Although there are plenty of reports on the economic data calendar in the September 23 week, none is likely to be a standout after the FOMC announced a rate cut of 50 basis points on September 18 to bring the fed funds target rate range down to 4.75 to 5.00 percent. Data related to the housing market, consumer confidence, and manufacturing will all have been compiled before the announcement. The impact of lower rates will deliver a boost to the economy that won’t be visible in the reports until next month.

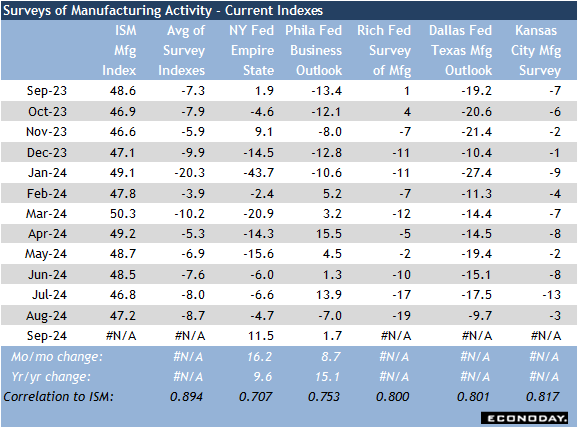

What may prove most interesting in the week – since it will reflect the more recent state of the economy – is the next surveys of manufacturing for September. The surveys for September from the New York and Philadelphia Feds both show a turnaround in the general business conditions indexes to positive territory. The New York index was up 16.2 points to 11.5 after six straight months of contraction. The Philadelphia index rose 8.7 points to 1.7, returning the index to expansion after plunging 20.9 points to -7.0 in August. Neither general business conditions index has the strongest correlation with the ISM Manufacturing Index (New York 0.707, Philadelphia 0.753), so may not be the best hint as to what is happening at the national level for September.

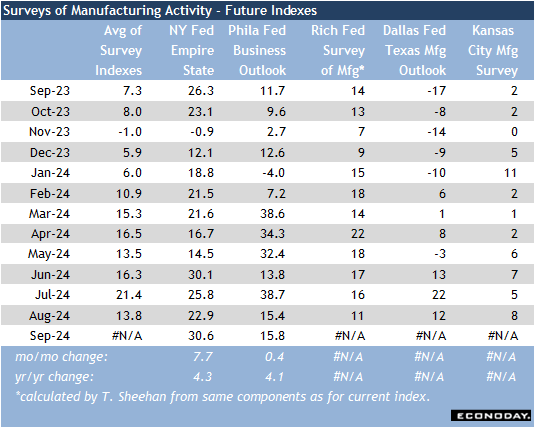

On the other hand, the composite indexes from Richmond and Kansas City – as opposed to the diffusion indexes from the other Fed district bank surveys – have solid correlations with the ISM measure at 0.800 and 0.817, respectively. The Richmond manufacturing index is set for release at 10:00 ET on Tuesday and the Kansas City manufacturing composite index is at 11:30 ET on Thursday. If the Richmond manufacturing index breaks away from the string of negative readings of November 2023 through August 2024, or at least improves from the near-term bottom of minus 19 in August, it will add to the brighter outlook for the factory sector. The Kansas City index hasn’t seen a positive reading since September 2022. If it gets a lift from the minus 3 in September, it will further broaden the outlook for the recession in the factory sector nearing an end.

—

Originally Posted September 20, 2024 – High points for economic data scheduled for September 23 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!