Let me be very clear: the title of today’s piece is NOT investment advice. Instead, it appears to reflect many investors’ mantra. And it’s working out for quite a few of them right now. While I have no access to customer data, I do see a table of the 25 most active names on our platform over the past week, and the activities mentioned in today’s title – buy dips, chase rallies, lever up – are usually reflected in that report.

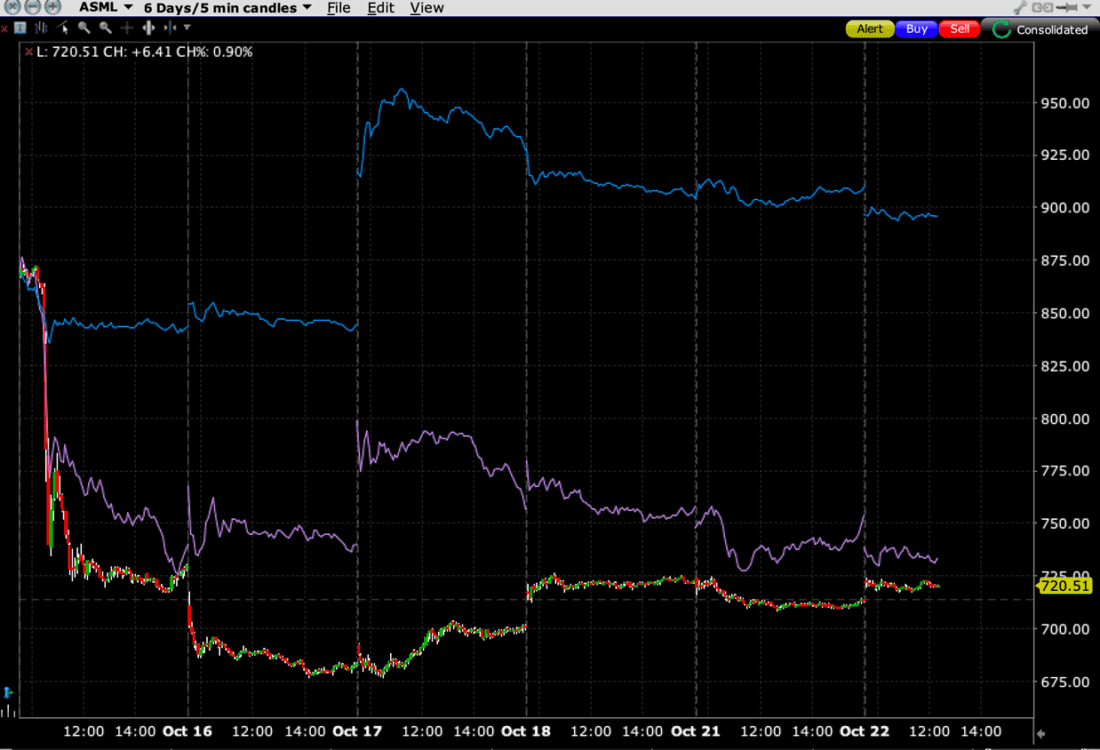

It should be no surprise that Nvidia (NVDA) and Tesla (TSLA) are perpetually the top two names. Over the past year, as NVDA became the market’s bellwether, it surpassed TSLA in both market and mindshare. We’ve written about the dominance of semiconductors in both the market narrative and its returns, and that is certainly the case among our trading activity. Last week was a particularly wild one for the semis. A week ago, ASML plunged after offering poor guidance despite solid quarterly earnings. The following day, Taiwan Semiconductor (TSM) shot up after offering positive guidance. Taken as a whole, investors chose to prefer TSM’s narrative. The chart below shows the recent movements of ASML and TSM plotted against SOXL, a 3X leveraged ETF based on the Philadelphia Semiconductor Index.

6-Day Chart, ASML (red/green bars), TSM (blue), SOXL (purple)

Source: Interactive Brokers

Some of you might be wondering why I chose to portray SOXL rather than SOX. That speaks to the activity that we see on our platform. SOXL was #3, trailing only the aforementioned NVDA and TSLA, while ASML was #5 and TSM was #7. ASML was by far the name with the most net buying activity, nearly double that of SOXL, though TSM only showed marginal net buying. Remember today’s title. The dip in ASML was obviously bought (with some success, depending upon timing), and there was a preference for utilizing a levered product over a standard ETF.

