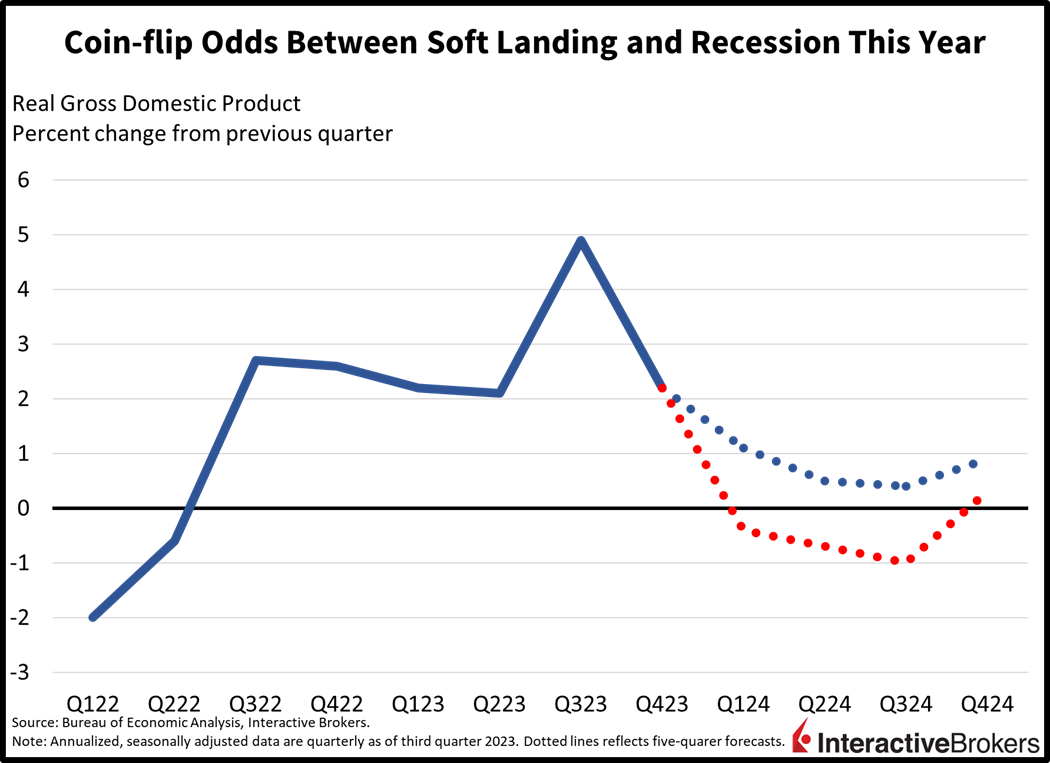

Throughout 2023, consumer spending was surprisingly resilient, but we believe this trend will weaken due to households facing increased affordability pressures while feeling the bite of restrictive monetary policy. A strong labor market, however, is likely to place a floor under the decline in consumer spending as employers have become reluctant to lay off workers due to concerns about the potential challenges of adding to their workforce in the future. The job market is likely to be the strongest in non-cyclical areas of the economy. In contrast, cyclical sectors are likely to continue slowing as the economy struggles with the long and variable lags of tighter monetary policy. Real estate and manufacturing are also likely to continue suffering due to persistently high long-term interest rates even after the Federal Reserve cuts rates. Contrary to many investors’ expectations, the Federal Reserve is likely to remain restrictive during the first half of this year, creating a scenario of weakening economic growth or even contraction. Once the Fed begins to accommodate, lofty long-term interest rates resulting from record federal debt, deficits and issuance will provide additional challenges not only for real estate and manufacturing, but also for the nation’s overall economic prospects. Geopolitical risks such as the Israel-Gaza war and the Ukraine-Russia conflict are also likely to challenge economic growth by weakening supply chains and threatening the supply of agriculture and energy commodities. With those points in mind, we believe there are coinflip odds between continued growth this year and recession, with only 15% odds of a hard landing featuring sharp job losses.

