The Fed remains on hold amid modest inflation gains and political noise around Chair Powell. While CPI rose slightly, shelter inflation eased and consumer expectations softened. With trade deals pending, a September rate cut remains a live possibility.

- US: Modest tariff evidence so far in US inflation data

- BoE: Less urgency for faster rate cuts

- Japan: Anxious week ahead

- Spotlight on next week

Weekly highlights

US: Fed on hold for now, but not for much longer

The June CPI data was the week’s main macro data event, but it was overshadowed by speculation around the search for the next Fed Chair. Media reports that President Trump may imminently fire Fed Chair Powell caused a brief dip in equity prices and a surge in gold prices before the President Trump said he has no such plans. Amid various waves of speculation on this topic our view has not changed: given the timeline involved (Chair Powell’s term as Fed chair ends next May), there is very little to be gained by his early removal. Even as we argue on economic grounds that the Fed should cut interest rates, we see aggressive calls to such effect from outside the Fed as counterproductive. The more the FOMC is openly pressured to cut, the more the perception is being created that if they do eventually cut, it would be because of such pressure, not because the data actually warrants it. Even the perception of a loss of the Fed’s independence is a loss, so in order to avoid it, the FOMC may in fact choose to delay any cuts beyond what otherwise they might prefer. Better to let the data flow alone drive the decision. To us, the conclusion is pretty clear: it is time to calibrate the policy rate lower.

The CPI data was largely as expected. Overall consumer prices rose 0.3% m/m and core prices rose 0.2%. The headline inflation rate accelerated three tenths to 2.7% y/y and the core rate rose a tenth to 2.9% y/y. The evidence for tariff pass through remains, if not outright scant, at least very limited. Perhaps the best evidence was a notable rise in appliance costs. On the other hand, vehicle prices (both new and used) declined again; for the latter, this is a little surprising given the recent firming of auction prices, but the pass through may be delayed. We do expect used car prices to tick higher. On the other hand, as we’ve been stressing for some time, shelter price inflation continues to moderate. Rent of shelter costs increased 0.18% m/m, the least since February 2021 and rent of shelter inflation decelerated another tenth to 3.8% y/y, the lowest since October 2021.

Another piece of inflation good news came from the University of Michigan consumer sentiment survey. 1-year inflation expectations—which surged from 3.3% in January to 6.6% in May—retreated to 4.4%. Long term inflation expectations eased four tenths to 3.6%, both being the softest readings since February.

The next month will be crucial for trade policy; we anticipate multiple trade deals to be concluded over the next few weeks, resulting in much more clarity on tariff levels going forward. Unless tariff rates are set up well above 25%, the Fed should feel confident by September that a 25 bp rate cut is warranted.

BoE: Less urgency for faster rate cuts

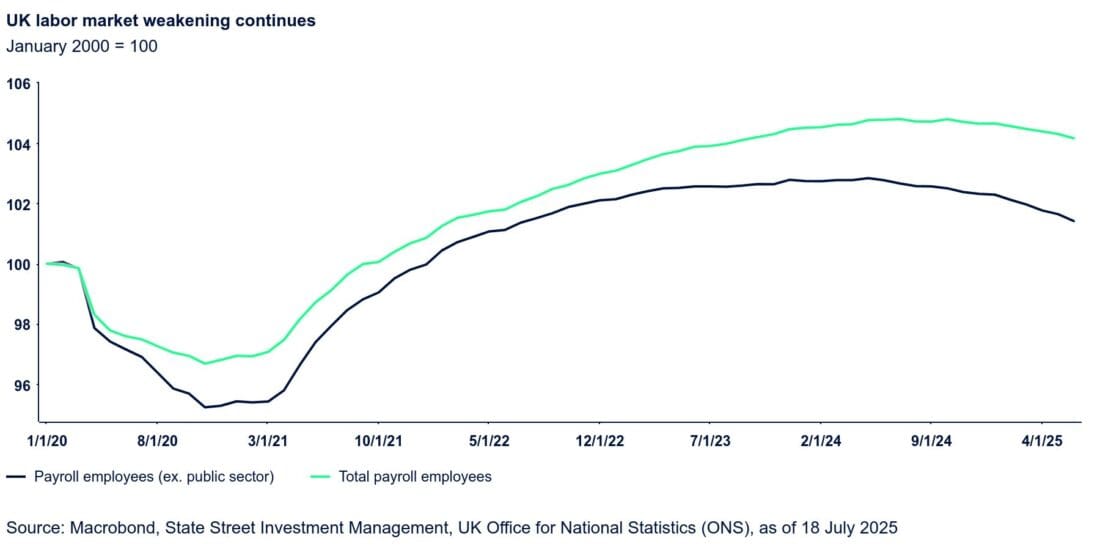

This week’s job data included significant revisions resulting in a mixed outlook. However, the broader trend indicates further easing within the labor market. In June, payrolled employees fell substantially by 41k, placing employment 178k below the level observed during the same period last year. Notably, the previously reported sharp decline of 109k jobs in May—initially interpreted as a substantial adjustment—has been revised to a more moderate contraction of 25k jobs. Consequently, while there is a clear weakness in the labor market according to this metric, there is no indication of an abrupt change during the second quarter.

Wage growth continues to moderate but remains elevated. Private sector regular pay grew by 4.9% y/y, down from 5.2%, with much of the increase concentrated in lower-paying sectors. This suggests that the recent rise in the national living wage is still constraining broader pay disinflation. Nonetheless, wage increases are now tracking below the Bank of England’s previous forecast and may remain under its Q2 projection unless a marked acceleration occurs next month.

