- As we enter peak earnings season for the second quarter, S&P 500 EPS growth continues to improve, now at 6.4% YoY

- Key tech players from the Magnificent 7 release results this week – Meta and Microsoft on Wednesday, and Apple and Amazon on Thursday

- Four S&P 500 companies reporting this week have delayed their earnings dates: Teradyne Inc, PPG Industries, UnitedHealth Group, and Kimberly Clark Corp

Peak earnings season for the second quarter begins this week and lasts through the second week of August. This is when roughly 75% of S&P 500 companies are scheduled to report. Thus far 34% of companies from the index have reported, and the early results bode well for the rest of the season.

Last week investors focused on results from the first two Magnificent 7 constituents, Tesla and Alphabet, which both reported on Wednesday and had differing results.

Not surprisingly, Tesla continued to report waning demand. This was expected after the EV maker released disappointing results in their Second Quarter 2025 Production, Deliveries & Deployments on July 2. That report showed that second quarter vehicle deliveries declined 14%, the second straight quarterly decline.1 In their second quarter earnings report, Tesla missed expectations on the top and bottom-line due to automotive revenue which was down 16% YoY, in part due to competition from Chinese EV makers which are producing more affordable models.2 The stock is down ~16% YTD.

On the flipside, Google parent, Alphabet, was a bright spot. Alphabet beat expectations on the top and bottom-line, driven by robust revenue from YouTube advertising and Google Cloud. The company also offered 2025 CapEx estimates that were higher than Wall Street’s expectations for the second time this year. In February, Alphabet said it expected to spend $75B in capital expenditures (CAPEX) mainly due to the expansion in its AI capabilities, which was higher than the $58.84B analysts had expected. Last week that number rose to $85B, this time due to “strong and growing demand for our Cloud products and services.” Alphabet CFO, Anat Ashkenazi, told investors to expect further increases to CAPEX in 2026.3 Alphabet stock is up ~2% YTD.

With the results from those names as well as the 110 other S&P 500 constituents that reported last week, Q2 growth propelled to 6.4% from 5.6% the prior week. Revenues also increased to 5.1% from 4.4% the week prior. Beat rates remain impressive with 80% of S&P 500 companies surpassing expectations on the top and bottom-line, better than the 1, 5, and 10-year beat rate averages according to FactSet.4

On Deck this Week – More Big Tech Results

This week all eyes will be on four more Magnificent 7 reports – from Meta and Microsoft on Wednesday, and Apple and Amazon on Thursday. Nvidia is the final of the group to report on August 27.

Source: Wall Street Horizon

Outlier Earnings Dates This Week

Academic research shows that, when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share negative news on their upcoming call, while moving a release date earlier suggests the opposite.5

This week we get results from a number of large companies on major indexes that have pushed their Q2 2025 earnings dates outside of their historical norms. Eight companies within the S&P 500 confirmed outlier earnings dates for this week, four of which are earlier than usual and therefore have positive DateBreaks Factors*. Those names are Regency Centers Corp (REG), Booking Holdings (BKNG), AES Corp (AES) and CVS Health Corp (CVS). The four companies with negative DateBreak Factors for this week are Teradyne Inc (TER), PPG Industries (PPG), UnitedHealth Group (UNH), and Kimberly Clark Corp (KMB).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

Q2 Earnings Wave

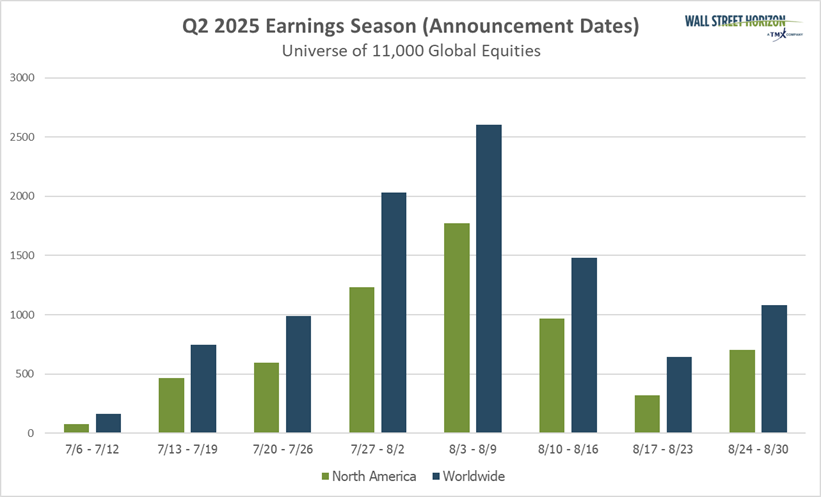

The peak weeks of the Q2 earnings season are expected to fall between July 28 – August 15, with each week expected to see over 2,000 reports. Currently, August 7 is predicted to be the most active day with 1,291 companies anticipated to report. Thus far, 71% of companies have confirmed their earnings date, and 14% have reported (out of our universe of 11,000+ global names), so this is subject to change. The remaining dates are estimated based on historical reporting data.

Source: Wall Street Horizon

—

Originally Posted July 28, 2025 – Magnificent 7 Diverge as Peak Earnings Season Puts Spotlight on Big Tech

1 Tesla Second Quarter 2025 Production, Deliveries & Deployments, July 2, 2025, https://ir.tesla.com

2 Tesla Q2 2025 Quarterly Earnings Update, July 23, 2025, https://www.tesla.com

3 Alphabet Announces Second Quarter 2025 Results, July 23, 2025, https://abc.xyz

4 FactSet Earnings Insight, John Butters, July 25, 2025, https://advantage.factset.com

5 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018, https://papers.ssrn.com

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!