The headlines haven’t been too kind to the travel industry lately. You’ve probably seen the same bearish takes I have—reports of slumping business travel to the U.S., falling international visitor spending and weak demand.

Context is everything, though, and if you dig a little deeper, you’ll see a more nuanced, surprisingly bullish picture. In fact, there’s a lot to like about the travel industry right now from an investment standpoint. You just have to know where to look.

Americans Are Still Hitting the Road (and the Skies)

Let’s start with one of the most time-tested indicators of travel health: Memorial Day. According to AAA, an estimated 45.1 million Americans were expected to travel at least 50 miles from home this holiday weekend. That’s the highest number ever recorded, breaking a record that’s stood since 2005.

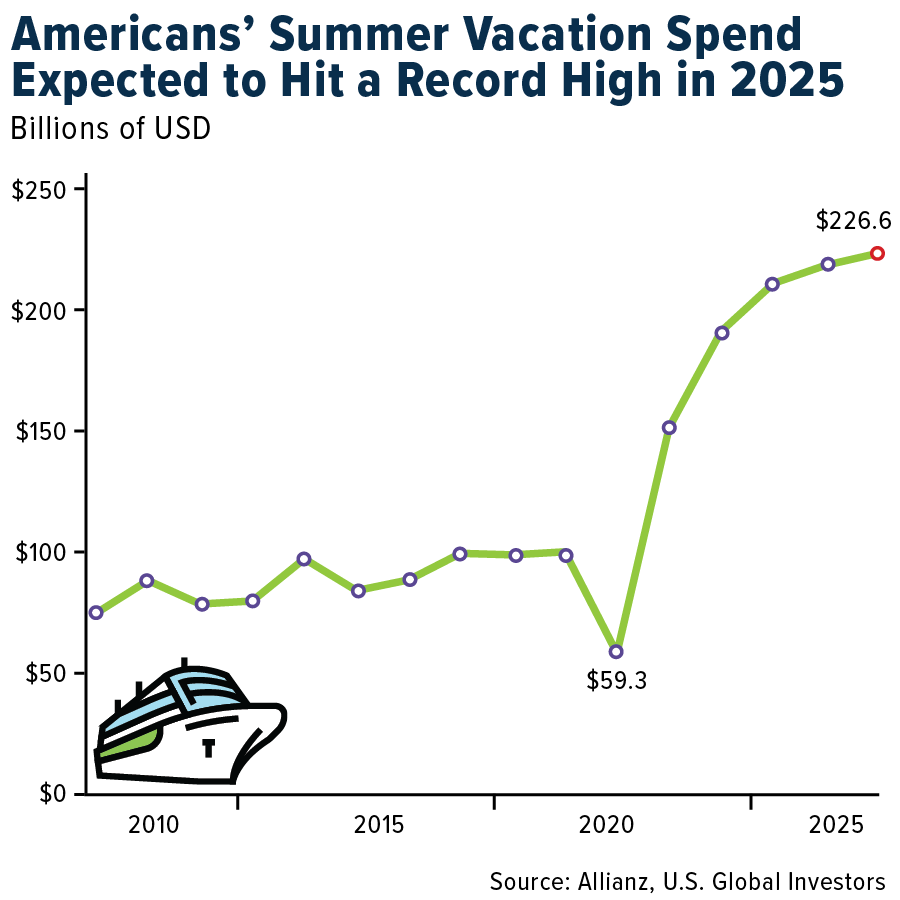

Despite inflationary pressures and economic uncertainty, American consumers continue to prioritize leisure travel. That’s according to Allianz, whose latest survey found that 63% of U.S. households express confidence in taking a summer vacation, and projected spending is set to hit a record $226.6 billion, with the average household shelling out nearly $2,900 for their getaway.