Household Finances and Consumer Spending Are Likely to Buckle

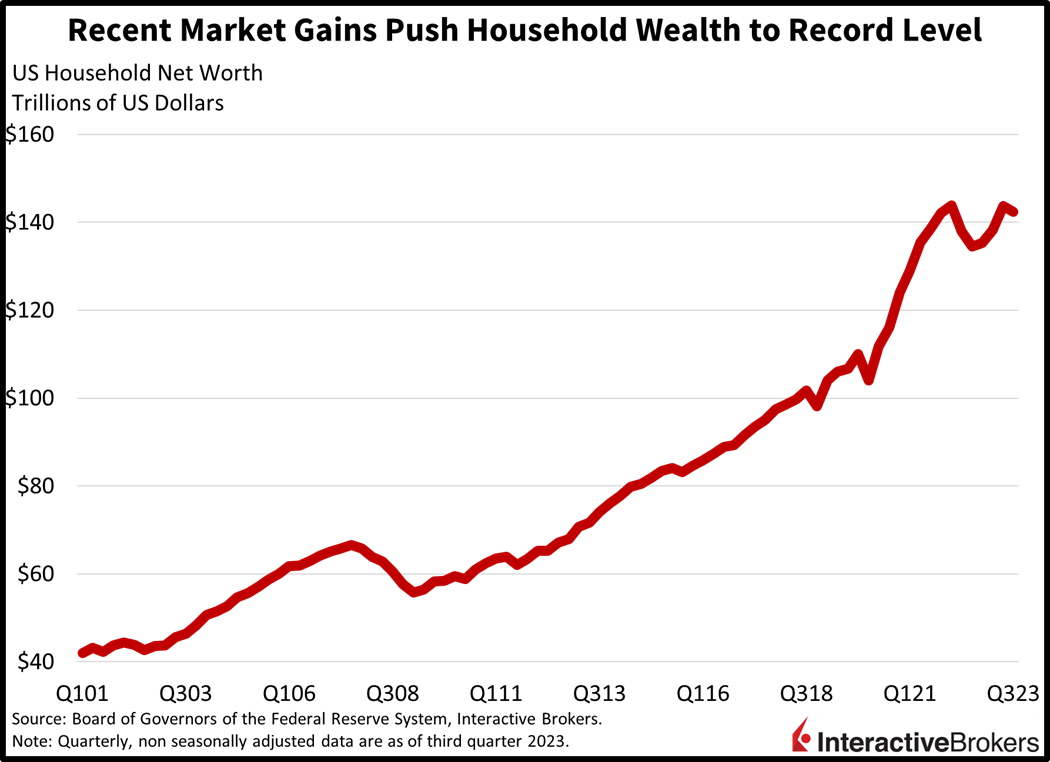

To date, U.S. household finances have been extremely resilient but the outlook for consumer spending, which represents approximately 70% of GDP, remains mixed, at best. On a favorable note, household net worth climbed to an all-time high of $144 trillion as of the end of the second quarter. This wealth includes $18 trillion in liquid assets, up from $10 trillion in 2013.

