1/ When Attention Leads Price

2/ Social Users Ditch SMCI

3/ Doing it Again in DogeCoin

4/ $SAVA Sentiment in Action

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

When Attention Leads Price

With retail investors and traders more involved in the markets than ever, social media data has become a valuable tool in identifying where they’re putting their money to work. Since Stocktwits is the largest social media platform for active investors and traders, our first-party data (available for free on our site) is a great tool for identifying opportunities (and risks) in various assets.

Our sentiment data is defined both by the level of activity around a symbol as well as the actual content of the messages surrounding it. On each symbol page, we offer a metered score of 0-100 to help market participants identify how bullish/bearish and how active/inactive retail is around a stock.

This data is often used as a supplemental indicator, much like volume, to surface potential opportunities before they make a large move in the market and/or become recognized by the broader media.

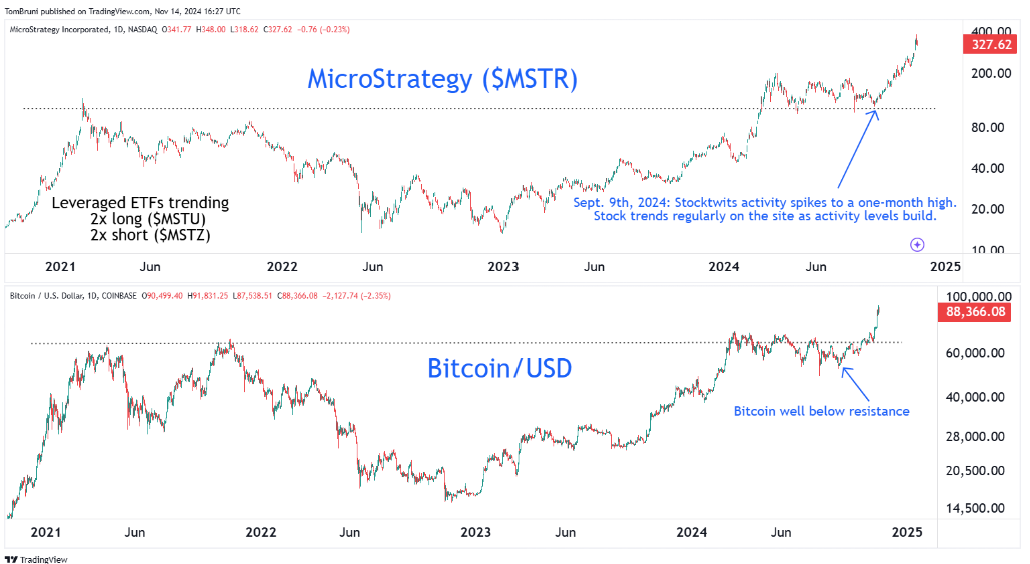

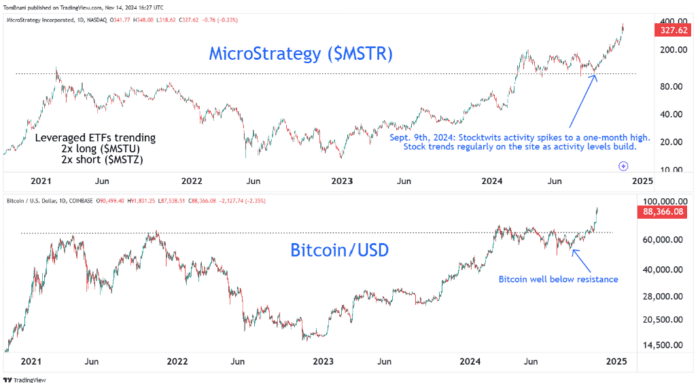

Our first example of this in action is MicroStrategy ($MSTR), which saw a spike in views and message activity on September 9th, 2024, with the stock trending regularly on our site from there on out. User posts were viewing the strength of MicroStrategy as a leading indicator for Bitcoin’s breakout…and they were right, with Bitcoin finally following through with a breakout of its own weeks later.

