The main physical effect of rising greenhouse gas levels in the atmosphere, primarily due to fossil fuel combustion, is the increase in the average global surface air temperature. As a result, the rise in global temperatures compared to pre-industrial levels (with 1850-1900 commonly serving as the baseline) represents the predominant indicator of contemporary climate change and is frequently referenced in global climate pacts.

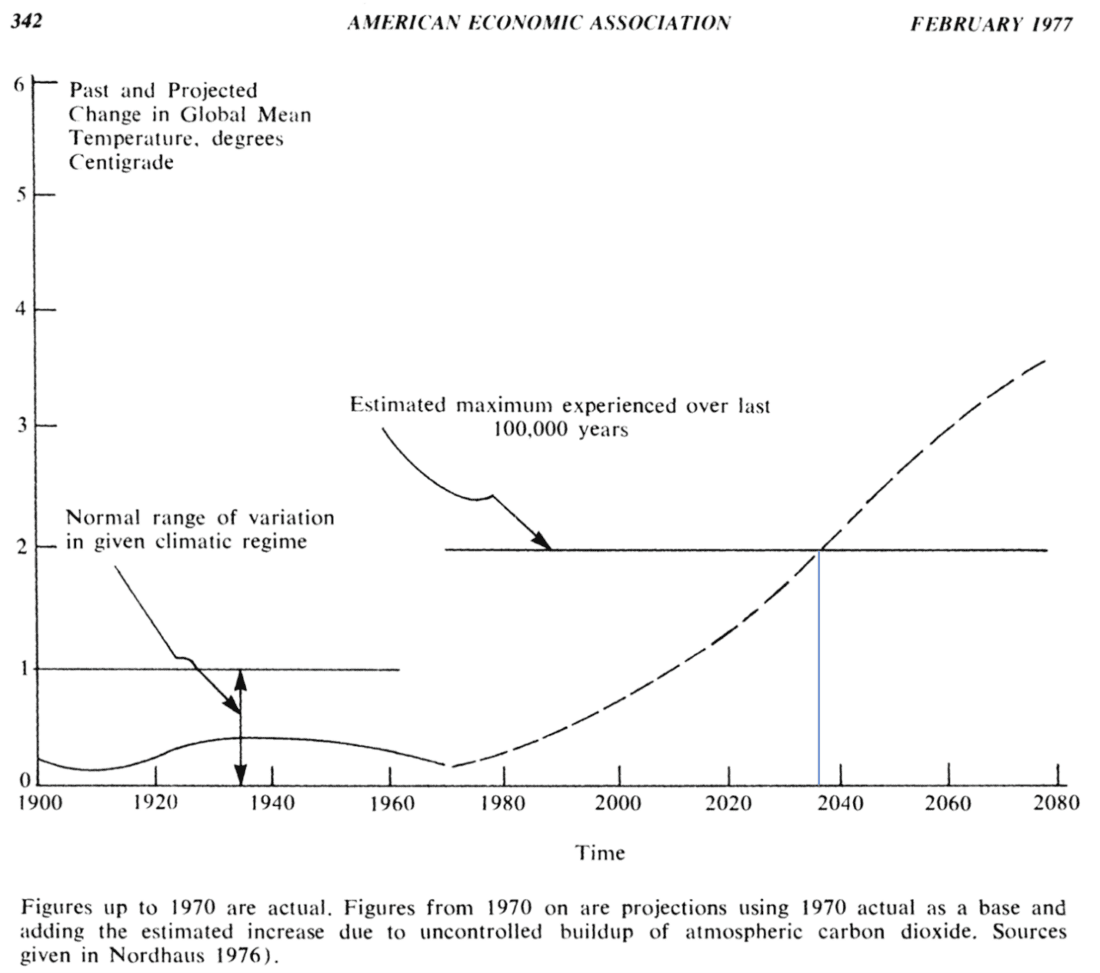

Dating back to the 1970s, a temperature rise of 2°C (3.6°F) above pre-industrial levels has been identified as a threshold humanity might like to avoid, as it would exceed the warmest global temperature had been over the past approximately 100,000 years. In William Nordhaus’s 1977 publication, this level of warming was projected to occur by around 2038, even though substantial global warming had not yet been observed (see also Broecker (1975) Climatic Change: Are We on the Brink of a Pronounced Global Warming?)