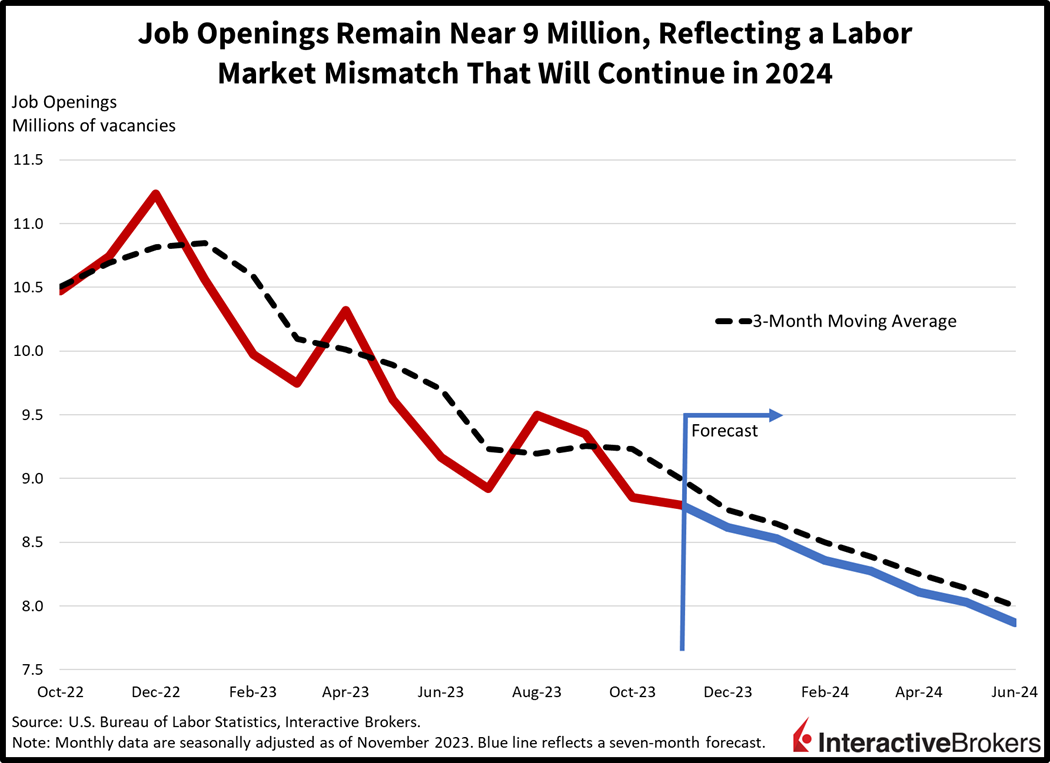

A strong job market with a significant number of job openings, furthermore, is likely to support consumer optimism. Yet, consumer finances may not be as strong as they appear. A large portion of wealth—approximately $75 trillion, is held by Baby Boomers who have benefited from increasing home values, equity market gains and years of routine saving through defined contribution retirement plans. Excess retirements during the pandemic also led to a low amount of available labor as job openings hover near a whopping 9 million. At the same time, a significant mismatch in skills desired by employers relative to the capabilities of prospective workers is making the job market appear tighter than it really is.

Unlike Baby Boomers, millennials are in far worse shape. Those Americans who were born in the 1980s experienced the Global Financial Crisis of 2008 and the Covid-19 pandemic recession during their peak working years. As such they have been unable to achieve the same financial milestones, such as home ownership, accomplished by Baby Boomers. Additionally, since 2019, childcare costs have increased 32% with the average household spending $700 a month for the service, according to the Bank of America Institute. Millennials, furthermore, make up approximately 22% of the country’s population.

From a broader perspective, household debt hit an all-time high of $17.29 trillion as of the end of the third quarter of 2023, according to the New York Fed. During the quarter, credit card balances reached $1.08 trillion, a 4.7% increase. WalletHub reports that the average interest rate for existing accounts is a staggering 21.19%. The New York Fed also found that non-housing debt increased by $93 billion during the quarter.

On top of those challenges, student loan payment requirements that were waived during the pandemic have resumed on approximately $1.5 trillion in debt. In a recent study of 1,024 student loan borrowers, Experian found that 50% of survey respondents feel either extremely stressed or very stressed about resuming their loan payments. Another 21% reported feeling somewhat stressed. Only 29% reported feeling either a little stressed or not at all stressed. Consumers are also struggling with the high levels of credit card debt as illustrated by an increase in delinquent payments. Auto delinquencies are also ticking up at a time when used car prices are declining, leading to many underwater loans with reduced incentive to pay back.

In addition, demographic developments have led to a reduced propensity to save. With families having fewer children and marriage rates plunging, folks aren’t savings for homes or big-ticket manufactured goods like they did in the past and instead are spending almost all of their money on services and essential goods like food, medicine and gasoline. Services, meanwhile, are much more labor intensive and inflation ridden, driving up the costs of wages to levels inconsistent with the Fed’s 2% inflation target. Additionally, tight monetary policy and lofty prices will serve as a ceiling for consumer spending, however. As pandemic excess savings have vanished, households have turned to servicing debt and are trading down on goods and services.