2/

Social Users Ditch SMCI

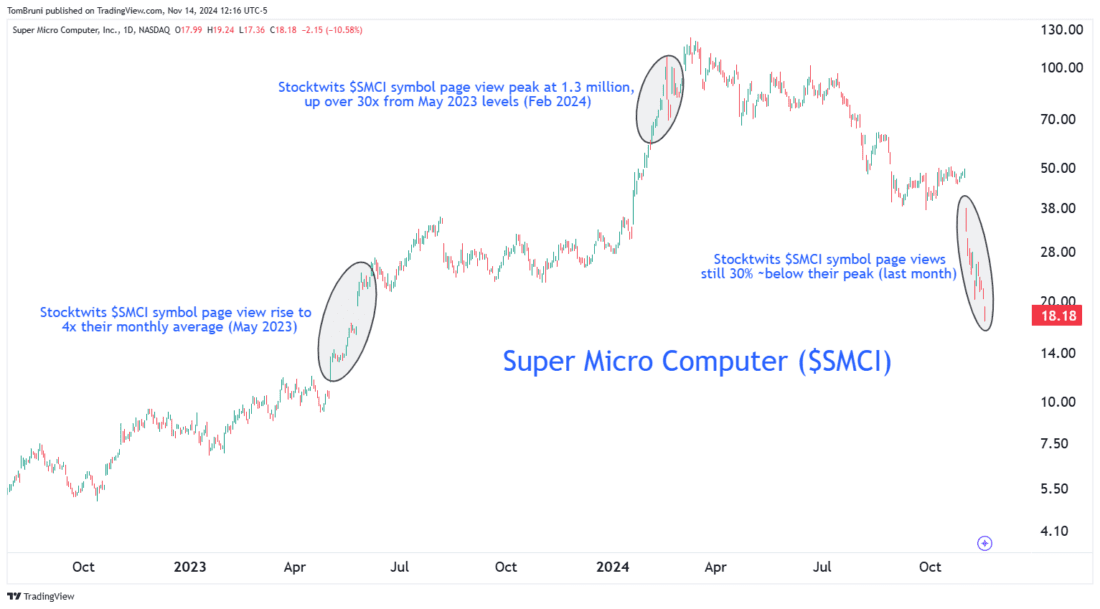

While retail attention is great while a stock has it, as prices climb (or fall) further and further in one direction, more ‘attention’ and activity is needed to support the stock.

A solid example of this occurred in Super Micro Computer ($SMCI), which saw a surge in views on Stocktwits beginning in May 2023. As prices climbed higher, so did attention around the symbol, with it peaking at 30x May 2023 levels in February 2024. However, attention levels on Stocktwits fell off their peak levels, and the stock ended up peaking shortly after, too. Now, with prices falling to the downside, message activity is picking up again but is still 30% below its peak.

It shows that, much like a momentum reading, social sentiment can be used to measure the absolute and relative attention levels a stock is getting. When divergences between social activity/attention and price occur, that’s generally a signal worth investigating further.

