The article “The Aggregated Equity Risk Premium” was originally posted on Alpha Architect blog.

This article explores how researchers forecast market returns by aggregating expected returns from individual stocks. Using machine learning, they improve accuracy over traditional methods. The approach helps identify when to increase or reduce market exposure. This can lead to better-informed investment decisions and improved performance. To explore how aggregate signals can aid in market timing, this blog about market timing offers valuable perspectives.

The Aggregated Equity Risk Premium

- Vitor Azevedo, Christoph Riedersberger, Mihail Velikov

- working paper, 2025

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

Key Academic Insights

You Can Forecast Market Returns from the Bottom Up:

By using machine learning models to predict returns at the stock level and then aggregating those predictions, researchers can estimate the equity risk premium for the entire market. For a deeper dive into how machine learning models can enhance ERP forecasts, consider this blog.

Firm-Level Data Improves Accuracy:

Compared to traditional methods that use macroeconomic or valuation ratios, this bottom-up approach produces forecasts that are more accurate out-of-sample.

Market Timing Can Be More Effective:

A simple investment strategy that increases market exposure when the aggregated equity risk premium is high significantly outperforms a buy-and-hold strategy—even after considering transaction costs.

Practical Applications for Investment Advisors

Use More Granular Data:

Instead of relying solely on broad market indicators, consider integrating firm-level insights into your portfolio decisions. Aggregated predictions can offer early signals on market shifts.

Explore Machine Learning Tools:

Advisors don’t need to become data scientists, but understanding how machine learning models can improve forecasting helps in evaluating more advanced investment strategies.

Implement Adaptive Allocation Strategies:

The research supports adjusting portfolio risk based on forward-looking indicators—this could mean tilting equity exposure in response to predicted market premiums.

How to Explain This to Clients

“Instead of just looking at the big picture to predict how the market will do, we can now learn a lot by looking at thousands of individual companies. When we combine those insights, we can get a better idea of what the market might do next. This helps us make smarter choices about when to take on more or less risk with your investments.”

The Most Important Chart

Abstract

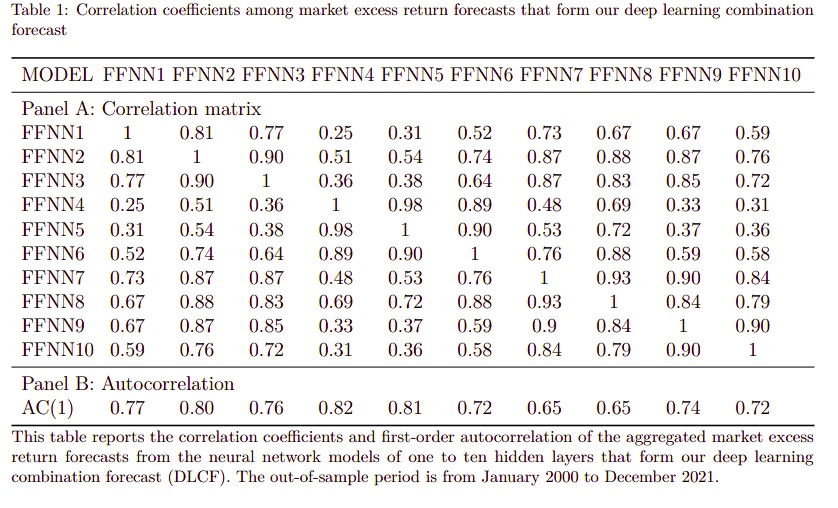

We propose a new approach for predicting the equity risk premium (ERP) that first estimates expected returns on individual stock before aggregating them to the market level. Our deep learning combination forecast aggregates firm-level return predictions from neural networks of varying complexity, trained on a comprehensive two-dimensional feature set of post-publication firm-level characteristics and aggregate macroeconomic variables. Using this aggregation method, we achieve an out-of-sample R² of 2.74% in a sample from 2000 to 2021. The forecasts demonstrate strong economic significance in trading strategies even with transaction costs. While the market generated a return of 376% over this period, a simple market-timing strategy based on our model’s forecast signs yields a net cumulative return of approximately 768%. Our results show that aggregating firm-level predictions can lead to profitable market timing signals, challenging the conventional wisdom that the ERP is unpredictable out-of-sample and suggesting that valuable market-wide information can be extracted from the cross-section of individual stocks.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!