The S&P 500 options market is flashing signs of unusual short-term anxiety. Traders have bid up the prices of near-term options so much that the implied volatility for options expiring in the next couple of days is now higher than that of options expiring weeks out. This rare condition, called backwardation in the volatility term structure, suggests the market is bracing for immediate risks to equities, more so than for longer-term uncertainties.

This article breaks down what implied volatility and backwardation mean, why this reversal has appeared, what’s driving current market jitters, and how investors can interpret these signals.

Understanding Implied Volatility and Backwardation

Implied volatility (IV) reflects the market’s expectation of future volatility, derived from option prices. When traders anticipate larger swings in the market, they are willing to pay more for options, pushing IV higher.

Term structure of volatility refers to how implied volatility changes for options with different expiration dates. Normally, IV increases with time to expiration—known as contango—because there is more uncertainty over a longer horizon. However, when near-term events are perceived as particularly risky, this relationship can invert. That’s called backwardation, and it signals that the market expects more volatility in the immediate future than further out.

Currently, the S&P 500 options market is experiencing this rare backwardation, suggesting that traders see a short-term storm on the horizon.

The Numbers Behind the Anxiety

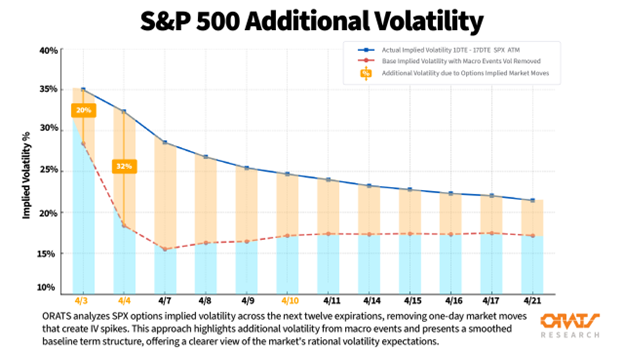

Data from the options market show a dramatic spike in implied volatility for near-term expirations:

- April 3, 2025

- Raw implied volatility: 35.0%

- Adjusted baseline: 28.5%

- Traders are pricing in roughly 98% more volatility than normal.

- April 4, 2025

- Raw implied volatility: 32.3%

- Adjusted baseline: 18.4%

- Implied volatility has 86% more volatility than the baseline.

Even after removing the excess volatility related to these two key dates, the adjusted baseline implied volatility across expirations remains elevated—around 19%, compared to a year-to-date average of 16%. This suggests that the overall market tone remains cautious beyond just the immediate headlines.

What’s Driving Market Jitters?

Several major factors are converging to elevate short-term volatility:

- Geopolitical Tensions: Continued overseas hostilities and uncertainty surrounding U.S. trade policy have created a cloud of unease. Conflicting commentary on tariffs and foreign policy developments are fueling investor caution.

- Macroeconomic Events: A wave of critical economic data and central bank communications is hitting the market this week.

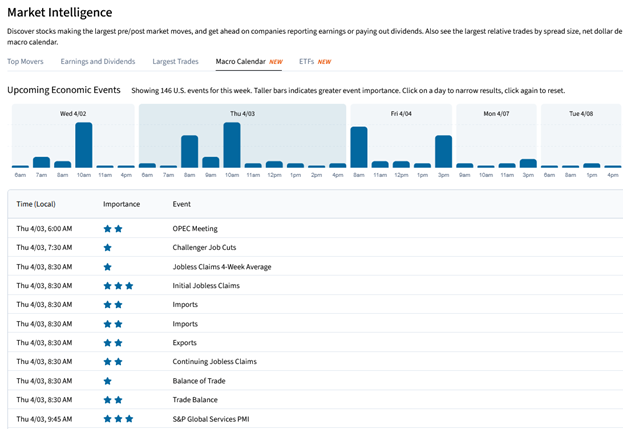

- Thursday, April 3

- OPEC Meeting: Oil price expectations and inflation concerns hang in the balance.

- Initial Jobless Claims: A key gauge of labor market health.

- S&P Global Services PMI: Insight into the services sector’s strength.

