By Megan Miller, CFA, Harin de Silva, CFA, Ph.D. and Benjamin Adams, CFA

The first six months of 2022 saw a precipitous 20% drop in the S&P 500 Index, plunging equities into their 15th bear market in the past 100 years. We’re now 16 months into this bear market—are investors prepared for what happens next?

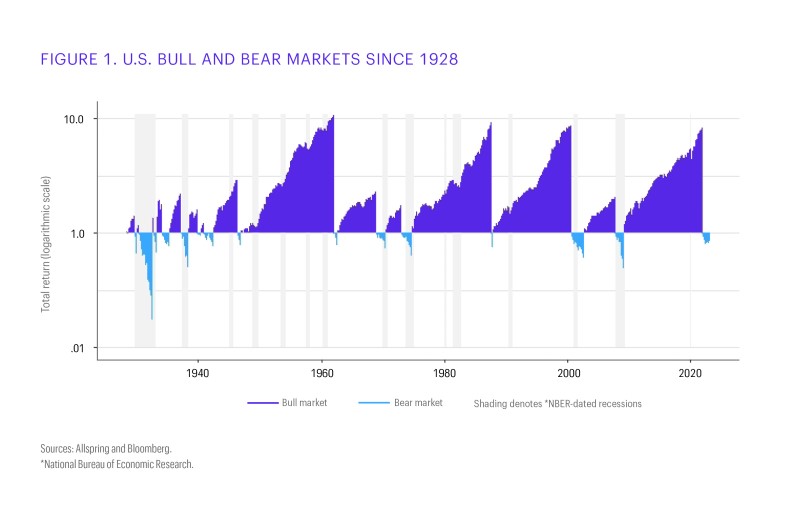

Figure 1 depicts U.S. bull and bear markets over the past century. We define a bear market here as a drop of at least 20% in the month-end S&P 500 Index’s total-return price from its recent month-end high. Bull markets then commence from the lowest monthly closing value.

The most meaningful drawdown in recent history occurred around the global COVID-19 pandemic in 2020. However, the reaction was short-lived, and the market recovered before the end of March. Given the monthly measurement cadence in our definition, this decline isn’t reflected in our analysis.

The last substantial drawdown we experienced resulted from the Global Financial Crisis (GFC). The GFC torpedoed us into bear-market territory (and an economic recession) that started in 2007, lasted 16 months, and saw a total cumulative loss of -51% during that period—the second largest on record.

U.S. bear markets, their durations, and their amplitudes

| COUNT | RECESSION TIMEFRAME | DURATION (MONTHS) | S&P 500 TR* (%) | STARTING SHILLER PE** | ENDING SHILLER PE | CHANGE IN VALUATION (%) |

| 1 | 1929-09-30 to 1929-11-29 | 3 | -34 | 29 | 22 | -24 |

| 2 | 1930-04-30 to 1932-06-30 | 27 | -82 | 24 | 6 | -76 |

| 3 | 1932-09-30 to 1933-02-28 | 6 | -33 | 8 | 8 | -7 |

| 4 | 1934-02-28 to 1935-03-29 | 14 | -24 | 13 | 11 | -16 |

| 5 | 1937-03-31 to 1938-03-31 | 13 | -50 | 21 | 12 | -43 |

| 6 | 1939-11-30 to 1940-05-31 | 7 | -26 | 16 | 13 | -21 |

| 7 | 1940-11-29 to 1942-04-30 | 18 | -24 | 14 | 9 | -39 |

| 8 | 1946-06-28 to 1946-11-29 | 6 | -22 | 15 | 11 | -22 |

| 9 | 1962-01-31 to 1962-06-29 | 6 | -22 | 21 | 17 | -20 |

| 10 | 1968-12-31 to 1970-06-30 | 19 | -29 | 21 | 14 | -35 |

| 11 | 1973-01-31 to 1974-09-30 | 21 | -43 | 18 | 9 | -51 |

| 12 | 1987-09-30 to 1987-11-30 | 3 | -30 | 16 | 13 | -14 |

| 13 | 2000-09-29 to 2002-09-30 | 25 | -45 | 39 | 22 | -44 |

| 14 | 2007-11-30 to 2009-02-27 | 16 | -51 | 26 | 13 | -49 |

| 15 | 2022-01-31 to 2023-03-31 | 15 | -12 | 35 | 29 | -17 |

| Average (all ex. 2022) | 13 | -37 | 20 | 13 | -33 | |

| Median | 14 | -32 | 19 | 12 | -30 | |

| Average: High starting P/E | 16 | -41 | 27 | 17 | -38 | |

| Average: Low starting P/E | 11 | -29 | 14 | 11 | -24 |

Sources: Allspring and NBER

*S&P 500 Total Return Index

**Shiller P/E is an acronym for Cyclically Adjusted Price/Earnings (CAPE) Ratio, which is calculated by dividing a company’s stock price by the company’s average earnings for the past 10 years, adjusted for inflation.

