The article “The Value of an Option at Expiration” first appeared on Robot Wealth blog.

Options have value because the future is uncertain.

One thing that is known and always unchanging, however, is the value of a given option contract at expiry. This is the most fundamental thing about an option.

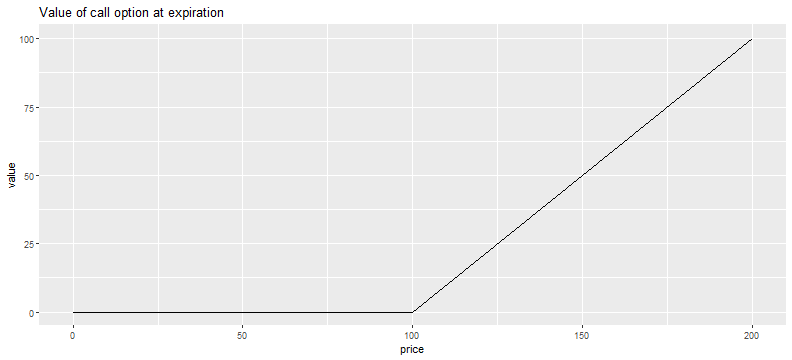

Value of a Call Option at Expiration

A call option gives the holder the right to buy the underlying at the strike price on or before the expiration date.

That means that the value, Vcall, of the call option at expiration, is described by a step-wise function in the price at expiry, Pe and the strike, s:

The option, at expiration, is:

- worthless if the price at expiration is less than or equal to the strike (“out of the money”)

- worth something if the price at expiration is more than the strike (“in the money”)

If the asset is trading below the strike price then we say that the option is “out of the money”. The option gives you the option to buy the asset at the strike price – but nobody would willingly buy an asset at a price higher than they could buy it in the market. So an “out of the money” call option is worthless at expiry.

If the option expires “in the money” then it is worth the price at expiration less the strike. That’s because you can exercise the option to buy the stock at the strike price and you can immediately sell at the market price at expiration, pocketing the difference.

Here’s a visual example of the payoff function of a call option at expiry with a strike of 100:

library(tidyverse)

min_price <- 0

max_price <- 200

strike <- 100

call_payoffs <- tibble(price = c(min_price, strike, max_price)) %>%

mutate(value = case_when(price < strike ~ 0, TRUE ~ price - strike))

call_payoffs %>%

ggplot(aes(x = price, y = value)) +

geom_line() +

ggtitle('Value of call option at expiration')

Value of a Put Option at Expiration

A put option gives the holder the right to sell the underlying at the strike price on or before the expiration date.

That means that the value, Vput, of the put option at expiration is also described by a step-wise function:

The option, at expiration, is:

- worth something if the price at expiration is less than the strike (“in the money”)

- worthless if the price at expiration is greater than or equal to the strike (“out of the money”)

If the asset is trading above the strike price, then we say that the option is “out of the money”. The option gives you the option to sell the asset at the strike price – but nobody would willingly sell an asset at a price lower than they could sell it in the market. So an “out of the money” put option is worthless at expiry.

If the option expires “in the money” it’s worth the strike less the price at expiration. That’s simply because when the option expires in the money, you acquire a short position in the stock at the (high) strike price and can immediately buy it back at the (lower) expiration price, pocketing the difference.

Here’s a visual example of the payoff function of a call option at expiry with a strike of 100:

put_payoffs <- tibble(price = c(min_price, strike, max_price)) %>%

mutate(value = case_when(price > strike ~ 0, TRUE ~ strike - price))

put_payoffs %>%

ggplot(aes(x = price, y = value)) +

geom_line() +

ggtitle('Value of put option at expiration')

Woah there! This all looks like a pretty good deal!

That “kink” at the strike price means that by buying options, we get the ability to participate in the upside of a move without participating in the downside.

Pretty sweet, eh?

This is better than a stop loss because we always keep our exposure to any upside until expiration. We’re not “stopped out.”

Needless to say, this is extremely attractive. And there are no free lunches in the market—nothing comes for free.

Options contracts are derivative contracts. And for a derivatives contract to trade, there needs to be a buyer and a seller. So we need to find a price for an option where people are prepared to sell it and buy it.

Whereas the buyer of the options contract gets to participate in unlimited upside and limited downside, the seller of the options contract gets limited upside and unlimited downside.

So the seller is going to want compensation for this risk. He will want to get paid for the option.

Next, we’ll look at the net P&L from being long options.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Robot Wealth and is being posted with its permission. The views expressed in this material are solely those of the author and/or Robot Wealth and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!