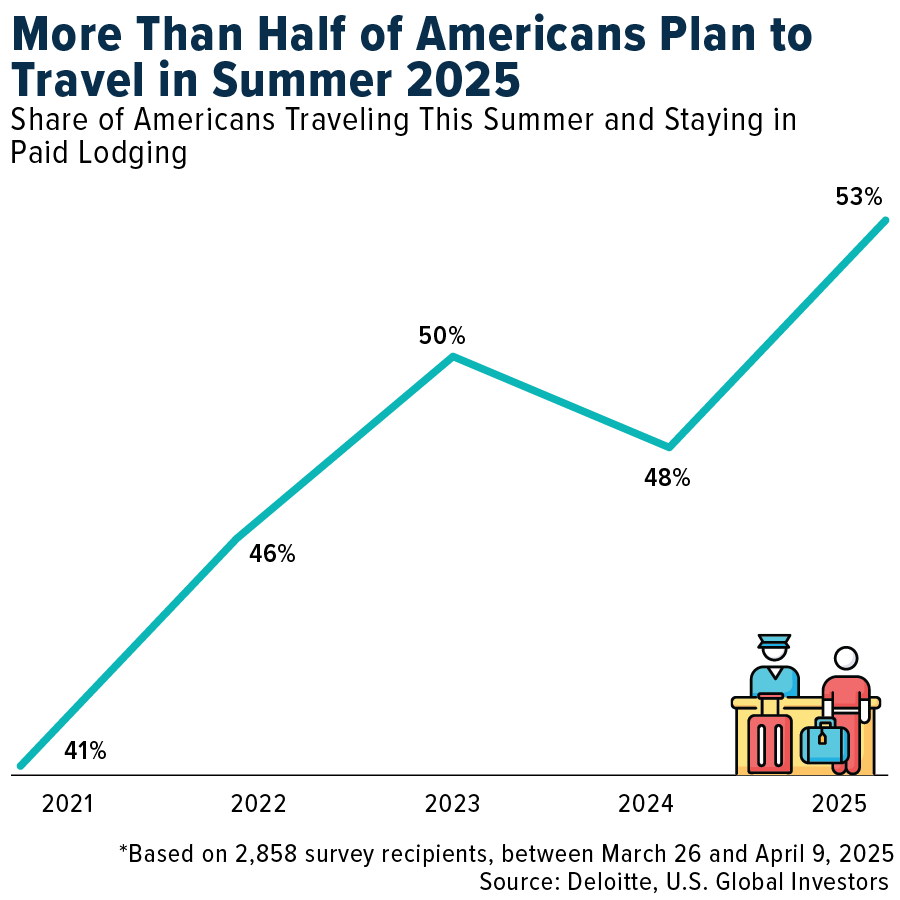

Deloitte also found that more than half of all Americans are planning leisure vacations this summer, with trip frequency on the rise. People may not feel wealthier, but they’re still putting a premium on experiences and making time for family and travel.

