Your Privacy

When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. This information might be about you, your preferences or your device and is typically used to make the website work as expected. The information does not usually directly identify you, but can provide a personalized browsing experience. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Please click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer.

Strictly Necessary Cookies

Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. They are typically set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. While you can set your browser to block or alert you about these cookies, some parts of the website will not work. These cookies do not store any personally identifiable information.

ALWAYS ACTIVE

Functional Cookies

Functional cookies enable our website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

Marketing Cookies and Web Beacons

Marketing Cookies and web beacons may be set through our website by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant adverts on other websites. They do not directly store personal information, but uniquely identify your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do Not Track" signals.

Interactive Brokers Group Cookie Policy

What are Cookies and Web Beacons?

Cookies are pieces of data that a website transfers to a user's hard drive for record-keeping purposes. Web beacons are transparent pixel images that are used in collecting information about website usage, e-mail response and tracking. Generally, cookies may contain information about your Internet Protocol ("IP") addresses, the region or general location where your computer or device is accessing the internet, browser type, operating system and other usage information about the website or your usage of our services, including a history of the pages you view.

How We Use Cookies and Web Beacons

Interactive Brokers Group collects information from cookies and web beacons and stores it in an internal database. This information is retained in accordance with our Privacy Policy. This website uses the following cookies and web beacons:

Strictly Necessary Cookies

These cookies are necessary for the website to function and cannot be switched off in our systems. They are usually only set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. You can configure your browser to block or alert you about these cookies, but certain areas of the site will not function properly. These cookies do not store any personal data.

Performance Cookies and Web Beacons

These cookies and web beacons allow us to count visits and traffic sources so we can measure and improve the performance of our site. They help us to know which pages are the most and least popular and see how visitors move around the site. All information that these cookies and web beacons collect is aggregated and, therefore, anonymous. If you do not allow these cookies and web beacons our aggregated statistics will not have a record of your visit.

The website uses Google Analytics, a web analytics service provided by Google, Inc. ("Google"). Google Analytics uses cookies to help analyse how you use this website. The information generated by the cookie about your use of this website (including your IP address) will be transmitted to and stored by Google on servers in the United States. Google will use this information for the purposes of evaluating your use of the website, compiling reports on website activity for website operators and providing other services relating to website activity and internet usage. Google may also transfer this information to third parties where required to do so by law, or where such third parties process the information on Google's behalf. Google will not associate your IP address with any other data held by Google.

Functional Cookies

These cookies enable the website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies, some or all of these services may not function properly.

Marketing Cookies and Web Beacons

These cookies and web beacons may be set throughout our site by our advertising partners. They may be used by those companies to build a profile of your interests and show you relevant advertisements on other sites. They do not store personal information that could identify you directly, but are based on uniquely identifying your browser and internet device. If you do not allow these cookies and web beacons, you will experience less targeted advertising. The website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to Do Not Track ("DNT") signals.

Managing Your Cookie Preferences

You have many choices with regards to the management of cookies on your computer. All major browsers allow you to block or delete cookies from your system. However, if you do decide to disable cookies you may not be able to access some areas of our website or the website may function incorrectly. To learn more about your ability to manage cookies and web beacons and how to disable them, please consult the privacy features in your browser or visit www.allaboutcookies.org.

This website may link through to third party websites which may also use cookies and web beacons over which we have no control. We recommend that you check the relevant third parties privacy policy for information about any cookies and web beacons that may be used.

It’s not that his political views are different, they’re are many CEO that have similar views. The problem is Mr. Musk in you face know all attitude.

Posting every 2 seconds doesn’t help.

X and trying to reelect Donald Trump has become his obsession and it will absolutely hurt Tesla in the long run. X’s value is down 80% and Tesla will soon follow – he will learn that alienating your biggest consumer base is not a wise strategy.

Its not just the manager being under increased pressure. Tesla clients too. I wont be buying anything from Mr Musk. The more I learn about him, the less I like his character and products. For the record, I wont be going to Mars,I dont need a robot, a chip for my head, or X to bore tunnels through my head.

