Originally posted on December 12th 2024

Get Ready for the Real Santa Claus Rally

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

Get Ready for the Real Santa Claus Rally

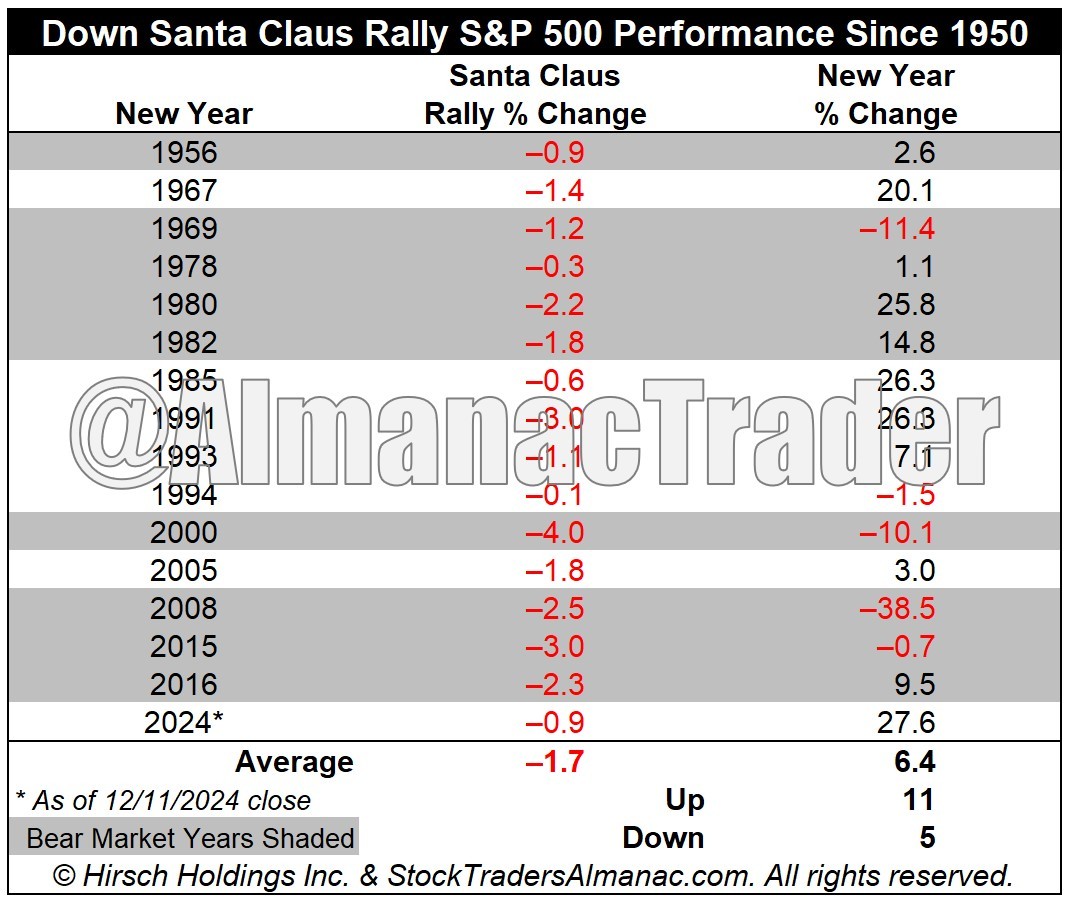

| Headed down to Wall Street yesterday to pave the way for Santa. As Yale Hirsch’s now famous line: “If Santa Claus should fail to call, bears may come to Broad and Wall.” This rather typical early December seasonal weakness sets up the Santa Claus Rally well. The Street has been buzzing about the Santa Claus Rally for three months now. Most still get it wrong. It’s not the yearend rally, the Q4 rally that runs from Halloween through January. Yes, November, December and January are the best three months of the year, but they are not the Santa Claus Rally. Santa Claus Rally was devised by Yale Hirsch in 1972 and published in the 1973 Stock Trader’s Almanac. The “Santa Claus Rally” is the last 5 trading days of the year plus the first 2 of New Year. This year it begins on the open on December 24 and lasts until the second trading day of 2025, January 3. Average S&P 500 gains over this seven trading-day range since 1969 are a respectable 1.3%. Failure to have a Santa Claus Rally tends to precede bear markets or times when stocks could be purchased at lower prices later in the year. Down SCRs were followed by flat years in 1994, 2005 and 2015, two nasty bear markets in 2000 and 2008 and a mild bear that ended in February 2016. This is the first leg of our January Indicator Trifecta (2025 STA p 20) which includes the “First Five Days” (2025 STA p 16) and the full month “January Barometer” (2025 STA p 18), also invented and named by Yale Hirsch in 1972. This January Trifecta helps us affirm or readjust our outlook. When we hit this Trifecta and all three are positive S&P is up 90.6% of the time with an average gain of 17.7%.” Based upon the outcome of these three indicators, we may adjust our outlook for the balance of Q1 and 2025. Until then, we remain bullish as this is the seasonal favorable period for stocks. Valuations are a concern, but economic data is holding up, the Fed is cutting interest rates, and the market continues to track seasonal trends and patterns rather closely.” |

About the author:

Jeffrey A. Hirsch is CEO of Hirsch Holdings and the editor-in-chief of the Stock Trader’s Almanac and Almanac Investor eNewsletter at www.stocktradersalmanac.com. Jeff is the author of The Little Book of Stock Market Cycles (Wiley, 2012) and Super Boom: Why the Dow Will Hit 38,820 and How You Can Profit from It (Wiley, 2011). Mr. Hirsch is a 30+ Wall Street veteran; he took over from founder Yale Hirsch in 2001 and regularly appears on CNBC, Bloomberg, Fox Business, and many other financial media outlets.

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!