Web1 was the first evolution of the consumer internet. Made possible by the development of open web standards, technically competent users could tap into internet protocols to build webpages and reach global audiences directly. The webpages developed during the Web1 era were static, allowing users to read text and view images, but offered little in the way of more complex interactivity. Because of the technical skill needed to create web content in this era, Web1 had few content creators but many content consumers.

The shift from the Web1 to the Web2 era represented a sea change in how the everyday user interacted with the internet. As internet use grew and commerce began to move online in the late 1990s, Web2 saw corporations begin to build online empires. Among their most significant advances, Web2 companies successfully abstracted away the complexity of web-based content creation. This era saw huge advances in the interactivity of webpages, progressing from static read-only pages to dynamic interfaces allowing users to both read and write. Now anyone around the world could publish content online without needing coding experience, coinciding with the rise of social media. These advances, however, came at the expense of the web’s open-source roots. In exchange for providing these dynamic platforms for free, centralized internet companies increasingly engaged in user data collection, surveillance, and monetization through advertising. As a result, the internet became defined by permissioned walled gardens with control and influence held by a handful of powerful companies.

Web3, what we expect to be the next evolution of the consumer internet, offers a compelling alternative by leveraging qualities from both the Web1 and Web2 eras. In short, Web3 seeks to offer a web experience that is highly interactive and content-rich, but in a format that is open-source and encourages collaborative development and user ownership. To accomplish this, Web3 developers are building applications on top of distributed, permissionless, and secure blockchain networks. By relying on these new networks to manage and secure user data, Web3 redistributes the centers of control and influence on the internet and allows users to regain control over their digital presence.

But for Web3 to succeed, it needs a novel set of building blocks. In the same way that a complex stack of infrastructure, service providers, and applications underpin Web2, Web3 requires an entirely new software stack to realize its vision of a permissionless, user-owned web. In this blog post, we highlight the tools that allow blockchains to create a decentralized web.

Key Takeaways

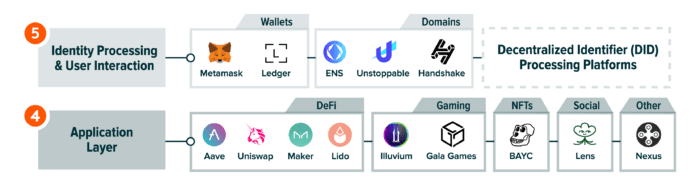

- Web3 is a new paradigm that runs on smart contract blockchains. The application layer of the Web3 stack is composed of decentralized applications (dapps) that leverage smart contract functionality to replicate many of our favorite internet use cases today.

- Dapps can tap into supporting services and infrastructure protocols that allow them to expand their utility. They may rely on layers of critical infrastructure, including block explorers, software development kits, and external computing services, to support their functionality.

- Smart contract blockchains are the base of the Web3 stack. These tamper-resistant platforms are used for storing and sharing computer code and data on networks of independent but connected computers.

The Application Layer Has the Potential to Provide an Alternative to Our Favorite Web2 Sites

Web3 comes to life within the application layer – the layer of the stack that users engage with. The decentralized applications (dapps) that make up this layer resemble traditional web applications on the surface but use smart contracts to run their code on the backend. Smart contracts are pieces of computer code designed to execute functions on a blockchain once pre-defined conditions are met, removing the need for any human input or intermediation. To create a dapp, any developer can leverage smart contract coding and attach an intuitive and simplified front-end display.

Today’s leading dapps facilitate sectors such as decentralized finance (DeFi), decentralized social media (DeSo), and on-chain gaming. Users can tap into popular DeFi protocols such as Aave to take out collateralized loans instantly without a credit check, for example. Alternatively, users can monetize gaming time and own unique in-game assets while playing games like Illuvium. The Web3 application layer can even bring about a new paradigm in social media through protocols like Lens, which allows users to verifiably own the content they produce and carry their audiences across platforms. In our view, the application layer will likely be the long-term driver of sustained blockchain demand.

Importantly, Web3 needs tools that allow users to interact with dapps. Web3 relies on wallets, domains, and decentralized identifiers to enable unified and non-custodial access to this new ecosystem of dapps. Wallets provide a secure way to manage and transfer digital assets and serve as the conduit for Web3 interactions. Metamask, for instance, is one of the leading wallet providers that provides its users with access to countless dapps across a wide array of blockchain networks.

Supporting Infrastructure Layers Maximize Application Potential

Web3 dapps may tap into layers of critical infrastructure to support their functionality. Included in these layers are tools such as block explorers that enable users to extract, interpret, and utilize the data stored on a blockchain. They also include software development kits and computing services that enable developers to index blockchain data, gather real-world inputs through decentralized oracle systems, and more.

By way of an example, Chainlink is a decentralized oracle network that brings data from the real world, such as the price of a stock, the weather forecast, or the outcome of a sporting event, onto blockchains in a trustless manner. This is a critical service as it allows smart contracts and their corresponding dapps to leverage this data, greatly expanding the possible use cases for dapps.

Blockchains Provide a Distributed and Permissionless Alternative to Today’s Centralized Data Servers

The base layer of the Web3 stack is made up of smart contract blockchains, the foundation on top of which developers can build this new set of tools. Smart contract blockchains are flexible, tamper-resistant platforms for storing, securing, and sharing computer code and data. In contrast to the Web2 paradigm in which data is generally stored on centralized servers, Web3 data is stored on thousands of independent computers across the globe.

User-generated data is protected through complex cryptography and consensus mechanisms that distribute the power of the network to a decentralized set of participants. These qualities guarantee that computer code hosted on blockchains cannot be manipulated from its promised function and that user data, including ownership rights to digital assets, cannot be tampered with.

By serving as the base layer for this new stack of tools, smart contract blockchains can redefine how online value is created and owned, and where the centers of power and influence on the internet exist.

The Web3 Stack Enables a New Internet Experience

The evolution of the internet has gone through two major eras, Web1 and Web2, each with unique characteristics and limitations. While Web1 provided a platform for technical users to create web-based content, Web2 revolutionized the internet by enabling anyone to publish content without needing technical skills. However, this came at the expense of centralization and control by a few powerful corporations. The emergence of Web3 and the introduction of its software stack seeks to provide a solution to these issues by leveraging distributed and secure blockchain infrastructure to create a more decentralized and user-owned web.

—

Originally Posted April 21, 2023 – Exploring the Software Stack That Enables Web3

Information provided by Global X Management Company LLC.

Digital assets are high-risk investments and may not be suitable for all investors. They may be highly volatile. Please consult your financial or tax advisor for more information. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. This material is not intended as research, tax, or investment advice.

Investing involves risk, including the possible loss of principal. Diversification does not ensure a profit nor guarantee against a loss.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information is not intended to be individual or personalized investment or tax advice and should not be used for trading purposes. Please consult a financial advisor or tax professional for more information regarding your investment and/or tax situation.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Global X ETFs

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s full or summary prospectus, which may be obtained by calling 1-888-GX-FUND-1 (1.888.493.8631), or by visiting globalxfunds.com. Read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Lots of rhetoric; where’s the beef?