Things are getting ugly, especially in rates and FX. Significant decoupling is occurring, indicating a potentially massive flight out of the U.S. and severe liquidity constraints now hitting the market. Rates rose sharply today as Fed speakers Mary Daly and Austan Goolsbee discussed the inflationary impact of tariffs. Perhaps the budget deficit of $1.3 trillion didn’t help things either.

I’m not sure whether the Fed speakers’ lack of urgency to cut rates or the inflation talk drove rates higher, but rates certainly jumped, especially for the 10- and 30-year, which rose by approximately 9 and 13 bps, respectively.

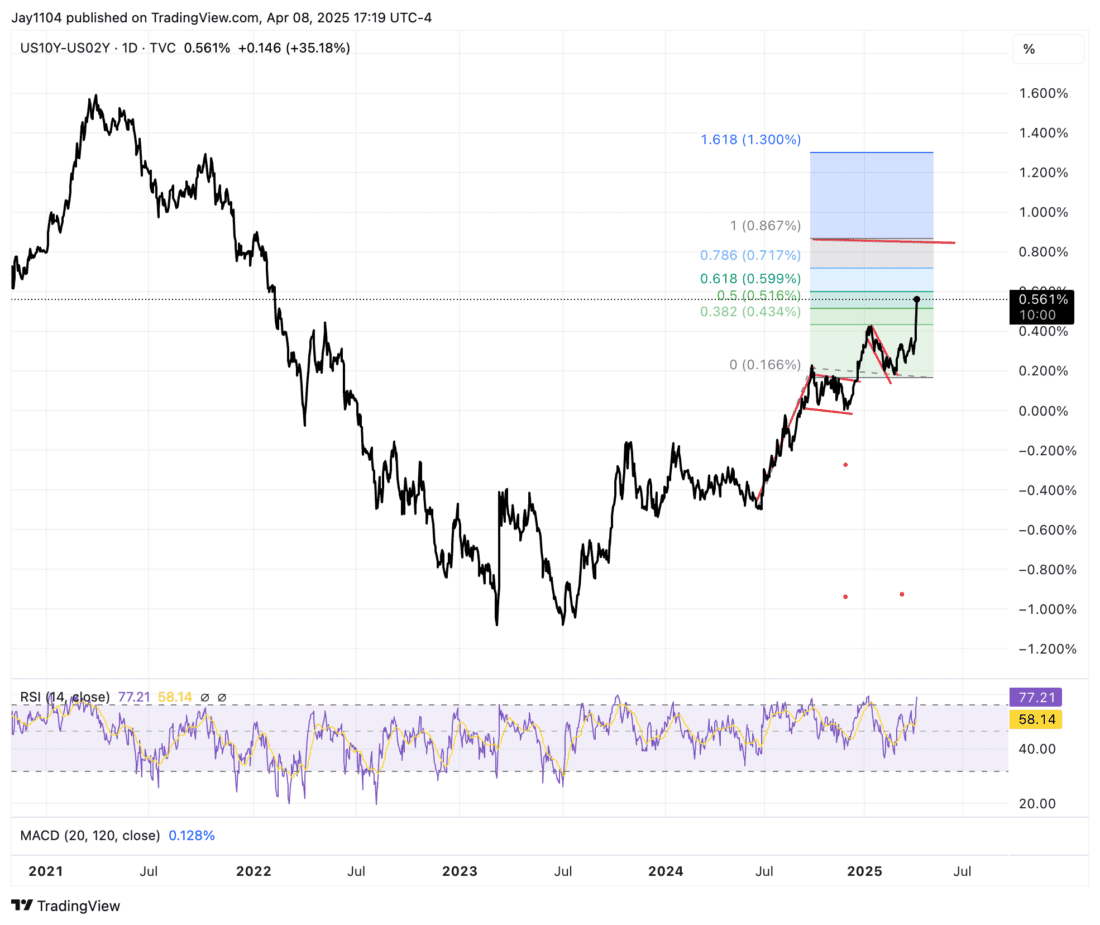

This led to the 10-2 spread rising by 15 bps through some serious bear steepening, bringing the spread to 56 bps. At this pace, the spread could reach the 85 bps region that the bull flag suggested a few weeks ago. More concerning, of course, is that tomorrow we have a 10-year auction, followed by a 30-year auction on Thursday.