When considering those factors and higher costs of living, our recession possibility points to real consumer spending contracting in the first three quarters of 2024. The boomers could save the day by digging into their savings and vast wealth, however, as our soft landing possibility reflect slowing, but still positive consumer spending activity throughout the year.

Job Market Serves as a Bright Spot

The resilient labor market is likely to weaken slightly but continue to be a bright spot, albeit one that will support inflation throughout the year. In 2023, the U.S. economy added 2.7 million jobs, a monthly average of 225,000. While this is below the post Covid-19 hiring boom in 2022 when 4.8 million were created, it is still an impressive number, especially when considering that it has occurred despite the Federal Reserve having maintained highly restrictive monetary policy. While companies tend to be pessimistic about the business environment, many executives are optimistic about the future of their own companies, so employers are holding on to existing workers and increasing their headcounts in anticipation of growing sales and earnings. Businesses also have strong balance sheets and would rather take the short-term hit to margins and earnings rather than lay off workers and have to re-hire in the future. The COVID-19 pandemic made employers reluctant to get rid of workers due to challenges of getting employees back when needed. Excess retirements during the pandemic also led to a low amount of available labor as job openings hover near a whopping 9 million.

Job growth is likely to slow to a monthly average of 110,000 in 2024 as non-cyclical areas of the economy have been adding the most jobs recently. While private-sector companies aren’t hiring much, they aren’t laying off either. Non-cyclical areas, namely government, education and health services, are unlikely to collectively continue saving the labor reports, however, with congressional stimulus shifting to fiscal drag while many municipal governments are dealing with budget constraints that will constrain hiring.

High Interest Rates Bog Down Manufacturing and Real Estate

The capital-intensive manufacturing and real estate industries are experiencing headwinds they’ve never faced. In real estate, sky-high prices combined with elevated interest rates have destroyed affordability harshly, dampening growth in the sector. Manufacturers, furthermore, are struggling with high financing costs and increased input expenses. To make matters worse, recent turning points in one or both of the sectors have been met with inflationary pressures that hurt conditions in short order. Together, these sectors make up almost 30% of the economy and their weakness has yet to spread to the overall economy due to ample liquidity from households and corporations.