3/

Doing it Again in DogeCoin

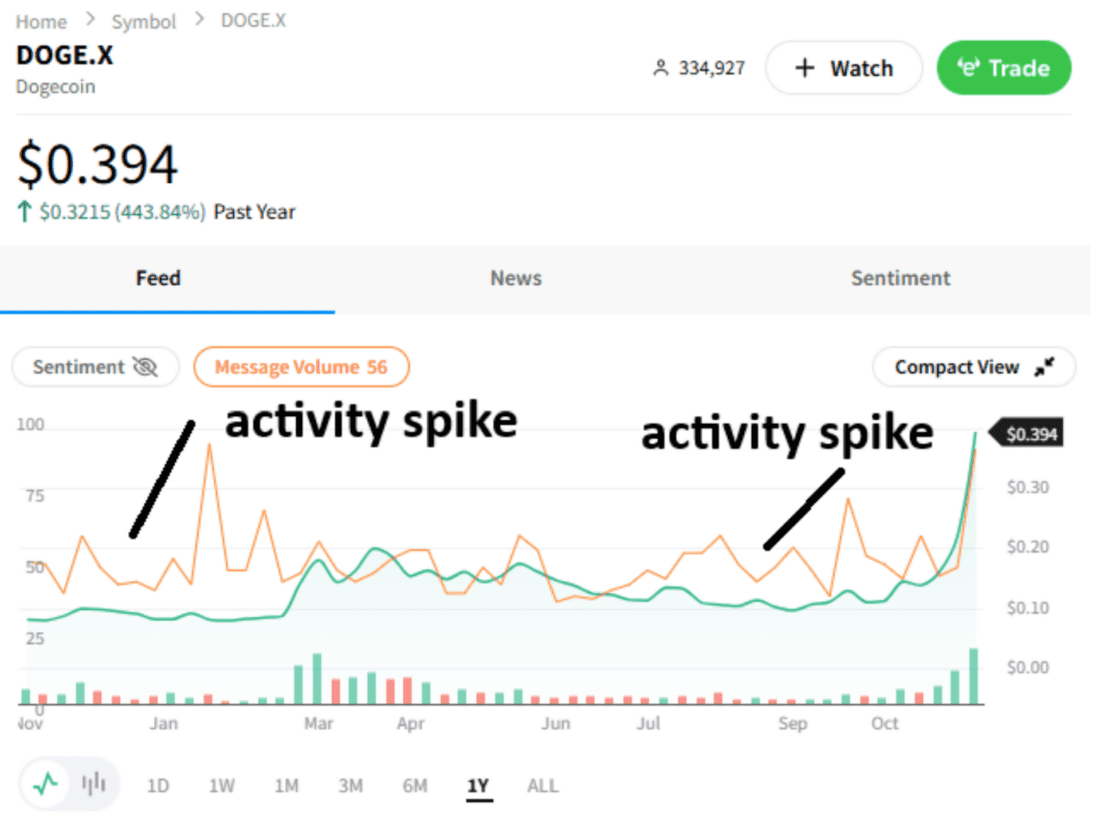

For certain asset classes, social activity (or social momentum) is a critical factor in understanding the price action. For example, crypto assets like DogeCoin trade almost solely on attention rather than fundamentals.

The meme coin made an epic comeback this year, and Stocktwits users were ahead of both major moves. The chart below shows an activity spike in message volume on our site in late January, which remained elevated until prices soared in March. Then, activity spiked again in September, shortly before the crypto made its latest run to new highs.

