1/ China Internet Faces Decline Amidst Weakness

2/ Energy Sector Anticipates Potential Downturn

3/ Ark Rally Hits Resistance, Drop Expected

4/ Bitcoin Struggles Amid Stagnant Range

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

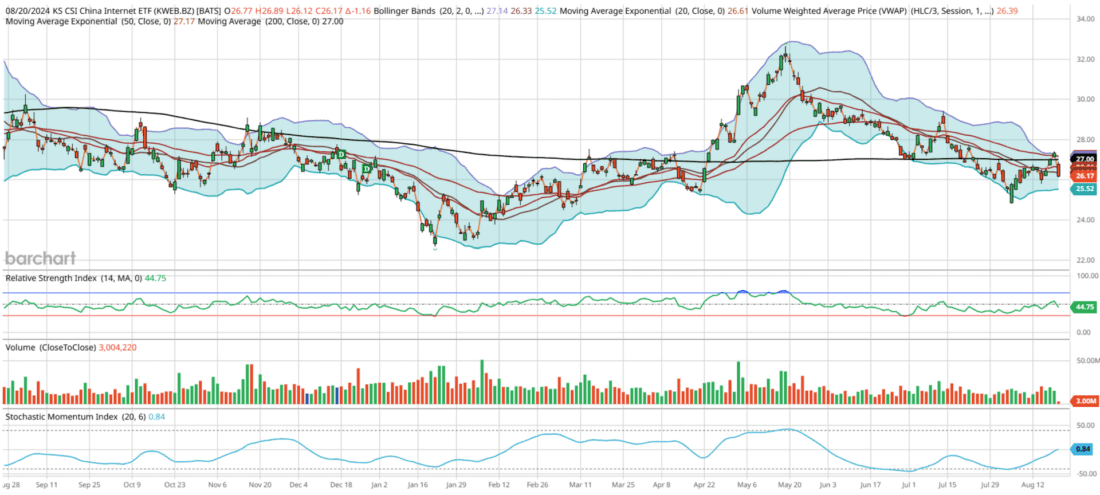

China Internet Faces Decline Amidst Weakness

Courtesy of barchart

Earlier this week, I pointed out the challenges facing Chinese markets, and the KraneShares CSI China Internet ETF (KWEB) exemplifies this frustration. Concentrated in top holdings like Pdd Holdings, Ke Holdings, and Vipshop Holdings, KWEB dropped 4% today amid aggressive selling. Since peaking at $32.63 on May 17th, the ETF has consistently made lower highs, with a flatlining 200-day moving average at $27.00.

Despite only briefly entering oversold territory—one day in January near its 52-week low and one day in June—KWEB experienced a period of overbought conditions in May, when its Relative Strength Index (RSI) surpassed 70 for about a week and a half, leading up to its 52-week high. For the last six months, the 200 DMA has remained flat, indicating a lack of momentum.

Similar to the broader China ETF FXI, KWEB dropped to $24.80 during the Japan crash on August 5th before rallying 10.5% to $27.41 two weeks later. However, nearly half of those gains were wiped out today. Given its underperforming profile, I believe KWEB has already exhausted much of its rally and is likely to decline to around $24.95 over the next three weeks, representing a nearly 5% drop.

2/

Energy Sector Anticipates Potential Downturn

Courtesy of barchart

Yesterday, I highlighted frustrations in the crude oil market, and today I’m turning to the S&P 500 Energy Sector SPDR (XLE), which is heavily weighted with Exxon Mobil Corp and Chevron, comprising 40% of the ETF. After bottoming out at $78.98 on January 18th, XLE surged to its 52-week high of $98.97 by April 12th, marking a 25% gain in just three months. Since June, the 200-day moving average (200 DMA) has flatlined at $88.66, serving as strong support since March when XLE began a month-long overbought phase driven by geopolitical tensions in the Middle East.

XLE has been confined to a 12% range between $85 and $95 since May. Following an 8% rally from the Japan crash until August 19th, energy stocks are down 2.6% today closing just above the 200 DMA. I anticipate a potential minor bounce to $90-92 this week, but I don’t expect much more upside. Instead, XLE is likely to decline toward $85.70 over the next three weeks, a drop of nearly 4%.

