A little over a century ago, Captain John Alcock and Lieutenant Arthur Whitten Brown became the first people to make a nonstop, transatlantic flight. Beginning in Newfoundland and ending with a nonfatal crash landing on the west coast of Ireland, the trip took some 16 hours in a World War I bomber, at an average speed of 120 miles per hour.

At the end of this month, if all goes according to plan, history will be made once again when a jet powered by 100% sustainable aviation fuel (SAF) will cross the Atlantic Ocean for the first time ever. Virgin Atlantic, the British carrier founded by billionaire Richard Branson, received permission from the United Kingdom’s Civil Aviation Authority (CAA) last week to fly from London to New York to test the feasibility of using only green jet fuel on long-haul flights. The demonstration is scheduled for November 28.

The Promising Future Of SAF

What is SAF? Advocates tout it as a cleaner alternative to traditional jet fuel, pointing to its ability to reduce CO₂ emissions by up to 80%. Produced from various sources such as waste oils, fats and feedstocks, the fuel is considered “sustainable” because it doesn’t compete with food crops or water resources, and it doesn’t cause deforestation.

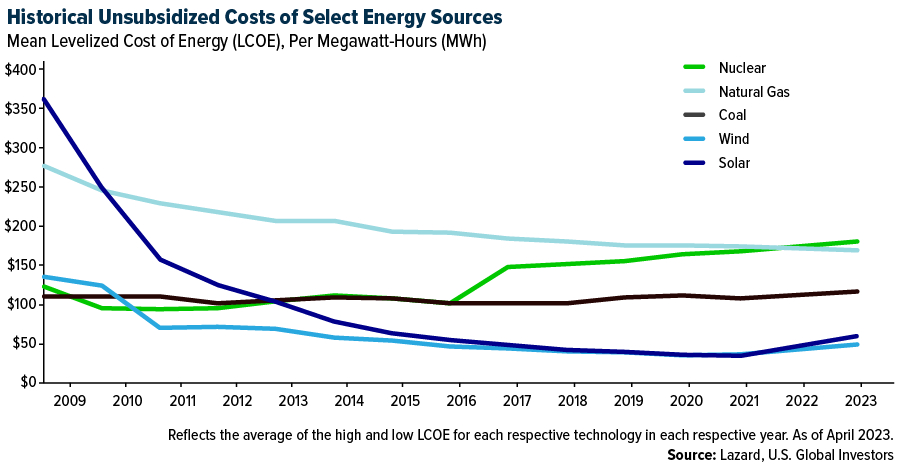

SAF is currently more expensive to manufacture than conventional kerosene, but as is the case with many other alternative energy technologies, scaling up is key to lowering costs. Take solar energy. The technology was once so prohibitively expensive, it could only be used on satellites, but in 2020, the International Energy Agency (IEA) proclaimed it the “cheapest electricity in history.”

With production volumes rapidly increasing, SAF is poised to become a primary tool in helping the commercial aviation industry achieve net-zero emissions by 2050, according to the International Air Transport Association (IATA). Last year, between 300 and 450 million liters (approximately 80 to 118 million gallons) of SAF are believed to have been produced, a 200% to 350% increase from 2021 and as much as a 1,700% increase from 2019. Responding to the Biden Administration’s challenge to produce 3 billion gallons of SAF by 2030, London-based Shell said it would begin ramping up supply for the U.S. market.

How BWB Designs Are Shaping More Sustainable Aviation

SAF isn’t the only technology that companies are eyeing to improve efficiency. A new aircraft design, one that some people describe as resembling a manta ray, could become part of the global airline fleet sooner than expected.

Known as a blended wing body (BWB), this design reimagines the commercial aircraft, doing away with the tubular fuselage and replacing it with a broad, triangle-shaped body. The layout provides additional lift and lowers aerodynamic drag by as much as 30%, which in turn cuts fuel consumption in half and reduces emissions and noise.

The BWB concept also offers a potentially more comfortable passenger experience. Because the interior is much wider and roomier than a traditional tube-shaped jet, seating on domestic flights could be spaced out more generously and even arranged with three aisles instead of the usual one or two. The aircraft is currently intended to serve the middle market of the airline sector, able to seat between 230 and 250 people. (The typical Boeing 737, by comparison, can carry between 108 and 215 passengers.)

In August, the U.S. Air Force announced that it was investing $235 million over the next four years into aircraft startup JetZero, which plans to have a full-scale BWB concept ready to test by 2027. The Los Angeles-based company, whose name is a clever play on “net-zero,” was founded in 2021 with the goal of developing “the next generation of sustainable jets.”

You can see some conceptual artwork of the aircraft and its interior by clicking here.

