The article “Polluters Provide Higher Returns than Non-Polluters” first appeared on Alpha Architect blog.

While sustainable investments allow investors to express their attitude to social investment criteria, research (for example, about socially responsible mutual funds and also about sustainability) has found that the demand for sustainable investments is driven by both financial and nonfinancial motives. What does economic theory have to say about these different motives: Are they aligned or in conflict?

Economic theory suggests that if a large enough proportion of investors choose to favor companies with high sustainability ratings and avoid those with low sustainability ratings (sin businesses), the favored company’s share prices will be elevated and the sin stock shares will be depressed. In equilibrium, the screening out of certain assets based on investors’ taste should lead to a return premium on the screened assets.

In our book, “Your Essential Guide to Sustainable Investing,” Sam Adams and I presented the evidence from about 60 studies that were entirely consistent with economic theory—sustainable investors should expect lower returns. However, their investments also entail less risk because companies with high sustainability scores have better risk management and compliance standards. Their more robust controls lead to fewer extreme events such as environmental disasters, fraud, corruption, and litigation (and their negative consequences). The result is a reduction in tail risk in high-scoring firms relative to the lowest-scoring firms. The greater tail risk creates the “sin” premium.

The Halo Effect

Christina Bannier, Yannik Bofinger, and Björn Rock, contributed to the sustainable investing literature with their study “The Risk-Return Tradeoff: Are Sustainable Investors Compensated Adequately?,” published in the May 2023 issue of the Journal of Asset Management, found that the preference for sustainable investment has been so strong that higher returns to less sustainable firms are sufficient to “overcompensate” investors for the risk they bear—the lowest-scoring firms produced the highest risk-adjusted returns. Thus, from a purely economic perspective, the optimal return-to-risk ratio is achieved for a portfolio that invests in the lowest CSR-rated firms.

Summarizing, sustainable and impact investors should expect lower returns from their investments. However, some investors may struggle to align their social and investment preferences. The result could be that the “halo effect”—a cognitive bias that leads investors to make decisions based on their overall impression of a product/company/investment, rather than on a careful analysis of its fundamentals—could lead sustainable and impact investors to believe that these investments have superior returns. That could lead to a loss of value creation.

Latest Research

Yigit Atilgan, K. Ozgur Demirtas, and A. Doruk Gunaydin, authors of the May 2024 study “Do Polluters Outperform Non-Polluters?” investigated whether industrial companies with higher toxic emissions outperformed those with lower toxic emissions. To measure pollution levels, they obtained plant-level chemical pollutants data from the Toxic Release Inventory database maintained by the Environmental Protection Agency between 1991 and 2022. They aggregated by parent company the annual plant-level toxic emissions across all chemical categories. Their sample basically included NYSE, AMEX or Nasdaq firms while excluding excluded financial firms and firms listed for less than two years. They scaled total emissions (in pounds) in year t-1 by total assets, plant, property and equipment, sales or market value of equity disclosed by the end of March of year t. Emissions data for year t-1 were updated between July and September of year t in TRI. They then constructed portfolios at the end of September of year t to avoid look-ahead bias. They sorted all firms with positive scaled emissions in year t-1 into quintiles within 49 Fama and French industries and then calculated monthly value-weighted returns of these quintiles from October of year t to September of year t+1. Following is a summary of their key findings:

- There was evidence of a pollution premium.

- The portfolio of stocks with the lowest (highest) emissions scaled by total assets or AT1 (AT5) had a monthly excess return of 49 (97) basis points.

- The monthly return to the hedge portfolio, which was long (short) in the highest (lowest) emission stocks, was 48 basis points and significantly positive at the 1% level.

- A similar pattern was observed for the other scaling variables.

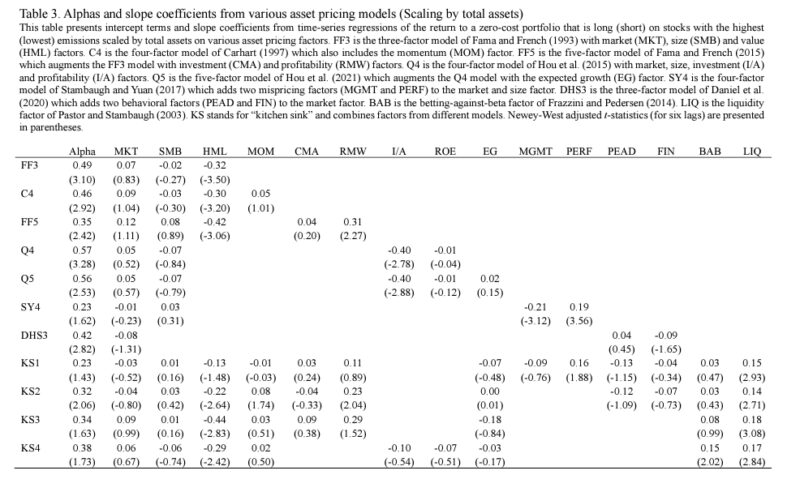

They then tested whether various asset pricing factors could explain the monthly return difference between the high-emission and low-emission quintiles: the three-factor model of Fama and French (beta, size and value); the four-factor model of Carhart (adding momentum); five-factor model of Fama and French (beta, size, value, profitability, and investment); the four-factor model of Hou et al (beta, size, profitability, and investment); the five-factor model of Hou et al. (adding growth in investment); the mispricing factor model of Stambaugh and Yuan; and the behavioral factor model of Daniel et al. They also considered several “kitchen-sink” specifications that also include the betting-against-beta (BAB) factor of Frazzini and Pedersen and the liquidity factor of factor of Pastor and Stambaugh.

They found:

- After controlling for market, size, value, momentum, investment, and profitability factors, the monthly alpha to the hedge portfolio that was long (short) stocks with high (low) emissions varied between 35 and 57 basis points and was significantly positive at least at the 5% level.

- The Q5 expected growth factor had a minimal impact.

- Behavioral factors could not explain the pollution premium as the alpha remained statistically significant with a value of 42 basis points (t-statistic = 2.82).

- The “kitchen-sink” regression produced insignificant alphas when the Fama-French five-factor model was augmented by momentum, expected growth, betting against beta, and the liquidity factors. EG, BAB and LIQ factors. The “kitchen sink” regression that replaced the investment and profitability factors of the Fama-French five-factor model with those of the Q4 model produced a marginally significant alpha.

The authors then examined reward relative to risk measures including the Sharpe ratio, the Sortino ratio (penalizes only those returns falling below a certain threshold that they defined as the risk-free rate), and the Calmar ratio (adjusts excess returns for maximum drawdown). They found:

- The lowest-emission quintile underperformed the other quintiles based on all metrics and scaling variables—the lower return to low-emission stocks was not compensated adequately with lower risk.

- While the highest-emission quintile generally overperformed the other quintiles, there were exceptions to this pattern—while high polluters tended to produce higher reward-to-risk ratios compared to non-polluters, the trend was not uniform.

- The highest-emission portfolio produced larger performance metrics than the S&P 500 index.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Investor Takeaways

Atilgan, Demirtas, and Gunaydin found that there has been a pollution premium for US stocks and that the premium translated into superior investment performance. Their findings are consistent with the literature demonstrating the existence of “a halo effect” that leads sustainable investors to believe that these investments have superior returns, resulting in a loss of value creation. The takeaway is that sustainable investors should expect lower returns from their investments and lower risk-adjusted returns as a “price” they pay for aligning their social and investment preferences.

Larry Swedroe is the author or co-author of 18 books on investing, including his latest, Enrich Your Future: The Keys to Successful Investing

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!