Yup

I prefer my cars with a little less Himmler, thank you very much

I guess you shouldn’t buy GOOGL, META, MSFT as well then… I prefer my Country with a little less Marxist

I recently got an EV, my first. I test drove a number of cars but completely avoided Tesla because of Musk’s self serving arrogant attitude and political support for another arrogant rich guy who doesn’t care about anyone but himself. No way l would give one penny to Musk!

and as of last night, you can add a giant belly flop of an announcement on Robocars to his list of declining glory. Guy should have stuck to his knitting – cars and space. Everything else is a distraction.

Mr Musk has left me way behind.

It seems to me that as much as we may dislike Musk’s over reach the real decline is just due to lack of new product differentiation. Tesla achieved it’s goal of pushing the car market toward EVs and now they are on among many instead of the only legit game in town. But I would be careful painting this company as one that is going down hill. Remember that this is an election year and consumer memories are short. People are looking at the robotaxis instead of the optimus robots serving the drinks and talking to the attendees.

If Tesla is going to have another massive rise it will be on the back of robotics and humanoid robots not taxis. So the real question is can he pull of another world changing product or is he just promising things he can’t make come true.

‘Never underestimate a man who overestimates himself’

I bought an EV. I went and tested every car out there. When all was said and done, the BMW, VW and Hyundai offerings were head and shoulder above Tesla. My concerns were later validated when JD Power and Associates showed that Tesla is in the lowest quartile in maintenance. The issue is not just that Musk is obsessed with Trump and betraying his base–it is more serious: He took his off the ball, and it shows in the quality of the product.

I just have to shake my head at most of the comments. Mr. Musk is just the smartest man on this planet…bar none. Face it folks, he is smarter than you…way smarter than you. He OWNs Space X. Do you really think he cares if you buy his cars or not. LOL.

It reminds me of when Michael Jordan was asked why he didn’t use his celebrity as a platform to publicly throw his support to the Democratic / Liberal presidential candidate at that time. His reply was something to the effect of “Hey, Republicans buy sneakers too”

Mr Musk could take a lesson from Mr Jordan.

I got out of Tesla soon after the Twitter deal.

Those who trade TSLA (aka “the Teslans”) are an interesting subset of most normal traders. Based on the pre-demo X comments (if they were indeed real), it would seem that some are true believers.

.., but the real believers are the day traders who believe (and somehow, it continues to be true) that this stock will move significantly, whipsawing back and forth with relatively large price changes for a stock in it’s price range.

In that way, regardless of anything else, it does serve a useful purpose.

If you will, it is a “vehicle” for the number that is price changing (aka creating profits/losses) significantly over a relatively short period of time.

How will this all play out…?

4T => There Things Take Time

Love the play on BC and AD Steve.

Thanks for great reporting on a number of topics on this social media site. The gods are indeed playing with us.

We hope you continue to enjoy Traders’ Insight!

It’s important to note that Musk doesn’t deserve credit for the labor of the 6+ corporations he’s ostensibly a figurehead of. No one can manage that. As a symbol figurehead whose myth-making attracts capital to corporate entities, however, he is phenomenal; so were the confidence men who hawked non-existent railroad stocks prior to the (first) Gilded Age. During the pandemic, Musk’s net worth multiplied by over 1000%. This is not because of Tesla’s earnings, it was because, quite simply, of surplus speculative capital provided to owners of capital (and, yes, some small retail capital speculators) while their labor forces were furloughed.

Certainly, however, those corporations are doing some pretty fantastic stuff, but coordinating engineers to a purpose could’ve been done by any entity — including the government, as NASA in the past has shown, and as China itself currently demonstrates. EV cars are a reality there, and their competitive success here in America is blocked by policy.

Accumulating massive capital on the backs of labor does not make one a brilliant entrepreneur, despite America’s misguided worship of Freudian daddy figures. The shortened form the term “confidence man” relies heavily on the confidence part. All bubbles eventually deflate.