All in all, 2024 job growth is likely to average 110,000 per month, down from 225,000 in 2023 and 399,000 in 2022. As the job market softens and weakening household finances force more individuals to join the labor market, the unemployment rate is likely to increase to 4.2% by year-end.

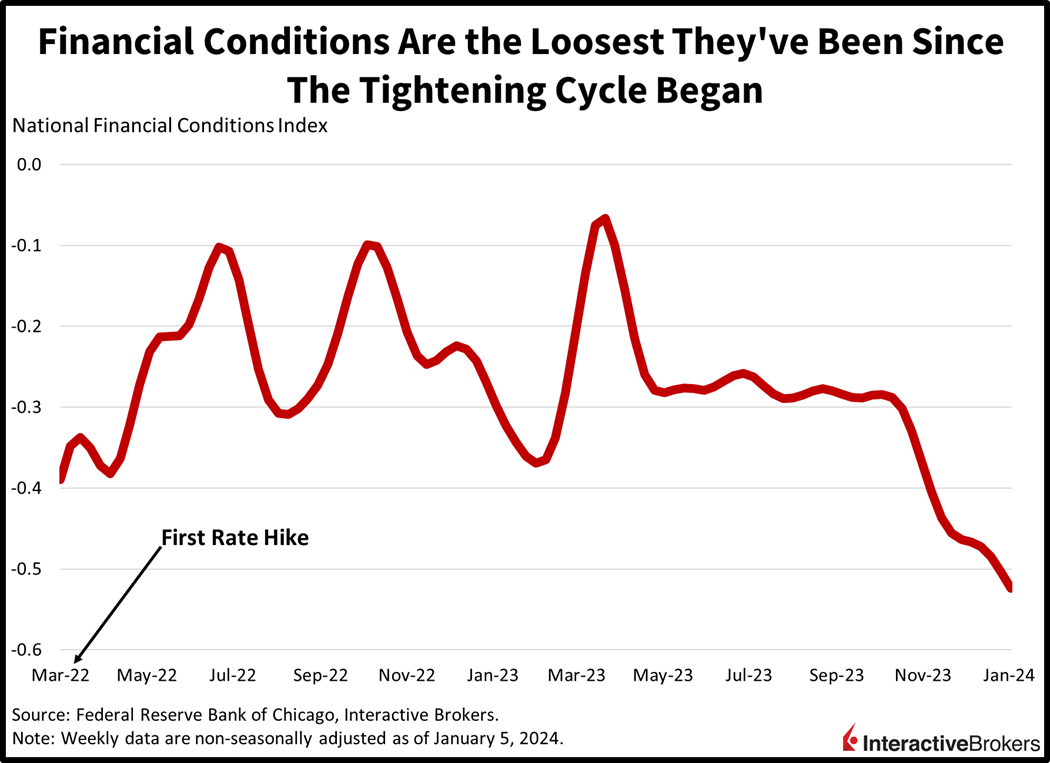

Inflation Is Likely to Persist

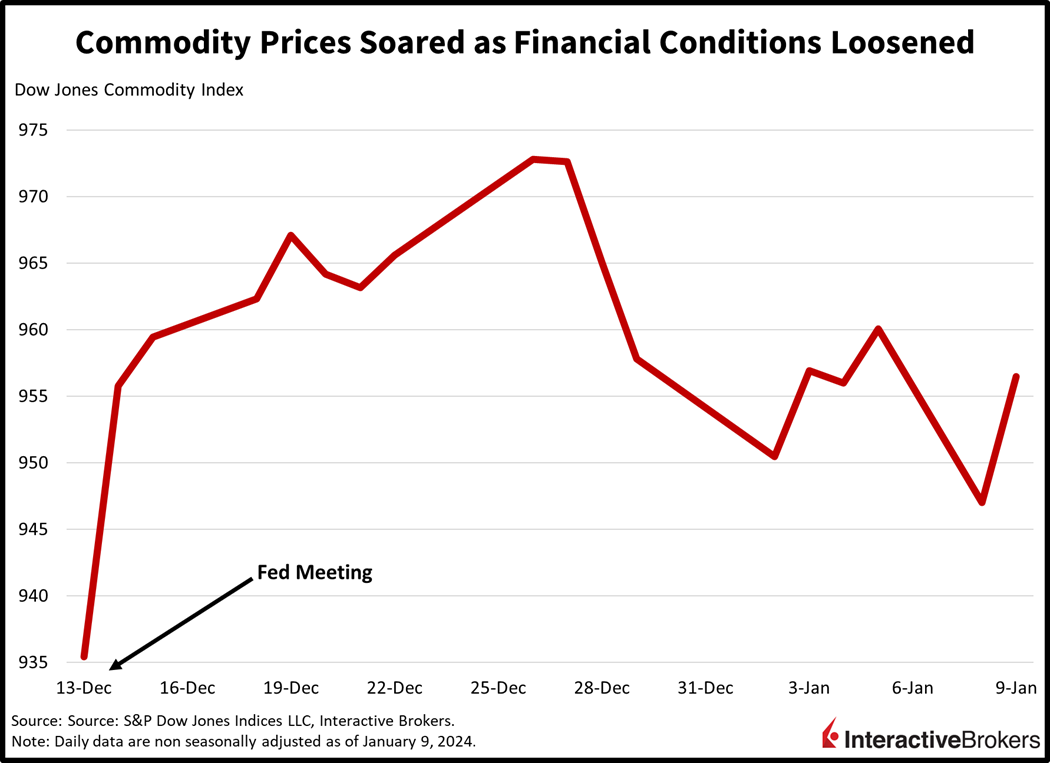

Federal Reserve Chairman Jerome Powell’s December 13 comments—or at least market participants’ interpretation of his comments—caused expectations of a fed funds rate cut in March to soar to above 85%. This optimism regarding a rate cut overlooked developments, such as looser financial conditions, that point to a likely resurgence in inflation. The biggest risk of another inflationary episode at this juncture, meanwhile, lies in the Middle East, with the blockage of the Suez Canal leading to significant increases in shipping costs. Powell’s comments had the following impacts:

- Equity prices soared, with gains led by stocks of small companies. This rally helped loosen overall financial conditions and contributed to the wealth effect, or consumers spending more because their higher portfolio values make them feel more optimistic about their finances.

- Treasury yields plunged.

- Financial conditions loosened, which have supported lending, consumption, economic growth and inflation in the recent past.

- Commodity prices soared in anticipation that looser financial conditions would support lending, consumption and investment.

At first blush, investors have had reason for anticipating lower inflation. The Core Personal Consumption Expenditures Index increased just 0.1% month-over-month (m/m) most recently and earlier in the month of December, the Consumer Price Index, while climbing 0.1% m/m, was up only 3.1% year-over-year (y/y). On the other hand, capital markets, financial conditions, wage pressures, goods reinflation and stubbornly high housing costs point to recent inflation readings being a trough and that price pressures in the coming months will require the Fed to maintain its restrictive monetary policy, which is likely to stymie economic growth. Indeed, wages increased a whopping 0.4% m/m in November and December, and 4% and 4.1% y/y, figures that are inconsistent with 2% inflation. Commodity prices cooperated well during last year’s inflation battle, but greater animal spirits and geopolitical tensions may reverse that progress in 2024.

