1/ Ethereum Bulls Bet on a Flag Breakout

2/ Precious Metals’ Bull Market Reaches Palladium

3/ U.S. Healthcare Providers Look Sickly

4/ Retail Bets Nike’s Problems Are Not Over

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

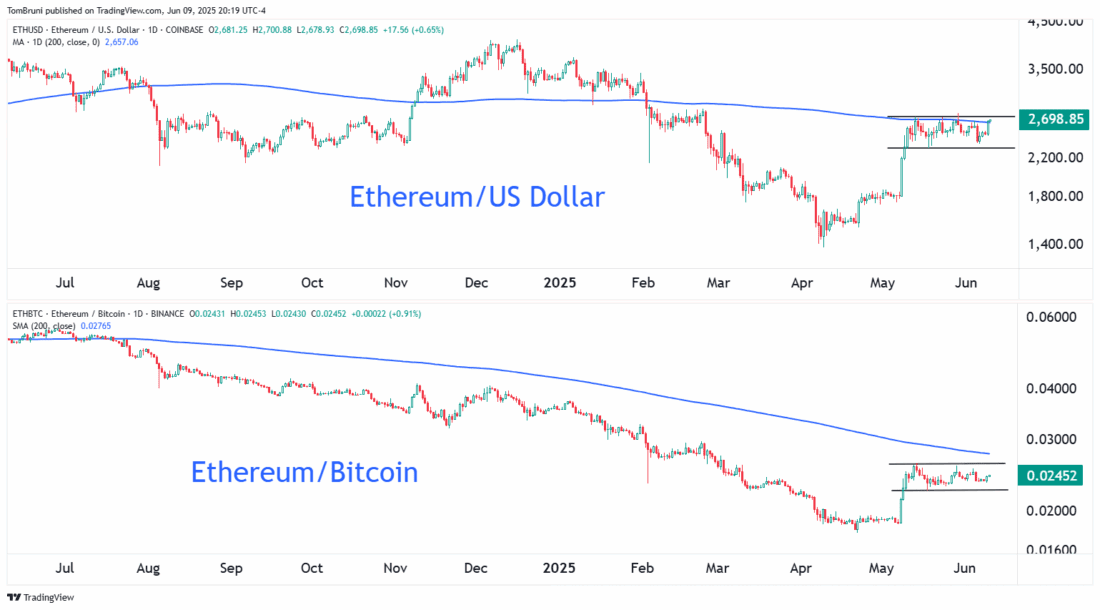

Ethereum Bulls Bet on a Flag Breakout

With crypto on the move and Bitcoin ($BTC) approaching new all-time highs, retail investors on Cryptotwits are looking for Ethereum ($ETH) to lead an altcoin comeback. The cryptocurrency was the #1 trending topic on the platform today, and sentiment shifted back into “bullish” territory.

From a technical perspective, both the Ethereum/US Dollar and Ethereum/Bitcoin charts are sporting bull flags. The 200-day moving averages, which are sloping slightly downward in both, indicate long-term underperformance, but bulls are hoping for a comeback.

Those who are bullish on crypto expect investors to spread the love as Bitcoin breaks out, and the risk in Ethereum is very well defined. As a result, they’re looking for a breakout, which would target the December highs near 4,000.

