By: Arne Staal, global head of product management and research and David Harris, head of sustainable business, LSEG

Materiality is central to sustainable finance. But what appears to be a straightforward concept is proving slippery in practice—and is triggering disagreements that could have significant implications for how companies disclose environmental and social indicators, and how regulators construct the market infrastructure on which sustainable finance depends.

Put simply, materiality is a measure of the importance of a piece of information when making a decision. But when this concept is used to assess the sustainability performance of a company, it becomes more complicated.

There are literally thousands of raw environmental, social and governance (ESG) indicators that can provide insights into the performance of companies. For any one theme—health and safety, or biodiversity, say—there is a wide variety of potential measures. Across FTSE Russell and Refinitiv, we hunt down data across hundreds of indicators based on the main global sustainability reporting frameworks.

Clearly, some indicators are far more relevant for certain industries than others: the environmental and social impacts of lithium mining will be highly relevant for an electric car company; less so for a clothing group. Geography is also important. Water usage is more important to a company in a drought-prone region than its peers in wetter climes.

But there is also a more profound question for investors to ponder. Should they only track those issues that are directly financial material to a company, or should they also consider impacts on society and the environment that don’t have a clear and immediate bearing on the company’s bottom line?

To take an extreme example, consider a “white label” clothing manufacturer with low brand recognition. Perhaps investors might be less concerned with poor labor or safety conditions in its factories because it does not have consumer brand recognition and therefore faces less reputational risks. The issue of labor conditions may be considered not financially material.

The alternative approach to such narrow financial materiality is known as “double materiality” as described by the EU. This argues that disclosure should not only address the impact of sustainability factors on a company, but also the impacts of the company on society and the environment. This reflects the fact that sustainability information is of interest to a broader range of stakeholders than just shareholders.

This debate is critical to the efforts underway to bring consistency to sustainability standards and reporting, as we discussed in the first blog in this series. Regulators, reporting standard setters, accounting firms, and data and index providers are all working towards common standards to guide sustainability disclosure.

Unsurprisingly, there is as yet no consensus on the materiality question. The EU, in its consultation on reforms to its Non-Financial Reporting Directive, came out in favor of double materiality. It is in agreement with the approach taken by the Global Reporting Initiative (GRI) which focuses not only on shareholders but also other wider stakeholders. The danger here is that this approach can be perceived as lacking a focus on the concerns of investors.

The Sustainability Accounting Standards Board (SASB), a US-based organization, takes a narrower, investor-focused view, following the definition of materiality used by the US Securities and Exchange Commission.

However, this approach arguably ignores issues that may rapidly become material over time. Take tax policy: while legally avoiding tax as much as possible while navigating grey areas of tax policy was considered by investors to be normal corporate policy a few years ago, it is has now emerged as a key reputational and financial exposure.

The difference between financial and double materiality is often just about time horizons. What is material for society and the environment ultimately becomes financially material for the company. To return to the example of the white-label clothing manufacturer. In our globally connected world, local whistle blowers, international NGOs and journalists could publicize abuses which, in turn, encourage its retail customers to cut their ties with the company.

Investors have different time horizons too: a day trader will not be concerned about the possible introduction of tighter labor laws in five years’ time; a pension fund with obligations to beneficiaries decades into the future will be far more likely to scan the horizon for structural changes in the economy and society.

Our view is that materiality is a dynamic concept. As noted above with tax, and indeed most environmental and social issues, it changes over time; few considered that emitting greenhouse gases was a material issue 25 years ago.

It is also highly subjective. An investor does not know which specific sustainability themes for a given company will necessarily become financially material—not even the best analyst can predict the future. Investment is about competing views of the future, and every investor will therefore consider materiality differently.

Materiality also varies between types of investor. Some hedge funds may favor companies that optimize their tax bills. A universal manager, who owns every listed company across an economy, is more likely to realize that tax avoidance has economy-wide impacts that drag on the performance of its other holdings.

So how do we square the circle between these different views? The standard setters—CDP, Climate Disclosure Standards Board, GRI, Integrated Reporting and SASB—are moving towards an approach to comprehensive corporate sustainability reporting that aims to accommodate these different views of materiality.

