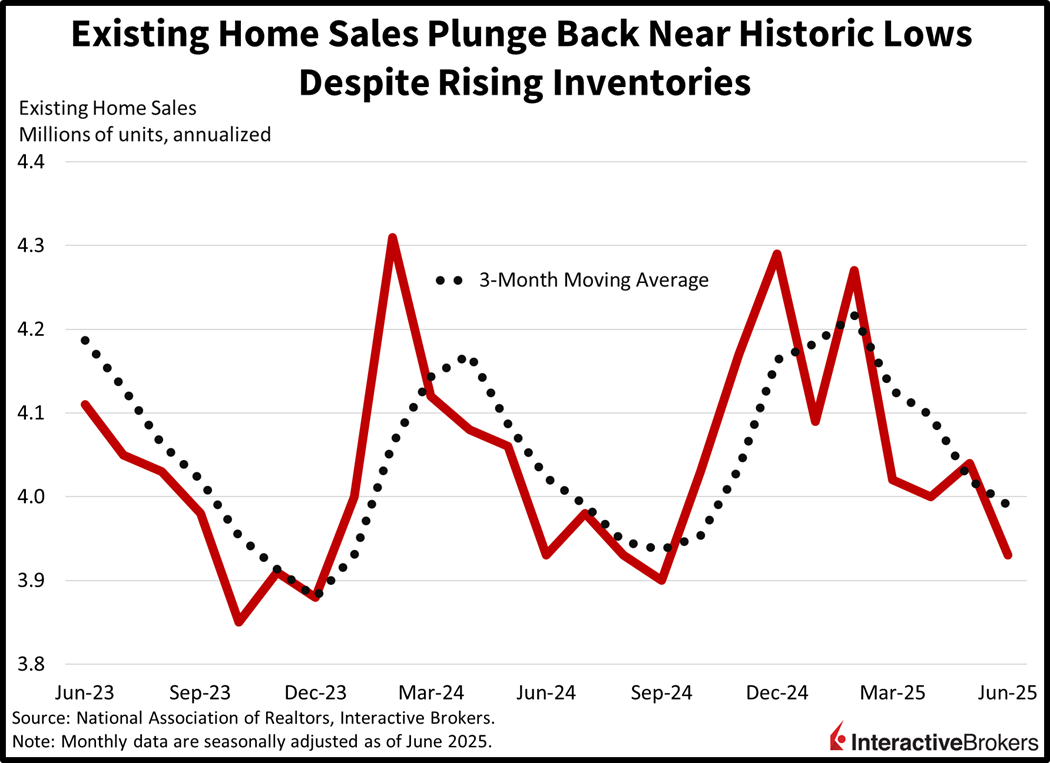

Stocks are soaring to fresh all-time highs as new US trade deals with Tokyo, Manila and Jakarta bolster confidence that additional accords may be completed prior to the August 1 deadline. The trade deal trio include tariffs ranging from 15% to 19%, much better than feared and not that disruptive to cross-border commerce. Indeed, economic growth expectations are firming following the agreements and sending interest rates north. Meanwhile, the stateside calendar was light but featured a 9-month low for existing home sales, as record prices and heavy financing charges constrain affordability and hamper transactions. Inventories have been climbing, helping to contain valuation expansion; however, the elevated expenses of moving to a costlier mortgage have left sellers with little room for negotiation. The focus for investors today, however, is the international progress and a decline in trade uncertainty, which is motivating advances in all 11 major equity sectors while traders also scoop up greenback futures, forecast contracts and the copper, lumber and silver commodities. Conversely, participants are trimming Treasuries pretty evenly across the curve and reducing exposures to volatility protection instruments, gold bars, bitcoins, natural gas and crude oil.

