Read about the mathematical and fundamental tools used in Quantitative Finance in Part I.

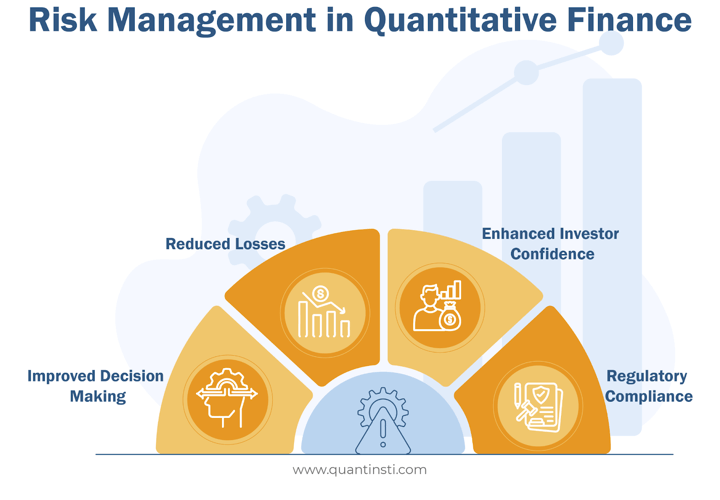

Risk Management in Quantitative Finance

Risk Management is important in Quant Finance for the reasons mentioned below.

- Improved Decision Making: By understanding and quantifying risks, quant professionals can make more informed decisions about investment strategies and risk allocation.

- Reduced Losses: Proactive risk management helps minimise potential losses by identifying and mitigating risks before they materialise.

- Enhanced Investor Confidence: Effective risk management builds trust and confidence among investors by demonstrating a commitment to protecting their capital.

- Regulatory Compliance: Many financial institutions are subject to regulations requiring robust risk management practices.

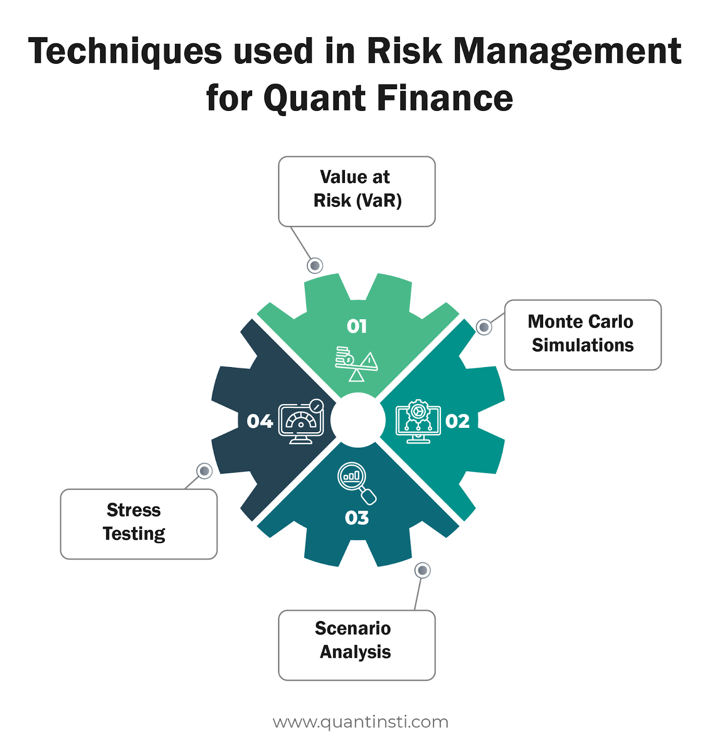

Techniques used in Risk Management for Quant Finance are:

- Value at Risk (VaR): This statistical method estimates the potential maximum loss within a specific time frame, at a certain level of confidence.

- Monte Carlo Simulations: This technique uses random simulations to model various market scenarios and assess the potential range of outcomes for a portfolio.

- Scenario Analysis: Analysing how a portfolio or strategy might perform under different hypothetical market conditions.

- Stress Testing: Pushing a model or portfolio to its limits by simulating extreme market events to assess its breaking points and risk tolerance.

Risk management in quantitative finance is a critical practice that ensures responsible decision-making, protects capital, and fosters stability in the financial system.

Let us see the applications of quantitative finance in trading now.

Applications of Quantitative Finance in Trading

Before mentioning the applications, it is important to note that Quantitative Finance in trading is not a magical tool. Markets can still be unpredictable, and even the most sophisticated models can have limitations.

However, by employing a data-driven and analytical approach, Quantitative Finance empowers traders to make informed decisions, navigate market complexities, and potentially achieve better trading outcomes.

Quantitative finance (quant finance) plays a major role in modern trading by providing a data-driven and analytical approach. Here are some key applications:

- Algorithmic Trading: Quant finance is instrumental in developing and implementing algorithmic trading strategies. These strategies use complex mathematical models and computer programs to automate trading decisions based on predefined rules and analysis of market data. This allows for faster execution, minimises emotional influence, and capitalises on fleeting market opportunities.

- High-Frequency Trading (HFT): HFT and even Medium Frequency Trading utilise sophisticated algorithms and high-powered computing to exploit tiny price inefficiencies in markets at ultra-fast speeds. Techniques like statistical arbitrage and market-making leverage quantitative analysis to identify and capitalise on these short-lived discrepancies.

- Market Making: Quant models can be used to create and maintain market liquidity by automatically providing buy and sell quotes for various financial instruments. This helps to ensure smooth trading by providing readily available counterparties for transactions.

- Quantitative Portfolio Management: Quantitative tools and models are used to optimise or manage investment portfolios by considering factors like risk tolerance, return objectives, and asset correlations. This helps to construct diversified portfolios that maximise returns while minimising overall risk.

- Developing New Trading Strategies: Quantitative analysis is constantly evolving, leading to the creation of innovative trading strategies. Techniques like machine learning and artificial intelligence are being explored to identify complex patterns and relationships in market data, potentially leading to new and profitable trading opportunities.

Stay tuned for the next installment to learn about courses in Quantitative Finance.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!