Ever felt as if the financial news only tells you a little bit of a whole lot of information? You are not alone. Quantitative finance uses a powerful mix of maths, statistics, and even coding to understand what drives the markets. Quants can be using Statistical Arbitrage, mean reversion, machine learning models etc.

In this blog, we will discuss the mathematical tools behind the financial instruments – stocks, bonds, derivatives, and more. We will also find out about probability and statistics because, let’s face it, financial markets do not like surprises. So, the probability will give you a number to represent the chances of uncertainty or volatility in the market. For instance, election results can lead to unexpected volatility in the market if, against the anticipation, a particular government does not get the majority votes.

But here is the best part: this blog isn’t just about theory. We will discuss how to use this knowledge in real life by learning about managing risks and applications of quant finance in the trading domain. Also, we will be going through the courses that help one become a quant. Then we will move to discuss the jobs available in the world of quantitative finance.

So, whether you are a finance professional looking to improve your skills, just curious about how markets work or have been wondering where to start, you must read this comprehensive article.

This article is divided into subtopics to help you understand Quantitative Finance in detail:

- What is Quantitative Finance?

- Mathematical tools used in Quantitative Finance

- Fundamental concepts in Quantitative Finance

- Importance of Quantitative Finance

- Risk Management in Quantitative Finance

- Applications of Quantitative Finance in Trading

- Courses in Quantitative Finance

- Jobs in Quantitative Finance

What is Quantitative Finance?

In simple terms, Quantitative Finance equips you with the skills to analyse financial markets and securities using mathematical tools and large datasets. Experts in this field of quantitative trading, known as quants, utilise these tools for various purposes, including: ⁽¹⁾

- Pricing derivative securities

- Managing risk

Moreover, quants specialise in designing, developing, and implementing algorithms to solve complex financial problems. Let us now move ahead and find out the mathematical tools used in quantitative finance.

Mathematical tools used in Quantitative Finance

Quantitative finance or quant finance relies heavily on a variety of mathematical tools to analyse financial markets, and price instruments, and to manage risk.

Here are some of the key tools for understanding the stock market maths:

- Calculus: Used to model changes in financial variables and to understand the dynamics of financial instruments.

- Linear Algebra: Essential for handling large datasets and for developing models that involve multiple variables.

- Probability Theory: Fundamental for modelling uncertainty and risk in financial markets.

- Statistics: Used to analyse historical data and to make inferences about future market behaviour.

- Stochastic Processes: Applied to model the random behaviour of financial instruments over time.

- Differential Equations: Used to describe the behaviour of financial instruments and to develop pricing models.

- Numerical Methods: Employed to solve complex mathematical models that cannot be solved analytically.

- Optimisation Techniques: Used to find the best solutions for various financial problems, such as portfolio optimisation.

- Monte Carlo Simulations: Applied to model and analyse the behaviour of financial systems under various scenarios.

- Time Series Analysis: Used to analyse and forecast financial data that changes over time.

These tools enable quants to develop sophisticated models and algorithms that provide insights into market behaviour, help price financial instruments, and manage risk effectively.

Going forward, let us learn about the core concepts in the world of quantitative finance.

Fundamental Concepts in Quantitative Finance

The understanding of quantitative finance requires the knowledge of the concepts that are fundamental for analysing financial markets and making informed investment decisions. ⁽¹⁾

These concepts include:

Financial Markets

Platforms where buyers and sellers trade financial assets such as stocks, bonds, derivatives, currencies, and commodities.

Financial instruments

The following are called financial instruments:

- Stocks: Represent ownership in a company and a claim on a part of its profits.

- Bonds: Debt instruments issued by corporations or governments to raise capital, with a promise to repay the principal along with interest.

- Derivatives: Financial contracts whose value is derived from the performance of an underlying asset (e.g., futures, options, swaps).

- Mutual Funds: Investment vehicles that pool money from many investors to purchase a diversified portfolio of securities.

- Exchange-Traded Funds (ETFs): Like mutual funds, ETFs are traded on stock exchanges like individual stocks.