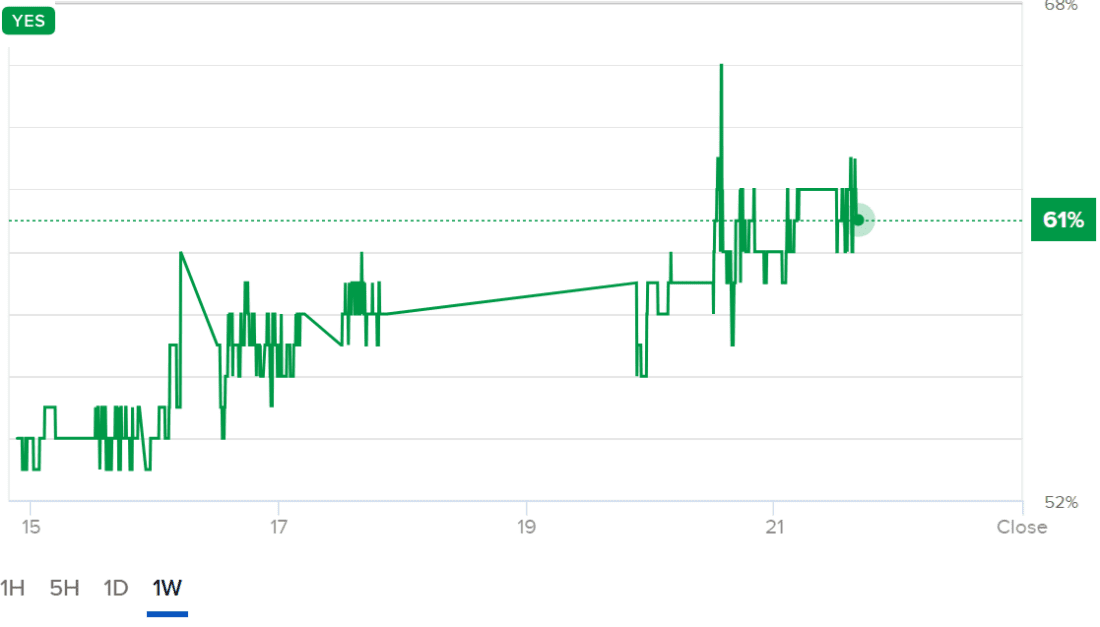

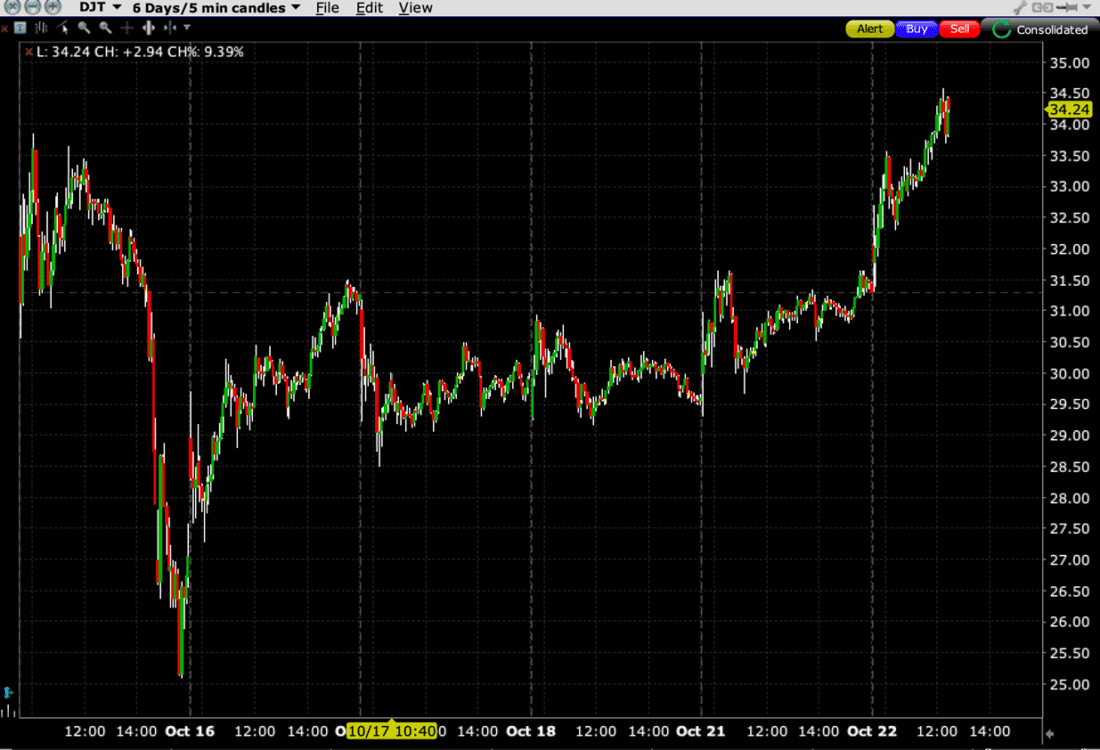

The ultimate leveraged election play, Trump Media & Technology (DJT), moves up to #6. Even as major polls remain largely split, prediction markets have been increasingly favoring the former President’s electoral chances. DJT’s stock moves generally parallel with of its namesake’s pricing on prediction markets, but with much more volatility. Note the comparison below, between the 5-day movement for a “Yes” vote on IBKR ForecastTrader with that of DJT shares. Many traders seem to prefer the more leveraged play.

1-Week Price History of IBKR ForecastTrader “Yes” Vote for “Will Donald Trump win the US Presidential Election in 2024?”

Source: Interactive Brokers

DJT, 6-Days, 5-Minute Candles

Source: Interactive Brokers

Usually, when I peruse the table there is one symbol that I need to look up. This week we have three names that I was unfamiliar with: #8 OKLO, #15 DRUG, and #24 ATNF.

- OKLO Inc. was clearly a beneficiary of the AI-fueled resurgence of nuclear power as this reactor company more than doubled last week. There is an understandable reason for enthusiasm ever since Microsoft’s (MSFT) agreement to buy power from Constellation Energy’s (CEG) Three Mile Island nuclear plant.

- Vancouver-based Bright Minds Biosciences (DRUG) traded with a $1 handle at the start of last week and nearly $80 by Friday. Even the company claimed to be unaware of any material changes last Tuesday to trigger its jump from $2.49 to over $40 that day (yes, one day). The company did a private placement at $21.70 on Thursday, and somehow that triggered a move on Friday to $79.02 before closing at $47.21 that day. This seems totally normal, no?