3/

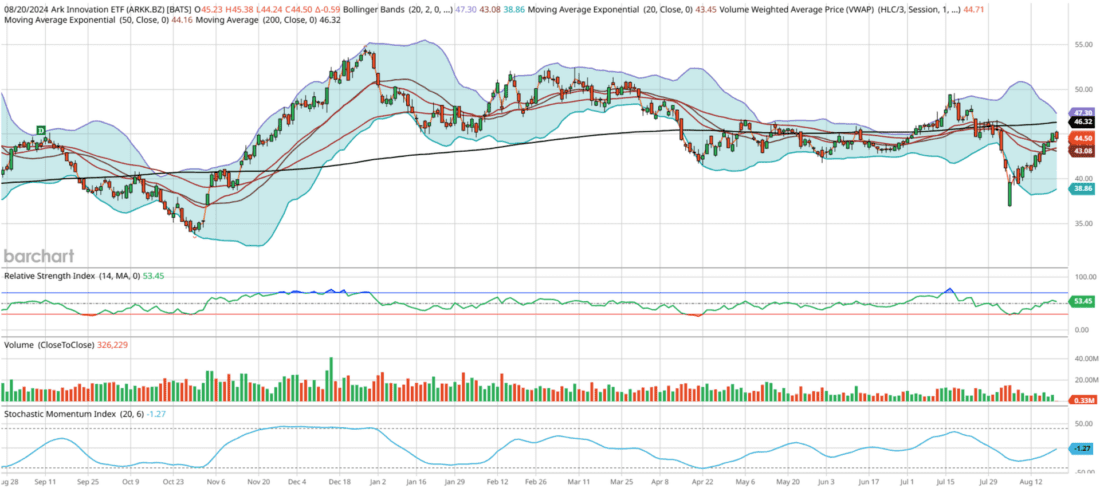

Ark Rally Hits Resistance, Drop Expected

Courtesy of barchart

The Ark Innovation ETF (ARKK) has experienced a remarkable rally since hitting a low of $36.85 during the Japan crash on August 5th, surging to $45.09 just two weeks later—a 22% gain. The fund reached its 52-week low on October 30th, as the “Higher for Longer” interest rate narrative took a toll on many of the pre-profitable companies within the ETF. However, it rebounded strongly, climbing 62% in two months to hit a 52-week high of $54.52 during Christmas week, underscoring the volatility of its components.

Key holdings in ARKK, managed by Cathie Wood, include Tesla, Roku, and Coinbase, which together make up 31% of the ETF. Since April, ARKK has been range-bound between $37 and $50, with its 200-day moving average (200 DMA) now showing some upward slope at $46.32. However, the ETF has struggled to maintain levels above its 200 DMA for any significant period since April. It was last overbought in mid-July,

reaching a 78 RSI as it hit its three-month highs.

Looking ahead, I expect ARKK to face significant resistance at $44.90-$45.60, just below its 200 DMA, reinforcing its overall trend of underperformance. I anticipate a decline to around $39 over the next three weeks—a 12% drop, giving back roughly half of its gains since the Japan crash.

4/

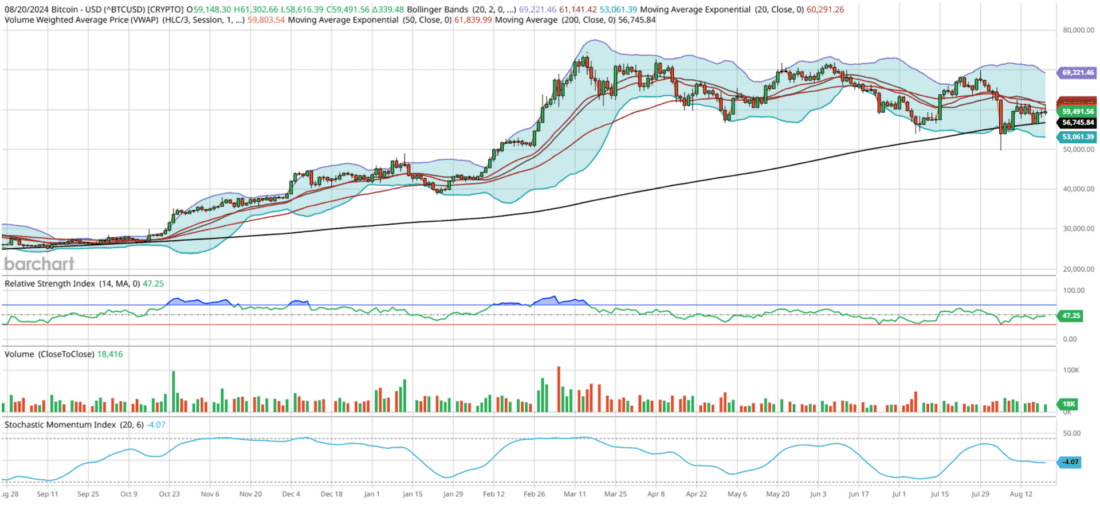

Bitcoin Struggles Amid Stagnant Range

Courtesy of barchart

Bitcoin, the top-performing asset both year-to-date and over the past 52 weeks, has recently struggled to break out after reaching its all-time high of nearly $74,000 on March 14th. While it hasn’t entered oversold territory in the past year, it was overbought from mid-October through mid-November, and again from mid-February through mid-March as it climbed to those record highs. The 200-day moving average (200 DMA), currently near $57,000, continues to provide strong support. Bitcoin has remained above this key support level for nearly the entire past year, even during its 52-week low of $25,000 in September.

Despite multiple ETF approvals for Bitcoin and other cryptocurrencies like Ethereum, investors remain frustrated as BTC has been stuck in a $50,000 to $74,000 range for the past six months. The chart suggests a potential small surge to $61,000-$62,000 in the coming week, but I anticipate a subsequent dip in September toward its $57,000 support level. The outlook suggests continued frustration for BTC holders.

—-

Originally posted 21st August 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!