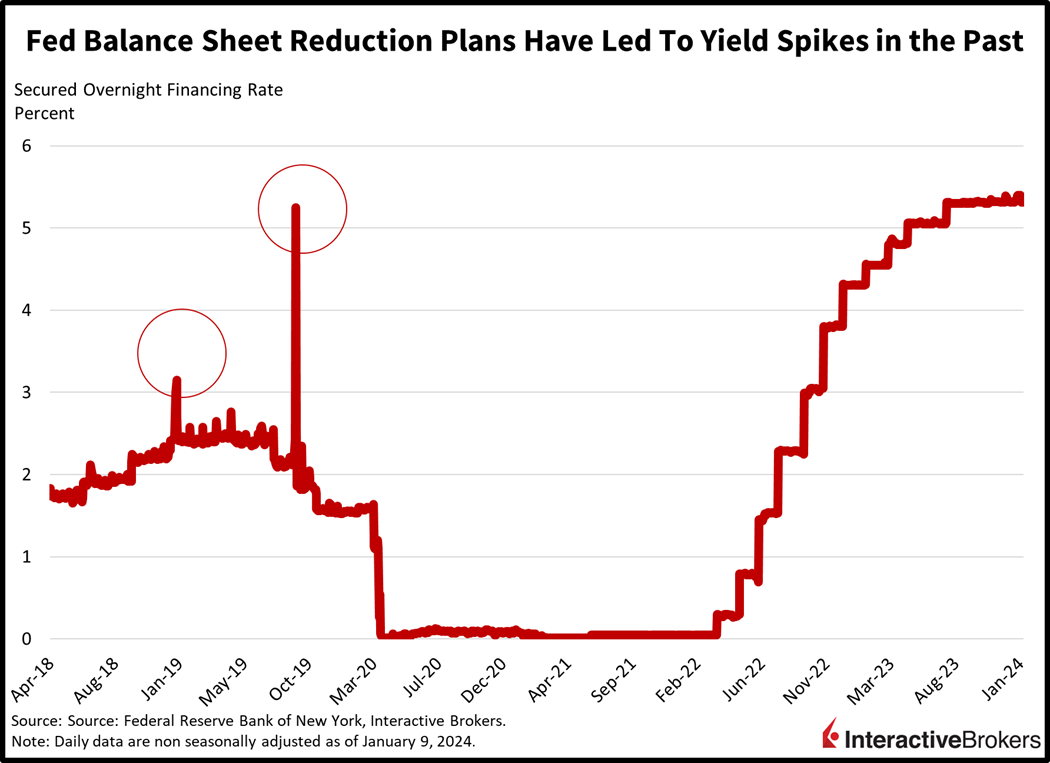

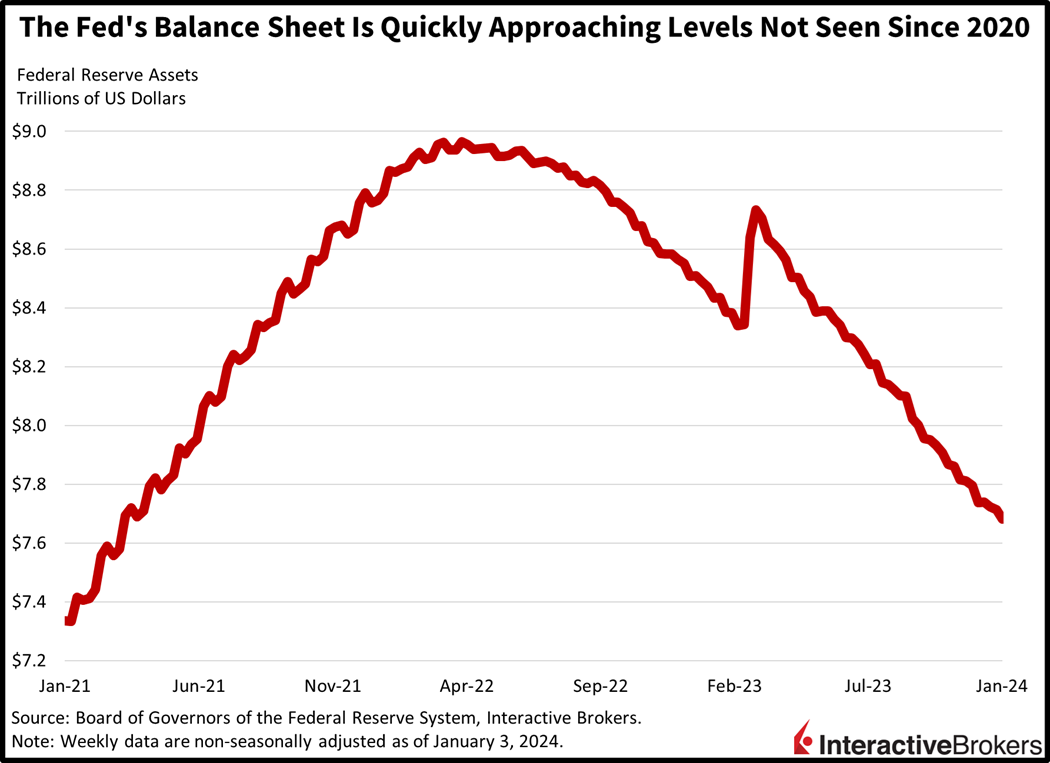

We believe the Fed will cut rates only three times this year, starting in June, and finish the year with a 4.63% fed funds rate. The Fed will continue cutting its balance sheet as it approaches a level of bank reserves that is appropriate. But market volatility is likely to emerge, similar to the yield spikes of 2018 and 2019 and the bank failures of 2023, as the pain of the Fed’s declining balance sheet is felt harshly by markets. Liquidity is abundant until it isn’t.

Fiscal Policy Is Another Headwind

The economy has been juiced by unprecedented levels of government debt spending to ward off a Covid-19 recession. More recently, deficit spending to improve supply chains and increase the use of clean energy has provided additional economic stimulus, but the outstanding debt from these programs along with multiple years of deficit spending prior to the pandemic is becoming a headwind to medium-term economic prospects and a driver of price increases.

The American Rescue Plan Act, the CARES Act and the Consolidated Appropriations Act of 2021 pumped more than $4.8 trillion into the U.S. economy to counter the impacts of efforts to slow the spread of Covid-19. Washington, D.C., has also unleashed more stimulus with the CHIPS and Science Act, which provides $280 billion in tax incentives and investments to boost semiconductor manufacturing and improve the supply chain. The Inflation Reduction Act, which primarily seeks to boost the development of clean energy and provides strong incentives for manufacturing electric vehicles domestically, has provisions for increasing tax revenues and it has received mixed reviews regarding its impact on the federal deficit.