- With a name like 180 Life Sciences (ATNF), one might expect a biotech company. It went from $1.52 on Monday to a high of $17.75 shortly after the open on Tuesday, powered by an announcement that the company plans to enter the online casino market. Never mind its name, apparently. The stock quickly gave back most of its immediate gains, but it remains about 4X above its prior levels.

I’ll leave it to you to decide whether we’re seeing a bit of froth right now, based on some of these moves. But for many of you, the concept of buying dips, chasing rallies, and adding leverage is working out. It certainly allowed equities to largely ignore a 10 basis point rise in bond yields yesterday. NYSE decliners outpaced advancers 3:1, but the lone positive S&P 500 (SPX) sector that rose was information technology, the group that includes semis. A new high in NVDA couldn’t push SPX into positive territory, but it minimized its losses. Surfing the wave is working for many. Hopefully it doesn’t result in a treacherous wipeout.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ForecastEx

Interactive Brokers LLC is a CFTC-registered Futures Commission Merchant and a clearing member and affiliate of ForecastEx LLC (“ForecastEx”). ForecastEx is a CFTC-registered Designated Contract Market and Derivatives Clearing Organization. Interactive Brokers LLC provides access to ForecastEx forecast contracts for eligible customers. Interactive Brokers LLC does not make recommendations with respect to any products available on its platform, including those offered by ForecastEx.

