The article “Understanding the Stock–Bond Correlation” was originally posted on Alpha Architect blog.

This study looks at how stocks and bonds move together over time, using data from 1875 to 2023. The authors find that inflation, interest rates, and government stability affect this relationship. When inflation and interest rates go up, stocks and bonds tend to move in the same direction, making diversification less effective. This means investors may need other assets, like commodities or alternatives, to reduce risk. Financial advisors should watch economic trends and adjust investments as needed. Clear communication with clients is key to keeping portfolios stable in different market conditions.

Empirical Evidence on the Stock Bond Correlation

- Roderick Molenaar, Edouard Sénéchal, Laurens Swinkels and Zhenping Wang

- Financial Analyst Journal, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

- Stocks and bonds don’t always move in the same way—they change based on the economy. Inflation, interest rates, and a country’s financial stability all affect how stocks and bonds are connected. After 1951, central banks began using policies to counteract economic ups and downs. This change made stocks and bonds more likely to move together when inflation and real interest rates are high. In countries with lower government credit ratings, this connection is even stronger.

- When stocks and bonds move in the same direction, investment portfolios become riskier. For example, a portfolio with 60% stocks and 40% bonds had more fluctuation—10.5%—during times when stocks and bonds moved together, compared to 8.4% when they moved differently. Understanding these patterns helps in making better investment choices.

Practical Applications for Investment Advisors

Building Portfolios – Monitor macroeconomic conditions to anticipate shifts in correlation and adjust bond allocations accordingly. If stock–bond correlation rises, advisors may need to reduce equity exposure in traditional balanced portfolios (e.g., shifting from 60/40 to 35/65).

Checking Government Bonds: Some government bonds are riskier than others. If a country has a lower credit rating, its bonds may behave differently, affecting how well a portfolio is balanced.

Managing Risk – If stocks and bonds move in the same direction, investors may need other options like incorporating alternative diversifiers like commodities, alternative investments, or absolute return strategies.

How to Explain This to Clients

“People often think that when stocks go down, bonds go up, helping to keep investments balanced. But this isn’t always true. When prices rise (inflation) and interest rates increase, stocks and bonds can both lose value at the same time. This can make investing riskier. If that happens, we may need to change your investments or add different options to help protect your money. Our goal is to watch these trends closely and make smart adjustments so your investments stay strong, no matter what happens in the market.”

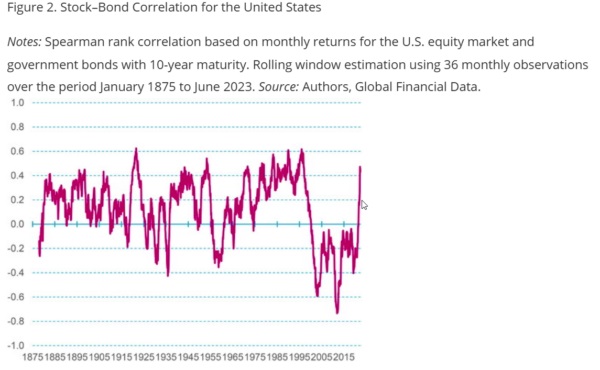

The Most Important Chart from the Paper

The graph below from the paper shows that the stock–bond correlation tends to be positive or close to zero. Exceptions with a correlation below −0.2 occurred in the early 1930s, in the late 1950s, and during most of the 2000s.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The correlation between stock and bond returns is a cornerstone of asset allocation decisions. History reveals abrupt regime shifts in correlation after long periods of relative stability. We investigate the drivers of the correlation between stocks and bonds and find that inflation, real rates, and government creditworthiness are important explanatory variables. We examine the implications of a shift in the stock–bond correlation and find that increases are associated with higher multi-asset portfolio risk and higher bond risk premia.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!