Balancing Fleet Growth With Sustainable Goals

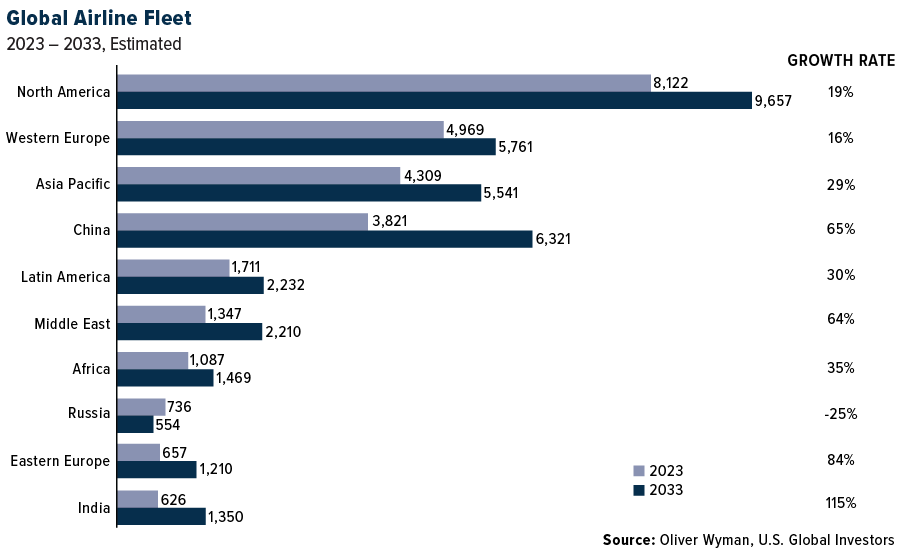

Sustainable jet fuel and more aerodynamic aircraft designs are just two examples of investments airlines are making to bring emissions down to zero by 2050. That year, an estimated 10 billion passengers will fly commercially across 22 trillion kilometers (13 trillion miles), significantly adding to greenhouse gases if nothing changes.

Take a look at the chart below. In just 10 years’ time, the number of commercial aircraft in the global fleet is set to grow dramatically, depending on the market. Consultancy firm Oliver Wyman believes India will more than double the number of commercial jets, from 626 today to 1,350 in 2033. Eastern Europe will also see massive growth, its fleet size expanding by 84%, followed by China (+65%) and the Middle East (+64%). The only market expected to shrink, according to Oliver Wyman, will be Russia, which could see the size of its fleet decrease by 25%, from 736 today to 554 within a decade.

To bring the entire industry into compliance and achieve net-zero emissions, trillions of dollars will need to be spent over the next 30 years to develop more sustainable fuels, more aerodynamic body designs and more efficient operations.

Yields Have Peaked This Cycle

On a final note, it looks more and more likely that Treasury yields have peaked in 2023, which seems to indicate that the market believes the Federal Reserve is at the end of this tightening cycle. It could also be good news for stocks in 2024.

This year’s spike in yields was initially driven, of course, by the Fed’s commitment to maintaining high interest rates to combat inflation. This pushed the yield on the 10-year Treasury bond to over 5% from a summer low of nearly 3.7%.

However, this upward trend is reversing, with the 10-year yield dropping to about 4.6% today. This decrease indicates a growing buyer interest, which pushes bond prices up and yields down. The Bloomberg U.S. Aggregate Bond Index is on track to post its third straight annual loss, which would be the longest losing streak on record.

As a result, defensive stocks, which have not performed as well as the S&P 500 this year, may become more attractive. Many investors consider these stocks stable, as they belong to companies whose products are consistently in demand, regardless of economic conditions. Examples of defensive stocks include utilities (NextEra Energy, Duke Energy, etc.), staples (Procter & Gamble, Coca-Cola) and so-called “sin stocks” (Altria Group, Philip Morris).

—

Originally Posted November 13, 2023 – Sustainable Aviation Fuel And The Blended Wing Body Revolution

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Bloomberg U.S. Aggregate Index is a broad-based flagship benchmark that measures the investment grade, dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

When one includes ALL of the costs required for different energy sources, like the cost of transmission lines, backup systems for intermittent sources, etc., it is clear that renewables are NOT less expensive than fossil fuels. Perhaps someday they will be, but not now. This becomes obvious when one simply watches which sources are chosen by the parts of the world that are energy starved. A poor African nation is NOT going to choose wind or solar over coal. And that is because coal is cheaper. Even the Chinese are building a large number of coal powered plants to provide their energy – it’s not because they prefer to spend more on energy than is necessary.

It is frustrating when misinformation, like the Lazard study, is promoted when it is obvious by just watching how the real world works to understand the truth.