Mat Cashman, Principal of Investor Education at the OCC joins IBKRs Senior Trading Education Specialist Jeff Praissman to discuss the concept of implied volatility and duration in pricing time spreads.

Contact Information:

- For more free options education from The Options Industry Council (OIC), an industry resource provided by OCC, visit OptionsEducation.org.

- Have an options-related question? Contact the OCC Investor Education team at options@theocc.com or via live chat on OptionsEducation.org.

- Connect with OIC Instructor, Mat Cashman.

Summary – IBKR Podcasts Ep. 100

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Jeff Praissman

Hi everyone, welcome to IBKR Podcasts. I’m your host, Jeff Praissman. It’s my pleasure to welcome back to the IBKR Podcast studio, Mat Cashman, Principal of Investor Education at the Options Clearing Corporation or OCC. Matt, welcome back.

Mat Cashman

Hi, Jeff, it’s a pleasure to be here. I am always happy to be here. I just got done with an IBKR webinar on the same topic that we’re going to be discussing today, which happens to be time spreads and duration and implied volatilities.

Jeff Praissman

Yeah, that was a great webinar. It was really interesting to sit through that and I definitely would recommend that to our listeners here as well. The link to that webinar will be in the podcast study notes, so please you know, after you listen to podcast, check out the webinar or vice versa. Let’s kind of start from the beginning just for our listeners., what are time spreads?

Mat Cashman

Yeah, absolutely. I think it’s great to start at the very beginning and work our way through this concept because it can be a little tricky sometimes. But time spreads are essentially trading two different duration options, most likely and generally on the same underlying. And so what you’re really doing here is you’re trading one option that has a specific duration against another option that has a specific duration and you’re trading them as a spread. So, you’re buying one of them and selling the other one. It can create lots of different dynamics as far as the risk is concerned and some of the Greeks of the position which we’ll get to a little bit later as far as duration, but that is essentially what a time spread is. It’s just duration and two options, one versus the other.

Jeff Praissman

So are all time spreads created equal or are there different like types of time spreads or different strikes that you would use?

Mat Cashman

Basically, if you want to really break it down into its most simple form, there’s two different kinds of time spreads. One is the horizontal time spread and one is the diagonal time spread. They are called that for very specific reasons. Many times, in options kind of nomenclature, there are words that people use in ways that people use to describe spreads or actions in trading that evolved from very specific parts of trading like way back in the day. This happens to be one of those situations. Horizontal time spreads are different durations, but the same strike, and so if you’re using the same underlying and you’re trading the same strike but you’re trading different durations, you can imagine that — Imagine if you were to open up a paper back in 1981 and option prices were in there. They would have the option prices for those strikes, those at the money strikes quoted on the page in order from left to right based on duration. So May, June, July, August. If you were trading the same strike across the board, you might trade the 80 strike between May and June. Well, those two actual prices printed on the page would be right next to each other horizontally, and so people used to call it a horizontal time spread because you would just look at those two prices horizontally right next to each other. Now the diagonal time spread is very similar in duration, but different in where those prices might be because you’re using different strikes and also different duration. Your eyes have to move from one price up and out to another price on the page and so you might need to look diagonally up to see where that next price was in the spread to be able to actually calculate the spread. That’s why they’re called, what they’re called and that moniker has stuck since, however long ago someone started calling it the horizontal time spread and the diagonal time spread.

Jeff Praissman

That’s actually a fascinating bit of option history because you know, I’ve been trading options for quite a while and that explanation really is. — this is really the first time I’ve heard it, so thank you for that. That’s great.

Mat Cashman

Yeah, right. God, I’m happy to provide a little bit of historical reference there.

Jeff Praissman

Why would an investor use some time spreads? You know, some of the purposes that they would be helpful with?

Mat Cashman

People generally use time spreads because of the component that exists in them where the spread comes from. The difference between these two options is in their duration generally speaking, and so what you’re dealing with when people want to trade these spreads is that maybe they have a differing idea about what implied volatility or what option prices in general are going to do during one time period versus another time period. Now the best part about options, one of the best parts about options is that anytime you’re looking at something and for instance, a lot of times in literature for ETFs and buffered ETFs and things of that nature, they talk about defined outcome strategies. Options are what provide those defined outcomes. Anytime you see defined outcome in a product, it’s using options somehow, so this is again one of those spreads that actually has a defined outcome because of the optionality that exists between these two options. But because of the fact that you’re buying one option and selling another option, just like you would with any spread, any option spread, what that oftentimes does is it actually reduces the overall price of the strategy and so that’s another reason why people like to use these. It’s a way to actually utilize the differences in implied volatility and prices but do so with a defined outcome that comes from the optionality, and oftentimes that inclusion of a buy versus a sale in this time spread that we’re talking about will actually lower the overall cost of the strategy. But make no mistake, anytime that you trade a time spread, what you’re really doing is you’re trading duration, you’re trading the time that exists between those two options, and that’s really what the real meat on the bone is as to this concept.

