One of the more unexpected developments this year is that a recession has yet to rear its ugly head. Here we are, approaching three-quarters of the way into 2023, and the totality of economic data arguably continues to confound what was perhaps the most widely anticipated economic downturn on record. With 525 basis points worth of cumulative Federal Reserve rate hikes in the books, the U.S. economy may still not be completely out of the woods, but signs are pointing to another positive performance for third-quarter real gross domestic product (GDP) as well (more on that later).

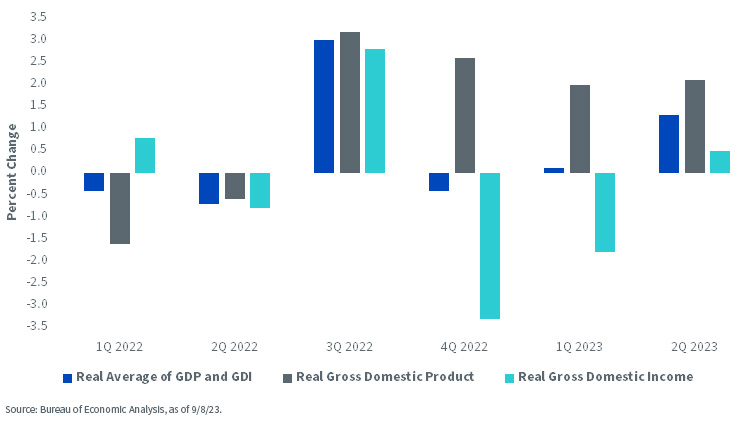

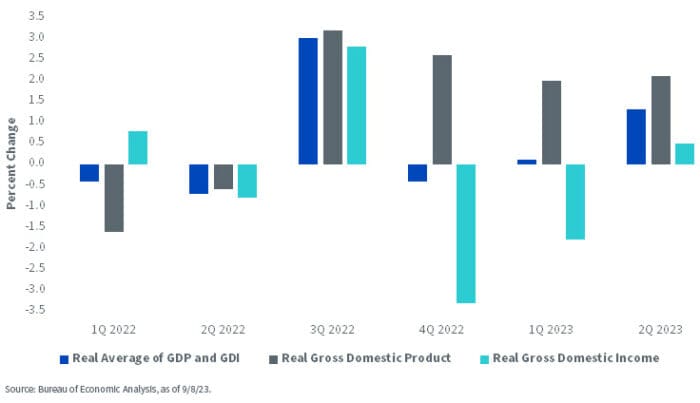

U.S. Economic Activity Measures

Notably, if you go back to last year, economists were fighting the complete reverse battle. Indeed, real GDP had printed two consecutive negative performances during Q1 and Q2 of 2022, but it seemed as if the narrative was trying to dismiss these readings as not being indicative of a recession, especially because of the solid labor market data setting (sound familiar?).

Back then, we were being told that we should look at an alternate measure of economic growth, gross domestic income (GDI). I blogged on this exact topic in early October of last year and thought it would be intriguing to look at how things have changed almost a year later.

As a refresher, according to the Bureau of Economic Analysis (BEA), GDI is defined as a measure of the incomes earned and the costs incurred in the production of GDP and is another way of measuring economic activity. For the record, GDP measures the value of the final goods and services produced in the U.S. To sum up, GDP calculates economic activity by expenditures, while GDI focuses on the incomes generated during the process. Interestingly, the BEA states that both are “conceptually equal.” While each series can produce different short-term results, they tend to come together over the longer haul.

The above table underscores how the “2023 experience” has essentially been the opposite of last year’s. While real GDP has been enjoying growth of around 2%, GDI has either been negative or just barely positive. However, another way of looking at economic activity is to average real GDP and GDI together, a component the BEA produces as well. Thus far in 2023, this average has produced basically no growth in Q1 (+0.1%) and a more modest 1.3% reading for Q2.

Conclusion

So will the real economy “please stand up?” That brings us to where Q3 activity is. According to consensus forecasts, real GDP for the July–September period is expected to post another 2% performance, but the Atlanta Fed’s GDPNOW gauge has growth surging to 5.6%, as of this writing. Either way, it would appear the recession may have to wait yet again, with all eyes turning to how this year ends and 2024 begins.

—

Originally Posted September 13, 2023 – U.S. Economy: Receding Recession Expectations

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!