I was recently asked to offer some comments about the general market environment and customer activity. Here are some of them.

- First and foremost, confidence among active investors is quite high. They never lost their faith in stocks during the April sell-off, and that faith seems even stronger now.

- The “half-life” of dips seems to have shrunk dramatically. Sell-offs, when they occur, seem to be ever-shorter and shallower. Traders are so loath to miss a dip-buying opportunity that they are now reluctant to sell aggressively. Just yesterday, when the reports about Fed Chair Powell’s potential firing emerged, we saw bonds and the dollar react quickly and sharply, but stocks had a relatively muted reaction. Bonds and the dollar didn’t fully recoup their initial drops after President Trump’s follow-up comments which said that a firing was unlikely, yet the denial was sufficient to send stocks higher.

- An upward market in motion has been tending to stay in motion. That’s momentum at work. Once equity traders have decided that any dip is behind them, they promptly switch into rally mode. It doesn’t take much to get the broad market heading north, since that has been the clearly predominant direction of travel since April.

- Our most actives list frequently features smaller, speculative names. While TSLA and NVDA are typically at the top of the list, recent lists showed a preponderance of more volatile names with recent volume spikes.

- It appears as though many customers are using our screeners to seek out stocks with spikes in volatility, volume and the like. Having identified fast moving situations, they either chase them higher or try to catch a buyable dip. In other words, volatility and volume are further begetting volatility and volume.

- Leveraged ETFs remain popular trading vehicles. Notably, TQQQ (3X QQQ) is usually more active on our platform than QQQ and TSLL (2X TSLA) is typically among the top 10 most actives.

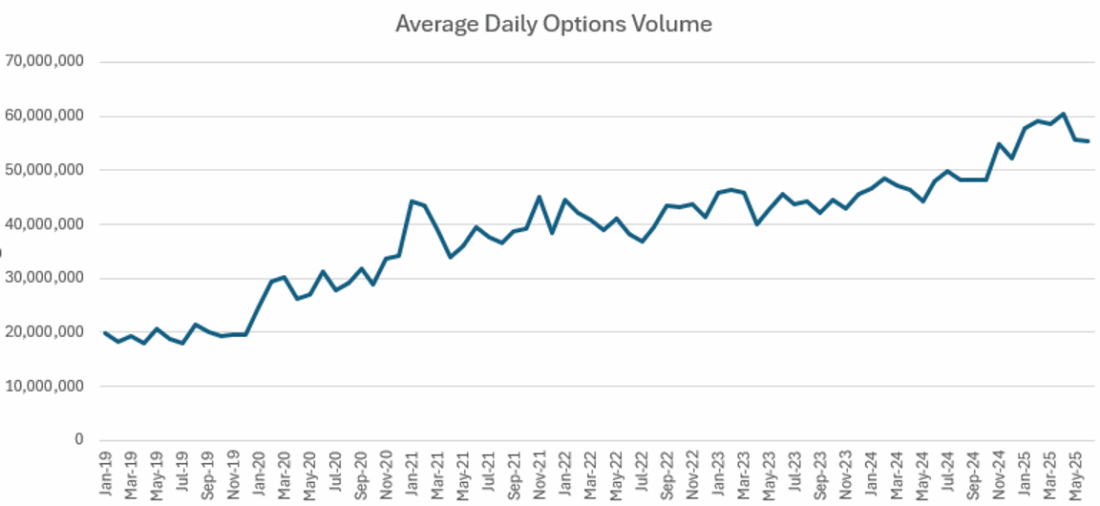

- Options volumes remain robust. While industry volumes have dipped somewhat from April’s records, they’re still well above last year’s levels, thanks to the ongoing popularity of ultra-short-term (0DTE) options. That said, even if we see customers trading more speculative stocks, our most active customers are using options in a more sophisticated manner than just pure speculation. If that were the case, we would see a huge bias toward call buying – and that is not the case. It implies that customers are using multi-leg strategies and appear to be quite disciplined about taking profits or cutting losses rather than simply gambling on outcomes.

Regarding that last point, we would like to offer a visual reminder about the incredible increase in the popularity of options trading over the past few years. The average daily volume in April was triple that of the typical pre-Covid level. That bump never fails to amaze those of us who have spent decades in the options business.

Source: Options Clearing Corporation

—

Originally Posted on July 17, 2025

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Complex or Leveraged Exchange-Traded Products

Complex or Leveraged Exchange-Traded Products are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy, and risks associated with the products. Learn more about the risks here: https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=4155

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

TS:LA is being forcibly bought pre-earnings, with dark pool signals calling the plays. Sickening and sad to watch the corrupt price manipulation, but who you gonna call?

How have the various “boomer candy” ETFs (buffer etf, etc) affected volumes shown above?