Jeff Praissman

You had mentioned implied volatility, if you could just in a few sentences explain to our listeners you know exactly what implied volatility is? And also we’re talking about duration, we’re talking about different expirations, is the implied volatility the same for every expiration for a particular option or you know, does it vary?

Mat Cashman

You’re full of good questions today, Jeff, that’s a really good question as well. So implied volatility in general, anytime you trade an option, you are trading a specific implied volatility level. What that means is that every option has its own implied volatility level. Now, not only every month of an option, right, all of May doesn’t trade for the exact same implied volatility level. The May at the money option may have a very specific implied volatility level but then within May, there might be options that have different implied volatility levels as well. Each strike within May would have its own implied volatility, and then each month along the curve would also have its implied volatility, its own implied volatility. But let’s take a step back and talk about implied volatility in general first. Implied volatility is essentially a metric that is built into an option, it is commensurate with price, and so it’s always kind of inexorably linked to the price. If you’re trading a price of an option, you are trading a commensurate implied volatility level. Now implied volatility is a forward-looking metric, and it is the market’s best guess essentially as to how much volatility is going to exist within the duration of that option. So, if you’re trading a 30-day option and it has a very specific implied volatility, what you’re saying is when I’m buying or selling this price of this option that encapsulates 30 days, I am buying or selling an amount of premium that is commensurate with the market’s best guess for the amount of volatility that’s going to exist for the next 30 days. If that option has for, say 90 days in it or 180 days, it’s going to have a different implied volatility because the markets expectation for volatility over the course of that amount of time is going to generally, and most of the time be completely different than what it would be for the next, say 30 days. So that’s why those volatilities can be different depending on the duration of the option itself.

Jeff Praissman

So, is that part of the challenge, the trading time spreads and why this time spreads aren’t all priced equally just based on pure duration?

Mat Cashman

Yeah, absolutely. It’s definitely one of the challenges, there’s many challenges. There’s also a lot of opportunities that exist in time spreads. As you can imagine, when you’re dealing with two options that have different prices and different durations and different implied volatilities that are commensurate with those prices, things can get kind of complicated because you’re dealing with a lot of different moving parts. Now one of the best ways to actually think about this and to, you know, have a metric that’s associated with it is to start with just step one, which is: what is the difference between these two implied Vols? If I’m trading, for instance, May versus July, what are the two implied Vols that I’m trading? Cause I’m going to be buying one of them and I’m going to be selling the other. And so, the first step is what’s the difference? And what we talked about in trading terms is we assign that as the Vol spread between those two implied Vols. So I would say take one Vol, subtract the other implied Vol from it, and then you can talk in terms of how large is the difference between these two Vols. So that’s like step one, right? What’s the Vol spread between the Vols?

Jeff Praissman

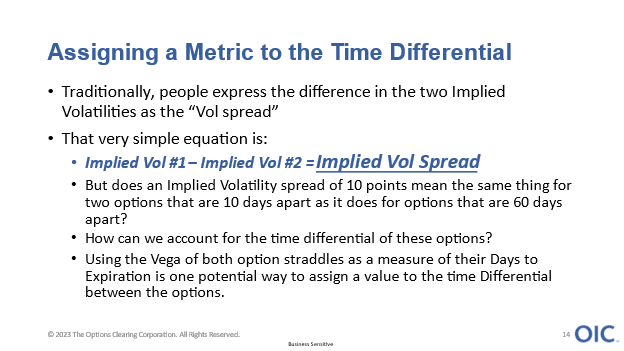

And I want to thank you too for the — For our listeners, there’ll be some slides included in the study notes of the podcast. — So, I want to thank Matt for including those there. There’s a nice slide that we’re going to input that is sort of visually showing what Matt just said as well as further down the road, there be a few more slides as well that we’re going to input I believe.