From an asset allocator’s perspective, a bear market has several dimensions that merit consideration in addition to the magnitude of the decline. These additional aspects include:

- The duration of the decline

- The change in valuation associated with the decline

- The level of valuation associated with the end of the decline

Bear market duration can provide perspective on the patience required to benefit from the equity risk premium, and valuation levels can be useful in making opportunistic asset allocation decisions.

In the table above, we’ve compared 2022’s bear market with its predecessors. Each bear market’s duration is shown in number of months, the total cumulative return is measured via the S&P 500 Total Return Index, and valuations are measured by the starting and ending levels of the Shiller price/earnings ratio (P/E). The Shiller PE is based on average inflation-adjusted earnings from the previous 10 years. We expect the Shiller PE to decline during bear markets as a function of a steeper decline in prices relative to smoothed 10-year earnings in the denominator.

Compared with previous bear markets, 2022’s bear market was smaller in magnitude, typical in its duration, and associated with a much smaller change in valuation. As of April 28, 2023, the current bear market was down 11% from previous highs compared with -37% for the average bear market over the past century, and the current change in valuation was -17% versus -33% for the average bear market.

Also striking is the level of current valuation, as measured by the P/E of 29, which is considerably higher than the average bear-market ending P/E of 13—and significantly higher than all previous bear-market exits. Furthermore, the data at the bottom of the table shows that bear markets associated with higher-than-average initial valuation levels (for example, 1930/the Great Depression and 2007/GFC) have been associated with significantly larger changes in valuation than declines with low initial valuation values.

History shows a change in price/earnings ratio of -42% for high starting valuations compared with -24% for low starting valuations. In summary, while the duration of the current bear market has been close to historical averages, both the magnitude of the decline and the level of valuations suggest that investors should not be surprised by further declines.

Preparing for the worst

Given uncertainties faced by the U.S. and international economies, we believe investors should be: “Hoping for the best, prepared for the worst, and unsurprised by anything in between.”[1] The data presented in the table suggest investors should prepare for the possibility of a longer bear market, potentially until valuations revert to long-term levels.

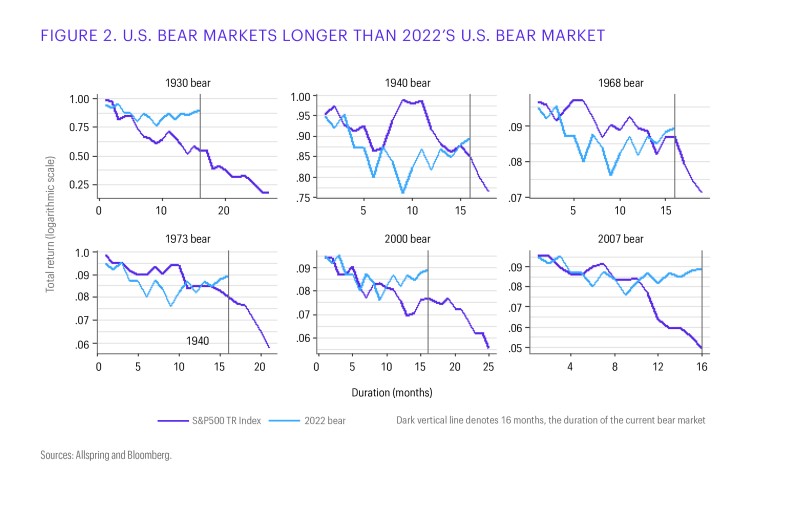

In Figure 2, we compare 2022’s bear market with prior instances when the sell-off was equal to or longer in duration than the current sell-off in order to evaluate possible paths the market may take to end today’s bear market. The vertical line in each graph represents where we are today, 16 months into a bear market. We first note the uniqueness of each bear market. When preparing for the worst, it’s likely that things will not look or feel like the last bear market. Therefore, investors should consider a diversified approached to hedging their equity risk.

Looking at bear markets in this way also illustrates that all the declines are interspersed with rallies. This pattern highlights that an intra bear-market rally—like what we’ve experienced year to date with the S&P 500 Total Return Index’s 9.16% increase—doesn’t necessarily correspond to the end of a bear market.

In conclusion, we use the market’s expansions and contractions history to gain perspective on intermediate-term equity market possibilities. Viewing the data through this lens confirms the conclusion of the valuation-based approach: We may not have seen the market lows yet.

Allspring’s Systematic Edge team provides several strategies that may help investors position their equity portfolios more defensively, including long/short equity, low volatility equity, and hedging option overlays. The volatility reduction of these strategies can potentially help mitigate the return lost to “volatility drag” associated with large losses’ harm to long-term compounded returns. Financial advisors and institutional investors can view more details on our offerings here.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

[1] Maya Angelou, I Know Why the Caged Bird Sings.

—

Originally Posted May 25, 2023 – Bear with us: An evaluation of valuation for those on the fence about getting defensive

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Allspring Global Investments and is being posted with its permission. The views expressed in this material are solely those of the author and/or Allspring Global Investments and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!