By: Daniel He, Yi Qiao, Georgi Popov

The persistence of elevated inflation has started to worry many market participants and central banks, because the longer CPI (consumer price index) inflation remains elevated, the higher the risk that inflation expectations accelerate. While the currently elevated levels of realized inflation do appear to have boosted inflation expectations, most forward expectations remain at or below monetary policy targets.

In recent communications, most central bankers appear to attribute the elevated inflation prints (at least partially) to global supply chain bottlenecks and associated scarcity of supply. Central banks could in theory influence this dynamic by raising policy rates, which would tend to stifle demand and ease some pressure on the supply side. But with major economies still shy of the central banks’ employment objectives, and with many of the current inflationary pressures likely to subside on their own, policymakers in the major developed economies have not yet started to raise rates.

This patient approach could feed investor demand to hedge their portfolios against future unexpected bouts of inflation.

- In the U.S., our base case is for headline CPI inflation to peak around year-end and into Q1 2022, and remain elevated through Q3 2022 when some moderation is likely as the handoff from goods to services consumption returns to more normal levels. However, consensus inflation forecasts have been playing catch up with inflation, signaling that risks to the base case skew to the upside – for details, see PIMCO’s recent blog post, “October U.S. CPI Adds Pressure to Fed Policymaking.”

- In Europe, supply chain breakdowns have contributed to deceleration in the Industrial Production measure and an acceleration in headline CPI. Volatility will likely remain elevated in the months ahead, with inflation expected to peak at close to double the European Central Bank’s (ECB) target, and then start to normalize – conditional on energy impacts weakening and a mild winter. ECB President Christine Lagarde recently acknowledged that rate hikes are very unlikely in the next year.

- In the U.K., we see a similar picture as in the U.S., with the Bank of England (BOE) likely to remain patient given supply disruptions driving inflation. In fact, in early November, the BOE surprised markets by not hiking rates. Although we expect a later peak in U.K. CPI versus the U.S. and Europe, our forecasts call for inflation accelerating to over twice the BOE’s target.

Swing factors for monetary policy

Looking over the cyclical horizon, we see two key swing factors – inflation expectations and wages – and they are related.

Inflation expectations, both market and survey-based, have been trending higher. Even though they remain generally contained, risks to the upside have risen, given stubbornly high inflation data and inflationary pressures.

Simultaneously, central bankers’ confidence in labor slack has been a key factor in their patient approach to policy. As the employment gap narrows and closes in many regions, as we expect, the path of wages and the ability of individuals to bargain for higher wages to keep up with mounting price pressures will be critical assessments in forecasting inflation, and could be a game changer for inflation expectations.

Investment implications

Over the last few weeks we’ve observed yield curves in major regions flatten through a sell-off in short-dated yields, signaling markets pulling forward rate hike expectations. (For details, see PIMCO’s recent blog post on flattening yield curves.) If central banks remain patient, rate valuations and breakeven inflation expectations may indeed be more attractive than expected.

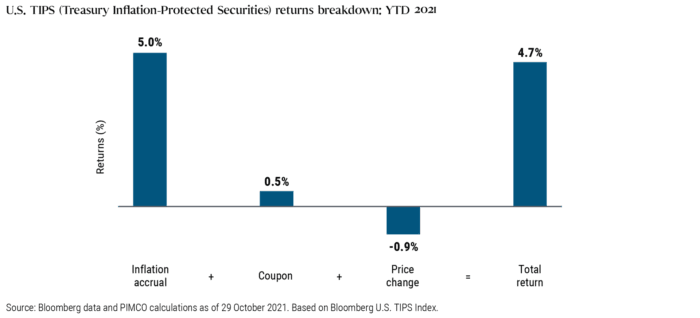

Inflation-linked bonds have posted attractive returns year-to-date – see this chart highlighting U.S. Treasury Inflation-Protected Securities or TIPS. And with inflation accruals likely to remain elevated and price impact unlikely to be a major drag, in our view, we could see attractive return potential in this asset class extending into 2022. Breakevens also look attractive, especially in the U.S. and eurozone, where levels have barely closed the gap versus the central banks’ targets, but remain below their pre-2014 averages, before oil prices collapsed. One notable outlier is the U.K., where inflation expectations are over a percentage point above the BOE’s target, offering potential value for actively managed portfolios that allow the flexibility to limit exposure to sectors believed to offer less value.

Visit PIMCO’s inflation page for further insights into the inflation outlook and investment implications.

Daniel He is a portfolio manager focusing on real return, Yi Qiao is a portfolio manager focusing on interest rate derivatives and inflation-linked products, and Georgi Popov is a product strategist focusing on liquid real asset and defined contribution solutions.

—

Originally Posted on November 18, 2021 – Amid Inflation Uptick, Valuations Signal Opportunities in Inflation‑Linked Assets

DISCLOSURES

All investments contain risk and may lose value. Inflation-linked bonds (ILBs) issued by a government are fixed income securities whose principal value is periodically adjusted according to the rate of inflation; ILBs decline in value when real interest rates rise. Treasury Inflation-Protected Securities (TIPS) are ILBs issued by the U.S. government. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2021, PIMCO.

Disclosure: PIMCO

All investments contain risk and may lose value. This material is intended for informational purposes only. Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. THE NEW NEUTRAL is a trademark of Pacific Investment Management Company LLC in the United States and throughout the world. ©2023, PIMCO.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from PIMCO and is being posted with its permission. The views expressed in this material are solely those of the author and/or PIMCO and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!