Even as Pandemic-19 savings decline, the resulting demand within the economy for consumer goods, building materials and manufacturing services resulting from stimulus is likely to continue supporting price pressures. For example, the CHIPs legislation contributed to the Taiwan Semiconductor Manufacturing Company breaking ground on a $40 billion foundry in Arizona. The location will eventually hire thousands of workers. Other chip manufacturers are following suit while automobile companies are building EV manufacturing facilities and clean energy companies are on a hiring spree to address growing demand for solar and wind energy. These projects are likely to support demand for construction workers and building materials. Over the long term, the jobs created at these facilities will help support demand for consumer products and other items.

Debt Becomes Increasingly Problematic

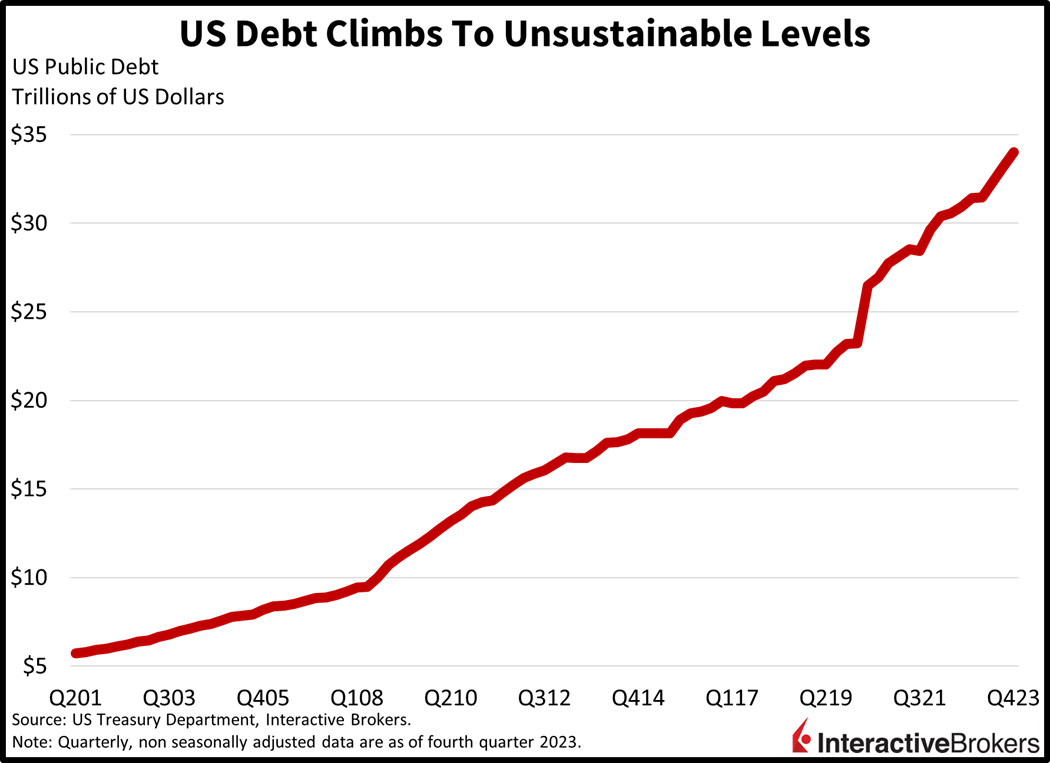

The benefits of these new manufacturing jobs, however, are likely to be offset by the country’s growing debt causing interest rates to soar, especially if members of Congress fail to curtail deficit spending. Consider the following points:

- U.S. debt has ballooned from $3.2 trillion in 1990 to $34 trillion.

- Investors who are becoming increasingly concerned that the nation’s debt is approaching unsustainable levels are likely to demand higher yields from Treasury securities.

- Earlier this year, Fitch Ratings downgraded the U.S. long-term credit rating to AA+ from AAA. More recently, Moody’s lowered its outlook for U.S. debt from stable to negative due to higher interest rates and polarization among members of Congress.

- Meanwhile, as the Federal Reserve allows its balance sheet to contract, it is no longer buying U.S. Treasuries, allowing them to roll-off at maturity. This process is reducing the Fed’s ownership share, which is being replaced by less reliable, price-sensitive buyers.

With little expectations for Washington, D.C., to strike a balanced budget, bond yields are likely to increase. When this factor is considered alongside of the Fed’s potential decision to hold off on cutting interest rates, the economy could face significant challenges in 2024.