Meanwhile, June’s headline inflation rose from 3.4% to 3.6% year-over-year, mainly attributed to stronger services. Service inflation held steady at 4.7%, reflecting lagged impact of April’s minimum wage adjustment and National Insurance changes, alongside ongoing nominal wage growth. Although forward-looking indicators including pay surveys and vacancy statistics suggest that these pressures may soon ease, the recent data indicates that the final phase of disinflation could exhibit increased volatility.

The Bank of England is unlikely to consider June’s inflation figures to be a major concern, as the bank had anticipated an uneven trend over the summer period. However, given the combination of this inflation data with mixed employment figures, it is unlikely that the Bank will accelerate its rate cuts. Our baseline projection continues to be two further rate cuts this year, expected in August and November.

Japan: Anxious week ahead

Three months ago, Japan’s primary risks were seen as external. Today, the picture has shifted: while domestic consumption still shows some resilience, the key vulnerabilities now lie within. Concerns over fiscal policy uncertainty—particularly the prospect of higher borrowing—have intensified ahead of the July 20 Upper House elections. There is growing apprehension that the ruling Liberal Democratic Party–Komeito coalition may lose its majority.

These elections are widely viewed as a referendum on inflation. Most opposition parties are campaigning on broader consumption tax cuts, contrasting with the coalition’s more limited one-time cash handouts. This narrative gained further traction following a Reuters survey this week, which revealed that businesses are calling for relief through sales tax reductions and deregulation, especially as the impact of higher tariffs becomes more tangible.

We downgraded Japan’s growth outlook three weeks ago to just 0.4% for the year, and now see a realistic risk of contraction in Q2. Trade is turning into a drag on growth, with real imports (5.0% m/m) outpacing exports (3.2%) in June.

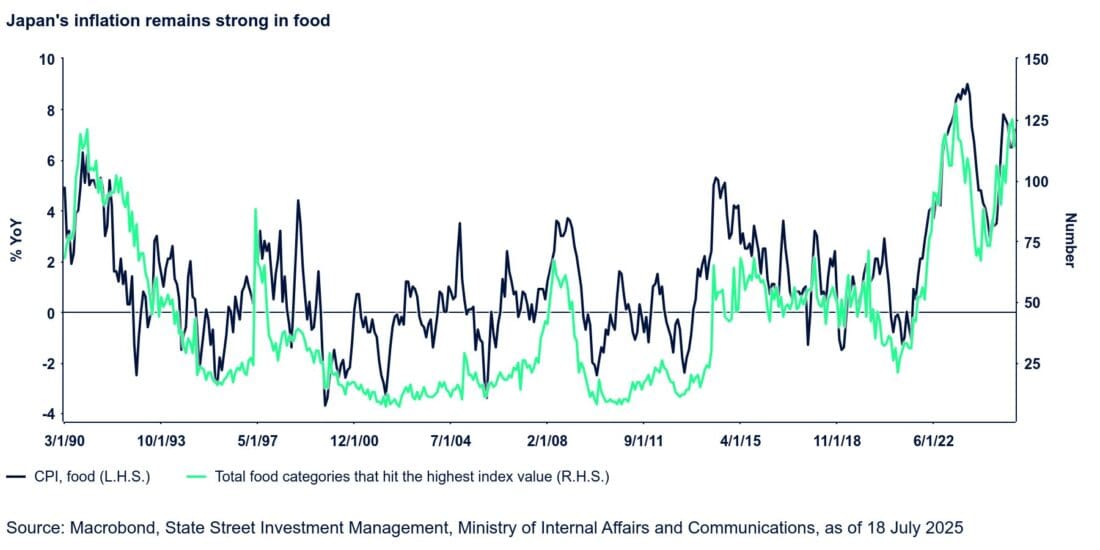

Inflation data offers a mixed picture. Headline CPI rose 0.1% m/m sa (3.2% y/y, down 0.3 pp from May), aided by gasoline subsidies. However, underlying inflation remains sticky: the BoJ’s core metric (excluding fresh food and energy) climbed another 0.4% m/m (3.4% y/y, up 0.1 pp). The passthrough to broader categories appears intact—114 of 278 food subcategories hit record highs, one of the largest spikes since 1990 (figure 4). A planned hike in mobile phone charges also pushed services inflation to a six-month high of 1.5% y/y.

These dynamics complicate the Bank of Japan’s path to policy normalization. While we still expect one rate hike this year, our conviction has weakened. That said, unless snap elections are called, a minority government could remain in power—though this would require careful political maneuvering to secure legislative support.

Can the Ishiba administration negotiate more effectively with their opposition than with its international counterparts? Possibly. But we approach the election outcome with considerable trepidation.

Spotlight on next week

- Japan heads to polls amid strong underlying inflation.

—

Originally Posted on July 21, 2025 – Fed on hold, but for how long?

Disclosures

Marketing Communication

State Street Global Advisors (SSGA) is now State Street Investment Management. Please go to statestreet.com/investment-management for more information.

State Street Global Advisors Worldwide Entities

The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your tax and financial advisor.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research.

This communication is directed at professional clients (this includes eligible counterparties as defined by the “appropriate EU regulator”) who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

The views expressed in this material are the views of SSGA Economics Team through the period ended 18 July 2025 and are subject to change based on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

© 2025 State Street Corporation. All Rights Reserved.

2537623.294.1.GBL.RTL

Exp. Date: 07/31/2026

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!