The article “The Hidden Effort Problem: Work More and Get Better Results?” was originally published on Alpha Architect blog.

This study tackles the challenge of quantifying executive effort—a traditionally elusive metric. By analyzing minute-by-minute Bloomberg terminal usage data from CEOs and CFOs across numerous public firms, they develop a novel proxy for executive work habits. Their findings reveal that increased executive effort correlates with positive earnings surprises, higher cumulative abnormal returns post-earnings announcements, and narrower credit default swap spreads. Moreover, portfolios constructed based on changes in executive effort demonstrate significant risk-adjusted returns, underscoring the tangible value of diligent leadership.

Uncovering the Hidden Effort Problem

- Azi Ben-Rephael, Bruce I. Carlin, Zhi Da, Ryan D. Israelsen

- The Journal of Finance, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

Innovative Effort Measurement: Utilizing machine learning on Bloomberg terminal activity, the study introduces a groundbreaking method to infer executive work patterns without direct observation.

Positive Correlation with Firm Performance: Elevated executive effort is linked to unexpected earnings gains and sustained stock outperformance, indicating that diligent leadership materially benefits shareholders. This supports the broader idea behind the quality factor, which focuses on traits like consistent profitability and operational efficiency—often shaped by effective management.

Market Underreaction to Effort Signals: The persistence of abnormal returns suggests that markets may not fully price in the implications of executive effort, presenting potential opportunities for informed investors.

Practical Applications for Investment Advisors

Enhanced Due Diligence: Incorporating executive effort metrics can refine assessments of management quality, aiding in the identification of firms with proactive leadership.

Portfolio Construction: Strategies that factor in changes in executive effort may capture alpha, as evidenced by the study’s long-short portfolio performance. Combining these insights with profitability and quality metrics—as described in Alpha Architect’s discussion of value and quality factors can further refine selection models.

Risk Assessment: Understanding the link between executive diligence and credit risk can inform evaluations of a firm’s financial stability, particularly in volatile markets.

How to Explain This to Clients

“Recent research has found that how hard a company’s top executives work—measured by their activity on professional platforms like Bloomberg—can significantly impact the company’s financial performance. When leaders are more engaged, companies often see better earnings and stock performance. By considering the work habits of company leadership, we aim to invest in firms where proactive management drives value, potentially enhancing your investment returns.”

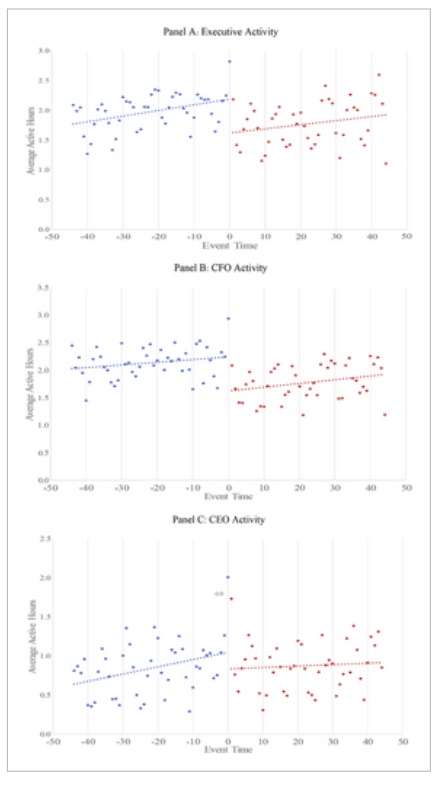

The Most Important Chart from the Paper

The figure shows executive platform activity through the quarter relative to the firm’s earnings announcement. Effort is defined as hours online on the platform. Panel A presents results for all executives in the sample, while Panel B presents results for CFOs only, and Panel C presents results for CEOs only. The data come from Bloomberg.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We analyze minute-by-minute Bloomberg online status and study how the effort provision of executives in public corporations affects firm value. While executives spend most of their time doing other activities, patterns of Bloomberg usage allow us to characterize their work habits as measures of effort provision. We document a positive effect of effort on unexpected earnings and cumulative abnormal returns following earnings announcements, and a reduction in credit default swap spreads. This is robust to using exogenous weather patterns as an instrument. Long-short, calendar-time effort portfolios earn significant average daily returns. Finally, we revisit important agency issues from the literature.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!