Wall Street’s record run is continuing in the aftermath of President Trump visiting the Fed’s headquarters during which he delivered a friendly, sports-like bump in the back of Chair Powell while telling the press that he would love lower interest rates. The two leaders and GOP members toured the central bank’s construction site and wore hard helmets on their heads, somewhat reminiscent of the Commander in Chief’s past ventures in commercial real estate. But the monetary authority’s rate decision is next week and investors are taking their cue from robust earnings reports, which are coinciding with hopes that another major trade deal or two will be announced by next Friday’s August 1 deadline. Rumors have it that the EU is nearing a Tokyo-like agreement with Washington, characterized by 15% tariffs on exports to the US. Participants are responding by picking up stocks in the majority of sectors while also reaching for greenback exposure and forecast contracts. Conversely, the commodity complex is facing selling pressure across the board, and so is bitcoin. But Treasuries are pretty flat along the curve and traders are generally unwinding hedges as prices of volatility protection instruments slide.

Boeing Orders Drag Durable Goods Report

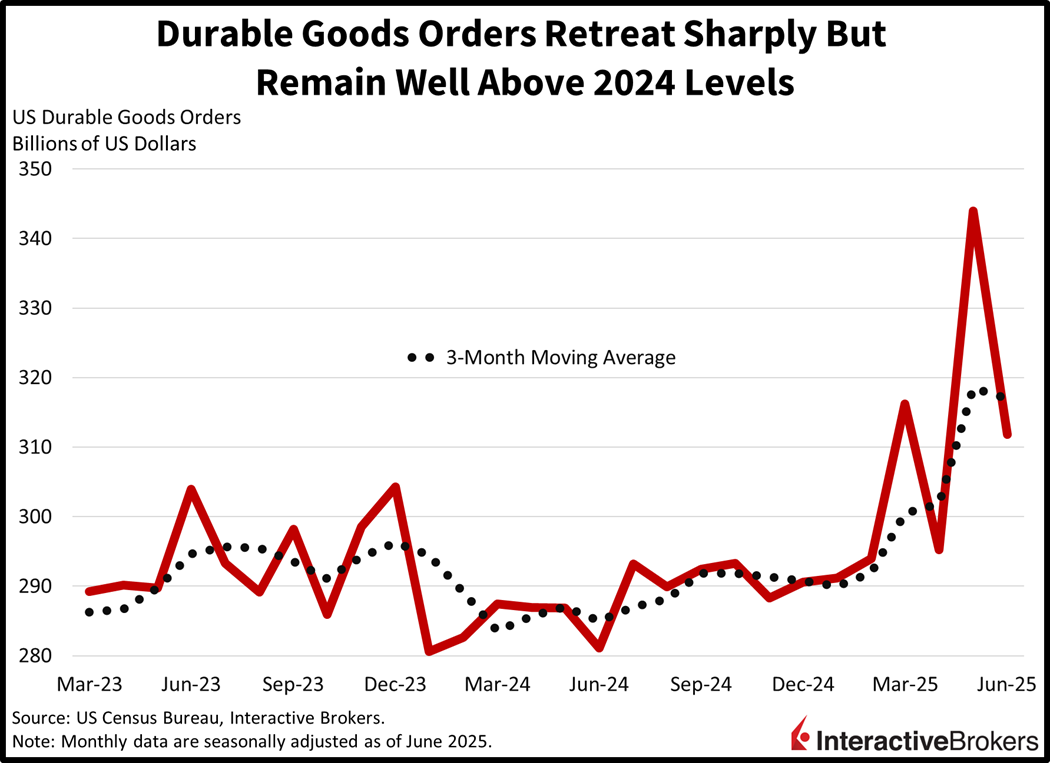

On a relatively quiet day for the economic calendar, durable goods was the only domestic data point delivered. The June headline sported a huge negative of 9.3% month over month (m/m) due to a heavy plunge in Boeing orders. Still, the result exceeded the -10.8% median estimate but gave back much of the 16.5% gain from May. Highly volatile passenger aircraft purchases were down 51.8% m/m and the other category also weighed on performance, but not by much, decreasing a modest 0.2%. All other major components reported gains as follows:

- Defense airplanes, 9.1%

- Automobiles, 0.9%

- Computers/electronic products, 0.6%

- Primary metals, 0.6%

- Machinery, 0.4%

- Fabricated metal products, 0.2%

- Electrical equipment, 0.1%.

The capital goods ex airplane segment, meanwhile, a critical indicator of business investment, descended 0.7% after a sharp 2% climb in the previous interval.

