Markets are taking investors on a wild ride so far today as a cocktail of corporate earnings, economic data and heightening trade tensions generates confusion amongst traders. Indeed, blockbuster earnings and decent guidance from AI juggernaut Nvidia was met with intensifying Trump tariff threats. At this point, folks are considering the possibility that 25% will be the levy charged on most imports under the sun, including semiconductors, which is weighing on tech enthusiasm despite the sector’s strong profitability. Meanwhile, the economic calendar dished out hot and cool data simultaneously, with quarterly PCE price pressures and monthly durable goods orders blowing past expectations. Conversely, initial unemployment claims jumped to their highest level of the year and pending home sales sunk to the lowest level ever recorded. Today is indeed a market rollercoaster with stocks switching from robust gains to sizeable losses to flat, but the most significant moves on the trading desk are coming from the greenback, as Trump tariff fury sends the dollar and yields north.

DC Layoffs Push Up Unemployment Claims

Initial unemployment claims totaling 242,000 exceeded the median analyst estimate by 2,000 for the week ended February 22 and climbed from 220,000 in the preceding seven-day period. Continuing claims, which are considered to be an indicator of the ability for laid off individuals to find work, however, dropped from 1.867 million to 1.862 million for the week ended February 15. The result was below the analyst expectation of 1.870 million. Today’s uptick in initial claims matched high levels of December 7 and October 12. With the exception of those dates, it’s the highest number since October 5. Four-week moving averages for initial and continuing claims of 224,000 and 1.865 million climbed from 220,000 and 1.862 million.

Pending Home Sales Tank

The National Association of Realtors’ (NAR) Pending Home Sales Index dropped 4.6% month over month (m/m) and 5.2% year over year (y/y) to 70.6 in January, hitting the lowest level since the start of the benchmark in 2001. The m/m weakness accelerated from December’s 4.1% contraction and was worse than the analyst consensus expectation for a 0.9% dip. The most dramatic decline was in the South, but tentative transactions also contracted in the Midwest and West. NAR notes that the Northeast posted a modest increase with home shoppers braving periods of low temperatures and high winds. Broadly speaking, elevated mortgage rates and high prices have led to record low levels of home affordability.

Quarterly Inflation Revised North

Both the headline and core Personal Consumption Expenditures (PCE) price indices were revised north for the fourth quarter, reflecting inflationary pressures that are drifting away from the Fed’s objective. The annualized headline and core figures rose 2.4% and 2.7%, higher than expectations of 2.3% and 2.5% and accelerating from the third quarter’s 1.5% and 2.2%.

Aircraft Orders, Capex, Drive Durable Goods Advance

A sharp recovery in passenger aircraft orders alongside an acceleration in business investment drove an upside beat in this morning’s print from the US Census Bureau. Durable goods orders rose 3.1% m/m in January, much higher than the 2% expected and the 1.8% contraction in December. Nondefense airplane, computer and military aircraft purchases led the gains, growing 93.9%, 7.1% and 1.9% m/m. Capital goods excluding defense and aircraft, a proxy for business investment, advanced 0.8% m/m, accelerating from 0.2% in the prior period. Orders for automobiles, fabricated metal products and the other category served as a drag, declining 2.5%, 1.2% and 0.6% m/m.

Rollercoaster Market

Markets are all over the place today and at the moment equity benchmarks are mixed, yields are climbing in bear steepening fashion and the greenback is surging. In stocks, the Russell 2000 and Nasdaq 100 indices are trimming 0.2% each while the Dow Jones Industrial and S&P 500 gauges increase 1% and 0.3%. Sectoral breadth is positive, however, as traders seek to cushion the blow from the technology sector’s weakness. Utilities and tech are the only segments losing on the session out of the 11 majors; they’re down 1.2% and 0.6%. Leading the bulls, meanwhile, are financials, energy and industrials, which are higher by 1.6%, 1.3% and 0.9%. Treasurys are getting sold due to an uptick in inflation expectations, the 2- and 10-year maturities are changing hands at 4.10% and 4.29%, 2 and 4 basis points (bps) heavier on the session. Pricier borrowing costs and Trump tariff threats are sending the US dollar to the nosebleeds, as its index climbs 70 bps. The greenback is appreciating relative to all of its major counterparts, including the euro, pound sterling, franc, yen, yuan, loonie and Aussie tender. Commodities are mixed, however, with gains of 2%, 0.9% and 0.8% in crude oil, lumber and copper being countered by losses of 1.3% across both gold and silver. WTI crude is trading at $70.16 per barrel as supply concerns mount against the backdrop of tariffs on Canadian energy as well as sanctions on Tehran.

