Stocks gave back all of yesterday’s gains and a bit more, with the S&P 500 finishing the day lower just over 1%. Tonight, the FX market will start to get really interesting, with the BOJ rate decision around 11 to 12 PM EDT. More important than the decision will be the read-through for the future path for policy, and then Governor Ueda’s press conference will follow.

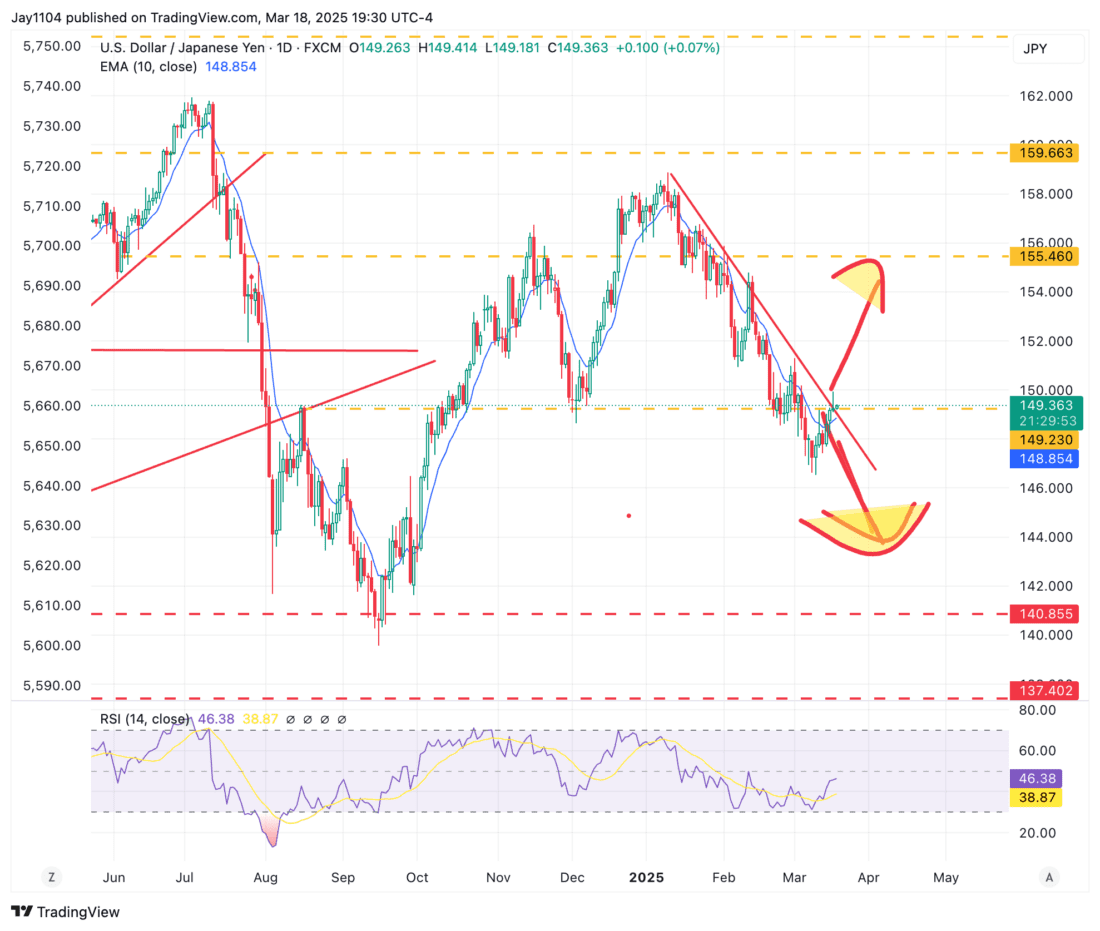

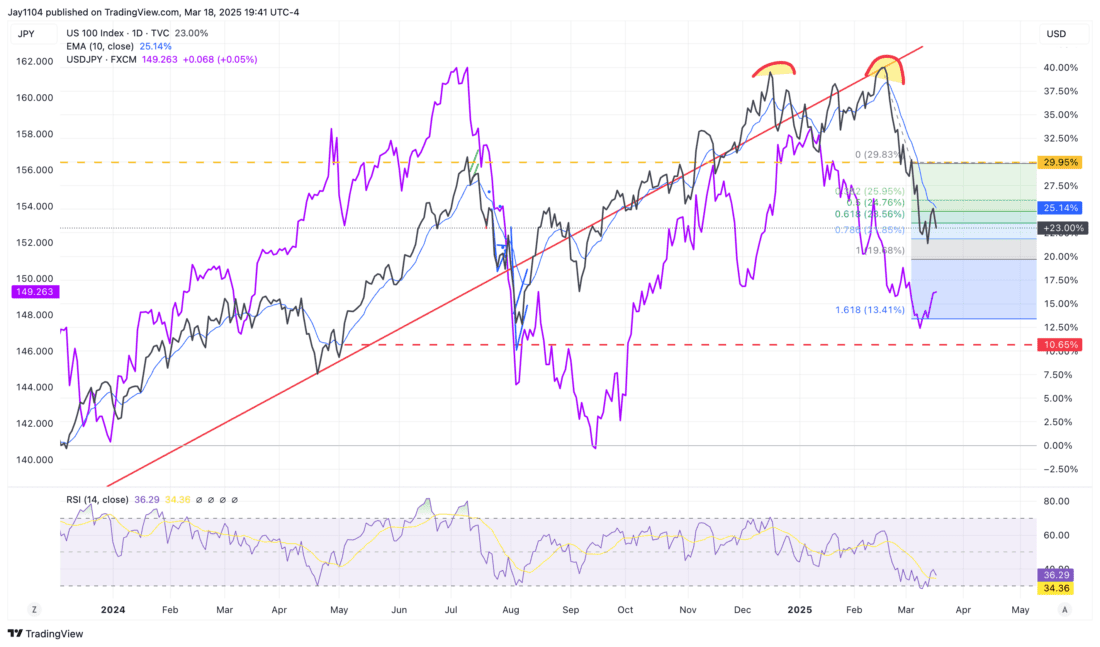

Of course, tomorrow at 2 PM ET, we get the FOMC meeting decision, the Summary of Economic Projections, and then the Powell