Disclosure: Forecast Contracts

Forecast Contracts are only available to eligible clients of Interactive Brokers LLC, Interactive Brokers Canada Inc., Interactive Brokers Hong Kong Limited, Interactive Brokers Ireland Limited and Interactive Brokers Singapore Pte. Ltd.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

It is more about the election now. I was doing this NVDA routine. However, Trump rose in the polls which means possible tariffs, economy collapse and stock market crash.

So I closed all my positions today. I will stop trading until the election results:

sell puts if Kamala wins or sell calls if Trump wins.

Is the most active list accessible to customers, or just selectively shared by the author/others at IBKR?

Thank you for asking. Please review the live markets here: https://forecasttrader.interactivebrokers.com/eventtrader/#/markets

Ed must not live in the USA. I’ve been a small trucking company owner in California since 2004. Business has never been as bad as it is now. We are down 50% from 2023 and 75% from 2021 levels. My attorney said many of his trucking clients are seeing the same slowdown. It was never this bad during Trump years, or even Obama years. Biden/Harris has been the worst administration in my 20 years of doing business.

Hello Jose, I honestly hear you. And I don’t have a preferred political party. It depends. But the way I see, Biden has a bad president with bad luck (high interest rates).

Kamala we don’t know, but Trump will make things much worse if he implements his tariffs plan. The other countries will immediately retaliate. This is how is works, and three things will happen: 1- inflation will return, 2- the US will loose power and competitiveness to China and others, and 3- the economy will cool down.

We live in an age of excess information, conflicting information and false information. So, please, check your own sources and read what history shows us about tariffs, commerce and economic collapse. It is very well documented. All best

Dear Jose, It is not about you. Nor a few politicians.

Thanks, Steve. You are an insightful genius regardless of what some of your knucklehead readers say!

Nothing makes us happier than satisfied readers!

Where can we find the full list??

The ultimate leveraged election play, Trump Media & Technology (DJT), moves up to #6.

Thank you for asking. Please review the live markets here: https://forecasttrader.interactivebrokers.com/eventtrader/#/markets

DJT seems to offer an opportunity to bet on the election outcome. There are no investment opinions on the stock. DJT says he’s not selling, but other large investors have. He by far is the largest shareholder. The stock will crater if there’s news that he’s selling through other means, although I have no idea how that could happen, but I trust it could. Nothing is to stop him from gifting shares and have the recipient sell. Strikes me as a straddle. There’s a 10 per cent short position. Any thoughts on this.

You don’t have the courage to sign your name and you can’t control yourself when facing an opinion different from yours. I see where you are coming from. I am not commenting anything from you.

Ed, have you seen what the market did last time trump was president? Have you ever heard of the trump bump?

Not everything is about the stock market. The guy is a convicted criminal. Betrayed his wife. Speaks about god, but doesn’t walk the talk. He lies compulsively. He tried to take the power by force. Yesterday he said he wanted Hitler’s generals. He humiliated the military and veterans multiple times. He told that he wants to use military force inside the US to arrest people. His economic plan will trigger an economic war that will shut down American exporters and importers. He is not a Republican and he has his own interests at heart.

That said, a small part of me would like him to will. It will be the most painful, traumatic lesson that his followers will learn. However, I can’t wish the same for the other half of the people.

Not everything is about the stock market but I was replying to Ed’s prediction about what will happen to the stock market

All the predictions you made didn’t happen last time he was president either

Ed has a good point. But about your comment that the predictions didn’t happen when he was president is false:

They are not predictions. They are facts. He was convicted. He betrayed Melania. He tried to take the government by force… anyway go for it. It is like I said, part of me will have fun watching China and Russia gain power while the US sinks in self-inflicted tariffs inflation and economic collapse. The regret will be bitter.

Ed doesn’t have a good point because the market did great when he was president so there is no reason to think it wouldn’t do great again based on history

He has a point because Trump flooded the economy with money to mitigate covid damage. It created inflation that Biden inherited. Now it is a different story. No covid, no stimulus, just tariffs. The economy will sink badly.

lol ok let’s see

You know it did great before covid too right? The tariffs didn’t sink the economy last time so there is no reason to think they will this time