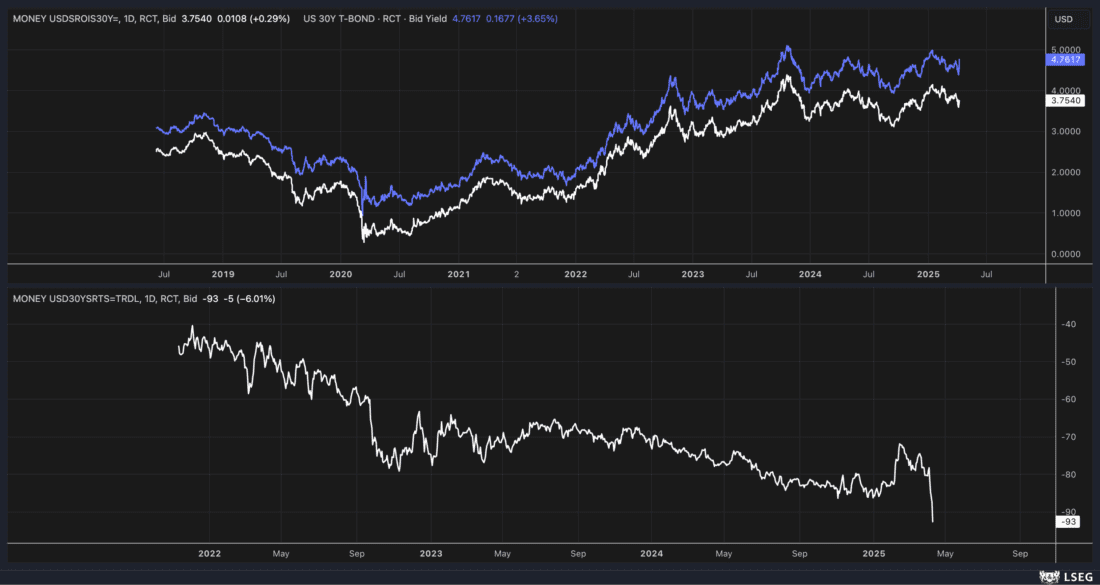

The rapid rise in 30-year nominal rates has sent the 30-year SOFR Swap spread to around -100 bps, the lowest on record, and we are seeing similar moves across the treasury curve. However, my general understanding is that it is a sign of liquidity constraints.

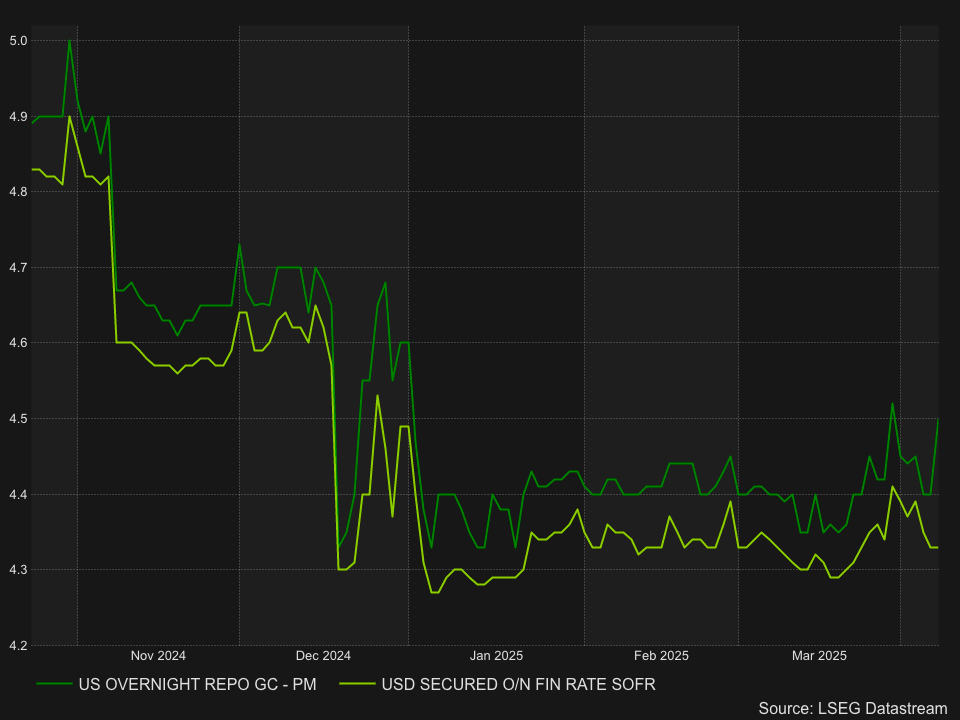

Indeed, it could be a case of liquidity tightening, as we also saw repo rates trading higher today. Overnight repo rates reached 4.5%, just below the 4.52% level on March 31. This suggests we should see secured overnight financing rates move higher tomorrow morning, suggesting tighter liquidity conditions, similar to what we see at quarter or month end.

