Interactive Brokers UK turns 25—and we’re celebrating with CEO Gerry Perez inside the Tower of London. From humble beginnings to a global powerhouse, hear the untold stories, customer moments, and what’s next for IBKR in a post-Brexit world.

Summary – IBKR Podcasts Ep. 239

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Andrew Wilkinson

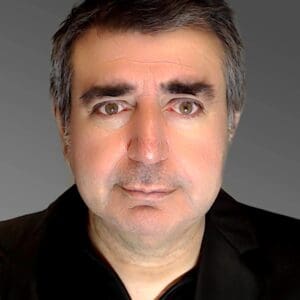

On March the 28th, 2000, Interactive Brokers opened its office in the city of London with three employees. Among them, Gerry Perez. Fast forward a quarter of a century to find Gerry is now CEO in the London office, which now boasts 127 employees. Gerry, happy birthday. How are you?

Gerry Perez

Thank you, Andrew. It’s always nice being a part of your podcast, and especially today, as we get close to our 25th anniversary in the UK. Well, we should—

Andrew Wilkinson

—probably kick off with a discussion about Timber Hill, which is Interactive Brokers’ former options market-making business. Did they have the original in London ahead of the London office, Gerry?

Gerry Perez

So let me provide you some context for those listening who may not be familiar with Timber Hill. In 1977, Thomas Peterffy, the founder and chairman of the IBKR Group, purchased a license to operate as a market maker on the American Stock Exchange, where he traded equity options. He then established a startup called T.P. & Company, which eventually evolved into Timber Hill. Over the years, Timber Hill evolved into the largest privately held market maker for exchange-listed derivatives worldwide.

Its innovative edge as a market maker was optimizing market making using fair value sheets and algorithms across multiple markets in a real-time setting through its in-house developed models and systems. In the early 1980s, it was the first to utilize handheld computers for trading on exchanges. It is safe to say Timber Hill could be regarded as a startup—

even more impressively, a unicorn. Timber Hill established operations worldwide. For instance, in 1995, the beacon began operations in the UK. Timber Hill held memberships in the London International Financial Futures and Options Exchange—better known as LIFFE—and the London Stock Exchange. Following the move to close open outcry markets in the UK, the group had a decision to make.

So it decided to go fully remote market maker. That means it closed its physical UK operations. Timber Hill continued as a market maker until the group decided to divest from the market-making business and sold Timber Hill in about 2017. By then, Interactive Brokers was already active as an online broker—and, more importantly for this setting, in the UK.

Andrew Wilkinson

Uh, Gerry, Interactive Brokers’ longevity of 25 years has been impressive. So what’s been the secret formula, in your opinion?

Gerry Perez

So let me start by saying reaching 25 years—a silver jubilee—in the UK means a lot to us. What’s the secret formula, you ask? There never has been one thing, rather a culmination of things.

For instance, to name some, let me revisit the early 1990s, when our founder of Timber Hill, Thomas Peterffy, decided to pivot the business strategy. After being a successful unicorn, we transitioned from all of Timber Hill’s successes as a market maker to a complete shift in becoming an online broker—or sell side.

That vision and determination led to the establishment of Interactive Brokers abroad, including in the UK. Further, we created a competitive edge by developing in-house trading platforms that served the unique needs of retail and institutional customers.

Now, let’s fast forward to early 2000. In the UK, Interactive Brokers was making a mark on providing some of the most innovative technology and tools the market had ever experienced.

This meant that customers could easily and affordably diversify their portfolios, reduce their risk, and measure their investments simultaneously across asset classes, around the globe, and in real time. The IBKR platforms were viable and adaptable for different types of retail and institutional customers.

Next, to earn trust, we have always prioritized our customers’ needs and desires. For 25 years—since day one—we have consistently displayed our cost, fees, and terms on our website, enabling customers to compare our offerings and make informed decisions. We have conservatively and carefully built the financial strength of our group to ensure it is financially sound to withstand market volatility and emergent disruptions.

Customers want a safe place to put their wealth. We continue to earn their trust with a strong balance sheet and client asset protection safeguards.