Gas Prices Are Down, Confidence Is Up

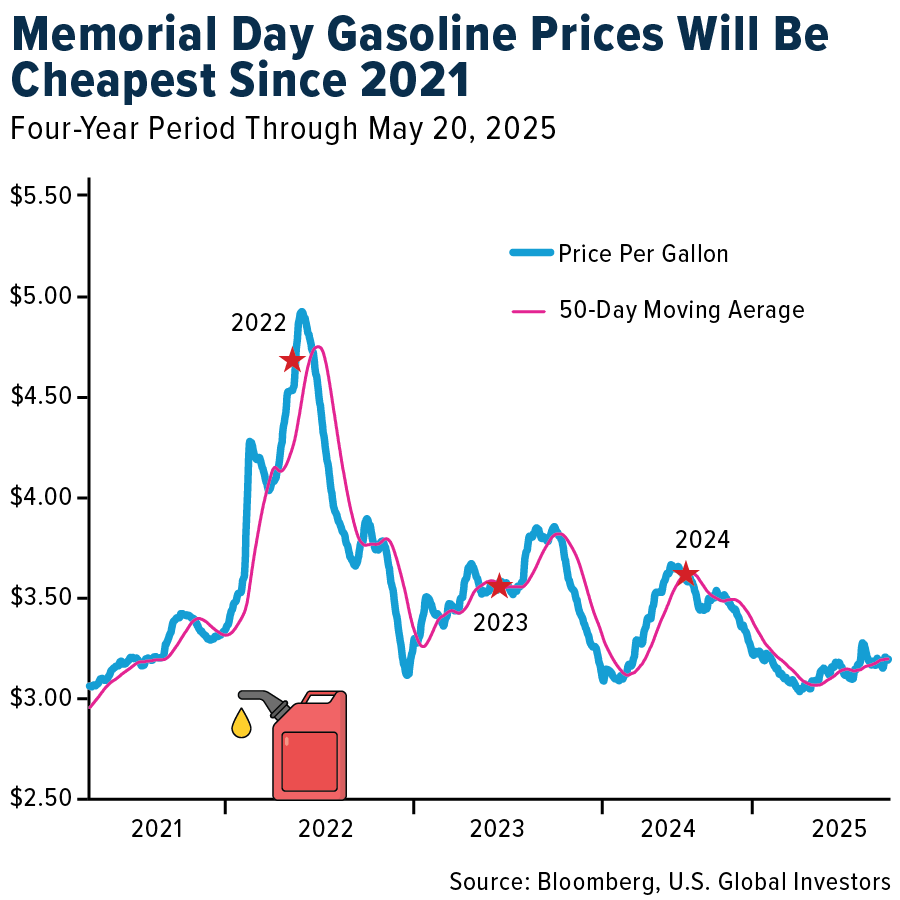

There’s another tailwind worth highlighting: fuel prices. GasBuddy projects a national average of $3.08 per gallon for Memorial Day, the lowest since 2021 and the lowest adjusted for inflation since 2003. Over the course of the summer, prices could even drop below the $3 mark. That’s good news for road trips and domestic leisure, which continues to represent a large portion of overall travel volume.

Meanwhile, air travel is climbing back as well. AAA expects nearly 3.61 million air passengers this Memorial Day, a 2% bump from last year and 12% above pre-pandemic levels. Average domestic airfare is also up 2% year-over-year, suggesting steady demand.

Yes, Inbound International Travel Is Weak, but That’s Not the Whole Story

Let’s address the elephant in the room: international inbound travel to the U.S. is underperforming. The World Travel & Tourism Council (WTTC) projects that the U.S. will lose $12.5 billion in international visitor spending in 2025, with total spending falling to just under $169 billion.

Why? Some of it comes down to policy and perception. Reports of detentions and rigorous border checks have created concern among some foreign nationals.

But from an investor’s perspective, this isn’t necessarily as damaging as it sounds. U.S. airlines and travel platforms still generate the majority of international revenue through domestic point-of-sale channels—in other words, Americans booking trips abroad. So while inbound traffic is down, outbound travel remains robust.

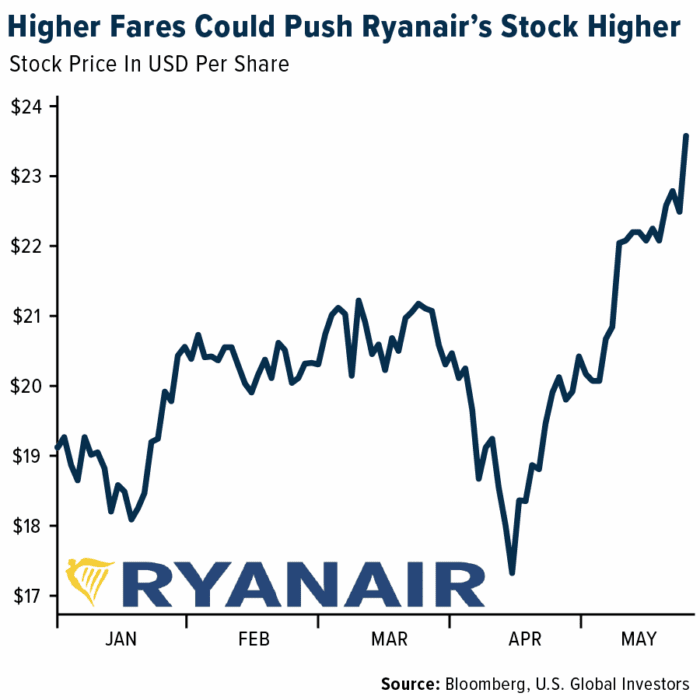

European Travel Is on Fire

If you want to see what strong travel demand looks like, look across the Atlantic. Ryanair, the largest airline in Europe by passenger volume, says it’s seeing record demand across its network of 37 countries, with fares up in the mid-teens year-over-year.

CEO Michael O’Leary said, “The whole of Europe seems to be traveling,” and recent earnings support that view. Ryanair’s fare outlook is “far stronger than we had expected,” according to analysts at Bernstein, potentially putting the company on track to replicate the profitability of spring 2023.

Demand for travel hasn’t disappeared. It’s just shifting geographically. Savvy investors can benefit from understanding where the action is moving.

Online Booking Platforms Offer Selective Strength

That brings us to the digital side of the travel business. Booking Holdings—the parent company of Booking.com, Priceline and OpenTable—was recently named IBD’s Stock of the Day after posting 22% earnings per share (EPS) growth and 8% sales growth in Q1. What’s key here is that Booking derives a majority of its revenue from Europe, giving it a natural advantage over U.S.-focused platforms like Expedia and Airbnb, which both flagged weakness in domestic travel.

