This post replicates the construction process of the SOFR index from daily SOFR rates. Since this index is published in a daily basis officially, there is no need to make it. But in the process of pricing SOFR swaps and floating rate notes, this sort of calculation is needed.

Introduction

LIBOR will transition to an alternative reference rate. The SOFR(Secured Overnight Financing Rate) is the risk-free alternative reference rates for USD and is an in-arrears rate. Unlike LIBOR, SOFR is a secured overnight rate, not a forward looking term rate. SOFR Averages (30-, 90-, and 180-calendar days) are constructed by the geometric average of the daily rates. There are two method to make them. The first is to use the daily rate directly and the second is to use the SOFR index.

Before going into SOFR Averages, we will calculate SOFR Index at first. The following pages are the information regarding the SOFR.

Additional Information about Reference Rates Administered by the New York Fed (https://www.newyorkfed.org/markets/reference-rates/additional-information-about-reference-rates#sofr_ai_calculation_methodology)

SOFR Averages and Index Data (https://www.newyorkfed.org/markets/reference-rates/sofr-averages-and-index#historical-search)

Daily SOFR rates can be downloaded at the following page.

Secured Overnight Financing Rate (SOFR) (https://fred.stlouisfed.org/series/SOFR)

We try to replicate the SOFR index from the following page.

Daily indicative SOFR averages and index (Apr. 2018 – Feb. 2020) (https://www.newyorkfed.org/medialibrary/media/markets/historical_indicative_sofr_avg_ind_data.xlsx)

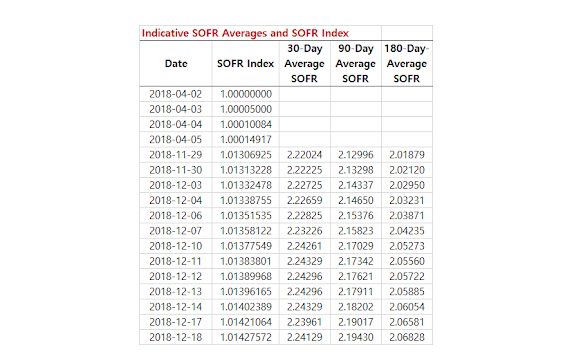

The above excel file have the following form (to get all visible rows of averages, some selected rows are hidden)

Before going into the detail, It is important to distinguish between publication date and value date (date of rate). SOFR rate available at publication date is the rate which is determined at previous business date(value date). If there is no holiday and weekend in between, the publication date is the time t and the previous business date is the time t−1.

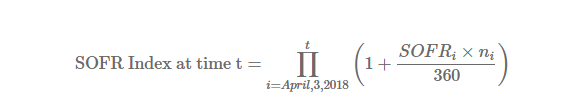

The SOFR Index measures the cumulative index of compounding the SOFR on a unit of investment over time, with the initial value set to 1.00000000 on April 2, 2018, the first value date of the SOFR. The Index is compounded by the value of each SOFR thereafter.

Here, i denotes a sequential business day from April, 3, 2018 to t. SOFRi is the SOFR applicable on business day i and ni is the number of calendar days for which SOFRi applies.

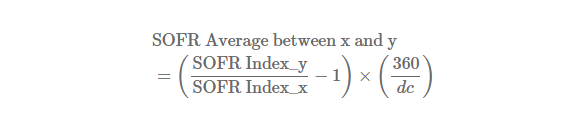

From this SOFR Index, SOFR averages can be calculated using the following formula.

Here, x and y are the start and end date of calculation period respectively. dc is the number of calendar dates in the calculation period.

We can calculate the SOFR index from the daily SOFR rates using the following R code.

#=========================================================================#

# Financial Econometrics & Derivatives, ML/DL using R, Python, Tensorflow

# by Sang-Heon Lee

#-------------------------------------------------------------------------#

# Calculation of SOFR Index from Daily SOFR Rates

#=========================================================================#

# construction of data frame

df <- data.frame(rbind(

c("2018-04-02", 1.00000000, 1.80),

c("2018-04-03", 1.00005000, 1.83),

c("2018-04-04", 1.00010084, 1.74),

c("2018-04-05", 1.00014917, 1.75),

c("2018-04-06", 1.00019779, 1.75),

c("2018-04-09", 1.00034365, 1.75),

c("2018-04-10", 1.00039228, 1.75),

c("2018-04-11", 1.00044091, 1.76),

c("2018-04-12", 1.00048982, 1.73),

c("2018-04-13", 1.00053790, 1.72),

c("2018-04-16", 1.00068131, 1.77),

c("2018-04-17", 1.00073051, 1.76),

c("2018-04-18", 1.00077944, 1.75),

c("2018-04-19", 1.00082809, 1.73),

c("2018-04-20", 1.00087618, 1.72),

c("2018-04-23", 1.00101964, 1.70)))

colnames(df) <- c("Pub_Date","SOFR_Index", "SOFR_Rate")

# string to date format

df$Pub_Date <- as.Date(df$Pub_Date)

df$SOFR_Index <- as.numeric(df$SOFR_Index)

df$SOFR_Rate <- as.numeric(df$SOFR_Rate)

for(i in 1:nrow(df)) {

if (i==1) {

df$Calc_Index[i] = 1

} else {

ni = as.numeric(df$Pub_Date[i] - df$Pub_Date[i-1])

df$Calc_Index[i] = df$Calc_Index[i-1]*

(1+df$SOFR_Rate[i-1]/100*ni/360)

}

}

# rounding at 8-decimal

df$Calc_Index <- round(df$Calc_Index,8)

# print df

print(df)In the above R code, data.frame (df) have all data as string formats because Pub_Date is of a string type. Therefore type recast is applied. The content of rest of code is the implementation of the SOFR Index by its formula. The following result shows that Calc_Index (the right most column of df) is the same as the SOFR_Index.

> print(df)

Pub_Date SOFR_Index SOFR_Rate Calc_Index

1 2018-04-02 1.000000 1.80 1.000000

2 2018-04-03 1.000050 1.83 1.000050

3 2018-04-04 1.000101 1.74 1.000101

4 2018-04-05 1.000149 1.75 1.000149

5 2018-04-06 1.000198 1.75 1.000198

6 2018-04-09 1.000344 1.75 1.000344

7 2018-04-10 1.000392 1.75 1.000392

8 2018-04-11 1.000441 1.76 1.000441

9 2018-04-12 1.000490 1.73 1.000490

10 2018-04-13 1.000538 1.72 1.000538

11 2018-04-16 1.000681 1.77 1.000681

12 2018-04-17 1.000731 1.76 1.000731

13 2018-04-18 1.000779 1.75 1.000779

14 2018-04-19 1.000828 1.73 1.000828

15 2018-04-20 1.000876 1.72 1.000876

16 2018-04-23 1.001020 1.70 1.001020

>Next time, we will make SOFR averages from the SOFR index. After that, we try to get the same results from the direct use of SOFR rates successively.

Originally posted on SHLee AI Financial Model blog.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SHLee AI Financial Model and is being posted with its permission. The views expressed in this material are solely those of the author and/or SHLee AI Financial Model and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!