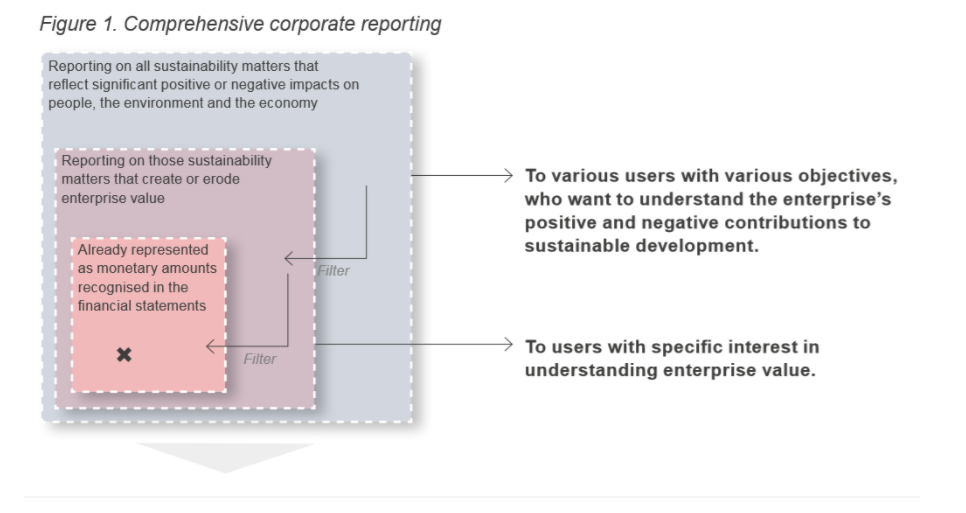

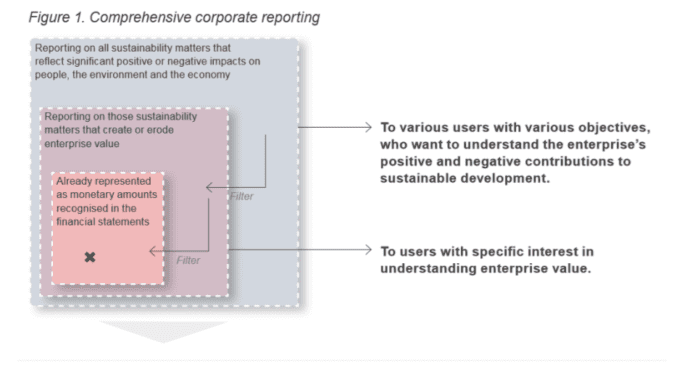

Their Reporting on enterprise value report, published in December 2020 and facilitated by the Impact Management Project, the World Economic Forum and Deloitte, sets out a “nested” approach to disclosure, which places financial reporting within the context of financially material sustainability disclosures and which, in turn, sits within wider reporting of the company’s sustainability matters that impact people, the environment and the economy. Sustainability issues can migrate between these layers as they become more (or less) financially material.

The approach encapsulated by this diagram aims to bridge the divide and nicely captures the concept of dynamic materiality. Financial materiality is found in the pink and purple boxes incorporating an “understanding enterprise value”, while social and environmental materiality is in the blue box. It aims to highlight the “interoperability” of approaches.

We would go further. Rather than distinct categories, we see materiality on a continuum, based on the time horizon over which it may impact enterprise value, and the level of market consensus around this. As noted above, all impacts on society, the environment or economy can theoretically become material to the company through reputational impact, license to operate, shifting client demand, fines, taxes or regulatory activity.

From this vantage point, there is no contradiction between financial and double materiality. It is a subjective continuum and trying to reach consensus on the materiality or otherwise for every issue for every company is a fool’s errand. Instead, it should be possible to reach consensus on an approach that recognizes the subjective and dynamic nature of materiality, and which gives companies, investors, regulators and other interested parties a framework in which to effectively communicate.

We need to appreciate that materiality, like beauty, is in the eye of the beholder.

—

Originally Posted on March 15, 2021 – Materiality in Sustainable Investment: In the Eye of the Beholder

Disclosure: FTSE Russell

Interactive Advisors, a division of Interactive Brokers Group, offers FTSE Russell Index Tracker portfolios on its online investing marketplace. Learn more about the Diversified Portfolios.

This material is not intended as investment advice. Interactive Advisors or portfolio managers on its marketplace may hold long or short positions in the companies mentioned through stocks, options or other securities.

© 2023 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®“ and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of the FTSE Russell products, including but not limited to indexes, data and analytics or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained herein or accessible through FTSE Russell products, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB, BR and/or their respective licensors.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from FTSE Russell and is being posted with its permission. The views expressed in this material are solely those of the author and/or FTSE Russell and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Tax-Related Items (Circular 230 Notice)

The information in this material is provided for informational purposes only and does not constitute tax advice and cannot be used by the recipient or any other taxpayer to avoid penalties under any federal, state, local or other tax statutes or regulations, or to resolve any tax issue.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!