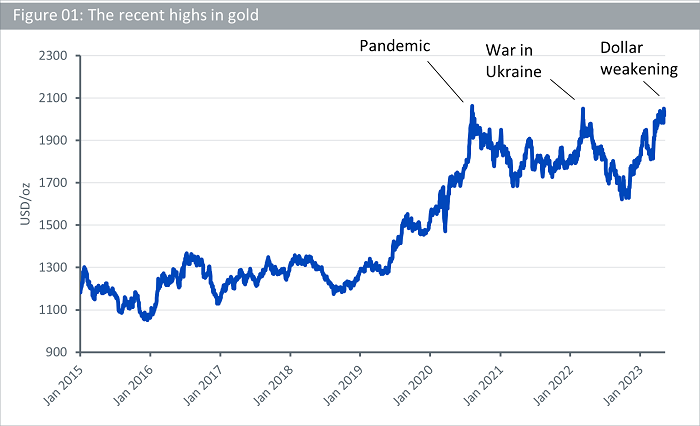

On 3rd May, gold very narrowly missed breaking its all-time high achieved in August 2020. As of this writing on 11th May, gold is holding its ground comfortably above the $2000/oz mark.

Gold’s recent rally was triggered in November last year when markets began foreseeing a slowdown in inflation in 2023 and the US Federal Reserve (Fed) toning down its hawkish rhetoric. As a result, despite subsequent interest rate increases, 10-year Treasury yields have pulled back and dollar has depreciated – both tailwinds for gold. Additional support came from the trouble in the banking sector which served as a reminder to investors to maintain their hedges given the systemic fragilities that can be exposed when monetary policy is tightened aggressively.

A look back at recent highs

Gold’s three recent peaks have each been driven by unique reasons. The record high achieved in August 2020 came following a strong rally triggered by the pandemic. Some might argue that gold was already upwardly mobile, and that monetary policy accommodation had been aiding gold’s ascent since the second half of 2018.

Once the worst of the pandemic was over, gold retreated but approached record highs again March 2022 when Russia invaded Ukraine. Pandemic, war, and turmoil in the banking sector are all distinct reasons that have fuelled gold rallies in recent times, but they all point to the need for hedging in investment portfolios. They highlight how gold’s credentials become apparent when it matters most. We discuss this in more detail in our recent podcast episode of The Commodity Exchange titled ‘Investing in Gold’.

Source: WisdomTree, Bloomberg. Data as of 10 May 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

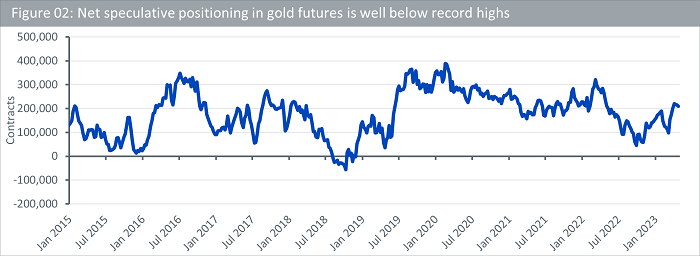

ETP flows vs speculative positioning

Investor sentiment can be measured by one of two things, flows into exchange traded products (ETPs), or speculative positioning on futures. Physical gold held in ETPs is flat year-to-date at around 93m troy ounces, compared to a record high of around 110m toy ounces in September 20201. Similarly, net speculative positioning in gold futures is well below highs seen in 2020 and 2022 (see figure 02 below). Both these data points suggest that investor sentiment is not stretched on the long side yet.

Source: WisdomTree, Bloomberg. 01 January 2015 – 10 May 2023.

Historical performance is not an indication of future performance and any investments may go down in value.

Potential catalysts for gold in the coming months

One potential catalyst for gold interest could be the US debt ceiling, which is the limit on the amount of money the US government can borrow. Currently standing at $31.4tn2, the debt ceiling has been raised multiple times in the past. However, the US government has warned that it is close to exhausting its cash reserves and may face a sovereign default or severe spending cuts by June 1st, 2023. This situation is likely to increase the demand for gold as a hedge against economic uncertainty.

Economic data could be the other driver. US annual inflation rate fell to 4.9% in April, compared to 6.4% in January3. If inflation continues to drop in line with consensus expectations, this could continue to support gold. Although this appears counterintuitive at first, given higher inflation is meant to be supportive of gold, but further declines in Treasury yields and additional dollar depreciation that will result from falling inflation are likely to exert greater force on gold’s path.

Keep an eye on other precious metals

Other precious metals like silver, platinum, and palladium all have notable, albeit varying, levels of correlation with gold. In the past, we have often seen silver demonstrate what appears to be a leveraged relationship with gold. In 2020, when gold rallied following the Covid outbreak, silver outshined gold.

Sometimes we also see a lag in the reaction by other precious metals to movements in gold. For example, when gold reached record highs in August 2020, platinum formed a peak in February 2021. Such dynamics may or may not repeat but it is always interesting to see what’s happening to the broader precious metals basket when gold shows strong moves in either direction.

Sources

1 Bloomberg, as of 10 May 2023.

2 Congressional Budget Office.

3 Trading Economics.

—

Originally Posted May 12, 2023 – What’s Hot: Gold is flirting with record highs again

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!