From Nordhaus (1977). Economic Growth and Climate: The Carbon Dioxide Problem

Over time, it became conventional wisdom that humanity should seek to avoid 2°C of warming, and this figure was officially defined as “dangerous anthropogenic interference with the climate system” by the United Nations in the 2009 Copenhagen Accord. Seven years later, in 2016, the U.N. Paris Agreement reiterated the 2°C ‘limit’ while also expressing intentions to restrict global warming to only 1.5°C. Despite widespread claims to the contrary, the 1.5°C and 2°C ‘limits’ were codified by international climate diplomacy negotiations rather than from any comprehensive, authoritative scientific assessment.

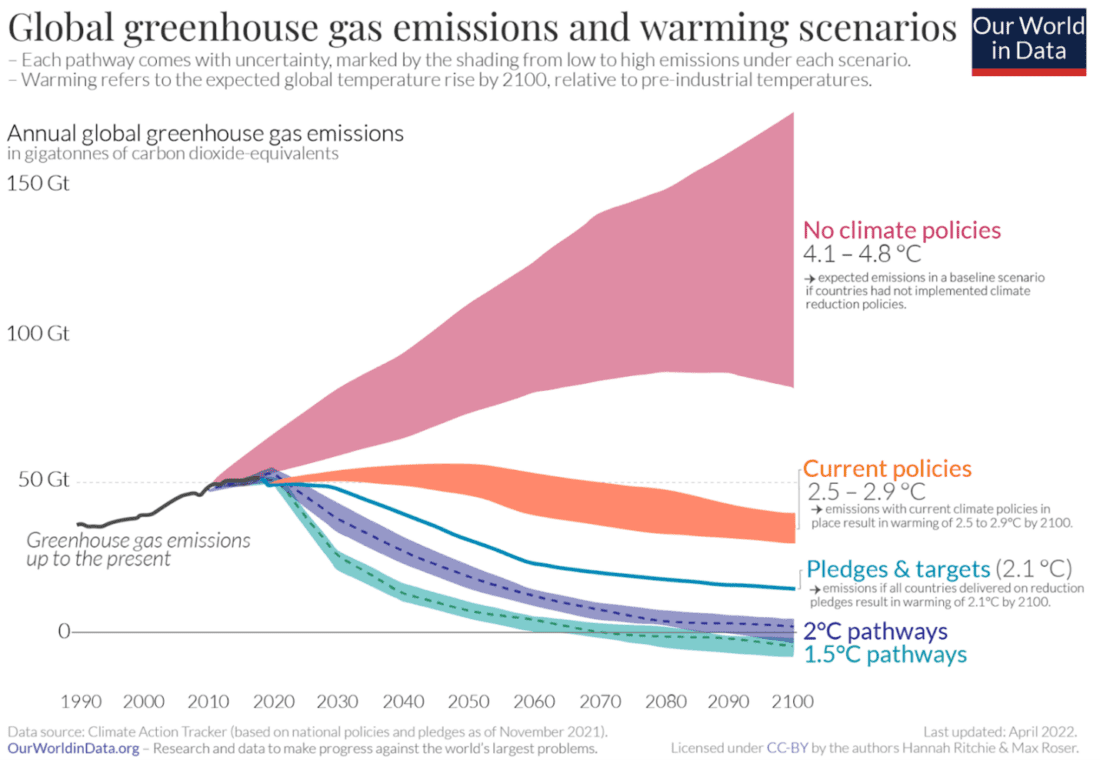

The Paris Agreement relies on voluntary pledges from countries regarding their emissions reductions, and countries face no binding penalties for failing to meet these commitments. In addition to nations, a wide range of entities—from regional governments to cities and corporations—have made emissions commitments aligned with the temperature targets of the Paris Agreement, often under a pledge to achieve “net zero emissions by 2050. ” However, while such pledges were initially a popular way to demonstrate environmental leadership, a growing number of organizations are quietly retracting or softening their commitments. Overall, estimates of ‘current policies’ suggest a long plateau of global greenhouse gas emissions that significantly exceeds what would be required to meet the Paris Agreement but still remains well below emissions levels estimated without any climate policies.