Trump Will Likely Get Upset at Powell, Again

The incoming week is another pivotal one from an earnings standpoint in light of a large number of S&P 500 members and 4 magnificent 7 constituents on deck to report numbers. And while the last 5 days have been quiet from an economic data perspective, the next 7 will be quite eventful. Indeed, the domestic calendar features a Fed decision, a 2nd quarter GDP recovery as well as tons of labor statistics including nonfarm payrolls, job openings, ADP hiring, and unemployment claims. Additionally, we’ll see updated PCE figures, construction spending, pending home sales and ISM-manufacturing. Also, a critical date falling on Jobs Friday is the trade deadline and closed deals with EU and India would add further fuel to the tank of this stock market rally. I’m projecting that investors will be pleased by profit performances from corporate America, but the economic data is a bigger question mark, considering that the US central bank is widely expected to keep interest rates unchanged which will probably spark a fiery response from President Trump. But if the committee stands back because the economy is doing so great, is that really a terrible thing?

International Roundup

Heatwave Sparks Increase in UK Retail Sales

Warm weather in the UK heated up retail sales last month after volumes sank in May, but the results missed expectations. Volumes grew 0.9% m/m, a recovery from the 2.8% May decline but less than the economist consensus forecast for a 1.2% increase.

Core retail sales, which exclude certain items with volatile prices, such as automobiles, gasoline, and building materials, also followed the trend. Within this metric, stores and other outlets sold 0.6% more m/m in June following a 2.9% drop in the fifth month of the year, missing the 1.2% economist forecast.

Regarding the broader headline gauge, supermarkets generated strong results, especially for beverages, with weather in June—the hottest month on record—causing consumers to stock up on drinks. Food sales also increased as UK residents dusted off their barbecues. At the same time, the weather triggered an increase in travel, pumping up gasoline sales.

As Consumers Remain Pessimistic

Great Britain shoppers’ pessimism strengthened last month with the Gfk Consumer Confidence gauge falling from -18 to -19, matching the economist forecast.

In another sign of pessimism, household’s put more money aside for the future with the Gfk savings gauge hitting 34, the loftiest result since November 2007. Gfk attributes the low sentiment to current inflation and the outlook for additional price pressures. UK residents are also concerned about potential tax increases.

Singapore Industrial Product Better than Expected

Industrial production in Singapore was flat m/m in June, much worse than the 1% gain in May but better than the economist consensus call for a 1.5% descent. When compared to June 2024, output was up 8%, surpassing the 7.1% forecast and May’s 3.6% print.

The m/m figure, while weaker than May, would have sank 0.8% ex biomedical manufacturing, which is a volatile sector, according the city-nation’s Economic Development Board. Singapore maintains a commanding role in electronics manufacturing, a sector of its economy that jumped 6.6% in June.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

WTF!!!!….We got all that with the numbers when they were released… Thanks for nothing… It would be interesting to get an informed analysis on what the numbers might mean,,,, is that not what financial journalism is meant to be… hell, just giving a 2 sided answer would give the public both options to consider and they could make their own mind up as to what they want to believe…. to spew out the already known #’s is lazy, if not malpractice…..take the weekend off..if not the next month and let someone else attempt to sound intelligent…

Shots fired!!!!

Commenter above sounds like they had a bad commute….. Sounds like the rates will not be changing next week, but earnings next week will still reflect the pre-tariff uptick in business. I’m still planning for the other shoe to drop in third or forth quarter earnings once those otherwise brainwashed by false claims, are forced to realize by rising shelf pricing, that tariffs are actually paid by those importing goods, not exporting. The USA absolutely needs stuff from abroad and most imports are about to get more expensive. The impact of US tariffs on the significant formerly cheaper raw resources imported from the northern neighbour is going to force our value added manufactures to raise their prices, thus sell less, thus reduce earnings, thus lay off, thus less consumer expenditures, thus lower earnings….etc. I’ve not seen it mentioned much in analyst commentary, but I’m expecting the dollar devaluation as a possible means of diminishing impact of growing national debt. Yep it’s drastic and probably damaging to global US standing…..so in complete keeping with current policy trends. Maybe this is where the new stable coins, with a possible commodity under pinning, come in. Sure seems like Trump is using the ‘Gold’ word a lot this term and in his WH decor. I am certainly kicking myself for not having added more before this year’s gold surge, but I think a play in the related miners presently makes more sense. At any rate, I’d be interested in hearing more from the IB analysts on how they see growing US federal debt finally being addressed by the current administration, and how these expected future maneuvers will impact the equity markets.

THE ‘ANTI’ TRUMP NEWS HAS CERTAINLY INFECTED IBKR, THOUGH IT WILL NEVER PRINT MY COMMENT, NOR DO THEY EVER? BUT WITH ALL THE REPORTING ON HERE THERE IS NO ONE TEASPOON OF FLAVOR GIVEN TO TRUMP IN ANY MANNER OR FORM? WHY US THAT? WAS SOME OTHER FACTOR RESPONSIBLE? SURE YOU CAN NAME A HALF DOZEN POSSIBLE CANDIDATE BUT THE TRUMP NAME WILL NOT BE ON THAT LIST. ASK YOURSELF WHY?

Release the Epstein files!