2/

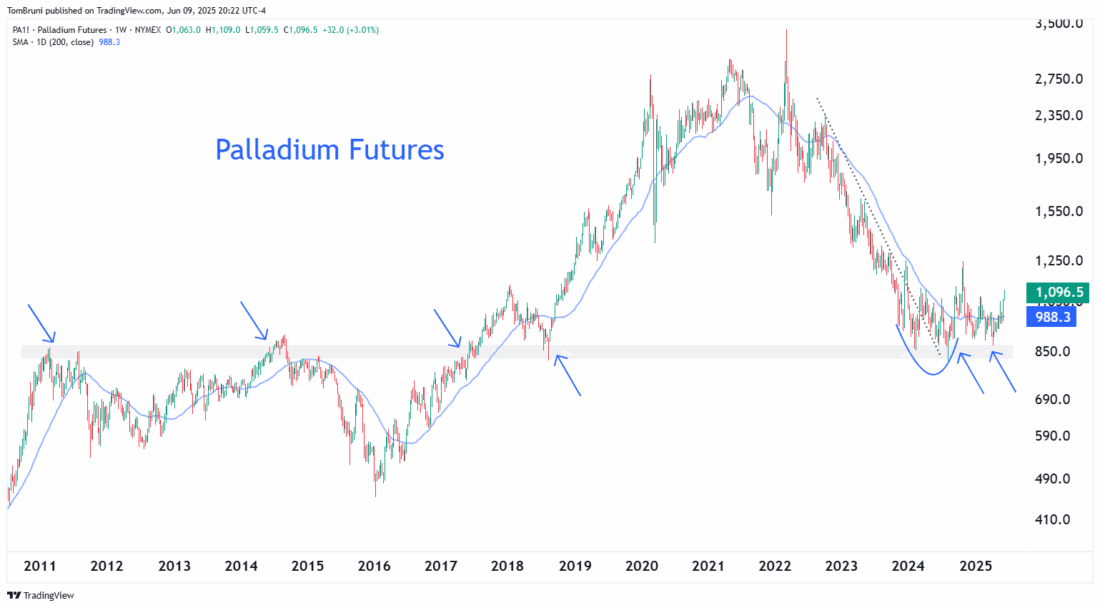

Precious Metals’ Bull Market Reaches Palladium

The precious metals bull market is continuing as Silver breaks out to 13-year highs and Gold hovers near all-time highs. Platinum and Palladium are joining the party as investors seek additional ways to capitalize on the theme.

Palladium is an interesting one, as it has stabilized for the last two years above long-term support and is now emerging from that base. Stocktwits sentiment in the Palladium ETF ($PALL) reached its highest level of the year, and message volumes have spiked, indicating increased interest.

From a technical perspective, there are a lot of ways to define your risk here, depending on whether you’re an investor or trader. But if the precious metals’ bull market is truly expanding, any dips back toward the 2025 lows will likely be met with demand as this long-term trend shifts to the upside.

3/

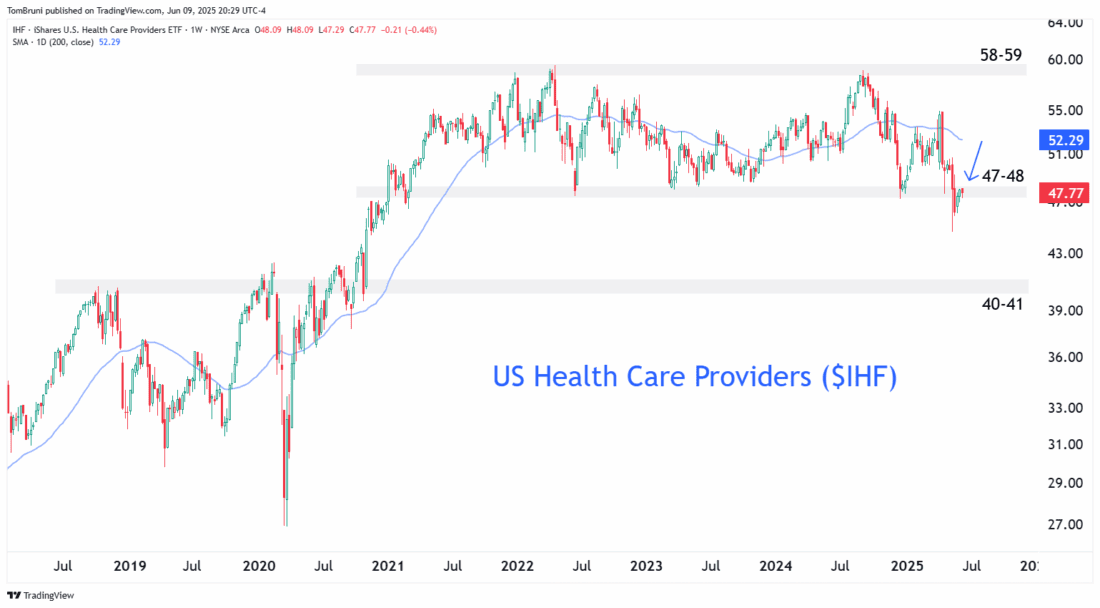

U.S. Healthcare Providers Look Sickly

The healthcare sector has been a serious underperformer relative to the broader market, with one area standing out as vulnerable in the current environment. That area is healthcare providers.

