I’m fresh off the plane from Las Vegas—and no, I wasn’t hitting the slots, though the city’s Harry Reid International Airport sure hit the jackpot with a record-breaking 57.6 million passengers last year. The airport is on track to service even more people this year, a reflection of the travel boom that’s expected to set new passenger figures this summer.

The reason for my visit was Dell Technologies World 2024, which brought together many of the world’s leading business leaders and experts in technology and artificial intelligence (AI).

As you’re probably aware, AI is driving much of the news and stock market right now. Google Trends data shows that global searches for “AI” recently hit the highest level ever as more and more companies roll out AI products and position themselves for the ongoing AI race.

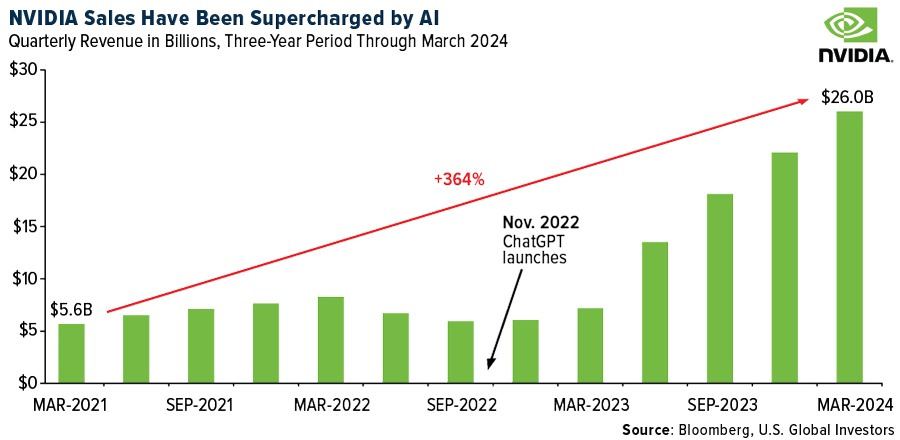

The man of the hour was Jensen Huang, CEO of NVIDIA, which just last week reported phenomenal March-quarter earnings. Revenues topped a record $26 billion, more than triple the amount from the same period a year earlier, while profits were up a staggering sevenfold.

The company expects sales to hit $28 billion in the current quarter as demand for its graphics processing units (GPUs)—ideal for use in AI applications—continues to accelerate.

Rewarding Shareholders After A Blistering Rally

Thanks to the whirlwind market rally, NVIDIA’s market cap now tops a mind-boggling $2.5 trillion, larger than the entire German stock market and making it the world’s third most valuable company after Microsoft and Apple.

With NVIDIA shares trading above $1,000, the company announced a quarterly dividend boost, from $0.04 per share to $0.10, an increase of 150%. It also announced a 10-for-1 stock split to make its stock more attractive to retail investors, following Walmart, which enacted a 3-for-1 split in February. Alphabet, Tesla and Amazon all split shares in 2022. Stock splits don’t change a stock’s fundamentals, but they’ve tended to result in near-term gains as additional investors pile in.

NVIDIA stock now turns up in more retail investors’ portfolios than any other name, according to recent analysis by Vanda Research. The stock represented 9.3% of investors’ portfolios on average, higher than other popular stocks and ETFs such as Apple, Tesla.

Finally, NVIDIA just ranked number one on the 2024 Axios Harris Poll 100, which ranks the reputations of companies most on Americans’ minds. Tens of thousands of respondents are asked which two companies—in their opinion—stand out as having the best reputation. Rounding out the top five companies were 3M, Fidelity Investments, Sony and Adidas.

The Modern-Day Pickaxes Of The Tech Industry

What does this all mean for us, the investors? I believe NVIDIA is just getting started. They already control a huge portion of the market, and they’ve built an entire ecosystem around their AI tools, locking in customers and driving sales. It’s like the gold rush, but instead of pickaxes, they’re slinging GPUs, purchased by everyone from Amazon to Dell to Tesla. During a recent earnings call, Tesla revealed that it had installed 35,000 of Nvidia’s H100 GPUs in its supercomputers.

Some people might compare NVIDIA to Tesla, and sure, there are similarities. Both companies are pushing the boundaries of technology and disrupting their industries.

As Jensen Huang himself pointed out last week, “Tesla is far ahead in self-driving cars, but every single car someday will have to have autonomous capability.” NVIDIA’s GPUs, much like those self-driving features, are poised to become ubiquitous.

Bitcoin’s Scarcity

Let’s not forget the Bitcoin angle. While NVIDIA might not be directly involved in crypto mining, the rise of AI is linked to the growth of blockchain technology. Both are driving demand for powerful computing, and both are shaking up traditional financial systems.

An unusual source for Bitcoin research is Incrementum’s annual In Gold We Trust report, which the Liechtenstein-based firm has been putting out since 2007. Analysts note that, like gold, Bitcoin is sought by investors mainly because it’s deliberately designed to be a scarce asset, capped at 21 million coins. Around 95% of all Bitcoin has been mined; within the next 10 years, this percentage is expected to reach 99%. “The scarcity could further solidify the perception of Bitcoin as a store of value and potentially lead to a reassessment of its value,” the group writes.

Gold Near An All-Time High

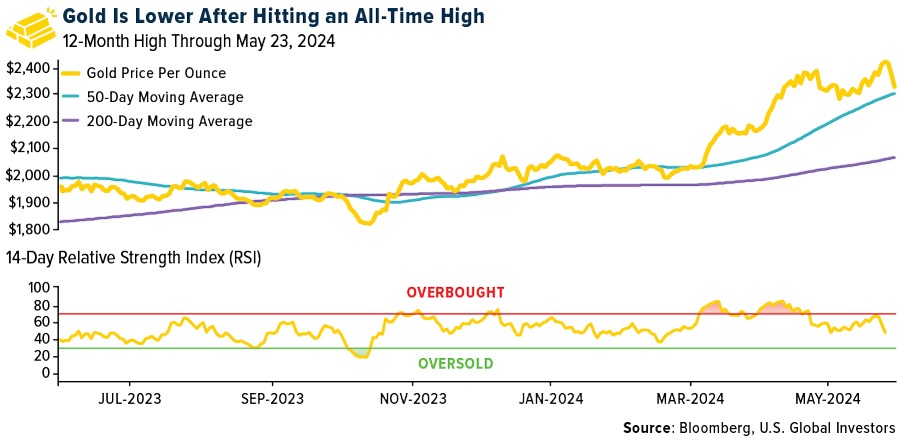

As Bitcoin’s analog cousin, gold has also been turning heads lately. The yellow metal is off its recent high of $2,450 an ounce, touched last Monday in intraday trading, as geopolitical uncertainty mounts and investors look ahead to a rate cut by the Federal Reserve. According to its 14-day relative strength index (RSI), gold looked overbought as recently as last month, but it’s since reverted to the mean.

Happy investing and stay bullish!

—

Originally Posted May 28, 2024 – NVIDIA Tops Corporate Reputation Rankings, Outshining Tech Peers

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (03/31/2024): Tesla Inc., Apple Inc., Amazon.com Inc.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.

Disclosure: Digital Assets

Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. Eligibility to trade in digital asset products may vary based on jurisdiction.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!