1/ Tariff Deadline

2/ Unemployment

3/ Fed Speak

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Tariff Deadline

Another expected week of volatile headlines should keep traders on their toes. While politics and the market don’t always have major correlations, that hasn’t been the case yet as we started Trump 2.0.

March historically has been a stronger month for the market. The focus will now turn to what impact government policy will have on those companies that gave guidance that was a tad more conservative than expected.

One reason for forward guidance that was conservative dealt with uncertainty surrounding tariffs. Hopefully this week we get some more clarity on that and other government concerns.

Tariffs on, tariffs off – uncertainty lingers.

Tariffs limited to certain parts of the economy, now blanket tariffs.

Is this a real threat or a negotiating tactic?

We just don’t know at this time.

What we do know is that the see-saw action out of Washington and uncertainty coming from the White House when it comes to enacting tariffs has been causing intraday volatility and hanging a cloud over this market for weeks.

As of writing this note, President Donald Trump has reaffirmed that the United States will implement “significant” tariffs on imports from Mexico, Canada, and China, effective this Tuesday.

What we know with Mexico and Canada at this time – a 25% tariff will be imposed on all imports from these countries. This decision follows concerns from the White House over inadequate measures to curb the flow of illegal drugs, particularly fentanyl, into the United States. Despite previous negotiations and a one-month delay granted earlier in February, President Trump stated that insufficient progress has been made, necessitating the enforcement of these tariffs.

As for China, an additional 10% tariff will be applied to all Chinese imports. The administration cites China’s failure to effectively address the export of illicit drugs to the U.S. as the primary reason for this action.

Implications. Both China and Mexico have indicated intentions to implement countermeasures in response to the U.S. tariffs, potentially leading to escalated trade tensions. Global brands like General Motors (GM), Walmart (WMT), Apple (APPL) and Nvidia (NVDA) have all seen significant declines over this possibility and the uncertainty of current negotiations.

Tariffs have been a hot button topic on conference calls in most S&P 500 stocks that have reported and the uncertainty has led to more cautious guides going forward.

I discussed traders’ frustration with the back-and-forth here with Liz Claman on Fox Business.

2/

Unemployment

Layoffs? Layoffs?

Yes – we are talking about layoffs and not just DOGE.

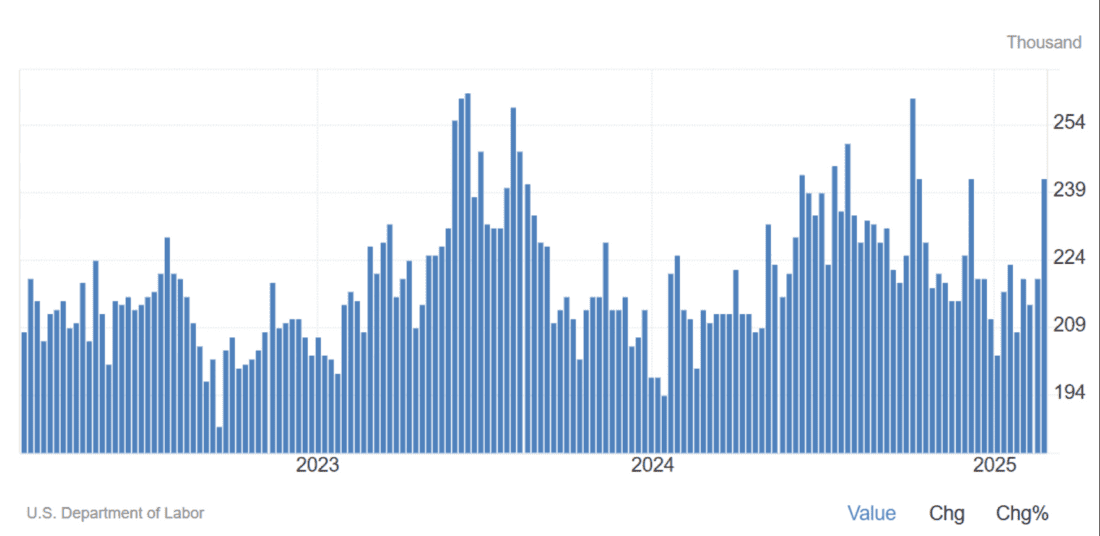

Over the past two weeks several S&P 500 companies announced layoffs during a time where we have seen an increase in weekly jobless claims. Last Thursday we hit yearly highs after an upside surprise. Was this a one-off or a new concerning trend?

Among those names announcing lay-offs just last week include – General Motors, Starbucks, Autodesk, Chevron, Hewlett-Packard. We are also at that time of year when the big banks make their annual culling and we haven’t seen the exact numbers out of the federal government.

Next week’s jobless claims are anticipated to come in at 242,000. The trend is climbing slowly higher and that could lead to a spike in unemployment over the coming months.

For the Fed this could be another conundrum as they look for evidence that their dual mandate of lower inflation and steady unemployment is under control. This may put a damper on any future rate cuts.

3/

Government Shutdown?

Government Shutdown? This may be more of a topic for next week as current funding, secured through a continuing resolution, is set to expire on March 14th. These negotiations have been used in the past by administrations on both sides of the aisle and the market tends to sell off heading into the deadline and then rallies after – regardless of a temporary shut down or not.

So watch for rhetoric to start to heat up this week as political posturing begins to grow louder. Budgetary disputes, proposed spending and of course optical dynamics will take center stage and could start to cause temporary angst in the market.

—

Originally posted 3rd March 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!