Focusing on Initial Claims

While today’s inflation data was stronger than expected, a greater threat to the earnings outlook stems from a weaker stateside consumer. This morning’s report on initial unemployment claims is indeed concerning and market participants are expressing their worry by raising the odds of higher filings ahead. A deterioration in employment conditions will certainly help to bring rates down but at the expense of corporate revenues. Meanwhile, the Fed is mandated to consider the risks stemming from higher price pressures as well as rising unemployment, but the bias has been tilted to the labor market part of the mandate. An uptick in joblessness will bring Fed accommodation regardless of where inflation is. Recall that all it took was a few job reports that were modestly soft for the central bank to go out of its way and reduce its key benchmark by 50 bps in September, which was a policy mistake.

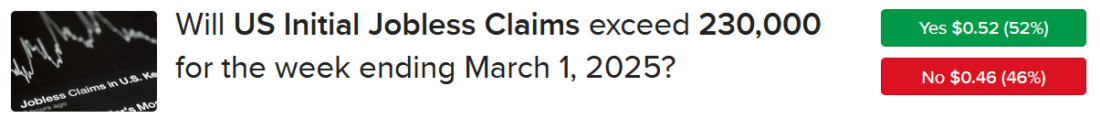

Forecast Traders Expect Higher Filings

IBKR Forecast Traders expect the rise in initial claims to continue next week, with current pricing of 52% corresponding to a figure north of 230,000.

Source: ForecastEx

International Roundup

Sentiment Improves in Europe

Despite the threat of a looming trade war, the euro area Economic Sentiment Indicator (ESI) climbed 1 point to 96.3 m/m in February, hitting a five-month high and exceeding the analyst consensus forecast of 96.0. Nevertheless, even with the increase, the result was below the long-term average of 100, according to Eurostat. On a positive note, the Consumer Confidence Indicator strengthened by 0.6 points to 13.6, matching the analyst estimate. Households have increased their plans to make major purchases, although views on current financial situations remained unchanged. The ESI also benefited from the Industrial Sentiment indicator climbing from -12.7 to -11.4, which exceeded the consensus estimate of -12.0, and the Business Climate Index advancing from -0.92 to -0.74. Businesses’ outlook for pricing also improved with the Selling Price Expectations metric climbing from 8.8 to 9.8. The outlook for retail trade was unchanged.

Gains in the various subindices were partially offset by the Employment Expectations Indicator dropping 1.5 points to 97.0 and the Services Sentiment gauge weakening from 6.7 to 6.2, which is below the estimate of 6.8. Regarding the job market, the weakness was led by faltering hiring plans in the services and construction segments. Hiring plans also weakened in the industrial sector but to a lesser degree.

ECB Confidence About Inflation Improves

Separately, minutes from the European Central Bank released today reveal that policymakers are confident that they are continuing to make progress in fighting inflation and still believe monetary policy is restrictive. Going forward, they will be more cautious in making rate cuts. Risks to curtailing inflation include higher energy and food prices, wage growth, and elevated services costs. Broader economic challenges include fiscal policy concerns within eurozone and global trade.

Canada Wages Climb

Average weekly earnings among Canadians climbed 5.8% y/y in December and total payrolls grew by 0.9% and 0.1% y/y and m/m, according to Statistic Canada. Wage growth accelerated from November’s 5% gain. Regarding payrolls, the transportation and warehousing sector grew the fastest with a 3.7% increase after labor strikes caused a 4.2% decline in the preceding month. The average hours worked metric and total payroll excluding transportation and warehousing changed little while job vacancies increased 3%.

Australia CapEx Falls

Capital expenditures in Australia dropped 0.2% on a seasonally adjusted basis in the final three months of 2024 relative to the second quarter of the year but increased 0.6% y/y, according to the Australia Bureau of Statistics. Allocations for buildings and structures climbed 0.2% quarter over quarter (q/q) but declined 1% y/y while equipment, plant and machinery outlays fell 0.8% q/q and increased 2.4% y/y. One bright spot was the media and telecommunication industry, which boosted CapEx by 22% q/q as cloud computing and AI fuels strong demand for data centers. The gain was offset by 8%, 7% and 5.4% declines in construction, health care and the finance and insurance category.

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

I tooooldddd you: pro-business (hahaha) Trump will crash the markets. It is happening. My short positions are very grateful to trump, musk and the rest of the circus