A much better-than-expected jobs report failed to offer relief to US stock investors who are having their worst week in over five years. Yesterday’s heavy selling pressure is continuing today after Beijing responded to Trump tariffs by accusing Washington of utilizing bullying tactics and then announcing a 34% levy on American imports. What’s worrying market participants most is that the global trade war, if maintained, essentially throws the US economy into recession alongside many international peers. Meanwhile, corporate earnings have no path to growth in this scenario, which is why the volatility index reflected the greatest level of fear in 8 months, the S&P 500 is 17% off its all-time high from February and the Nasdaq 100 and Russell 2000 benchmarks have dropped into bear market territory. Traders are hedging with downside puts and volatility calls while aggressively scooping up safe-haven Treasury instruments across the curve.

US Hiring Gain Extends Broadly

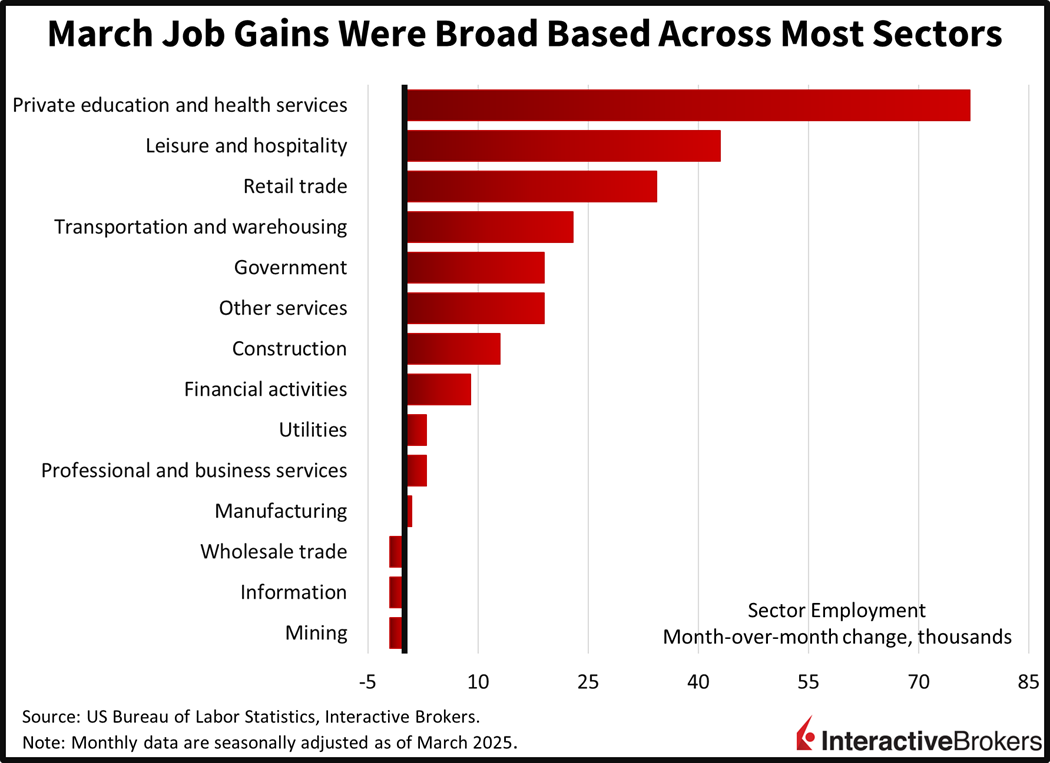

US hiring hit its fastest pace of the year in March as most industries expanded rosters. Job growth of 228,000 came in well above expectations of 135,000 and February’s downwardly revised 117,000. The headline figure was the strongest since December and was helped by robust activity in the private education/health services, leisure/hospitality, retail trade and transportation/warehousing sectors, which added 77,000, 43,000, 23,700 and 22,900. All other gaining components introduced 19,000 more workers or fewer. Meanwhile, mining, information and wholesale trade were the only segments reducing headcounts, trimming 2,000 each.

