This morning, Halloween is bringing tricks, not treats to many investors. The S&P 500 (SPX) seemed set to extend its monthly winning streak to six, but it seems to be choking – just like my Yankees did last night. Yes, I’m tired and cranky after a lousy night in the Bronx, but even though I can’t be objective about my team’s ability to snatch defeat from the jaws of victory, I’ll do my best to keep my sour mood out of today’s analysis.

While last night’s baseball game hinged upon a series of silly mistakes, today’s drop seems to be much more rooted in cogent thinking. Microsoft (MSFT) and Meta Platforms (META) are leading a broad selloff. Both companies handily beat their EPS estimates – MSFT $3.30 vs. $3.11 exp, and META $6.03 vs $5.52 exp – but their commentary seems to have spooked investors, nonetheless. MSFT offered tepid guidance for its Azure cloud division, noting that they fell short of data center capacity and thus will need to spend more to catch up. META reaffirmed its commitment to spend heavily on artificial intelligence and other forward-looking technologies. META investors have heard this before, perhaps recalling the stock’s swoon in 2022 when its heavy spending on the metaverse failed to improve the bottom line.

That combination has led to some rethinking about the promise of AI. At some point, all this spending has to improve the bottom lines of its users – not just the chipmakers.

The market’s mindset seems to be switching from one where anything AI-related was a reason for enthusiasm towards one where investors are looking for some returns on their massive spending. That’s definitely what’s hitting META and MSFT today. If I’m investing in a company that is spending billions on AI chips, servers, and developers, I’d eventually like to see that resulting in some ROI. And I think an increasing number of investors agree, though not all.

Ultimately, we need to see a wide range of companies see bottom-line results from their AI activities. So far, it’s been a huge boon to the chipmakers, the picks and shovels of the AI gold rush, and there is a giant halo on the “miners”, the software providers like MSFT, GOOGL, META, AMZN, etc. But think about the early days of the internet. It did indeed prove to be a huge productivity boost for a wide range of companies, but it took a while to achieve it. I would not be surprised if we start to see some more skepticism about AI spending until we start to see some real productivity as a result – not just a lot of capital spending. Let’s see what AAPL and AMZN have to say on the topic today. (And will the potential accounting issues at NVDA’s 3rd largest customer (SMCI) have any effect on its bottom line?)