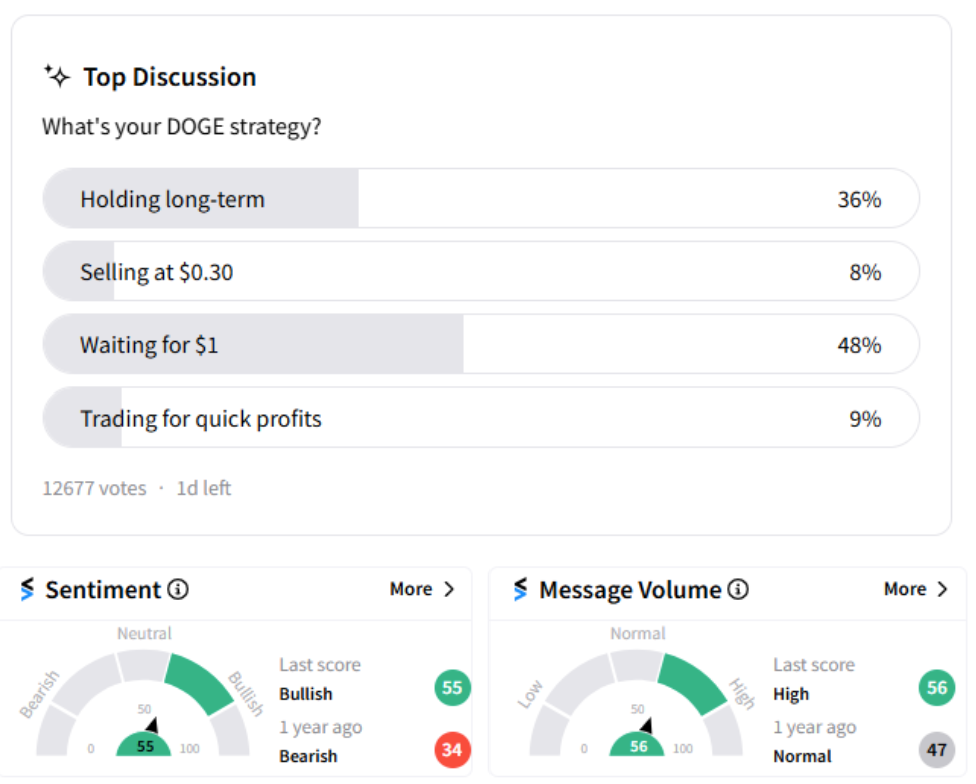

In addition to the activity data, Stocktwits also has polls and other mechanisms in place to keep a pulse on retail’s feelings toward certain assets. Below is our recent DogeCoin poll, which shows that most of our users are either looking to hold the meme coin long-term or waiting until $1 to sell it. Given prices are only at $0.40 today, having this info on how thousands of players in the market plan to trade it is an additional data point to consider.

4/

$SAVA Sentiment in Action

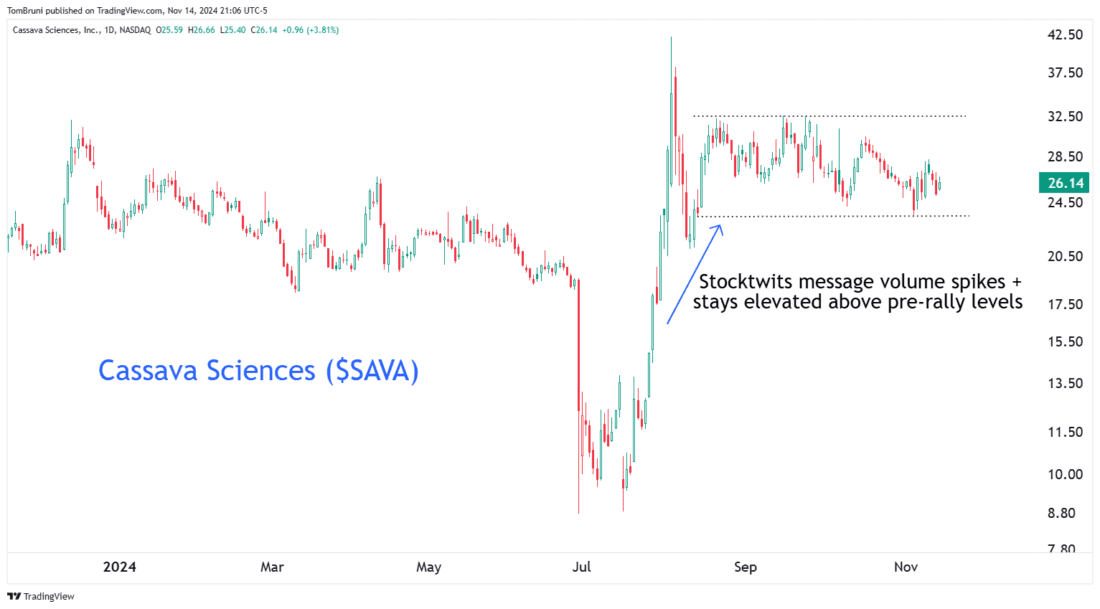

To help close the loop and provide an actionable example of this, I’ll leave you with a current setup based on improving social data. Cassava Sciences ($SAVA) is an embattled small-cap pharmaceutical company that saw a strong price rise during August, bringing Stocktwits message volume with it. Since the initial spike, prices have essentially gone nowhere, consolidating sideways and waiting for their next catalyst. Meanwhile, Stocktwits message volume has also pulled back but remains well above the levels it was before prices jumped. This suggests a continued interest in the stock from retail investors, and the sentiment of messages on the site is in ‘bullish’ territory as of writing this.

Overall, this suggests a continued upward bias in the stock, with traders likely to get involved again at the first sign of renewed, upward price momentum. At the very least, it suggests keeping this stock on your watchlist because the social momentum remains intact.

—-

Originally posted 15th November 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!