Risk

Risk is the potential for losing some or all of the original investment. It represents the uncertainty associated with the returns on an investment.

Types of Risk

- Market Risk: The risk of losses due to changes in market prices.

- Credit Risk: The risk that a borrower will default on a loan or bond.

- Liquidity Risk: The risk of being unable to buy or sell an asset without significantly affecting its price.

- Operational Risk: The risk of loss due to failed internal processes, people, and systems.

- Systematic Risk: Risk inherent to the entire market or market segment.

- Unsystematic Risk: Risk specific to a single company or industry.

Return

Return is the gain or loss on an investment over a specified period, typically expressed as a percentage of the investment’s initial cost.

Components of Return

- Capital Gains: The increase in the value of an asset or investment over time.

- Income: Earnings received from an investment, such as dividends from stocks or interest from bonds.

Measuring Return

- Absolute Return: The total return on an investment expressed in absolute terms (e.g., £100 gain on a £1,000 investment).

- Relative Return: The return on an investment compared to a benchmark or index (e.g., outperforming the market by 2%).

- Risk-Adjusted Return: The return on an investment adjusted for the level of risk taken to achieve it (e.g., Sharpe Ratio).

Moving further in our exploration of the world of quantitative finance, let us find out why quantitative finance is so important.

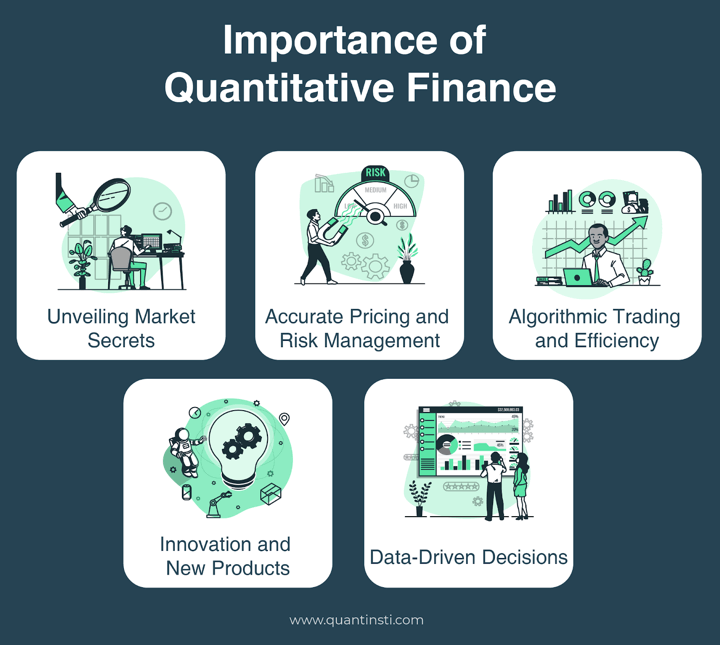

Importance of Quantitative Finance

Quantitative Finance is the core where you learn everything you need to get placed in one of the quant jobs.

Quantitative finance (quant finance) is crucial in today’s financial world for several key reasons:

- Unveiling Market Secrets: It uses powerful mathematical tools and data analysis to understand the complex behaviour of financial markets. This allows investors, traders, and risk managers to make more informed decisions.

- Accurate Pricing and Risk Management: Quant finance helps accurately price complex financial instruments like derivatives and options. It also plays a vital role in risk management by quantifying and mitigating risks associated with investments

- Algorithmic Trading and Efficiency: Algorithmic trading strategies developed through quant finance automate trading processes, improving efficiency and speed in executing trades.

- Innovation and New Products: The field is constantly evolving, leading to the development of new financial products and investment strategies that cater to diverse market needs.

- Data-Driven Decisions: In an increasingly data-driven world, quant finance provides the tools and techniques to analyse vast amounts of financial data, leading to more objective and data-supported decision-making.

Overall, quantitative finance bridges the gap between financial intuition and the complexities of modern markets. It empowers professionals with the knowledge and tools to navigate the ever-changing financial landscape.

Stay tuned for the next installment to learn about risk management in Quantitative Finance.

Originally posted on QuantInsti blog.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!