From Our World in Data.

The upshot is that future emissions and, therefore, future global average temperatures remain quite uncertain. Correspondingly, there is substantial interest in how quickly we expect to exceed specific temperature thresholds, as was exemplified by the interest in 2024 being the first year to exceed 1.5°C. Such threshold crossings do not necessarily indicate a long-term violation of Paris Agreement targets because the treaty is framed around multi-decadal averages at the end of the 21st century, but they still carry information about where we are headed and how fast we are headed there.

It is for these reasons that ForecastEx Forecast Contracts are now available, based on when certain temperature thresholds (+1.75°C and +2°C) might be crossed for the first time at both the monthly and annual timescale.

At first glance, this may seem like a narrow physical calculation that is best left to climate scientists, but this event question actually goes well beyond physics and requires information on the future trajectory of economics, technology, demographics, and geopolitics. It is thus a quintessential example of a question that would benefit from aggregating diverse information dispersed broadly across society in a prediction market.

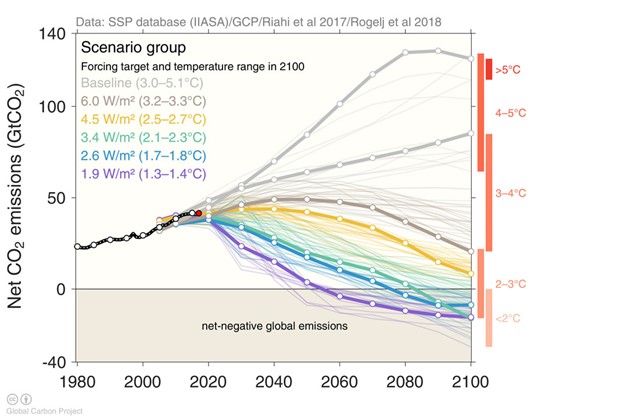

To price the initial probabilities, investors could use the same suit of climate models used by the United Nations Intergovernmental Panel on Climate Change combined with simple stochastic auto-regressive time series modelling. The climate models simulate the Earth’s climate system by solving the physical equations governing the atmosphere, oceans, land, and ice. For our purposes, they calculate the ‘forced response’ of the global average temperature corresponding to a given change in greenhouse gas concentrations. We look at three different emissions scenarios (SSP1-2.6, SSP2-4.5, and SSP5-8.5), which embed assumptions about economic growth, population trends, technological progression, and the level of global policy action.

From Carbonbrief.

SSP1-2.6 (referred to as ‘2.6 W/m2’ above) assumes a world that prioritizes sustainability, with low population growth, rapid technological progress, and aggressive climate mitigation policies. This leads to sharply declining emissions to net zero by around 2070.

SSP2-4.5 (referred to as ‘4.5 W/m2’ above) depicts a “middle-of-the-road” world with moderate economic growth, uneven development, and only moderate top-down climate policy. Emissions peak in the 2030s and gradually decline thereafter.

SSP5-8.5 (referred to as ‘baseline’ above) assumes rapid economic growth fueled by heavy reliance on fossil fuels and minimal climate policy. This results in rapid increases in greenhouse gas emissions through the remainder of the century.