This divergence is worth watching. As American travel preferences shift toward regional and road-based trips, and international travel increasingly favors Europe over transatlantic routes, platforms with broad, diversified exposure may come out ahead.

Cruise Lines Are Quietly Sailing Strong

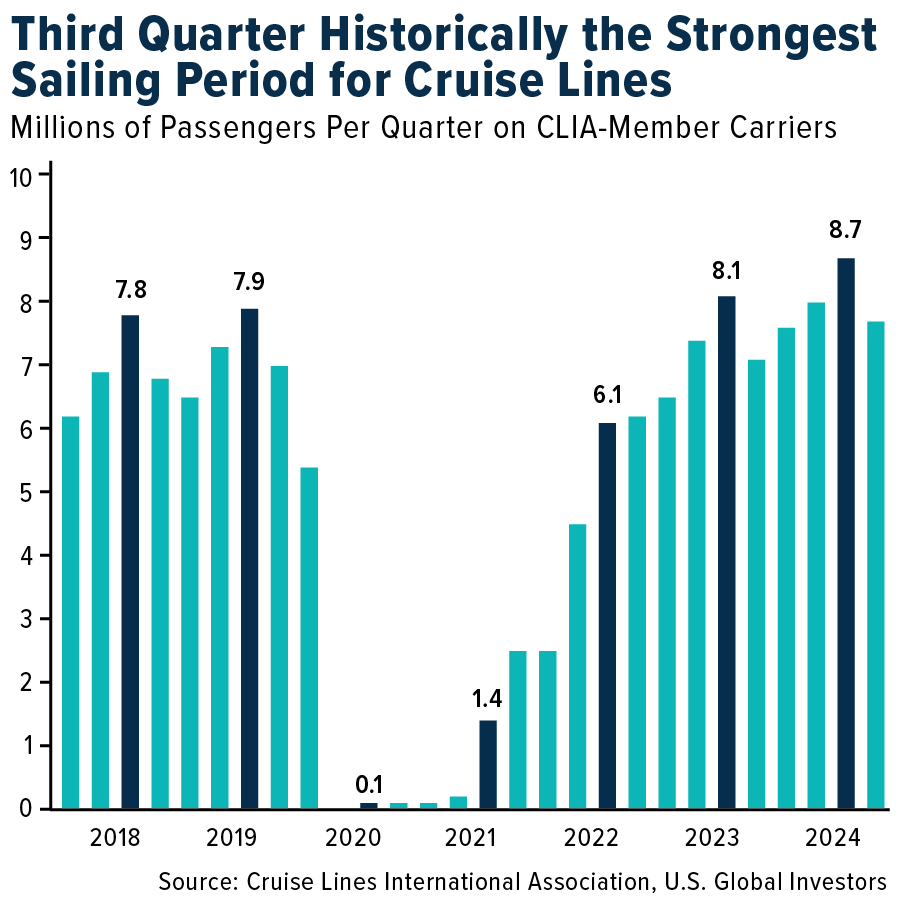

Another area that’s sometimes overlooked, but increasingly important, is cruising. After a few tough years navigating pandemic-era restrictions and capacity limits, cruise lines are finally seeing smooth waters ahead.

Passenger volume has surged, especially in the post-pandemic recovery years. In 2023, cruise lines carried 31.7 million passengers, and that number jumped to 34.6 million in 2024, according to Cruise Lines International Association (CLIA). Forecasts suggest another 9% increase in 2025, reaching 37.7 million passengers, with continued growth projected to hit 42 million by 2028.

The third quarter, typically the high season for cruising, continues to be the industry’s strongest sailing period. In Q3 2024, 8.7 million passengers sailed on CLIA-member cruises, surpassing all previous seasonal peaks. These gains reflect not only pent-up demand but also fleet expansions and strategic deployments of larger, high-capacity ships, especially in popular destinations.

What Investors Should Watch

There’s no denying that parts of the travel industry are under pressure. Business travel to the U.S. declined 9% in April compared to last year.

But that’s only part of the story. As I see it, the broader trend is one of resilience. Consumers are still traveling, and planes are still packed. They’re just adjusting how and where they do it. And companies that are well-positioned in those areas—low-cost carriers in Europe, digital platforms with global exposure, airlines benefiting from lower fuel costs—stand to benefit.

—

Originally Posted May 27, 2025 – Travel Industry Fundamentals Remain Strong, Bucking Negative Headlines

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2025): Ryanair Holdings PLC, Booking Holdings Inc., Expedia Group Inc.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!