The U.S. Healthcare Providers ETF ($IHF) recently broke down from a 4-year range and is now retesting broken support near 47-48. For stock market bears who have few places to hide in this bull market, this may be a clearly defined opportunity to play the short side with a target near 40-41.

With the biggest weightings being D.R. Horton, Lennar Corp., NVR, Inc., PulteGroup, Sherwin Williams, Home Dpeot, and more…stock market bulls do not want to see this weakness accelerate to the downside. But the longer we stay below the 200-day and broken support near 95-98, the higher the chances that occurs in my view.

4/

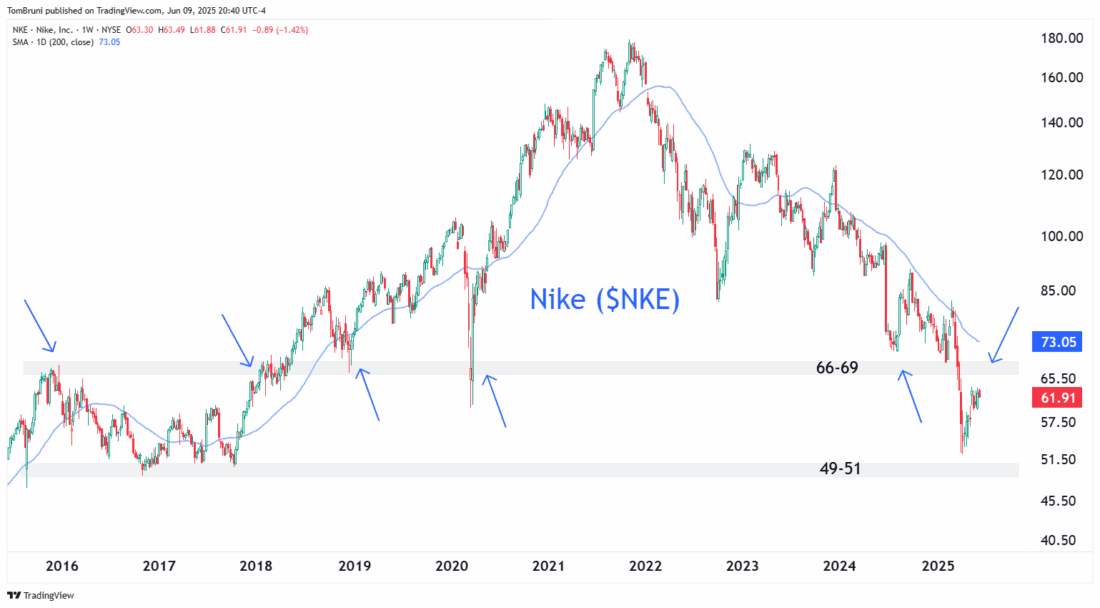

Retail Bets Nike’s Problems Are Not Over

Another chart that’s sporting a similar breakdown retest is Nike ($NKE). Stocktwits sentiment is currently in ‘bearish’ territory, suggesting retail investors are betting that the bad times for the sports apparel maker aren’t over yet.

From a technical perspective, prices are stuck below broken support near 66-69 and a downward-sloping 200-day moving average, both of which bears will be using as a reference point to trade against. On the downside, 49-51, where the stock settled in 2016-2017, is a logical target. Nevertheless, in a world full of long setups, bears may view this as another viable short.

—

Originally posted 10th June 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Cryptocurrency based Exchange Traded Products (ETPs)

Cryptocurrency based Exchange Traded Products (ETPs) are high risk and speculative. Cryptocurrency ETPs are not suitable for all investors. You may lose your entire investment. For more information please view the RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!