Click to View this Option in the NVDA Option Chain Profit Calculator

Unusual Options Volume: 133,700 Contracts Traded on the $145 Call

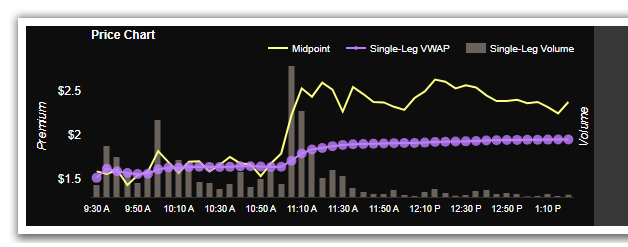

At 1:36 PM today, NVIDIA’s (NVDA) June 20, 2025, $145 call option took center stage, clocking an extraordinary 133,700 contracts in volume. That’s 9.7% of the entire day’s options activity for NVDA, a standout figure that rarely goes unnoticed. The high activity arrives as NVDA stock rallies 2.65%, gaining $3.76 to reach $145.73—just cents away from the strike of this heavily traded contract.

Bullish Sentiment Leads the Charge: 61% of Trades From Pros

Drilling into the data, professional or institutional-sized trades accounted for 61% of today’s $145 call volume, while retail activity made up the remaining 39%. More interestingly, order flow was almost evenly split, with 51.6% of contracts bought and 48.4% sold, hinting at some cautious optimism rather than outright speculation. It’s unclear if the positions were primarily opening or closing, but the surge in open interest—up 20,760 contracts from the previous day—suggests traders are making fresh bets.

| Metric | Value |

|---|---|

| Option Contract | Jun-20-25 $145 Call |

| Today’s Volume | 133,700 |

| Percent of Total NVDA Option Volume | 9.7% |

| Last Trade Price | $2.37 |

| Open Interest Change | +20,760 |

| Percent Professional Trades | 61% |

Technical Indicators Are Bullish: Price Gains, Open Interest, and Positive Order Flow

Today’s surge in both stock price and options volume aligns with a classic bullish narrative: NVDA’s share price has advanced 2.65%, the $145 call saw new interest, and a majority of large traders have sided with calls. All this suggests traders are either hedging for a continued run higher or positioning for a breakout over the coming months. The fact that most activity is concentrated right at the current price level could be signaling high confidence in continued momentum or an active hedging campaign from funds managing large stock holdings.

Volatility Indicators Signal Calm: Implied Volatility Drops Nearly 20%

The most surprising shift? The option’s implied volatility (IV) dropped sharply from 33.9 yesterday to just 27.2 today—a 19.7% decline. For options traders, falling IV can signal reduced expectations of near-term swings or, alternatively, a rush of call selling that’s pressuring option prices lower. The wide intraday IV range (25.3–30.7) reflects both morning excitement and a quick normalization as the market digested new orders.

| IV Metric | Value |

|---|---|

| VW Implied Volatility (IV) | 27.2 |

| Previous Day’s Close IV | 33.9 |

| High IV | 30.7 |

| Low IV | 25.3 |

| Change in IV (%) | -19.7% |

Takeaway: High Activity, Bullish Bias, and Volatility Reset—What’s Next?

In short, the outsized activity in the June 2025 $145 call option, rising open interest, and predominantly pro-driven flow paint a picture of mounting optimism. But the sharp drop in implied volatility throws a twist: bullish bets are being placed, but at a time when the market isn’t expecting huge fireworks—at least not right away. For investors and traders watching NVDA, this could be an ideal window to gauge the true appetite for upside ahead of major catalysts. The key question: Is this surge a prelude to sustained upside, or simply smart hedging in a cooling volatility environment?

—

Originally Posted on June 16, 2025 – NVDA’s Jun-20-25 $145 Call Dominates With 133,700 Contracts Traded—Bullish Sentiment Amid Falling Implied Volatility

Contact Information:

If you have feedback or concerns about the content, please feel free to reach out to us via email at support@marketchameleon.com.

About the Publisher – Marketchameleon.com:

Marketchameleon is a comprehensive financial research and analysis website specializing in stock and options markets. We leverage extensive data, models, and analytics to provide valuable insights into these markets. Our primary goal is to assist traders in identifying potential market developments and assessing potential risks and rewards.

NOTE: Stock and option trading involves risk that may not be suitable for all investors. Examples contained within this report are simulated and may have limitations. Average returns and occurrences are calculated from snapshots of market mid-point prices and were not actually executed, so they do not reflect actual trades, fees, or execution costs. This report is for informational purposes only, and is not intended to be a recommendation to buy or sell any security. Neither Market Chameleon nor any other party makes warranties regarding results from its usage. Past performance does not guarantee future results. Please consult a financial advisor before executing any trades. You can read more about option risks and characteristics at theocc.com.

The information is provided for informational purposes only and should not be construed as investment advice. All stock price information is provided and transmitted as received from independent third-party data sources. The Information should only be used as a starting point for doing additional independent research in order to allow you to form your own opinion regarding investments and trading strategies. The Company does not guarantee the accuracy, completeness or timeliness of the Information.

Disclosure: Market Chameleon

The information provided on MarketChameleon is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading and investing in financial markets involve risks, and individuals should carefully consider their own financial situation and consult with a professional advisor before making any investment decisions. MarketChameleon does not guarantee the accuracy, completeness, or reliability of the information provided, and users acknowledge that any reliance on such information is at their own risk. MarketChameleon is not responsible for any losses or damages resulting from the use of the platform or the information provided therein. The 7-day free trial is offered for evaluation purposes only, and users are under no obligation to continue using the service after the trial period.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Market Chameleon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Market Chameleon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by going to the following link ibkr.com/occ. Multiple leg strategies, including spreads, will incur multiple transaction costs.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!