Labor Force Expands By 232K

On the other hand, the unemployment rate ticked higher to 4.2%, as expected, but it was driven by lower-than-feared mass deportation trends, as the labor force climbed by 232,000 people. The developments served to offset fears that the Trump administration’s restrictive immigration policy would curb worker supply. The increase contributed to an advancement in the labor force participation rate to 62.5% from 62.4%, which is still well below the pre-pandemic level of 63.3%.

Wages Growth Marchs On

Compensation trends remained firm even as the slower moving annualized figure decelerated to its weakest pace since July. Average hourly earnings increased 0.3% month over month (m/m) and 3.8% year over year (y/y), as expected on the former but a tenth of a percent lighter on the latter. The results slowed from February’s 0.2% and 4%, however. The average hourly work week was unchanged at 34.2.

Equity Tailspin Continues

Stocks are down sharply with equity benchmarks getting creamed across the board as a global trade war dampens the outlook for earnings growth and weighs on investor sentiment, driving profit multiples south. Commodities are also joining the bloodbath on recession fears as WTI crude oil traded at its lowest level of $60.48 per barrel since April 2021, four years ago. All major, domestic equity gauges are plunging with the Russell 2000, S&P 500, Nasdaq 100 and Dow Jones Industrial indices lower by 4.5%, 4%, 3.9% and 3.5%. All 11 major sectors are losing with energy, financials and technology weighing the most; they’re plummeting by 7.1%, 5.8% and 4.6%. Treasurys and the greenback are catching strong bids, however, benefitting from safe-haven status. The 2- and 10-year maturities are changing hands at 3.6% and 3.94%, 10 basis points (bps) lighter in both instruments while the Dollar Index jumps 54 bps. The US currency is appreciating against the euro, pound sterling, yuan, loonie and Aussie counterpart but its depreciating relative to the franc and yen. Commodities are being punished on demand worries with copper, crude oil, silver, gold and lumber descending 7.1%, 6.9%, 6.6%, 3% and 2.2%.

Fed and Trump Puts Are Out of the Money

Stocks have quickly priced in recession risk, which normally sends the asset class toward an approximate 30% decline depending on the starting point, magnitude and duration. Against this backdrop, Federal Reserve Chair Jerome Powell just told a group in Arlington, Virginia, at the Advancing Business Editing and Writing conference that tariffs will likely send inflationary pressures north, pointing to the central bank potentially having its hands tied if economic conditions deteriorate meaningfully. The comments point to the Fed not being in a position to provide much support to the economy and market if prices begin to accelerate too fast. All in all, this market is upset as it finds out the hard way that both the Fed and Trump puts are still way out of the money.

International Roundup

Singapore Retail Expands

Singapore retail sales climbed 3% m/m in February, up from 2.8% in the first month of the year. Excluding automobiles, the value of transactions increased 2.2%. The other category led with a gain of 24.8%. Other leading categories that expanded along with their increases were as follows:

- Mini-marts and convenience stores, 11.8%,

- Motor vehicles, 8.5%

- Computer and telecommunications equipment, 6.9%

- Food and alcohol, 4.6%

Conversely, The supermarket and hypermarket category and the wearing apparel and footwear segment experienced declines of 3.7% and 2.7%, respectively. Additionally, watches and jewelry fell 0.8%.

On a y/y basis, however, sales dropped 3.6% in February after growing 4.7% in the preceding month. The January y/y result was aided by the Lunar New Year celebration occurring in that month.

Canada Unemployment Climbs Modestly

Canada’s unemployment rate climbed from 6.6% to 6.7% in March, matching the median expectation while its participation rate dropped from 65.3% to 65.2%. The country’s total number of employed individuals declined by 32,600 due to a 62,000 decline in full-time employees that was partially offset by a 29,500 increase in part timers. It was the largest decline in more than three years. Job losses occurred in wholesale and retail trade, information, culture and recreation, agriculture, manufacturing and construction sectors. Meanwhile, wages among permanent employees climbed 3.5% y/y.

Japan’s Household Spending Strengthens

Household spending in Japan climbed 3.5% m/m in February, reversing from a 4.5% decline in the first month of the year and exceeding the analyst forecast of 0.5%. On a y/y basis, expenditures fell 0.5%, which beat the expectation for a 0.9% contraction but was down from 0.8% in January. The y/y result was driven by weak results for housing, food, and clothes and footwear.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!