presser. That leaves the USDJPY in the crosshairs, and really, the path for the USDJPY couldn’t be more two-way. You can flip a coin at this point to call the direction.

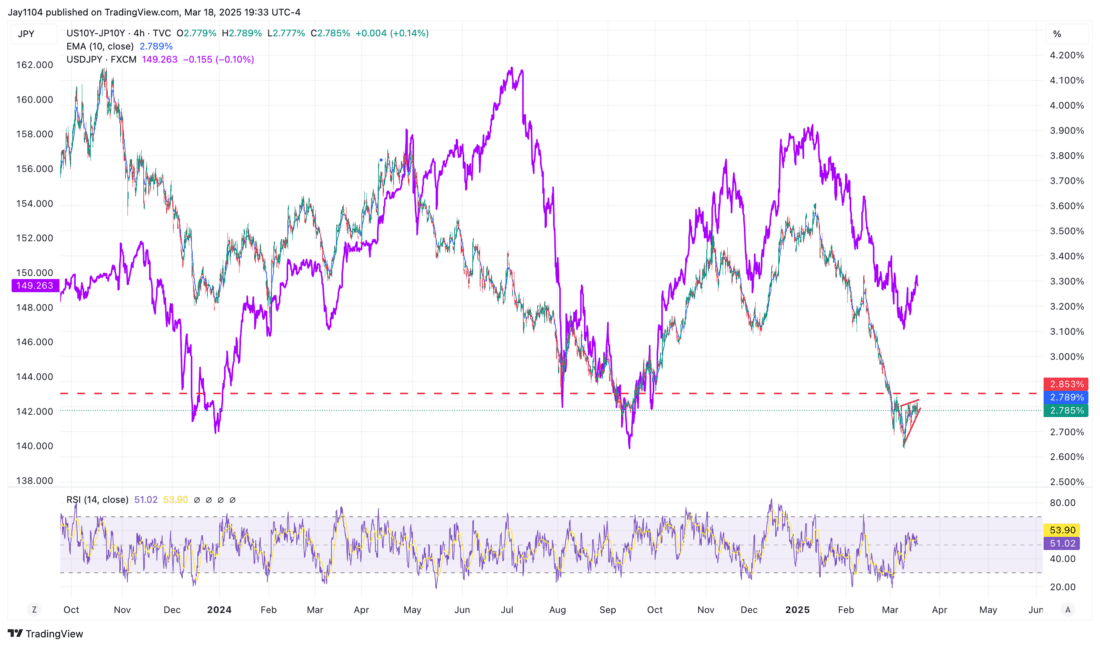

However, when looking at the spread between the US 10-year and the 10-year JGB, the bias appears to suggest that the spread continues to narrow; it certainly looks like some kind of bear pennant has formed in the chart.

If the spread narrows further, it would suggest that the USDJPY falls, meaning that the Yen strengthens since the two track each other almost perfectly.

