Your Weekly Roadmap with Jay Woods, CMT

1/ A Trick or Treat to Finish October?

2/ Economic Data – PCE, Unemployment

3/ Some Magnificent Earnings

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

A Trick or Treat to Finish October?

It’s the final full week of trading before next Tuesday’s Presidential Election. Rhetoric may get crazy as it is anyone’s guess as to the outcome of this race. Will that matter?

As I have stressed time and again – the headlines will be unpredictable and the past does not prognosticate future results, but we have a track record that shows even with a contested election, that the market should continue on its uptrend once we get through Election Day.

Let’s look at 2016…

Contentious election. Surprise result. Stocks were limit down overnight. They opened lower and reversed. Bottomed post-election morning and never looked back into the year end.

Now 2020…

Contentious election. Contested result. Sell-off into Election Day and then rally afterwards. Rally until year-end and new highs two days after an insurrection on the Capitol steps. I think it’s safe to say the market didn’t care about your politics.

What will drive us higher this week and beyond?

This week it will be economic data ahead of next week’s FOMC meeting on November 6th. We are also experiencing the biggest week of earnings this quarter.

2/

Economic Data – PCE, Unemployment

Economic Data. This week we get several pieces of data – GDP, housing numbers, wholesale inventories – but none may be more important than the unemployment report and the PCE. Each one is a key component in the Fed’s dual mandate – stable unemployment and easing inflation – in navigating their hopeful soft landing.

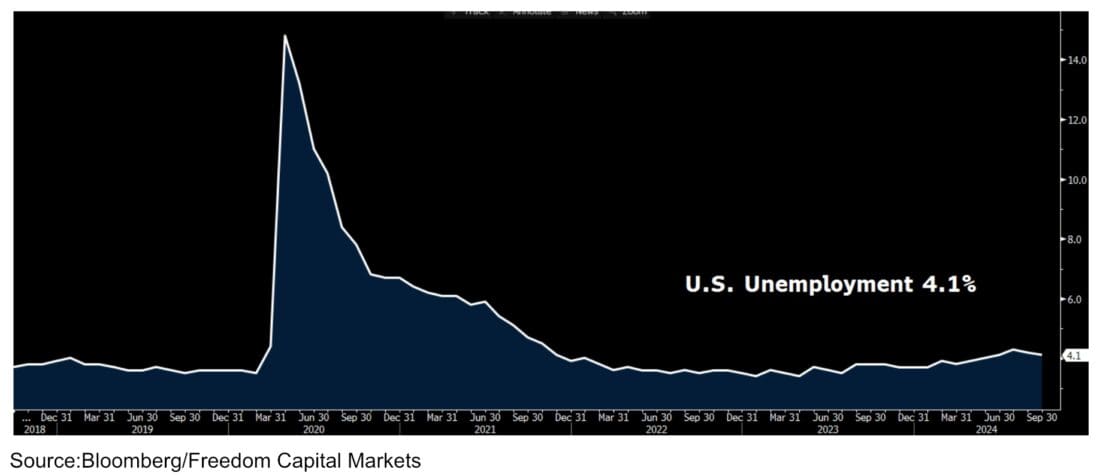

Unemployment Report. The October unemployment report will be released on Friday morning. What effects, if any, will the recent 50 basis-point rate cut have on current unemployment numbers.

Last month the rate was expected to come in at 4.2% but surprised many by coming in slightly lighter at 4.1%. Expectations are for the rate to remain unchanged at 4.1%. However, there is a chance that recent Hurricanes in the southeast may cause a temporary rise in the numbers.

Historically, the rate remains low, but it is now above the 2019 pre-Covid average. The most important aspect is that the trend remains neutral and there are no surprises to the upside. A tick higher and the path to 2% inflation and a stable labor market gets much rockier.

Personal Consumption Expenditures (PCE) could be the most important data point the Fed reviews as they head into their meeting next Tuesday and Wednesday.

As you know, because I reiterate every month, the Fed prefers this inflationary measure more than the CPI because it covers a broader range of spending. Unlike the CPI and PPI numbers, we haven’t had many upside surprises in the PCE as it continues to slowly trend lower.

The PCE is expected to drop to 2.6% when numbers are released on Thursday. That keeps the trajectory going to their desired 2% goal. The fear is that any tick higher means inflation is beginning to trend the wrong way and that maybe the recent ½ point cut was premature and future cuts may be detrimental to a declining PCE.

3/

Some Magnificent Earnings

Magnificent Earnings. It would be an understatement to say it’s a huge week for earnings as five of the largest companies in the world report. It’s so big that five of the six top market cap companies are set to report within a three day span. These stocks will move the markets.

Capex will continue to be a major focus as they spend feverishly due to strong AI demand. We know about the big spend but are we starting to see the benefits of their investments? Will this be perceived as money well spent or will the stocks get punished?

Only META and Nvidia have been able to sizably outperform the S&P 500 in 2024. So in that sense they are the leaders. Can Apple, Amazon, Alphabet, and Microsoft take the baton and lead the indexes even higher when they report this week?

Last quarter saw mixed results. Microsoft dropped -1.1%, Amazon -9%, and Alphabet -5%. Apple gained 0.7% and Meta was the big winner up 4.8%. Since that time the winners have managed to rally to new all-time highs and the three decliners have made up their losses from the last quarter, but are still well below their 2024 highs.

The most intriguing one to me was Amazon. They gave mixed signals in its financial outlook last quarter. While they beat EPS estimates, concerns emerged over slower-than-expected revenue growth in its cloud division, Amazon Web Services (AWS). The guide was cautious as management’s comments indicated that although AI growth is promising, it remains in early stages, leading some investors to hesitate about immediate upside potential. This was a key factor to the post-earnings sell-off – big spend and no results… yet.

Technically, shares have filled the gap caused by last quarter’s sell-off. They regained their footing above the 200-day moving average and are poised to move again. Clearly Thursday’s earnings will be that catalyst.

Watch near term support around the 200-day at $179.65. If it fails to hold, look at the last quarter as your guide. Can the stock withstand the shock of a negative report and quickly get back to its moving average?

To the upside, watch the all-time highs at the $200 level. There has been major resistance there as well. Part of that has been due to a well known seller at this price point in founder and former CEO Jeff Bezos. Let’s see if a good report and guide can lift shares even higher than there.

—

Originally posted 29th October 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!