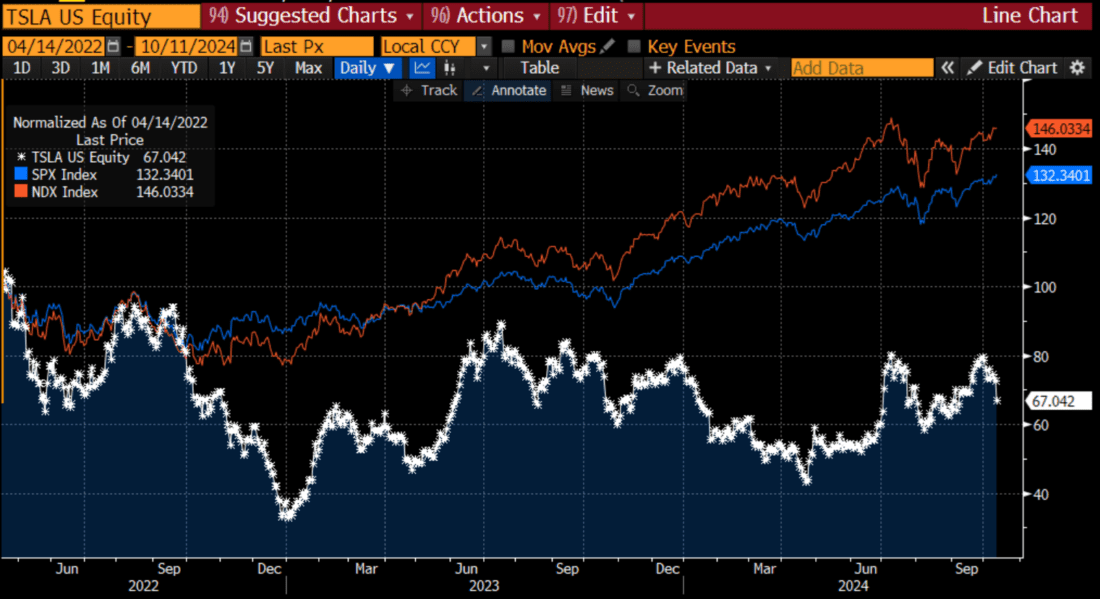

I think your conclusion is backward; Tesla’s bearish trend in 2022 should be attributed to the saturation of the electric vehicle market.

There are still many issues with electric vehicles, including insufficient mileage from batteries and safety concerns, which means the customer base for battery cars has always been a fixed group of people.

Additionally, the rise of Chinese electric vehicles has compressed Tesla’s sales, ultimately forcing the company to engage in price competition in 2023. Musk may have sensed these concerns before 2022, and his anxiety led him to make extreme statements on Twitter during that time, resulting in his ban from posting.

With his wealth, his solution was to buy Twitter, freeing himself from restrictions; this is what actually happened.

Musk doesn’t deserve credit for the labor of the 6+ corporations he’s ostensibly a figurehead of. No one can meaningful contribute to 6 companies, especially as a “leader.” But, as a symbolic figurehead whose myth-making attracts capital to these corporate entities, he’s phenomenal. So were the “confidence men” who hawked non-existent railroad stocks prior to the (first) Gilded Age. During the pandemic, Musk’s net worth multiplied by over 1000%. This is not because of Tesla’s earnings, it was because, quite simply, the government directly supported firms with surplus capital while their labor costs were abrogated. That capital was translated to speculation and asset price inflation, with the biggest confidence men winning the pot.

Certainly, however, those corporations are building some pretty novel stuff, but coordinating engineers to a purpose could’ve been done by any entity — including the U.S. government, as NASA in the past has shown, and as China itself currently demonstrates. Alternately the engineers could own the company themselves. BEV cars are already a reality China, and their competitive success here in America is blocked by policy. Plus, knowledge and research is a cumulative, social form of wealth that CEOs seem quite happy to appropriate as if they themselves are the source of that value.

Accumulating massive capital on the backs of the labor that actually creates that value does not make one a brilliant entrepreneur, despite America’s sycophantic worship of Freudian daddy figures. The term “con man” is shorted from “confidence man.” All bubbles eventually deflate.

Musk should have bought Nikola vs Twitter. Having a truck company vs a social media company would’ve made a lot more sense.