direction of the break of the GoNoGo Squeeze to help determine price’s next direction. If this “Go” trend is to remain healthy, we will expect the oscillator to find support at zero as it has through the duration of the trend thus far

4/

Silver: A Precious Metal

The metals are helping drive the commodity index higher and precious metals are playing their part. Below is a chart of $SLV, the silver fund, with the full suite of GoNoGo tools applied. After entering the “Go” trend at the beginning of March, price has made a series of higher highs and higher lows. We can see that as price fell from its most recent high, it found prior high support. This kind of traditional technical analysis is easy on a GoNoGo chart because there is nothing else on the chart distracting us from focusing on price movements. On to our three questions.

Courtesy of StockCharts

- GoNoGo Trend is painting aqua “Go” bars, telling us that the trend remains in place

- GoNoGo Oscillator is at a value of 1 and volume is light

- The zero line has acted as resistance twice already during this “NoGo” move, but now we see that it failed to hold and the oscillator has broken into positive territory

—

Originally posted 30th May 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!