Next, over the years, we have been deeply curious about how to improve things for our customers. We have been relentless and resilient in providing our customers’ experience by continuously providing value through new tools, lower pricing, and enhanced interactions.

These are all building blocks that have made—or been part of—our winning formula.

Andrew Wilkinson

Gerry, if you were to take a snapshot of the IBKR London footprint right now, what does it look like?

Gerry Perez

It has been 25 years of Interactive Brokers in the UK. We’ve broadened our reach by opening up a branch office in the UAE. By expanding our presence there, we aim to attract and serve customers not only in the UK but also throughout the Middle East and beyond.

We now provide a localized platform that features a general investment account, along with tax-wrapper accounts such as the ISA and SIPPs.

We extended our ISA offering to include mutual funds and bonds—and all for a low cost. We aim to leverage the technology and tools that the group excels in and envisions to enhance the customer experience continuously. For instance, artificial intelligence is emerging globally and attracting more interest.

We strive to deploy AI-centered applications for various use cases that benefit customers. Recently, we launched the AI-generated news summary application—not only in the UK but also globally. This will enable users to gather information across markets instantly and obtain valuable insights easily. And there’s more to come.

Andrew Wilkinson

A lot’s happened in 25 days. Gerry, what are some of your best memories, or what are some of the landmarks during that period that you can tell us about?

Gerry Perez

There are some great memories, Andrew, over the last 25 years.

Andrew Wilkinson

I guess one of them, Gerry, is my visit to the office in 2007.

Gerry Perez

You know, I was gonna put that at the end, but now it’s gonna go fast forward.

So I’m gonna skip some of them, like Andrew visiting us here in the UK. And I’m also gonna skip things like the banking crisis, COVID-19, Brexit, and all the other crazy stories in between. Rather, I’m gonna focus mainly on the best stories personally that originate from my experiences with customers.

I remember one lady in particular from the very beginning, when we first launched our platform here in the UK. This customer shared her story at a conference where I was speaking. She explained how she had been investing through advisors for some time. However, she was determined to self-invest in order to lower her fees and take control of her portfolio. Her name was Anne.

Now, Anne mentioned that she had placed her first order—not her first trade—and she was over the moon, as if she had just completed a winning trade. It was gratifying to hear her share how easily she could place an order to self-invest, and that human experience was priceless.

Next, there was a customer by the name of Dan, who primarily invested in UK shares. However, he wanted to invest globally but was worried that he didn’t know enough. So we redirected Dan to our IBKR Campus. Dan later reached out and expressed his gratitude for having a free resource like the IBKR Campus—to watch videos and gain insights on how to use our products and services and invest worldwide.

Giving anyone—whether you’re a customer or not—the ability to access the IBKR Campus has proved to be a game changer for those looking to deepen their financial knowledge and shape their investment skills.

And I’m gonna conclude with the other memorable point, because it happened just recently. We developed the IBKR Student Trading Lab, a free online resource for academics and students in finance and computer science at the postgraduate level. This initiative was truly rewarding, and it has grown within our top UK postgraduate institutions.

Recently, I met with students who were introduced to the Student Trading Lab in their finance and math classes. The same students have since launched their own hedge funds or started careers in financial services. Engaging with the next generation over the years brings me great joy, knowing that we’ve made an investment in the academic community.

The IBKR Student Lab is unique because it provides a safe, interactive, and comprehensive way to integrate academics with practical trading simulations. All great stories, all great experience, and very memorable in 25 years.

Andrew Wilkinson

Gerry, I love those landmarks that create—particularly what you’re saying about the Traders Academy—and we’re very proud of that over here.

Now, something you did mention in there was Brexit. The other side of the coin: you had to deal head-on with Brexit, completely unexpected, uh, several years ago. Apart from the shock of Britain leaving the European Union, what did it mean for you, Interactive Brokers?

Gerry Perez

Man, let me take some memories back here. So, the shock of Brexit reshaped the financial marketplace. For institutions like Interactive Brokers UK, Brexit meant that the establishment of IBKR was mandatory on the continent.

So we continued to foresee that we needed to service our EU clients. So we established two entities on continental Europe because we wanted to make sure our customers were not disrupted.