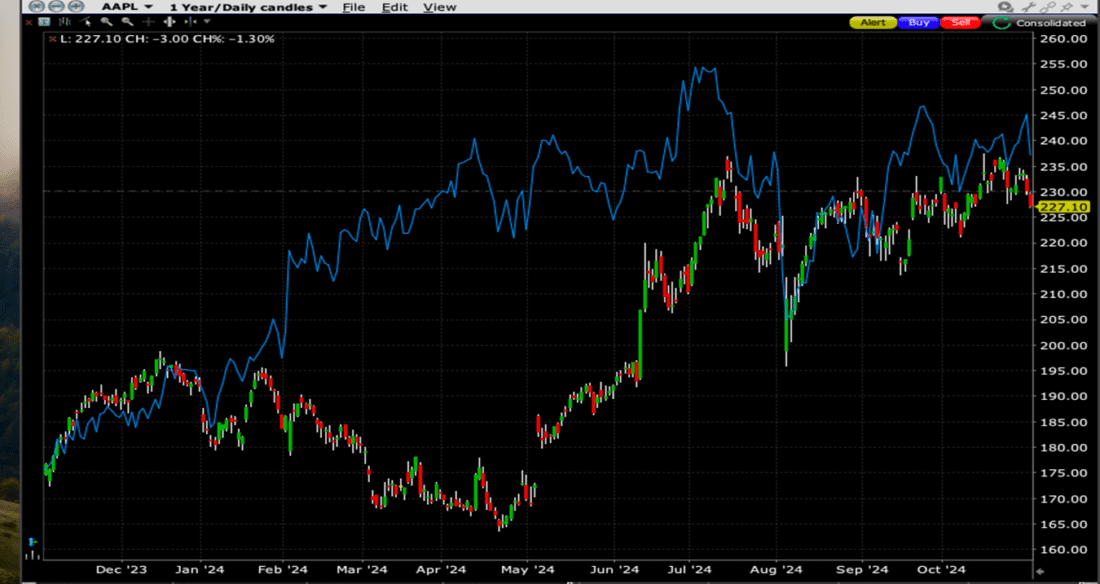

So now it’s Apple’s (AAPL) and Amazon’s (AMZN) turns at bat. On a one-year basis, both have offered double-digit returns, and on a year-to-date basis they have performed roughly in line with SPX and the Nasdaq 100 (NDX):

1-Year Chart, AAPL (red/green daily candles), AMZN (blue line)

Source: Interactive Brokers

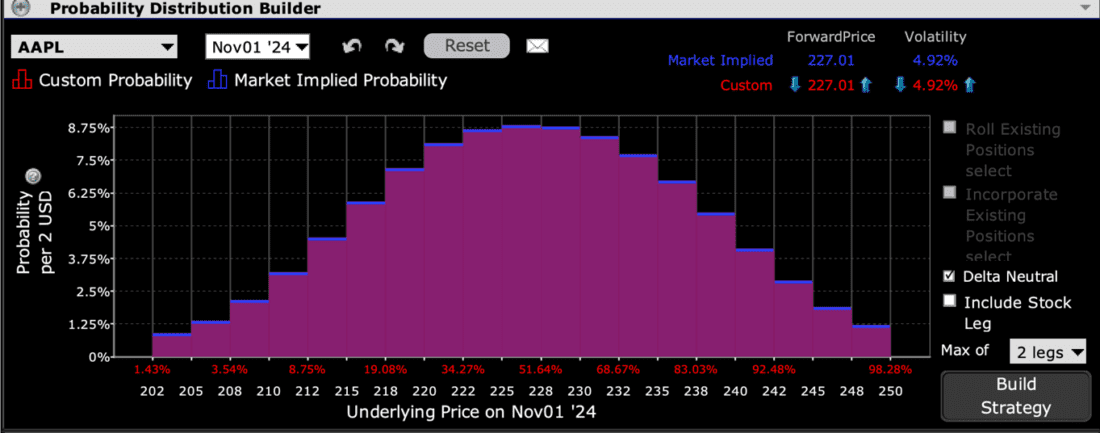

Looking at AAPL, the IBKR Probability Lab reveals little. We have a symmetrical probability distribution with a peak in at-money options:

IBKR Probability Lab for AAPL Options Expiring November 1st, 2024

Source: Interactive Brokers

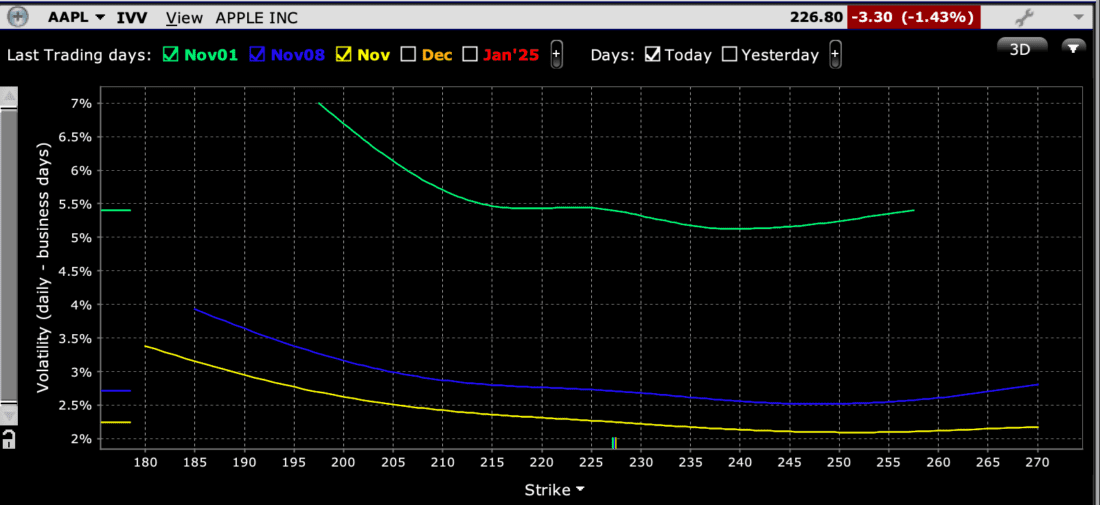

Skew charts reveal a bit more risk aversion. Once again, we see a bit of a “W” shape, but there is a pronounced bias to the downside. Today’s drop seems to have traders a bit more concerned about the potential for another megacap dip. The at-money, near-term options have a daily volatility just shy of 5.5%. That is well above the average for the past six post-earnings moves of 2.87% (+0.69%, +5.98%, -0.54%, -0.52%,-4.8%, +4.69%)

Skews for AAPL Options Expiring November 1st (dark blue), November 8th (light blue), November 15th (yellow)

Source: Interactive Brokers

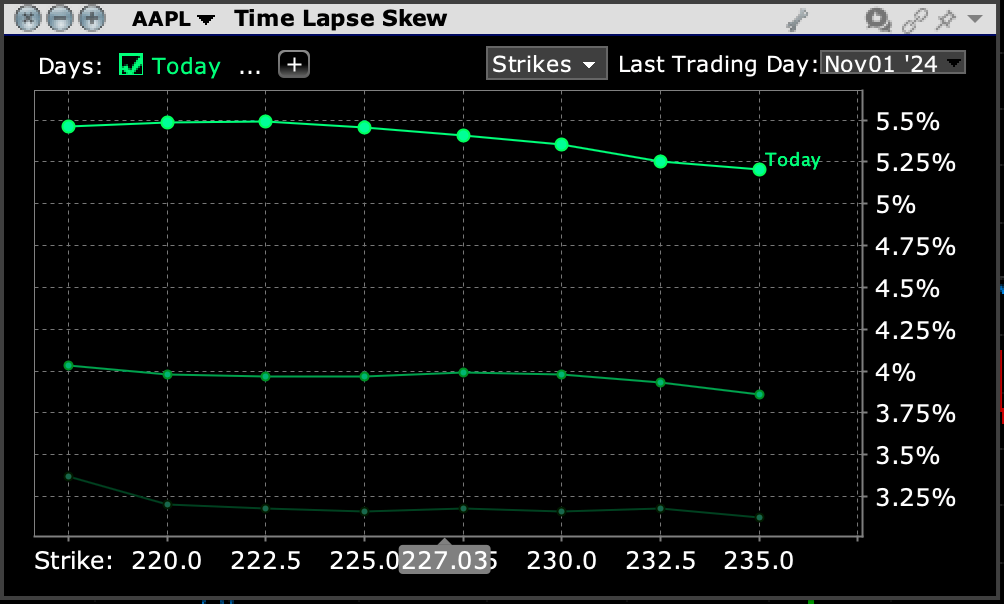

It is normal for implied volatilities to rise as an earnings date approaches, but the one-day change in AAPL is indeed quite pronounced. A down day will do that:

Skew for AAPL Options Expiring November 1, 2024, Today (dark green), Yesterday (light green)

