1/ 3-Month Relative Highs

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

3-Month Relative Highs

For the week ending Friday March 14th the S&P500 index closed down 2% for its fourth negative week in a row. However, this relative strength scan shows 10 stocks making new relative 3 month highs versus the index on Friday, with the highest relative close for $GE in 1,842 days (since November 2017).

You will see that 3 of the stocks ($PSX, $AIZ, and $CINF) have a ‘True’ label in the Breakout column. This means that this is their first new 3 month relative high in 3 months, signaling a potential run of outperformance.

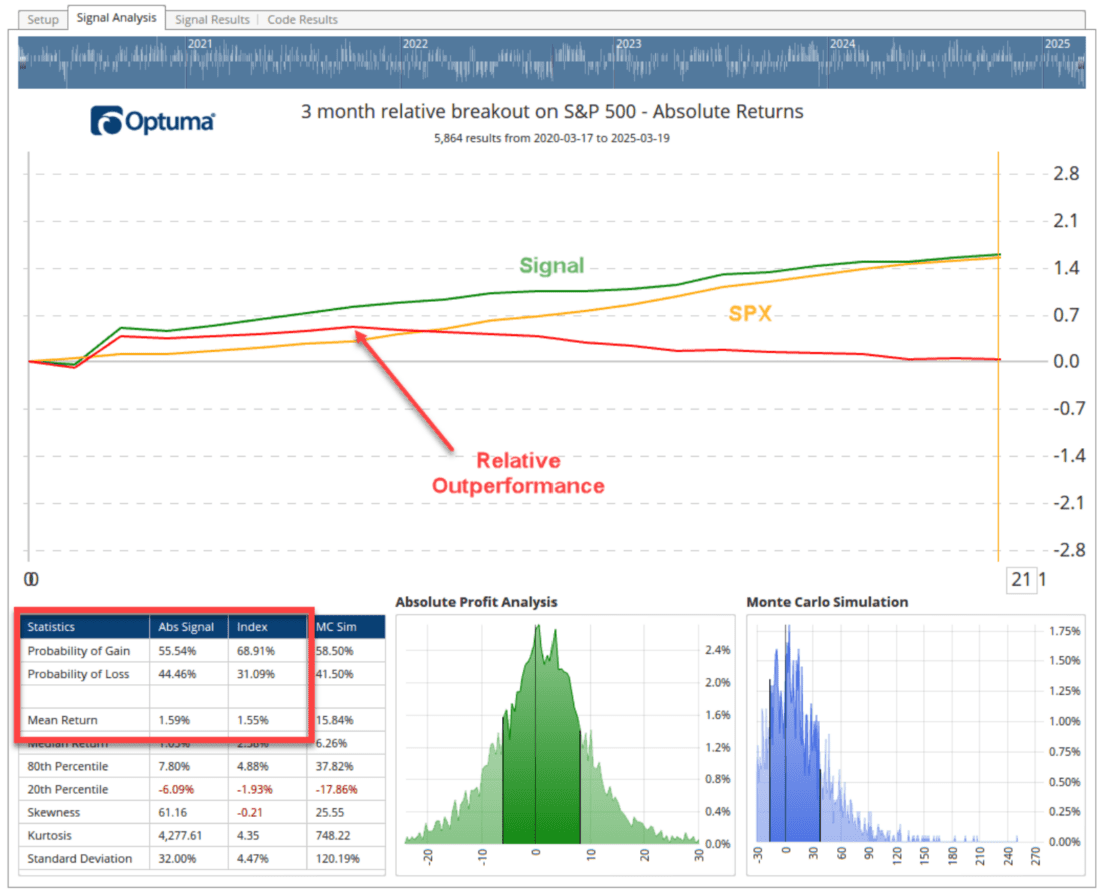

Using our Signal Tester we can test how the breakout signal has performed historically. Using the historical S&P500 members over the last 5 years we see that there were over 5,800 breakout signals. The chart below shows the average performance 21 days after each signal (the green line) plotted against the average return for the index (yellow), with the relative performance in red.

You can see the red line dips slightly after the first day after each signal (profit taking?) before reaching its maximum outperformance after about 8 trading days. The rally then starts to lose steam, as the red line descends. At the end of the 21 day period the average gain versus the index were almost identical in a strong market (+1.5%), but the initial breakout provided a short term buying opportunity.

—

Originally posted 17th March 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!