Heavy Inventories Not Helping Home Sales

The pace of existing home sales fell to the lightest level since September last month and is trending south as homebuying remains incredibly out of reach for many prospective purchasers. Indeed, mortgage rates above 6% can’t catch a break as global long-term government debt, which home loans are heavily tied to, remains pricey due to strong economic growth projections, inflation uncertainty and sovereign debt concerns that are supporting elevated term premiums. Transaction tempo dropped 2.7% month over month (m/m) to 3.93 million seasonally adjusted annualized units, below both the consensus estimate of 4.01 million and May’s 4.04 million. The loftiest median price ever recorded of $435,300 drove m/m declines of 8%, 4% and 2.2% in the Northeast, Midwest and South while the West offset some of the sluggishness, advancing 1.4% during the period. The single-family segment weighed on results, decreasing 3% m/m while the condominium/cooperative component was unchanged in the print. Inventories relative to current closings are near a nine-year high, meanwhile, as the 4.7 months’ supply in this morning’s report was the heaviest figure since July 2016.

Corporate Earnings Take Center Stage

This week’s news of cemented trade agreements is supporting the ferocious animal spirits we’re seeing in equity markets. The deals are bolstering economic growth projections and offering confidence to investors that the path for corporate earnings expansion remains clear and wide. Meanwhile, hesitation regarding income prospects has led to participants doubting whether firms can deliver strong top and bottom lines while additionally providing robust outlooks. Incoming quarterly performance reports will probably be well received by Wall Street as economic activity has been buoyant in the second quarter while the skies ahead are clearing up from here. But for valuation-focused market watchers that are wary of extended profitability multiples, the long-end of the curve looks attractive to me, as inflation expectations and term premiums appear stretched and likely to fall, delivering lightering interest rates in the days to come.

International Roundup

Consumer Sentiment Climbs in South Korea

South Koreans’ view of the economy improved marginally this month with the Composite Consumer Sentiment Index climbing from 108. 7 in June to 110.8, according to the Bank of Korea.

Most of the gain, however, was focused on assessments of present conditions as follows:

- Current domestics economic conditions, up 12 points to 86

- Current living standards, up two points to 94

Sentiment regarding the future was unchanged at 101 while the outlook for spending climbed one point to 111.

Conversely, the gauge regarding future domestic economic conditions sank one point to 106. For price pressures, consumers anticipate inflation of 2.5% for the upcoming year, an increase from 2.4% in June. For the three-year period, the expectation of a 2.4% pace was unchanged from June.

Leading Indicator for Australia Sinks

The six-month annualized growth rate of Westpac-Melbourne Institute Leading Index fell from 0.11% to a barely positive 0.03% in June, implying the country is likely to have weaker-than-anticipated economic growth three to six months from now.

Declines in commodity prices, consumer sentiment, and hours worked weighed upon the headline, which has declined for six consecutive months. Westpac Bank now estimates the economy will expand only 1.7% this year after growing 1.3% in 2024.

Singapore Inflation Falls Below Expectations

Inflation in Singapore eased slightly and fell below the economist consensus estimate last month. The Consumer Price Index declined 0.1% m/m after climbing 0.7% in May. For the year over year (y/y) metric, the benchmark was up 0.8%, matching May’s result and less than the 0.9% consensus forecast. The core version, which strips out items with volatile prices, was also benign, climbing 0.6% y/y, which matched May’s pace and was cooler than the 0.70% estimate.

Within the broader CPI, clothing and footwear had the largest m/m price gain of 0.8% followed by the recreation, sport and culture category, with a 0.3% increase.

The information and communications category became 1.1% less costly while charges for the household durables and services group and the transport sector sank 0.4% and 0.2%.

New Home Prices Continue to Fall in Canada

The cost of new homes in Canada fell 0.2% in June, marking the third consecutive monthly decline, according to Statistics Canada. Prices were stable in 10 survey regions but sank in 12 other geographic areas. The remaining five regions experienced price gains. Despite prices being stable during the first three months of 2025, a second-quarter drop in stickers resulted in a year-to-date decline of 0.8%. In a press release, Statistics Canada attributes the lower prices to uncertainties regarding tariffs imposed on Canada by the US and tariff countermeasures imposed on the US by Canada.

As Cross Boarder Travel Weakens

Canada experienced a 6.6% y/y drop in visitors from overseas in May, which was the eighth consecutive month of declines. Trips from US residents fell at a slower pace of 5.6%. Meanwhile, the US-Canada trade dispute resulted in the number of residents returning from trips to the United States in May declining 31.9% from May 2024. Return trips from overseas increased 8.9%.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!