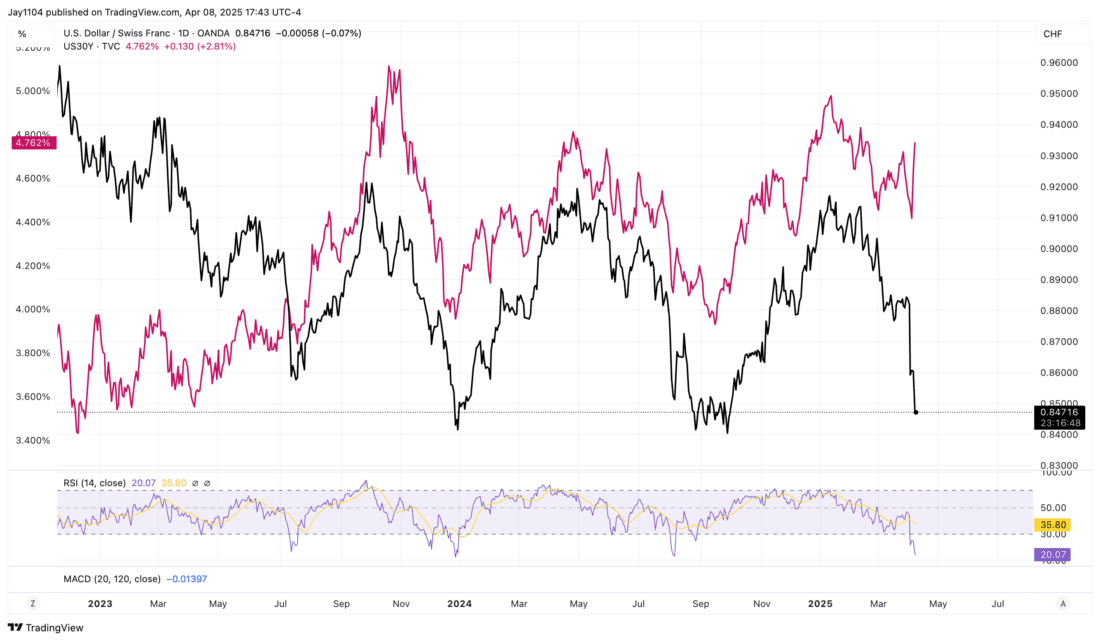

Additionally, we saw some huge and more critical divergent moves in USDCHF, which was firmer by 1.5%. What is important here is that it has wholly decoupled from nominal Treasury rates. Higher rates in the US typically lead to a weaker CHF, not today and not the past two days.

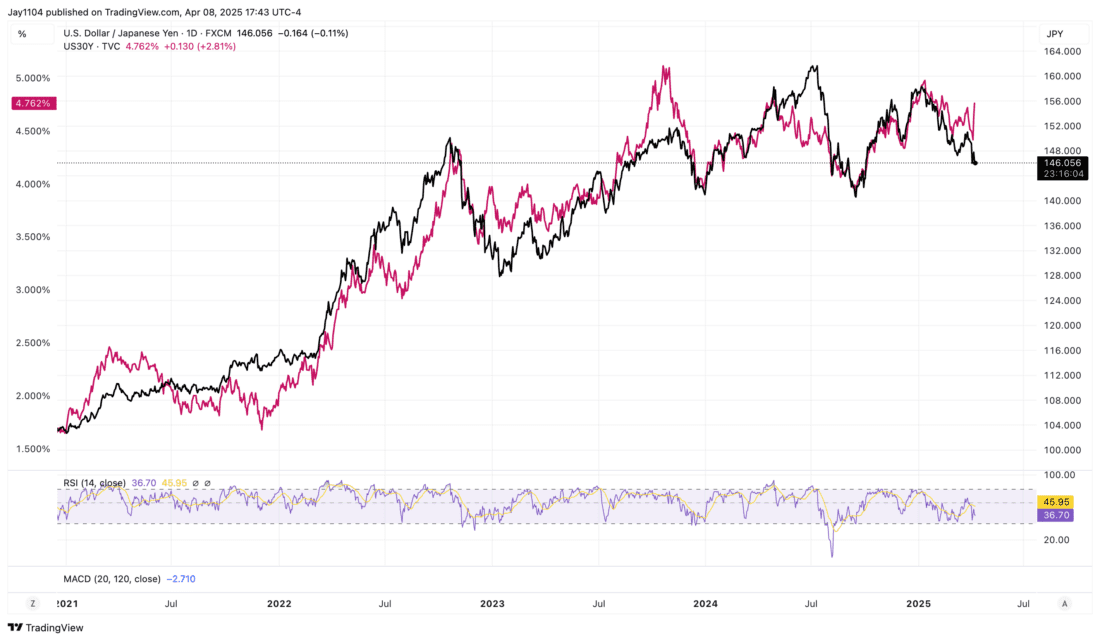

It was notably the same with the USDJPY, which was stronger on the day by more than 1%.

—

Originally Posted on April 8, 2025 – The Market is Starting to Look Really Ugly

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!