Apart from reading an issuer’s official statement or attending an investor presentation about an issuer’s proposed offering, investment decisions about municipal bonds typically require additional information from certain organizations in the ecosystem in which these instruments are issued and traded.

Along with other fundamental factors that investors may use to assess the risks associated with municipal securities, institutions such as municipal bond guarantors, as well as credit rating agencies such as S&P Global, Moody’s Investors Service, and Fitch Ratings each play a role in the issuance and trading process.

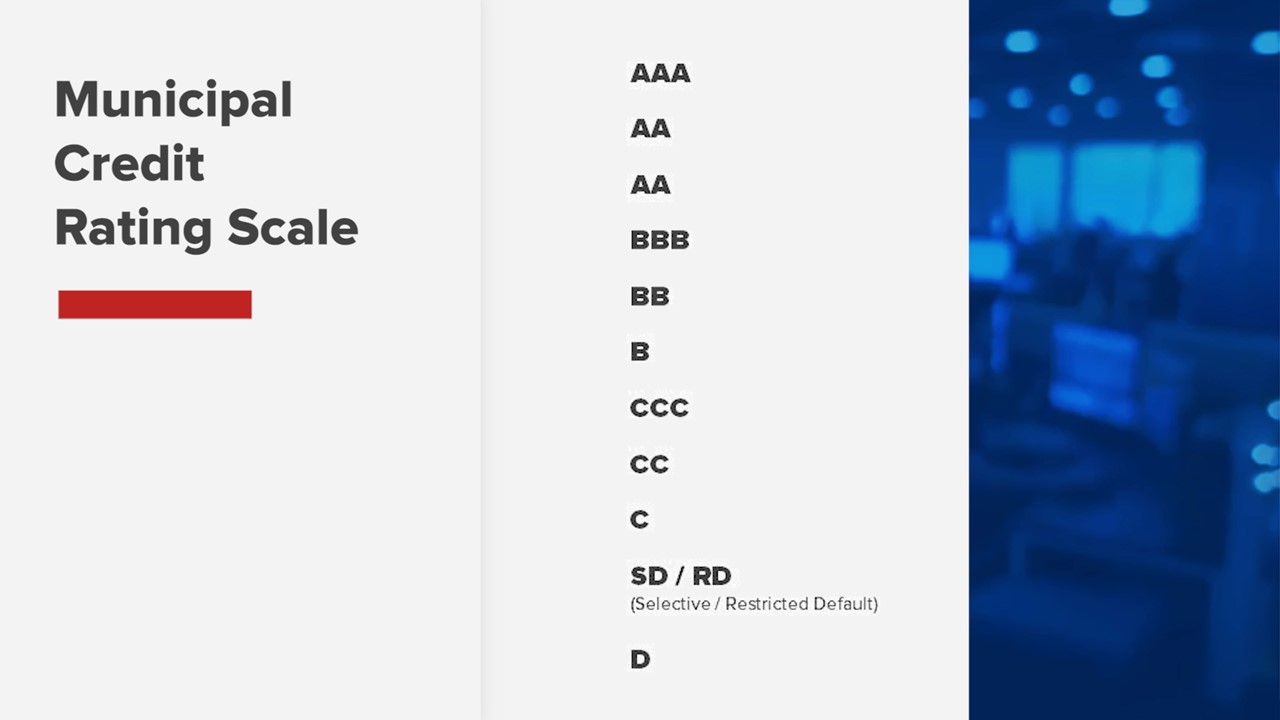

For example, certain credit rating agencies typically use a scale to categorize the creditworthiness of most issuers of municipal debt, as well as their debt offerings, with designations usually divided into investment-grade (‘AAA’-‘BBB’) and lower-quality (“BB’-‘C’) credits.

Interview with Tempus Advisors CEO Ed Grebeck (December 6, 2019)

Key Takeaways

The following are key takeaways from an interview between Interactive Brokers’ senior market analyst Steven Levine and Ed Grebeck, a strategist in the global debt markets and an expert in the bond Insurance and rating agency industries. Grebeck had given one of the earliest warnings to investors about the global financial crisis.

Investing in Stocks vs Bonds

- Stocks are typically riskier investments than fixed-income products.

- Investing in municipal bonds may be considered a form of capital preservation.

With equity investments, individual investors can do their own research into each individual company, with the hope of finding one of the gems that’s going to rapidly increase in value, and they also want to make sure that its value doesn’t collapse.

With respect to bonds, all they’re hoping to get is their principal investment back plus some interest over the period.

Credit Rating Agencies & Municipal Bond Guarantors

- Rating agencies conduct fundamental research on each individual bond.

- Bond guarantors ensure that investors will receive their principal and interest on a municipal security pursuant to the terms of the documentation of that issuance – should the municipal issuer default on its debt obligations.

- Bond insurers are ‘creatures’ of the rating agencies.

- Bond insurers still have very little capital relative to the municipal securities that they guaranty – similar to before the Credit Crunch of 2008-2009.

In the case of municipal bonds, rating agencies will usually look at items such as:

- the official statement issued by the state or municipality,

- other bond documentation, and

- the overall macro environment, as appropriate to the issuance.

They will seek to answer questions that may include:

- Is the state or city issuing the debt attracting profitable industries?

- What is the state of local employment or unemployment?

- Are people moving in or moving out?

In aggregating all these factors, the rating agency will assign a credit rating aligned with their scale.

Meanwhile, rating agencies will also assign a credit rating to bond insurers, with ‘AA’ currently the highest.

The ratings agencies set up the capital charges that influences the bond insurer’s investment-grade double-‘A’ rating based on what its investments are.

For example:

If the bond insurer’s guarantee is for an ‘A’-rated or double-‘A’ rated credit, they may allow pennies on the dollar of capital; but if they were to guarantee a double-‘B’ rated investment, that may require several dollars of capital for every hundred guaranteed.

Political & Governance Risks

- Political and governance risk in the municipal bond market has risen over the last 10-20 years with respect to U.S. state and local credits underscored by unfunded pension liabilities, among other factors.

- While rating agencies may capture some political and governance risks, there are many more issues that investors can only learn from reading local newspapers and by conducting street-level research.

- Political risk will not be found in the municipal issuer’s official statement.

For example:

New York State

In 1978-79, the New York State budget was roughly US$16bn, while in 2018-19, it mushroomed to around US$175bn. This represents a compound annual growth rate (CAGR) of more than 6% over that 40-year period.

Over the same timeframe, the state’s population has grown from about 17.5 million to 19.5 million – a CAGR of around 0.25%.

An investor would most likely be hard-pressed to identify any business that would grow as fast as New York State, while its economy is shrinking.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!