Mat Cashman

Make sure to take a look at that. I think it’ll say assigning a metric to the time differential and really what you’re doing here is you’re really just talking about, OK, how different are these options from an implied volatility perspective? Once you’re able to actually figure that out and assign a metric to that, let’s say it’s a 10 implied Vol points difference between these two options. Then you need to think about, OK, how much time exists between these two options, because really, what the concept that I’m going to talk about today is you can look at the two options and very simply just subtract one implied Vol from the other and say, oh well, there’s 10 implied Vol points between these two options. And yes, that is true but what does that mean? And what are those expectations actually mean from what the market is implying, as far as what the market expects to happen? But then also what’s the risk that’s built in here because it’s really hard to kind of quantify what that risk is if all you do is look at it and say well, there’s 10 Vol points between these two options. The question then becomes, if there’s 10 Vol points between two options that are right next to each other in duration, if they only have 10 days in between them, is that different than having 10 Vol points between two options that have 90 days in between them? And what I’m saying with this concept is yes, there is a difference between those and now, how do we actually measure that? What’s the best way or one of the best ways to measure that? And so that’s the next step of this whole process.

Jeff Praissman

So it’s essentially like a time weighted volatility spread in other words. It’s what you’re getting at as far as taking into account the implied volatility as well as the duration versus just strictly duration.

Mat Cashman

Absolutely. That’s what this concept really does, it references the differences in Vols with the differences in times for the option, and it actually creates a metric that you can start to track and look at, you know. If you want to look at something like what is the 30-day, 90-day volatility spread between these two options in this stock? And then go back and look at it over time. You can always kind of pull those numbers and then pull the actual duration that you need and look at them over time and be able to figure out well what does this look like now versus what did it look like three years ago? And is that landscape completely different? And is it really priced in the same way as it used to be? So yes, that’s really what we’re doing. We’re really assigning a metric and a risk number to the time differential relative to the Vols.

Jeff Praissman

And here’s a good point for me to mention that another slide that will be included in this will actually show that formula, right? It’s essentially –

Mat Cashman

Yeah, absolutely. That next slide is going to be something, it’ll say assigning a metric to the time differential. Again, it’ll show you the actual equation that I use or that you can use. It’s a very, very simple equation. Don’t be put off by this in any way, shape or form. It’s not complicated math. Let me give you the concept behind it and then we’ll talk about how the execution of it actually plays out. The concept behind it is really what we just talked about before, which is how do I figure out what the Vol spread is? And so what you do is you take the implied Vol of option #1 and you subtract the implied Vol of option #2. That’s very simple. And that’s how anytime you’re talking with an options trader, and you want to talk about time spreads, that’s the first question everyone asks. How big is the vol spread between the two options, right? And that’s just one Vol minus the other Vol, one implied Vol minus the other implied Vol.

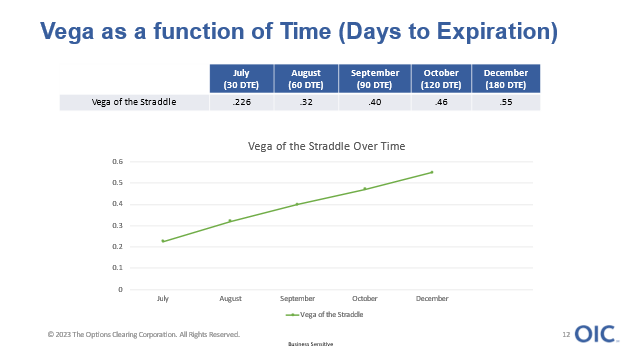

Now the actual execution of this concept comes in the additional piece of information which is how do we measure the duration of these options? Easiest way to measure the duration of an option is by using the actual Greeks that are involved with those options that are embedded within them that give you an idea of what their duration is. What’s the best way to do that or one of the best ways? Well, the easiest way is to look at the Vega of an option. And why is that? Well, it’s because Vega is actually positively correlated in a linear fashion to time, to days to expiration. And so really what we’re doing here is we’re just saying Vega of the option is actually a proxy for the amount of time that’s in it.

Jeff Praissman

And for our listeners, that may not know, Vega, is the Greek measure that, you know, measures the option sensitivity to implied volatility.

