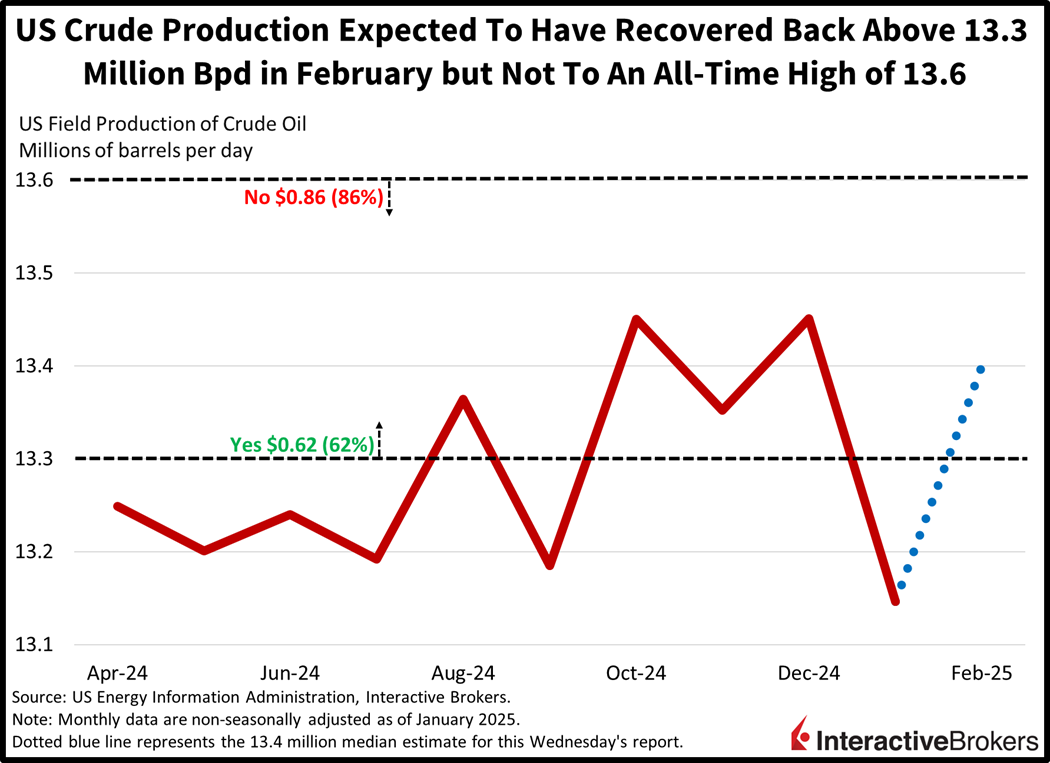

Preliminary estimates from two separate Energy Information Administration (EIA) reports suggest that February US oil production was either 13,350 thousand barrels per day (Bpd) or 13,500 thousand Bpd, marking a recovery from January’s challenging weather conditions. Indeed, the weekly estimates published by the EIA can be used to help forecast the results of the monthly aggregates which are released with a substantial lag. For example, the final figure for February will be released this Wednesday in the EIA’s Petroleum Supply Monthly print, while weekly estimates for March and April are already available.

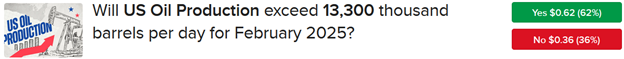

A combination trade I like going into the print includes the “Yes” answer to the IBKR forecast contract question asking if the final result will exceed 13,300 thousand Bpd, which is priced at $0.62. The median estimate is at 13,400 thousand and the EIA is expecting 2025 to average 13,500 thousand throughout the year. Furthermore, January was the first month in four in which production dropped below 13,300 thousand and it was due to severe cold weather, which negatively affected extraction activities across the country. Volumes are expected to have recovered in February since the month didn’t feature substantial disruptions. Meanwhile, last December marked the all-time high at 13,451 thousand Bpd and in consideration of the tall hurdle, I like the “No” answer at 13,600 thousand Bpd, which costs $0.86. The combination trade consisting of the “Yes” at 13,300 thousand and the “No” at 13,600 thousand costs a total of $1.48 and pays out $2.00 on a figure in between both thresholds.

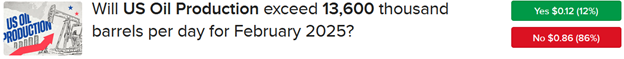

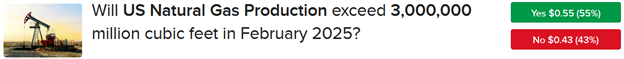

Another trade I like is related to natural gas production and is released in the same Wednesday report is the “Yes” answer concerning whether US dry natural gas production exceeded 3 billion cubic feet in February. Now in this data series the number is reported as a monthly aggregate which is critical considering that there were 28 days in February relative to the 31 days in January. But I’m still expecting February’s figure to arrive ahead of 3 billion cubic feet because January’s 3.23 billion was achieved alongside significant weather disruptions that weren’t present in February. The “Yes” for a figure above 3 billion costs just $0.55. Finally, volumes have come in above 3 billion for 23 consecutive months.

Source for Images: ForecastEx

Note: Prices are highest bids as of the morning of April 28, 2025.

To learn more about ForecastEx, view our Traders’ Academy video here

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ForecastEx Market Sentiment

Displayed outcome information is based on current market sentiment from ForecastEx LLC, an affiliate of IB LLC. Current market sentiment for contracts may be viewed at ForecastEx at https://forecasttrader.interactivebrokers.com/en/home.php. Note: Real-time market sentiment updates are only active during exchange open trading hours. Updates to current market sentiment for overnight activity will be reflected at the open on the next trading day. This information is not intended by IBKR as an opinion or likelihood of a potential outcome.

Disclosure: CFTC Regulation 1.71

This is commentary on economic, political and/or market conditions within the meaning of CFTC Regulation 1.71, and is not meant provide sufficient information upon which to base a decision to enter into a derivatives transaction.

Try 13.5 million barrels per day!