Source: Interactive Brokers

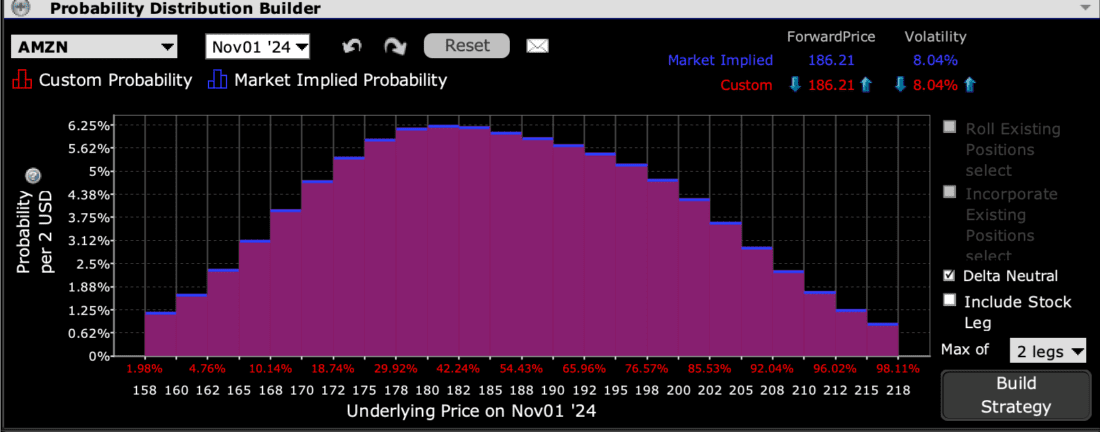

Interestingly, AMZN options tell a different story from AAPL’s. In AMZN’s case, the Probability Lab shows a peak below the current $186.21 in the $180-$182 range:

IBKR Probability Lab for AMZN Options Expiring November 1st, 2024

Source: Interactive Brokers

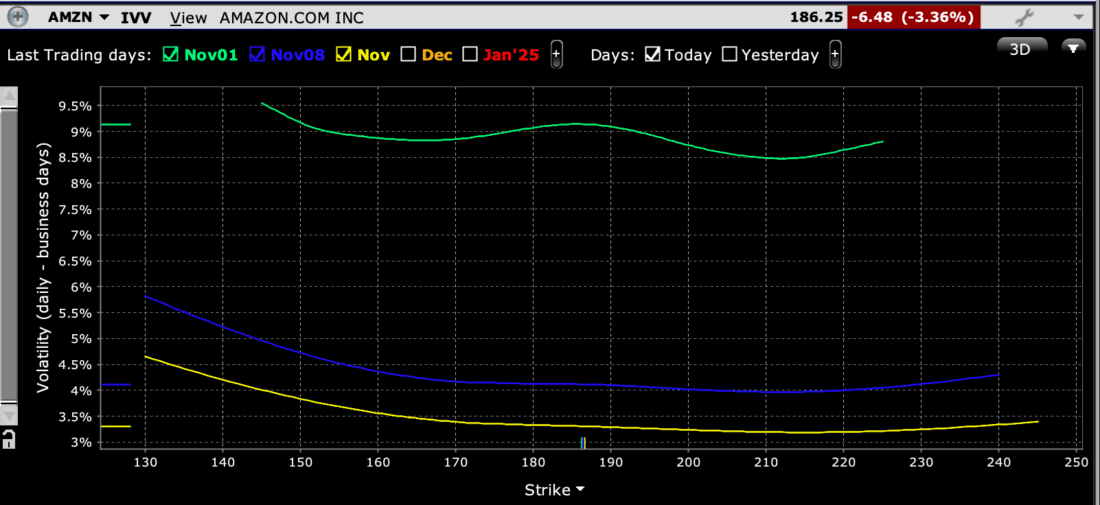

Skews, however, are largely flattish, with only a slight tilt towards the downside. Those too reflect a daily at-money implied volatility well above the 6.34% average of the past six post-earnings moves (-8.78%, +2.29%, +7.87%, +6.83%, +8.27%, -3.98%). The flat skew might be the result of four rises after the last five earnings.