Regional Banks Are Under Pressure

Deposits have been flowing out of smaller institutions, negatively impacting lending and credit. This is likely to result in further industry consolidation and a dampening of economic growth. Commercial real estate is also a big risk, with debt for the sector held mostly by smaller institutions that have hunted for yield. Refinancings in the office sectors and to a much lesser degree apartment buildings are likely to create additional bank failures this year.

Geopolitical Risks, Supply Chain Issues and Energy Supplies

Geopolitical turmoil is likely to be another considerable economic headwind that supports additional inflation by weakening supply chains and interrupting oil production. The military conflict resulting from Russia invading Ukraine in February of 2022 shows no signs of abating while the Israel-Palestinian conflict is showing potential for widening and involving Lebanon and Iran. Meanwhile, China appears to be in an uneasy holding pattern regarding its controversial desire to annex Taiwan. Consider the following:

- In the Ukraine-Russia conflict, sanctions against Russia have capped prices that oil importers pay the country, which has helped maintain the global supply of the commodity. Russia’s trade of oil and other items appears to be continuing, at least at a reduced level, and some countries have found ways to avoid sanctions that would otherwise prohibit such commerce. A crackdown on sanction enforcement or an escalation of the conflict could create additional supply chain issues and support inflation. Grain exports from Ukraine, one of the world’s largest providers of agriculture commodities, were initially maintained due to the Black Sea Grain Initiative (BSGI), which expired in mid-July 2023. Since then, grain exports have declined by 30%, according to reliefweb. Auto manufacturers, meanwhile, have reported a shortage of parts that have been manufactured in Ukraine factories.

- In the Israel-Gaza conflict, supply chain problems have become more prevalent as fears that the turmoil could escalate. Despite the creation of the multi-national Operation Prosperity Guardian to safeguard the Red Sea, Tehran-backed Houthi rebel attacks against ships in the waterway have caused shipping companies to divert traffic around the southern tip of Africa, causing transportation costs to climb significantly. Iran-backed militants have also attacked U.S. military forces in Iraq and Syria, provoking the U.S. to retaliate, and separately, a Hamas leader was assassinated in Beirut. These developments have sparked fears that Iran and Lebanon may be drawn into the dispute.

- The China-Taiwan conflict started the year on an ominous note when China President Xi said it is inevitable the self-governing island is reunified with China. So far, peace has resulted from the view that Taiwan lacks formal independence, but at the same time, formal reunification hasn’t occurred.

Foreign Investment, Onshoring, AI

A massive semiconductor foundry is rapidly rising among the tree-like saguaro cactus north of Phoenix, Arizona. In one the largest foreign direct investments in the history of the U.S., Taiwan Semiconductor Manufacturing Company is undertaking the $40 billion project. Taiwan Semiconductor isn’t alone in building U.S. production facilities as illustrated by construction on manufacturing facilities jumping 71.2% for the 12-month period ended in October, according to the Associated Builders and Contractors. Efforts to improve supply chains after significant issues during the Covid-19 pandemic and more recently, various legislative initiatives, such as the Bipartisan Infrastructure Law, the CHIPS and Science Act and the Inflation Reduction Act, have caused a surge in both foreign direct investment and onshoring. While numerous companies are building chip factories, others are building electric vehicle battery plants so that that their automobiles will qualify for tax incentives under the Inflation Reduction Act.

Artificial intelligence is likely to be another bright spot. While it may take time for AI adoption to provide a significant boost to the economy, it is already driving demand for advanced semiconductors and other technologies while helping companies improve productivity and earnings.

Economic Contraction is in the Cards

If the combination of the Fed’s restrictive monetary policy, high long-term interest rates, weakening consumer finances and geopolitical risks sparks a recession, the likely impact will be felt upon corporate earnings rather than the workforce as companies are still struggling to recruit workers at a time when unemployment is at a considerably low 3.7%. While developments in the final months of 2023 have made a soft landing less likely amidst rising recession risks, the strong job market and wealthy baby boomers could result in economic growth slowing only modestly.

Year-End Targets

We believe earnings expectations are too optimistic, with 9% earnings growth from $220 to $240 unlikely to occur as nominal GDP grows only 3-4%. We think 5% earnings growth is more likely, with a downside scenario to $210 much more probable than an upside surprise to $250. We also believe that a structurally higher fed funds rate around 4.5% alongside a lack of fiscal restraint from Congress leaves the 10-year yield at 4.5% as the Consumer Price Index finishes the year above 3%. These developments will challenge the valuation narrative amidst lackluster earnings. I’m estimating earnings come in at $230, while assigning a generous multiple of 17.8 against the backdrop of a 4.5% 10-year Treasury. That scenario would lead us to finish the year at 4,100 on the S&P 500.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!