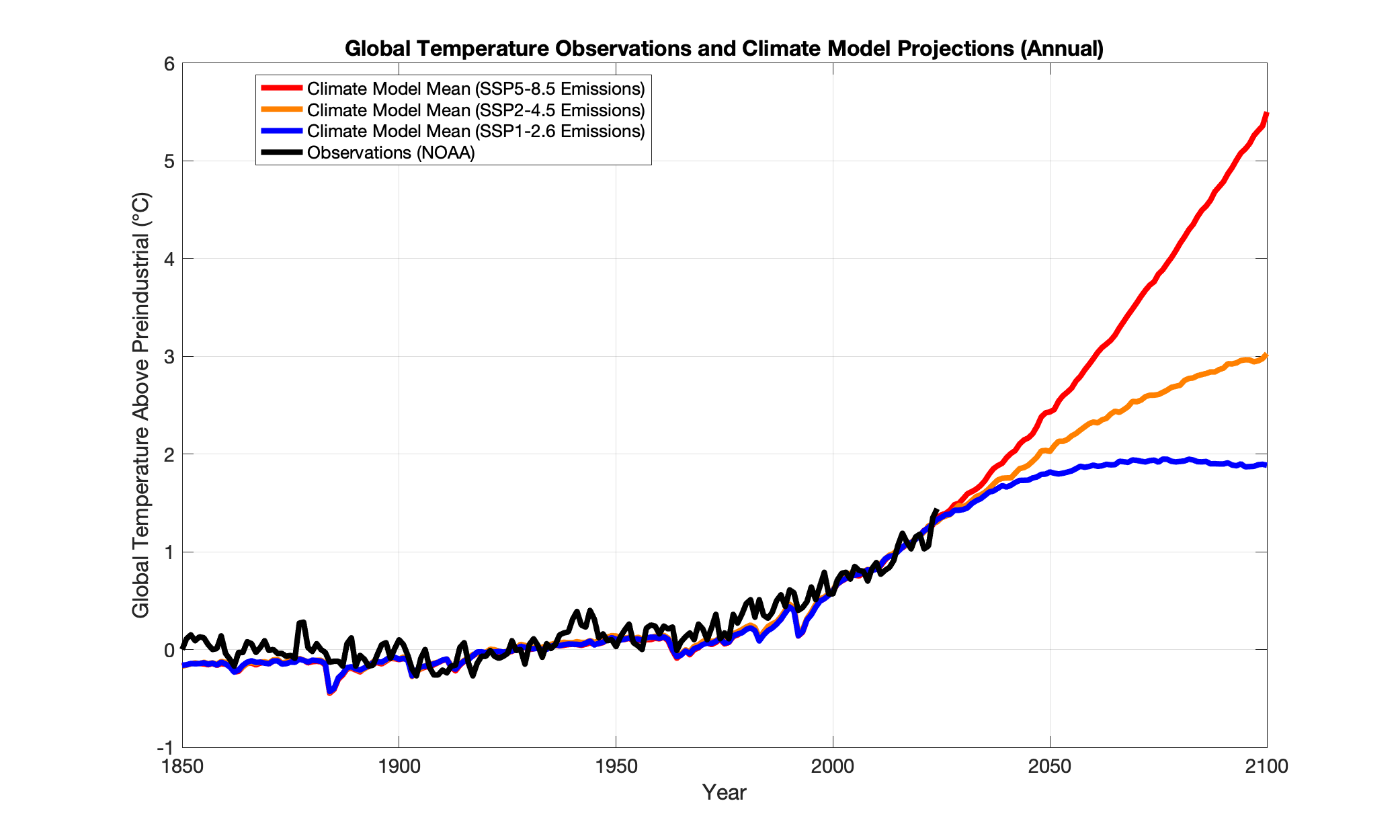

The forced responses of global temperature for these three emission scenarios, calculated by and averaged over many climate models, are shown below.

Forecast Contracts give participants a chance to express their judgments about which scenario or combination of factors will ultimately come to pass. A participant who believes that renewable energy costs will continue to decline dramatically and that policy interventions will intensify might take positions aligned with a lower-emissions scenario like SSP1-2.6, anticipating that global temperature threshold breaches are less likely or will arrive later. Conversely, a participant who expects population growth to outpace technological gains or who doubts that political will can sustain deep decarbonization might tilt toward higher emissions and earlier threshold crossings associated with SSP5-8.5.