What that meant for Interactive Brokers as a business was that we needed to take a comprehensive approach to rebuild our UK customer base. We achieved this by being transparent and clear with our affected customers.

We adjusted our offering and pricing to reestablish ourselves as a provider of fair value for the price we requested from the beginning. We enhanced the customer experience by processing customer applications quickly and efficiently.

We recalibrated our approach to being customer-centric to reinforce customer trust. We continued to offer innovative solutions, such as our platforms and tools, to improve our customers’ investment opportunities.

And lastly, we viewed growth opportunities through the local lens, so we tailored local needs by offering tax-wrapper accounts like the Stocks and Shares ISA. I’m glad to say things worked out better than we saw.

Andrew Wilkinson

Gerry, how important is IBKR in the UK retail and institutional spaces these days?

Gerry Perez

Oh, good question. From retail traders to major institutions, Interactive Brokers has established itself as a dependable broker for a varied audience—thanks largely to our innovative technology, affordable pricing, and a wide choice of products.

When it comes to retail traders, Interactive Brokers is regarded as one of the most cost-effective platforms in the UK. We offer highly competitive commissions and low margin rates, which are essential for active retail customers.

Furthermore, we provide a broad reach—over 160 global markets—making us a popular choice for those looking to diversify their portfolios internationally.

By offering different types of platforms to meet the unique trader needs of our various investors, we ensure our customers have access to a readily available platform that grows with them in their customer journey.

When it comes to institutional customers, our low-tiered fees for large-scale institutional clients are equally—if not more—important and appealing. By having a reliable and robust infrastructure, we have earned the trust of our institutional customers.

When it comes to risk, managing it is a crucial concern for institutional customers. IBKR provides advanced risk analytics, compliance tools, and tailored margin controls. These features are especially advantageous for institutional firms like hedge funds.

By offering clearing and custody, Interactive Brokers reduces the need for intermediaries, which lowers costs for institutional customers.

So, Interactive Brokers plays a crucial role in both the retail and institutional trading sectors in the UK. Our technology, low fees, and global reach make us an appealing broker for both retail traders and institutional clients. We are adept, and we aim to bridge the needs of these groups—positioning ourselves as the frontrunner in the UK brokerage space.

Andrew Wilkinson

Gerry, that’s a fantastic story for the last 25 years. Tell me—what’s next for London?

Gerry Perez

Well, London continues to be one of the most important financial hubs in the world. The city continues to be a hub for international finance—even after Brexit.

The UK provides unmatched access to a vast network of leading universities that seek to cultivate the next generation of professionals in our industry.

Coupled with the research and contributions in AI and investment, universities are putting forth a lot of technology, a lot of skill and knowledge for that next generation to take advantage of.

We seek to be the enabler for the next generation to go ahead and invest and make this an important marketplace for the future.

London serves as the headquarters for many of the largest banks, asset managers, and financial institutions worldwide—providing services to numerous prospective customers actively involved in trading, which offers Interactive Brokers significant growth opportunities.

By leveraging London’s robust financial infrastructure, skilled workforce, and potential, Interactive Brokers is well-positioned to better serve our clients and enhance our brand at a large scale.

For 25 years, we’ve been proud to call this great city our home, and we look forward to another 25 years and beyond.

Andrew Wilkinson

Gerry, how are you guys gonna celebrate over there for the official birthday?

Gerry Perez

Well, we actually celebrated just recently. We held a very nice celebration at the Tower of London, where we had staff and guests come and join us—where we had the opportunity to bring up stories, give a lot of gratitude to the staff and the people that have empowered us for 25 years, and take special mention of our customers. And since then, we’ve had a little bit of a celebration in between—and more to come.

Andrew Wilkinson

Brilliant. Gerry Perez, CEO of Interactive Brokers in London—thank you very much for joining me today. Gerry’s been with Interactive Brokers since its inception. What did we say? March 28th, 2000. Congratulations, Gerry.

Gerry Perez

Thank you, and we’re looking forward to the next 25 years.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: ISAs

Stocks and Shares ISAs are only available to UK residents. Restrictions apply to ISA account eligibility.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!