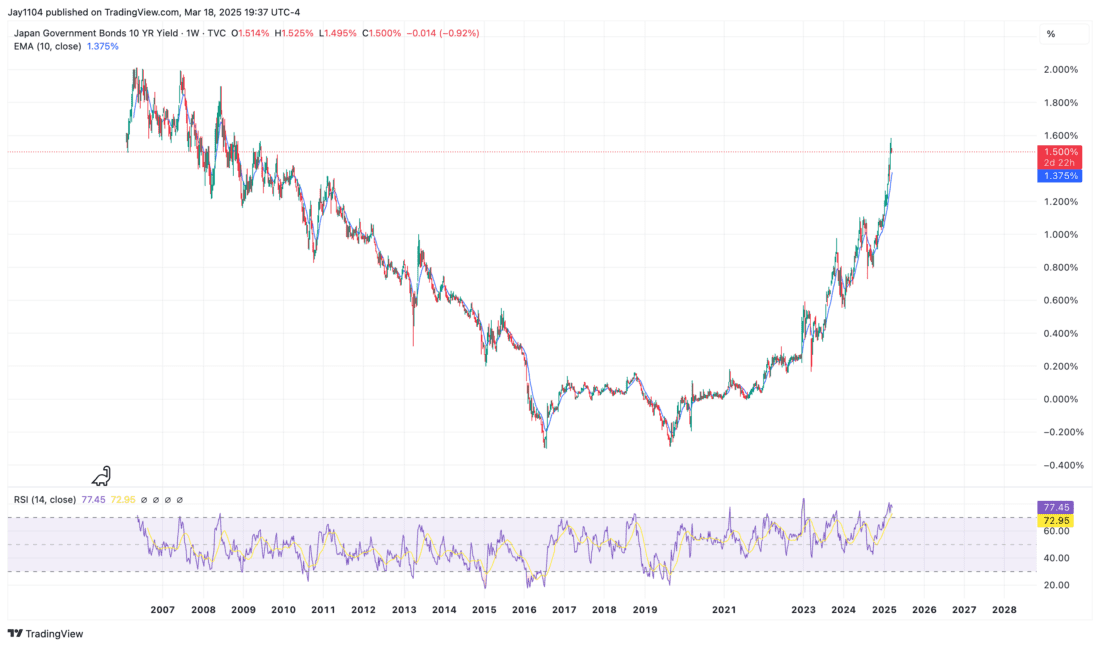

The BOJ has had plenty of opportunities to counter the rising 10-year JGB yield recently, but it has opted not to counter the higher yields. If the BOJ is really serious about a 1% neutral rate, then I’d think that, given their 4% inflation rate, the 10-year rate should be significantly higher than it is today.

So we go back to the USDJPY, and if material strengthening occurs, then I think it will mean that the carry trade continues to unwind.

Of course, we won’t know the actual outcomes until Wednesday evening, after the Fed’s meeting, because we must wait and see what Powell & Co. has to say. So, being patient may be the best bet until outcomes become clear.

—

Originally Posted on March 18, 2025 – BOJ & FOMC Decisions Set the Stage for Volatility

Terms by ChatGPT:

1. FX Market (Foreign Exchange Market) – The global decentralized marketplace for trading currencies, where exchange rates fluctuate based on macroeconomic factors, interest rate differentials, and geopolitical events.

2.BOJ (Bank of Japan) Rate Decision – The monetary policy announcement by Japan’s central bank, influencing JPY liquidity, yield curve control, and global carry trades.

3.Read-Through – The market’s interpretation of an event’s broader implications, such as how the BOJ’s decision signals future policy shifts.

4.Governor Ueda’s Press Conference – A key event where BOJ Governor Kazuo Ueda provides guidance on policy direction, impacting market expectations for rate hikes or continued stimulus.

5.FOMC (Federal Open Market Committee) Meeting Decision – The U.S. Federal Reserve’s policy announcement, setting short-term interest rates and shaping global monetary conditions.

6.Summary of Economic Projections (SEP) – A quarterly FOMC report outlining projections for GDP growth, inflation, unemployment, and the future path of interest rates (dot plot).

7.Powell Presser (Press Conference) – Fed Chair Jerome Powell’s post-meeting Q&A, where his tone and language often drive market volatility more than the actual rate decision.

8.USDJPY in the Crosshairs – A phrase indicating that the USD/JPY exchange rate is at a critical juncture, with major catalysts ahead.

9.Spread Between US 10-Year and 10-Year JGB – The interest rate differential between U.S. Treasuries and Japanese government bonds, a key driver of capital flows and JPY strength/weakness.

10.Bear Pennant Formation – A bearish technical analysis pattern where a consolidation phase after a sharp decline suggests further downside.

11.Narrowing Spread – A situation where the yield differential between U.S. and Japanese bonds shrinks, typically leading to a stronger JPY and weaker USDJPY.

12.BOJ Yield Management – The BOJ’s approach to controlling JGB yields through bond purchases, affecting interest rate expectations and currency valuations.

13.1% Neutral Rate – The theoretical interest rate at which the BOJ’s policy neither stimulates nor restricts economic growth, currently in focus given Japan’s inflation dynamics.

14.Carry Trade Unwind – The process where investors close leveraged positions in high-yielding currencies (USD) against low-yielding ones (JPY), leading to JPY appreciation.

15.Waiting for Powell & Co. – A reference to market participants holding off on major moves until after the Fed’s decision and Powell’s remarks clarify policy direction.

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!