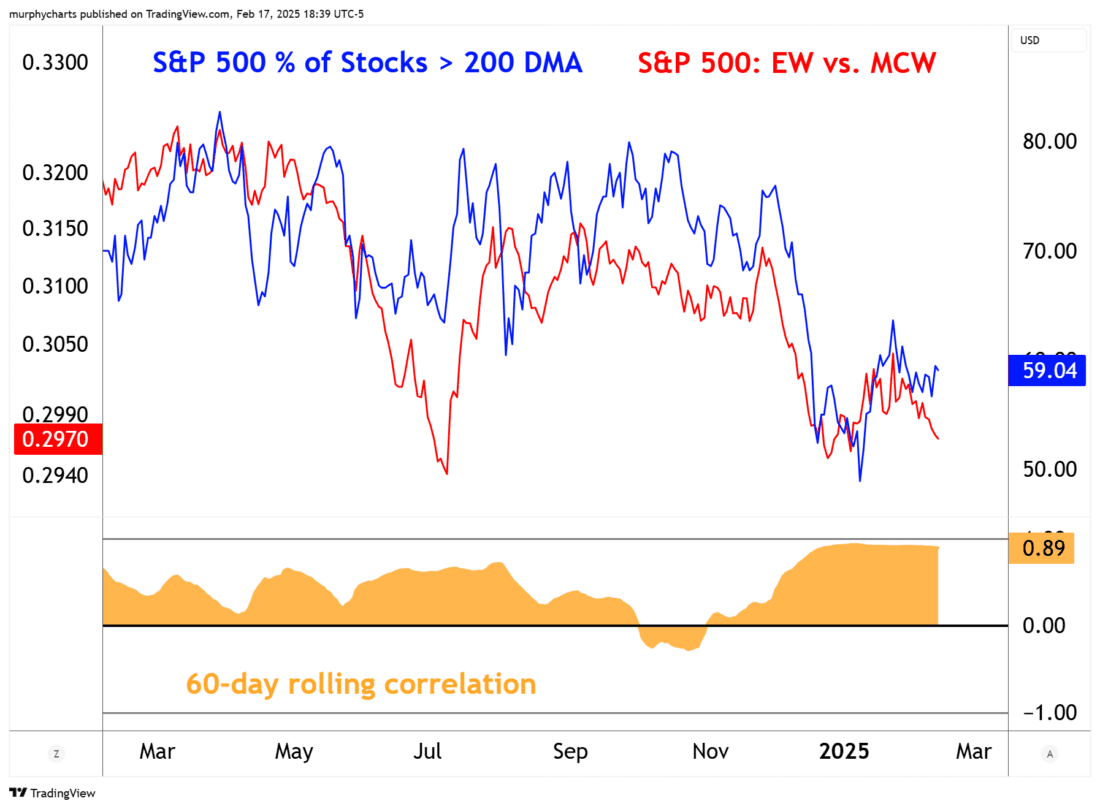

1/ Strong Breadth & Equal Weight

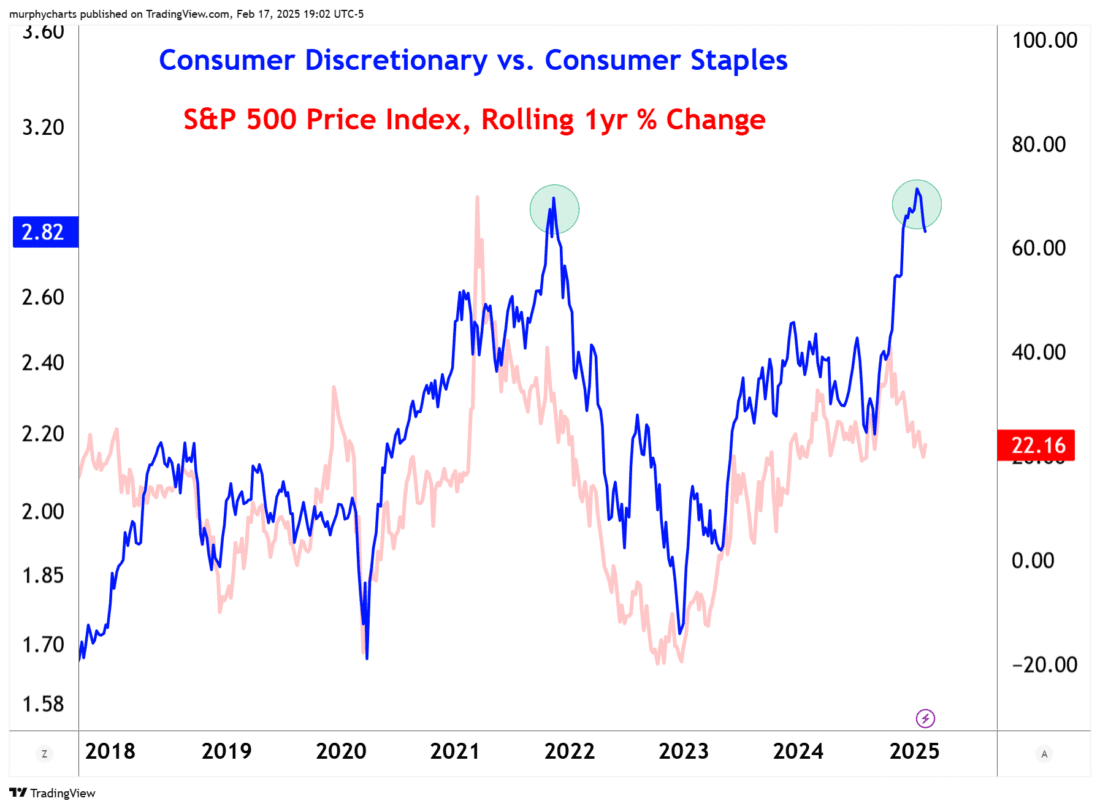

2/ Discretionary vs. Staples

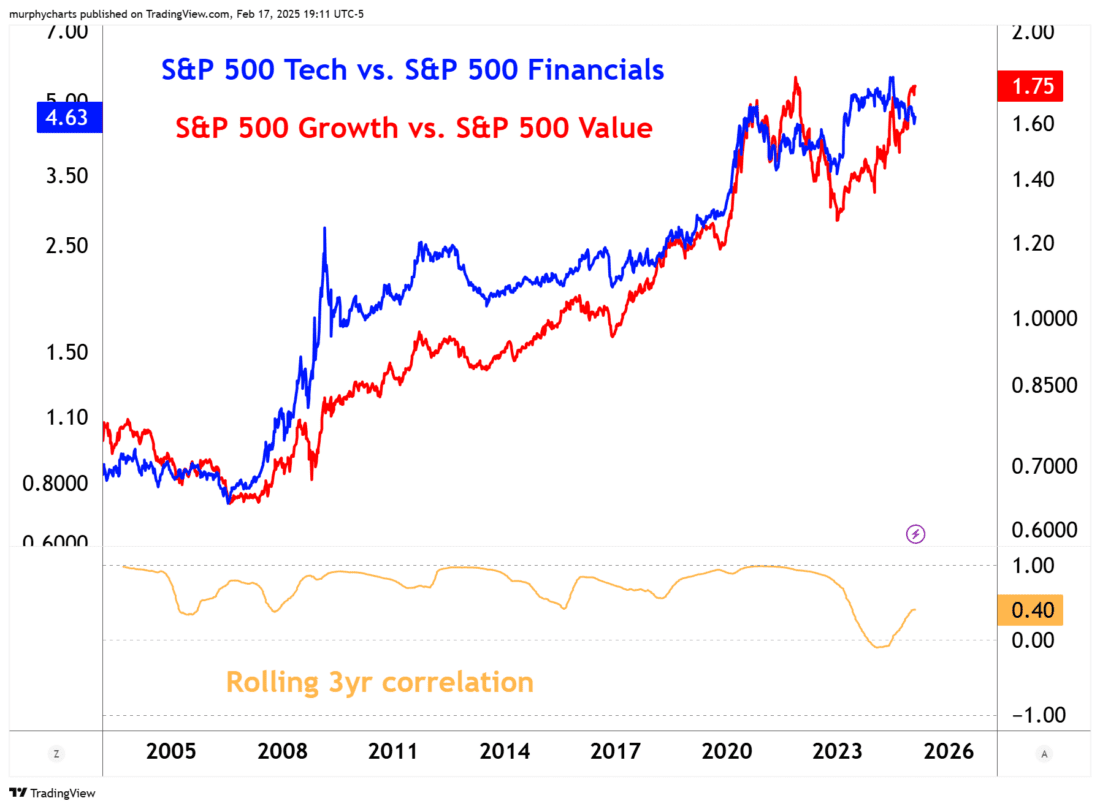

3/ Growth vs. Value

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Strong Breadth & Equal Weight

Moving average breadth is improving and recovering off the lows to start the year. 59% of S&P 500 companies are now trading above the 200-day average. This breadth indicator strongly correlates to the ratio of S&P 500 Equal-weight vs. S&P 500 Market-cap Weight.

If breadth is improving and more stocks are in healthy uptrends, one could assume equal-weight is outperforming market-cap weight. Historically, some of the strongest spurts of equal-weight outperformance followed an expansion of moving average breadth. Something to keep an eye on in 2025!

2/

Discretionary vs. Staples

One of my favorite gauges of investor risk appetite is the price ratio of Consumer Discretionary to Consumer Staples stocks. Typically, new highs are meant to signal increased risk appetite among investors i.e. investors are bidding up cyclical stocks and selling defensive stocks. However, the ratio is trading +3 standard deviations above the 3yr average. In recent years, this level has signaled muted forward 12-month price returns.

3/

Growth vs. Value

The definitions of growth and value equity haven’t changed, but the constituents that make up various growth and value indices certainly have. The below chart displays two price ratios. The first compares S&P 500 Growth Index to the S&P 500 Value index (red line). The second compares the S&P 500 Technology sector to the S&P 500 Financials sector (blue line). Historically, the ratios held a very strong positive correlation. For obvious reasons, Financials tend to be more represented in the Value Index and Technology more so in the Growth Index.

The story here is in the decoupling of the ratios. The rolling 3-year correlation reached negative territory in 2024. The reason is in part due to the growth of the Technology sector. Just 5-years ago in February 2020, the Technology sector represented 8.6% of the S&P 500 Value Index. Today, Technology is the largest weighted sector at 24%, surpassing even Financials (#2 weighted sector, 15.6%). The top 3 weighted companies in this Value index are Apple, Microsoft, and Amazon. Yes, you read that correctly. My point being, is that not every Large-cap Value Index is built the same. Know what you own and why you own it!

—

Originally posted 18th February 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!