Views on climate sensitivity (how much warming we get from a given emissions trajectory) can also shift the anticipated probabilities of threshold breaches. For example, if one supposes very high climate sensitivity, they may anticipate warming rates more in line with the SSP5-8.5 emissions scenario even if they think that the actual emissions associated with the scenario are implausible. This logic, of course, runs in the opposite direction as well. If a participant thinks that greenhouse gas emissions will continue to rise for the foreseeable future but thinks that climate sensitivity is low (a low amount of warming for a given amount of emissions), they may be more favorable to an SSP1-2.6-like temperature trajectory.

In addition to using climate-model calculated estimates of the ‘forced response’ of global average temperature to increasing greenhouse gas concentrations, we account for stochastic ‘unforced’ variability that emerges from dynamics internal to the climate system like the El Niño Southern Oscillation.

Global climate models also simulate this ‘unforced’ variability, but they are not specifically optimized for it and often have well-known discrepancies with observations. Therefore, to obtain a better representation of initial probabilistic estimates of temperature threshold crossings, you can utilize an AR(2) time series model fit to observations which allows us to reproduce the magnitude of variability and autocorrelation we observe empirically (this model is fit to the observational data after being “detrended” by subtracting the climate model mean over the historical period).

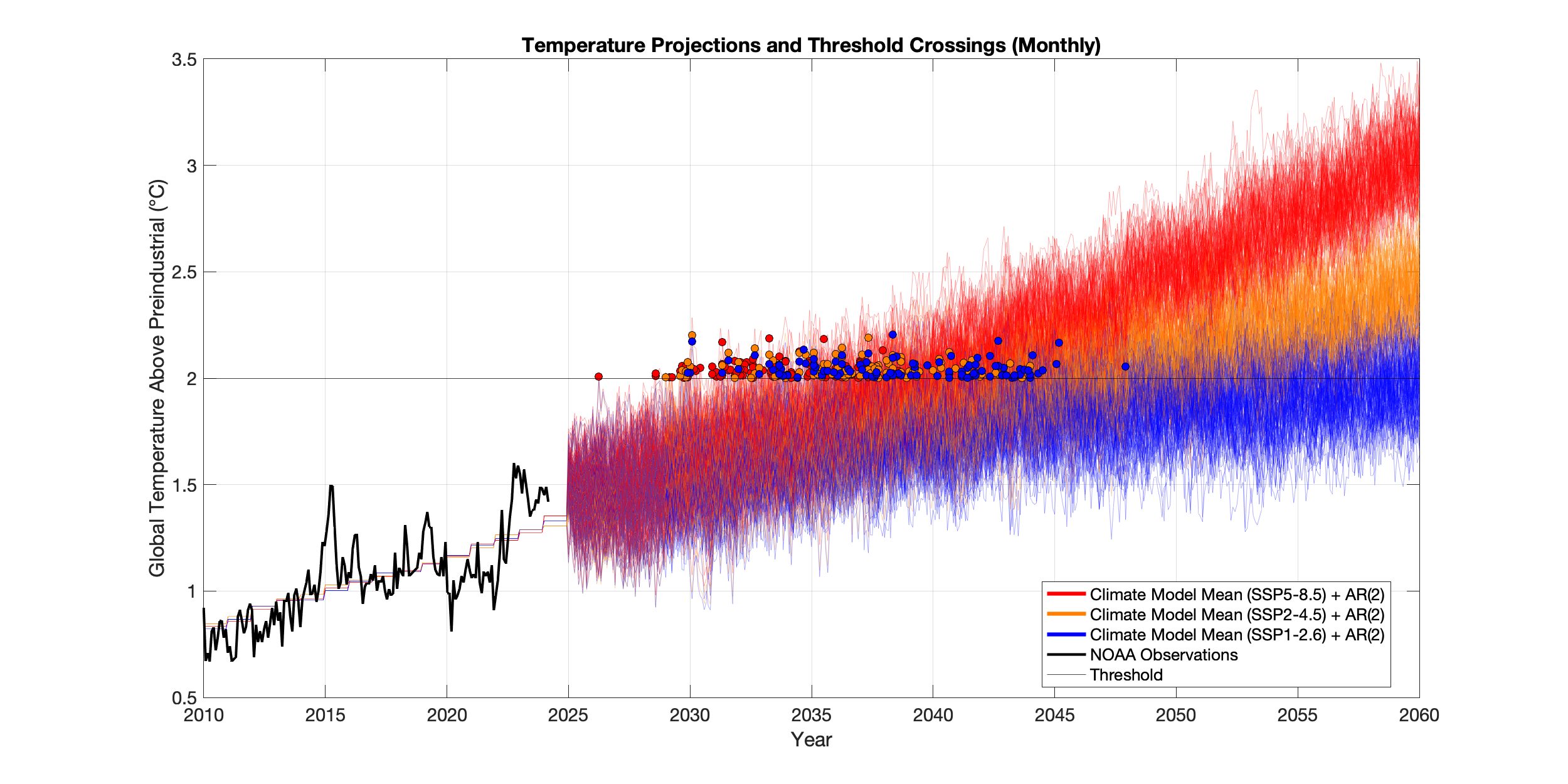

Below are thousands of synthetic AR(2) time series superimposed on the three forced responses associated with the three emissions scenarios (SSP1-2.6, SSP2-4.5, and SSP5-8.5) at both the monthly and annual timescale.

As a side note, it is remarkable how many simulations cross +2°C very close to 2038, just as projected all the way back in the 1970s (first figure above).

The event question in the Paris Agreement Forecast Contracts concerns when a temperature value will be breached for the first time, which is indicated by the dots in the figures above.