Mat Cashman

What that does is it just tells you essentially how much an option should move when you move implied Vol 1%. So if an option has a Vega of .08, we would say in option terms it has $0.08 of Vega, but what that means as far as where the rubber meets the road is if you were to move the implied vol from 20 up to 21 for instance, that option should theoretically move by eight cents. That’s that .08 metric at work in how the option is priced. Now, the interesting part about how we kind of utilize this ratio in terms for this discussion is that you’re going to use the actual straddle Vega of that month versus the straddle Vega of the other month. How do you get the straddle Vega? Well, it’s pretty easy, the call has a Vega and the put has a Vega. They’re generally the same amount of Vega because they exist on the same at the money strike. So, you take the at the money call and you have the money put and you take the Vega of those two options, you add them together and that gets you your straddle Vega. And so, what you’re really doing is you’re taking the straddle Vega of the first month minus the straddle Vega of the second month, and that gives you the difference in the Vegas of those months and that’s going to be the actual denominator for this equation. The difference is in the implied Vols is the numerator. The difference in the Vega of those options is the denominator. And that’s how you end up with this time weighted Vol spread, because what it does is it expresses the actual Vol spread itself in terms of the amount of Vega that exists between those two options and so that’s really what you end up with when you’re talking about this. It’s a way to assign an amount of risk that exists within that time frame between the options.

Jeff Praissman

Just to plug another slide that you provided us with, there’ll be another slide embedded, Vega is a function of time, days to expiration. Nicely charts this out as well. So while you’re listening, if you want to hop onto the website as well and click on the study notes, this will kind of put a visual to what Mat is describing as well, which would be — definitely could be helpful as well for especially the more novice investors that are listening to this.

Mat Cashman

Yeah, what that’s going to do is just give you a visual representation of what Vega looks like over time, and it’s essentially a straight line from bottom left to top right, because it’s positively correlated to time. The more time and option has the more Vega an option will have. Then what we’re left with is once you do this, how does it essentially work? And what you end up with is once you have this time weighted Vega amount or time weighted Vol differential, time weighted time spread Vol differential, that’s in there, you can actually utilize that number and you can use it to do things like back test how the 30-day, 90-day time spread has performed over the last however many days. Like how has it looked? How is it priced? And what it does is it gives you a metric that actually encompasses the duration of those two options instead of just referencing it as like the 30-day, 90-day time spread has 10 Vol difference or 10 implied Vols different between them and looking at that over time. That doesn’t tell you as much as this does, which is, this will tell you the actual vol differential but in terms of the Vega differential.

Jeff Praissman

Right. So, it sounds like if you’re looking at two different — similar but different — time spreads such as say like the March, June 150 and the March, June 155, this could give you some more information and some more data to differentiate between the two to see whichever is better for your own.

Mat Cashman

Absolutely. And the reason why is because right the 150s and the 155s are going to have completely different implied volatilities. And in some cases, for instance, in that case if the 150, 155 call spread traded a bazillion times in one of those months, the 150, 155 relationship in that month is going to be stretched a little bit by the amount of flow that existed between those two strikes. And that might only exist in one month and not in another month and that’ll come to bear when you look at how these Vols line up relative to the Vegas that exist there, between those two options.

Jeff Praissman

Mat, this has been great. This along with the webinar that you just did have been super helpful. Yeah, that webinar again is Not All Time Spreads Are Created Equally: The Concept of Flattening Implied Volatilities. Both can be found on the website plus several other webinars and podcasts from Mat and the OCC, you just go to our website, you go under education and you can view all the previous OCC podcasts and webinars that you’ve done with us, which have all been great.

Mat Cashman

Oh, thanks. Really appreciate it.

Jeff Praissman

I also want to remind everyone that you can find all our podcasts, you know, on the website, under education or on YouTube, Spotify, Apple Music, Amazon Music, PodBean, Google Podcasts and Audible and I encourage everyone to check those out. Mat once again, thank you for stopping by and for our listeners thank you for listening. Until next time, I’m Jeff Praissman with Interactive Brokers.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

![It’s Option Implied Volatility Time[Spread]](https://www.interactivebrokers.com/campus/wp-content/uploads/sites/2/2023/08/pod-20230814-occ-Mat-rect-700x394.jpg)

Very interesting discussion. Jeff asks pointed questions and summarizes the responses with clarity.

Thank you, Lee! We will be sure to let Jeff know.

Nice presso. Question = what is the margin / collateral equation for the option time spreads?

That would have been great info, and Jeff could have described an actual time spread trade

Hello Joseph, thank you for asking. The margin collateral equation would vary by broker and potentially the product and region (US, Eur, Opt, FOP), so we did not state it in the podcast.