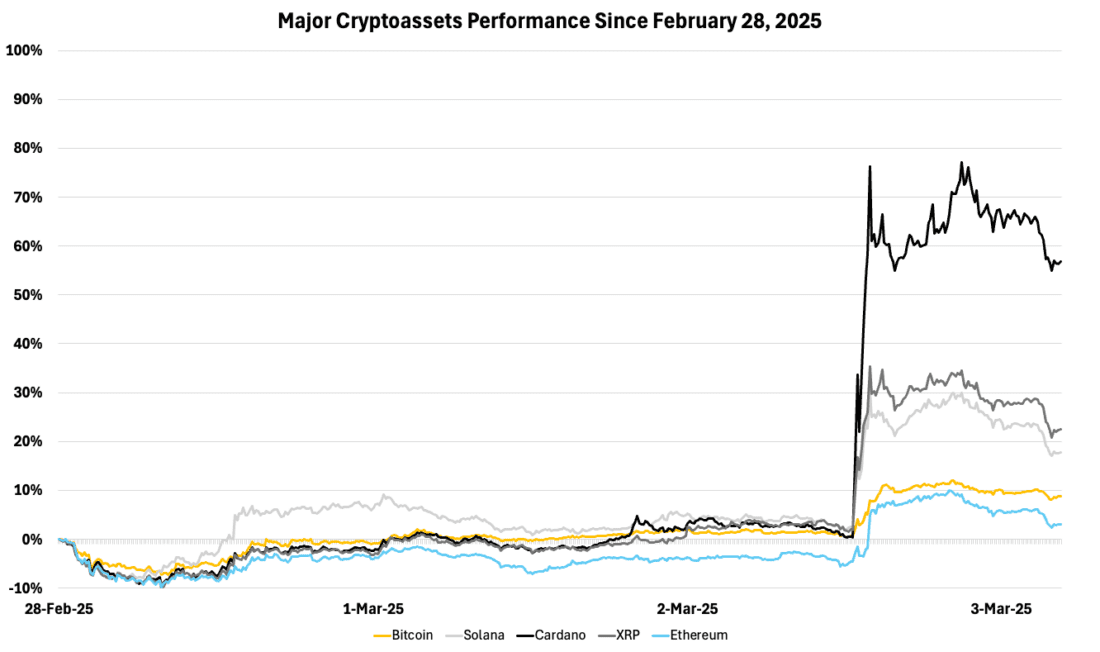

Donald Trump announced plans for a U.S. strategic crypto reserve to diversify assets and position the U.S. as a crypto leader. Funded partly by seized assets, the news spiked markets for the assets he highlighted, with XRP (+33%), Solana (+26%), and Cardano(+69%) surging, before a subsequent message mentioned Bitcoin(+11%) and Ethereum (+13%) and sent them up also. More details are expected to be revealed on March 7.

The shift from stockpiling seized crypto to actively purchasing assets for a strategic reserve marks a major policy change. Unlike passive holdings, this move creates institutional buying pressure, potentially elevating prices and further legitimizing crypto. Government backing could accelerate adoption, stabilize volatility, and trigger a global race to follow suit.

Historically, the U.S. has maintained reserves across diverse assets to stay competitive—the crypto reserve aligns with this strategy. A crypto-inclusive Fed could further stabilize markets by acting as a buyer/seller of last resort, integrating digital assets into traditional finance while reinforcing the U.S.’s leadership in the evolving financial landscape.

Friday’s Crypto Summit, co-chaired by David Sacks and Donald Trump, will tackle stablecoin oversight, state-federal crypto policy harmonization, and strategic crypto reserves. The five previously mentioned assets will be included, with potential for more. Rep. Bo Hines will lead policy discussions, shaping the regulatory framework for blockchain innovation.

If more details emerge on Friday, especially on asset selection, it could spark a further market rally across a broader range of cryptocurrencies.

It’s important to remember that implementing a strategic crypto reserve may take longer than expected. Sell-offs may follow due to retail disappointment that it would come sooner. Here are noteworthy risks that may be lost between the optimism:

- Execution Risks: Unclear funding sources (seizures vs. new purchases) and management frameworks pose risks. Markets could correct sharply if Friday’s summit lacks key details, similar to the post-inauguration volatility.

- Reputational Risk: Trump’s inclusion of XRP, Solana, and Cardano raises concerns over favoritism and conflicts of interest. Critics argue that only Bitcoin’s scarcity justifies its strategic reserve status.

- Dollar Implications: Large-scale crypto acquisitions could pressure the U.S. dollar’s dominance, though using seized assets may reduce inflation risks.

- Legal Barriers: Trump can’t unilaterally establish permanent crypto reserves; congressional approval is required. Workarounds include repurposing seized assets, but legal hurdles remain.

—

Originally Posted March 3, 2025 – Strategic crypto reserves are coming to America

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from 21Shares and is being posted with its permission. The views expressed in this material are solely those of the author and/or 21Shares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

How incredibly stupid and self-wounding to US dollar based system. Not to mention the conflicts of interest, self-serving money grab by the Trumps, in a useless fraud that will end badly for all involved and others. Shame.