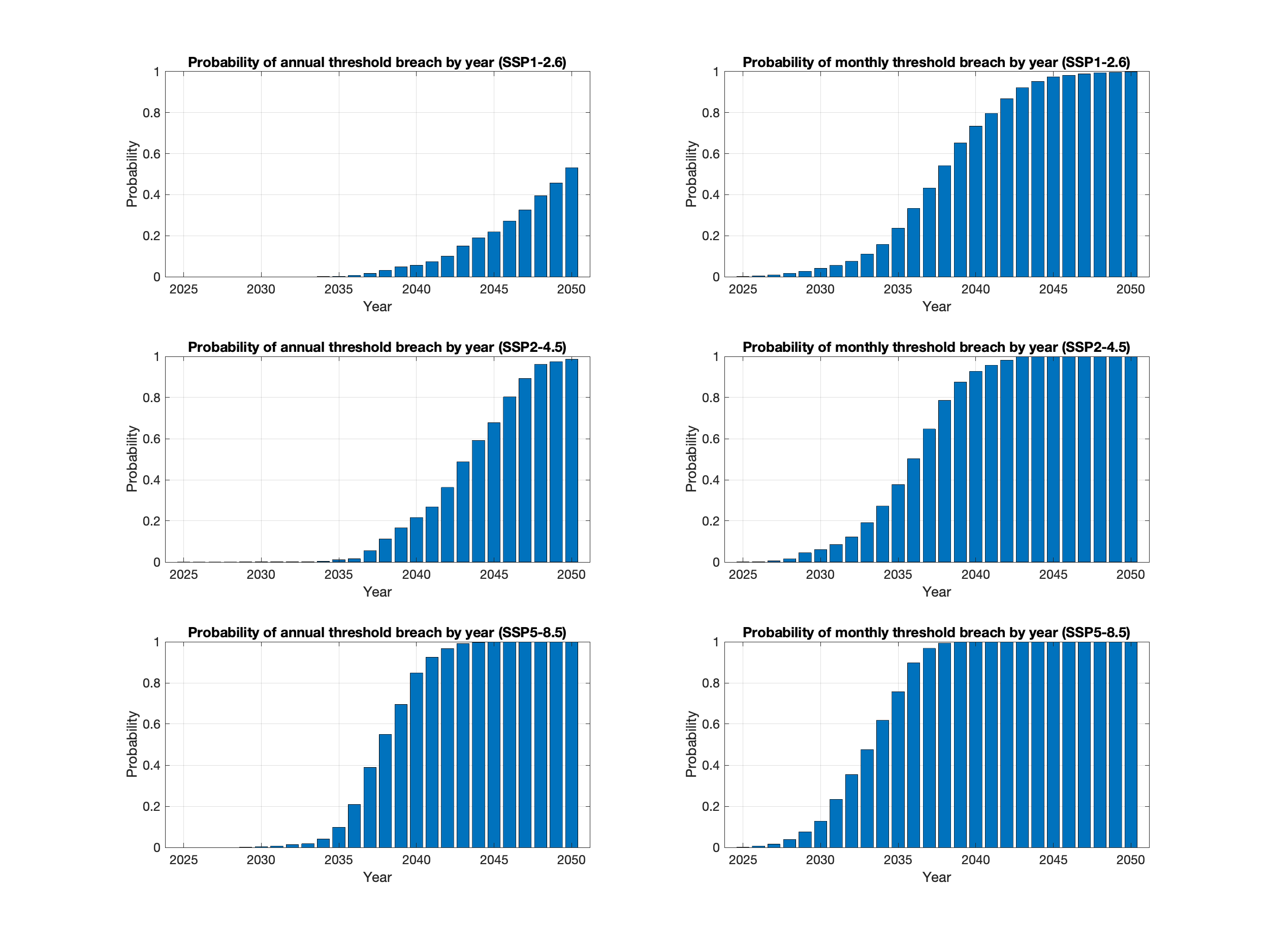

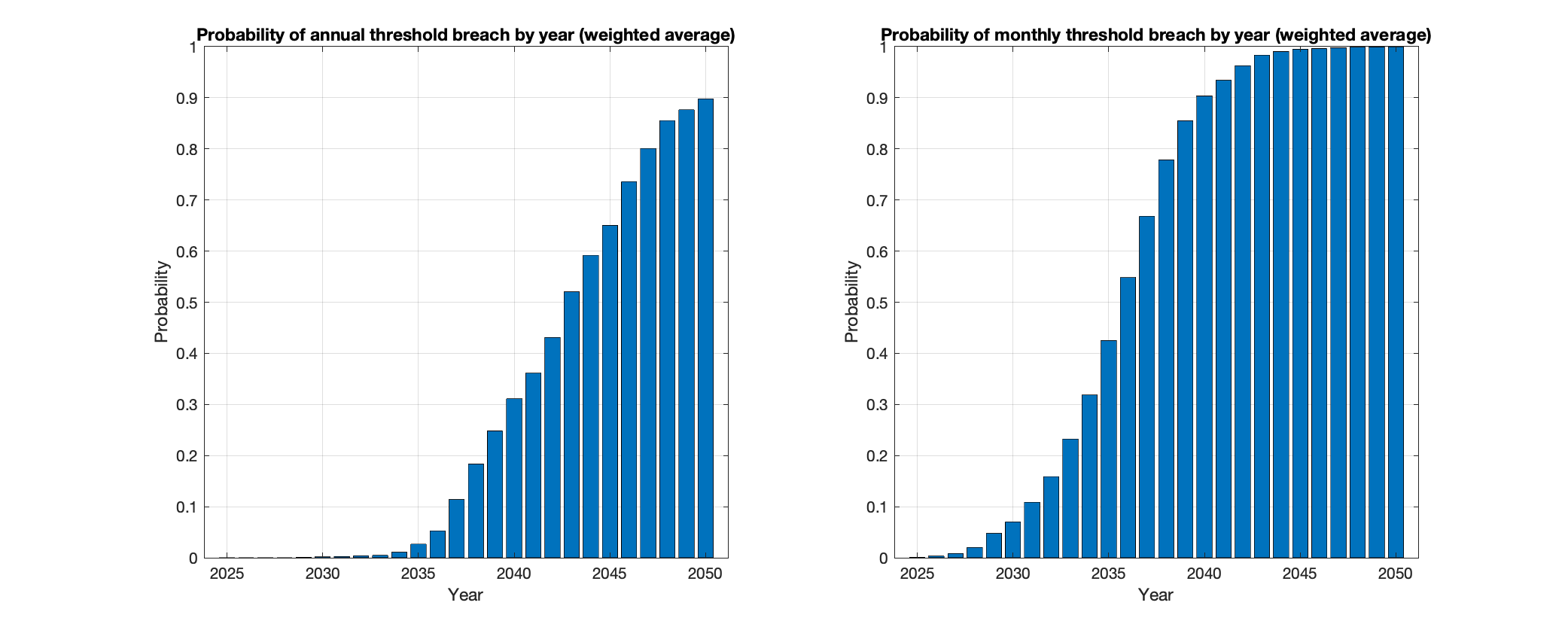

These breaches are then counted in order to calculate the probabilities of surpassing a threshold (in this case 2°C) by a specific time for the three emissions scenarios. For the monthly timescale, the year indicates that any month up to and including the months within that calendar year has breached the threshold.

It can be seen that because monthly variability exceeds annual variability, the odds of crossing thresholds are higher earlier. Essentially, monthly values are more likely to breach thresholds sooner since, in any given year, there might be one or more months that spike above a threshold while the annual mean for that year stays below it.

To produce unified estimates of probabilities, you can use a weighted average of the probabilities from the three emissions scenarios where the weights are 20% for SSP1-2.6, 60% for SSP2-4.5, and 20% for SSP5-8.5.

The timing of threshold crossings hinges on the physics of the climate system as well as humanity’s future energy, economic, and demographic pathways. Will continued innovation in wind, solar, batteries, advanced geothermal and nuclear power keep us on a low warming trajectory similar to SSP1-2.6? Will top-down policy achieve the same outcome even without such innovation? Conversely, will accelerating economic and population growth, combined with a lack of policy efforts and a higher climate sensitivity, lead us closer to an SSP5-8.5-like temperature trajectory?