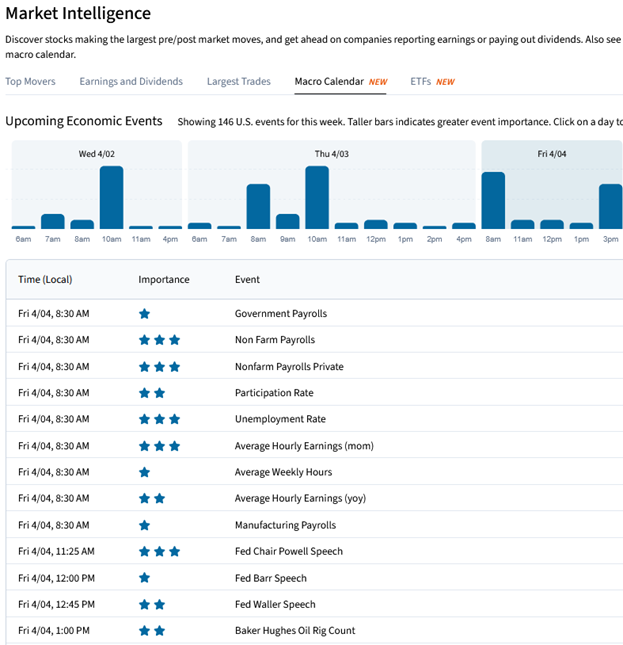

- Friday, April 4

- Non-Farm Payrolls & Unemployment Rate: One of the most important data releases of the month.

- Fed Chair Powell Speech: Market participants will parse his words closely for clues on interest rate policy.

- Thursday, April 3

- Additional Fed Speakers: Several other Federal Reserve officials are scheduled to speak throughout the week, adding to uncertainty.

The concentration of potential market-moving events in such a short span has significantly raised the stakes, and the options market is reflecting that tension.

Bottom Line

The S&P 500 options market is sending a clear message: traders are bracing for potentially large market moves over the next few days. With geopolitical tensions simmering, trade policy uncertainty lingering, and critical economic data and Fed commentary on deck, it’s no surprise that implied volatility is spiking—particularly for April 3rd and 4th.

Even after adjusting for these specific risks, the market remains more volatile than usual. For investors, this is a moment to assess your risk exposure, avoid knee-jerk decisions, and stay focused on long-term strategy while being prepared for short-term turbulence.

Disclosure: ORATS

The opinions and ideas presented herein are for informational and educational purposes only and should not be construed to represent trading or investment advice tailored to your investment objectives. You should not rely solely on any content herein and we strongly encourage you to discuss any trades or investments with your broker or investment adviser, prior to execution. None of the information contained herein constitutes a recommendation that any particular security, portfolio, transaction, or investment strategy is suitable for any specific person. Option trading and investing involves risk and is not suitable for all investors.

All opinions are based upon information and systems considered reliable, but we do not warrant the completeness or accuracy, and such information should not be relied upon as such. We are under no obligation to update or correct any information herein. All statements and opinions are subject to change without notice.

Past performance is not indicative of future results. We do not, will not and cannot guarantee any specific outcome or profit. All traders and investors must be aware of the real risk of loss in following any strategy or investment discussed herein.

Owners, employees, directors, shareholders, officers, agents or representatives of ORATS may have interests or positions in securities of any company profiled herein. Specifically, such individuals or entities may buy or sell positions, and may or may not follow the information provided herein. Some or all of the positions may have been acquired prior to the publication of such information, and such positions may increase or decrease at any time. Any opinions expressed and/or information are statements of judgment as of the date of publication only.

Day trading, short term trading, options trading, and futures trading are extremely risky undertakings. They generally are not appropriate for someone with limited capital, little or no trading experience, and/ or a low tolerance for risk. Never execute a trade unless you can afford to and are prepared to lose your entire investment. In addition, certain trades may result in a loss greater than your entire investment. Always perform your own due diligence and, as appropriate, make informed decisions with the help of a licensed financial professional.

Commissions, fees and other costs associated with investing or trading may vary from broker to broker. All investors and traders are advised to speak with their stock broker or investment adviser about these costs. Be aware that certain trades that may be profitable for some may not be profitable for others, after taking into account these costs. In certain markets, investors and traders may not always be able to buy or sell a position at the price discussed, and consequently not be able to take advantage of certain trades discussed herein.

Be sure to read the OCCs Characteristics and Risks of Standardized Options to learn more about options trading.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from ORATS and is being posted with its permission. The views expressed in this material are solely those of the author and/or ORATS and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!