The post “Stocks Aren’t Always the Best in The Long-Run” first appeared on Alpha Architect blog.

By examining data going back to 1792, McQuarrie’s study comes up with a surprising observation : stocks are not as dominant as once thought. The variability of the performance of stocks vs. bonds across various time periods is dramatic. So buckle up, stocks do not invariably outperform bonds.

Stocks for the long run, sometime yes, sometimes no

- Edward F. McQuarrie

- Financial Analysts Journal

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Does the “stocks for the long run” thesis hold consistently over time?

- How do regime changes affect the equity premium and investment outcomes?

What are the Academic Insights?

- NO. Using a comprehensive data set beginning 1792 and including international markets, the author studies the historical performance of stocks and bonds and discovers significant variability in their relative performance. The belief that stocks without question outperform bonds everywhere and over the long term is overturned.

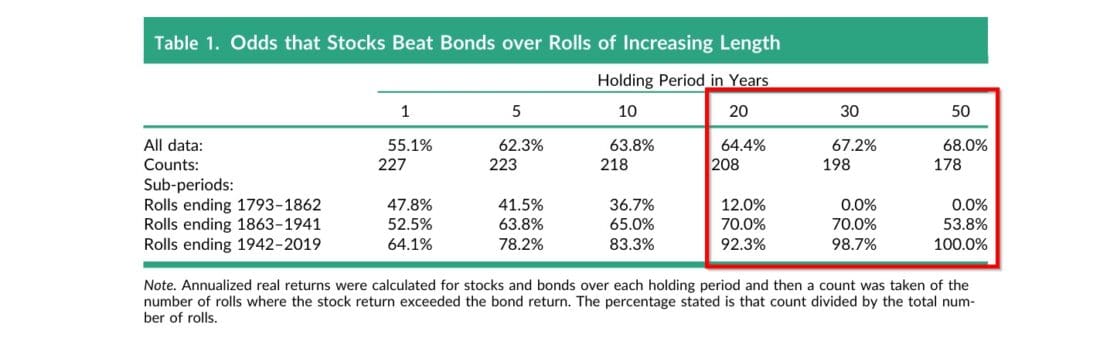

- Review Table 1: Odds that Stocks Beat Bonds over Rolls of Increasing Length. This table is critical because it covers the central argument end to end. Domestic and international stock performance relative to bonds across different periods is definitely variable. A closer look will provide the reader with a statistical breakdown of the likelihood of stock outperformance. Overall, between 1792–2019, stocks outperformed bonds in only 68% of 50-year periods. During the period 1793-1862 when stocks underperformed bonds over very long horizons with no chance of outperformance (by bonds) over 30-and 50- year periods. Between 1842 and 2019, stocks outperformed bonds consistently, with a 100% likelihood over 30 years.

Why does it matter?

Our understanding of risk and return will never be the same. For investment planners, the presence of regime shifts in relative performance will prompt more investors to diversity and change expectations. For asset allocators, the shift away from equity-dominate allocations will be towards a more balanced mix. The general population of investors, advisors, and managers will have to adopt a more nuanced view of risk as recognition of the frequency of equity underperformance becomes widespread.

The most important chart in the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

When Jeremy Siegel published his “Stocks for the Long Run” thesis, little was known about 19th-century stock and bond returns. Digital archives have made it possible to compute real total return on US stock and bond indexes from 1792. The new historical record shows that over multi-decade periods, sometimes stocks outperformed bonds, sometimes bonds outperformed stocks, and sometimes they performed about the same. New international data confirms this pattern. Asset returns in the US in the 20th century do not generalize. Regimes of asset outperformance come and go; sometimes there is an equity premium, sometimes not.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!