These are the kinds of questions participants should consider as they assess the prices of contracts. If a potential participant has any qualms with the probability calculations laid out above, it should motivate them to purchase a contract in one direction or another, which will implicitly move the odds towards their view.

Ultimately, the ambition behind these forecast contracts is to bring climate science to a broad community of participants—investors, policy experts, researchers, and anyone with an informed opinion about technology, policy, and Earth-system dynamics. The hope is to garner broad participation such that price signals aggregate diverse information across many domains of expertise and thus sharpen global awareness of the proximity the Earth is to major warming benchmarks.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

B S. Geoengineering is the weather warfare we face, spraying poisonous chemicals daily poisoning land sea and air.

I have read elsewhere that all climate models do poorly in backtesting projections without adding “fudge factors” to improve fit. If true, that suggests that scientists don’t understand climate science well enough to make accurate forward projections, especially into uncharted zones. How would an objective expert answer this criticism?

Dave I believe your assumption is correct. There are many naysayers out there all of whom including ourselves are not sure because of many hypotheses which have not been proven or confirmed I would direct your attention to a Canadian Climatologist Pat Moore out of Simon Frazier university and TV land about CO2. His studies show it is declining relative to the Carboniferous age of the volcanoes and plants in the Devonian era. If this doesn’t make one scratch their heads, nothing will. We simply have to be good stewarsds of our island home in this vast universe

Very disappointed in interactive brokers for publishing this “climate” theory. Water and Air Pollution are real measurable problems. CO2 pollution is a political ESG ploy. Doesn’t exist .A Marxism type “creative disruption “ tool to take control of societies.. Personally have graduate degrees in Public Health and business from British universities taught by UN ESG consultants. These climate philosophies create poverty and death around the world. Wake up.! Our poor education system for the past 50 years has perpetuated the CO2 climate crisis. Distracting scientists from solving real problems of pollution.

Also VERY disappointed that interactive brokers can not see through the propaganda of anthropomorphic climate change. I understand that these so-called scientists have to play the game of climate change so they can get their funding. However there is no excuse for IBKR to succumb to the tiresome corruption of the so-called CO2 crisis. We need more CO2 ….not less. As the CO2 content in the atmosphere increases, the world increases in greening …particularly where it is needed most, in arid regions. IBKR should be ashamed of itself for being so gullible. Do some research.