Skews for AMZN Options Expiring November 1st (dark blue), November 8th (light blue), November 15th (yellow)

Source: Interactive Brokers

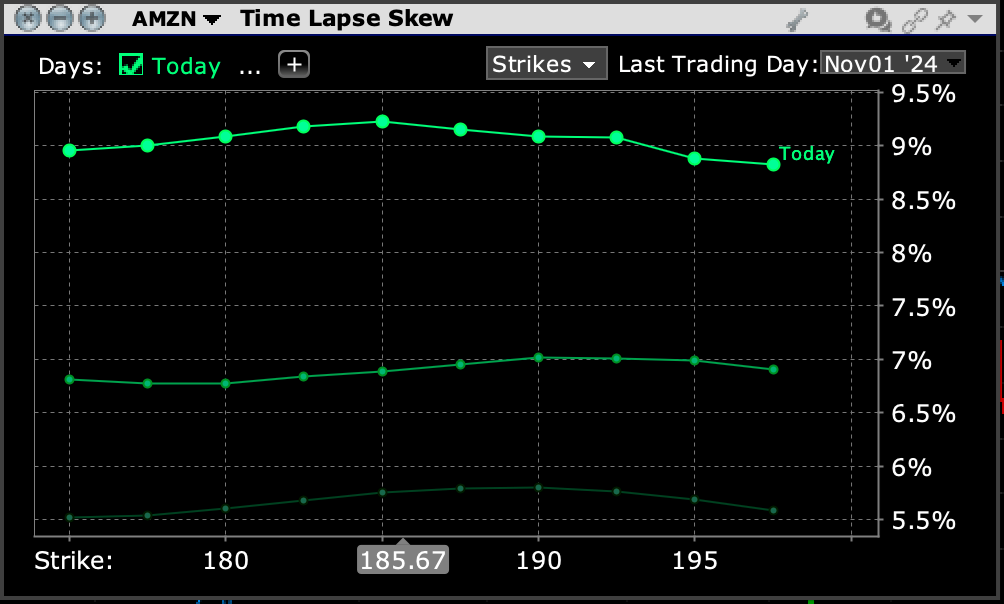

As with AAPL, the front week’s volatilities expanded dramatically today:

Skew for AMZN Options Expiring November 1, 2024, Today (dark green), Yesterday (light green)

Source: Interactive Brokers

Today’s reports will hopefully offer some clarity into whether AI is benefitting two important tech giants. AMZN has noted that AI has improved the company by simplifying many programming tasks, though it’s not clear if those benefits have been quantified. AAPL’s latest iPhones have highlighted their improved AI ability. We hope to learn if that is engaging buyers, leading to greater revenues and profits. For today, at least, that seems to be what investors want.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Probability Lab

The projections or other information generated by the Probability Lab tool regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Please note that results may vary with use of the tool over time.

all this article does before it got to apple, where i stopped reading, was to repeat/go over the already known and up until this morning was considered positive not negative. also there is no mention how all your options’ insights got it wrong again. To me the markey sworn is due to the high inflation # reported this morning which again points to no need for any rate cut next week as the consensus overwhelmingly now is there should not have been one in september.

AAPL’s “greater revenues and profits” are irrelevant, because they are a company which has proposed a $110 billion stock buyback of approximately 4% of the outstanding stock. Since every stock buyback’s affect on a company’s Balance Sheet results in a dollar-for-dollar reduction in the asset Cash and the Equity account. In AAPL’s case this reduction in Cash and reduction in existing Equity will leave the remaining 96% of shares, which now own 100% of AAPL, actually owning nothing, or less than nothing!!

Thanks for the stats Soz, well done as usual. Damn Yankees, comedy-of-errors, it was… almost a “win” by default. Not sure whose fault, but anyway… life goes on. Glad to see tech taking a bit a well-deserved tumble. Short on while we can! Nobel in Physics was cool for Deep Mind’s Demis and John, and U-Dub Dave was cool, but AI is obviously not ready for Wall Streets love-a-bubble-but… bottom line prime time.