Stocks – FB,

Macro – SPY, DXY, DJT

MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN TSLA

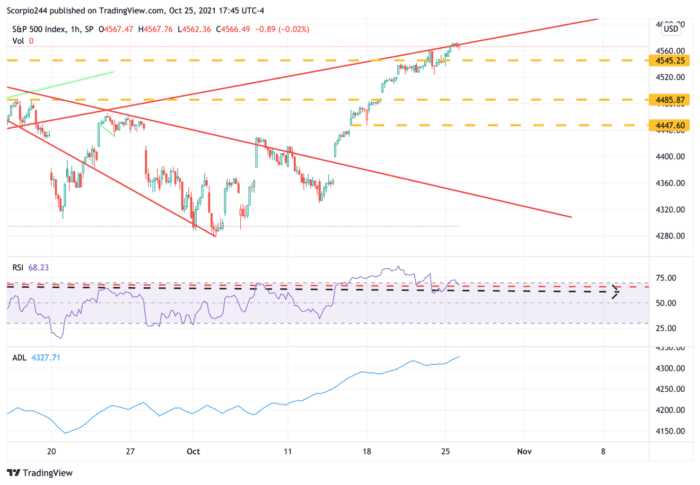

Stocks finished higher, with Tesla responsible for a good portion of the day’s gains, probably about half of the day’s gains on the S&P 500. So can Tesla rise another 12% tomorrow and put a bid in the market? I guess anything is possible. But there was a massive gamma squeeze in Tesla. The S&P 500 finished the day rising by 47 bps and is still respecting the trend line.

The advance/decline managed to push higher after months of nothing happening. It does confirm the recent high, and it is worth watching to see if it holds.

Dollar Index

The dollar index managed to push higher today, rising by around 20 bps to trade up to 93.80. It looks like the dollar index is trying to break out and move higher. This period of dollar consolidation has helped to push the S&P 500 higher. That may change later this week, especially with an ECB meeting on Thursday. It seems unlikely the ECB will be too eager to end QE or begin the process of raising rates anytime soon. With a Fed that is about ready to taper and likely to start raising rates in 2022, it seems the dollar index should continue to push.

Dow Transports

The Dow Transports went from being worst to first really quickly. The move higher seems to be an inflationary bet on transportation prices rising, I guess. I really couldn’t find a good reason for this move higher. It doesn’t seem to be tied to a resurgence in the US economy, that’s for sure. Interestingly, the increase in the DJT is coming as the Baltic Dry Index and the Nikkei fall. Now, the Transports and the Nikkei seem to have a lot in common, with the Nikkei leading the Transports by a couple of weeks. If the transports top out here, I would not be surprised one bit. I guess we will find out tomorrow with UPS.

Facebook (FB)

Facebook’s results weren’t stunning, missing on the top and beating on the bottom. Meanwhile, at the mid-point of the range, fourth-quarter revenue guidance was $32.75 billion, or 6% below the consensus of $34.9 billion. The company also noted investments in its AR/VR business would reduce 2021 operating profit by $10 billion. Surprisingly, the stock is trading up around 2%; I couldn’t explain why. It sounds like the changes to Apple’s iOS are hitting their business too, and a 6% miss on guidance is pretty big. Maybe it fills the gap up to $337 before resuming lower; I’m not sure. It sounds like dead money to me.

–

Originally Posted on October 25, 2021 – Stocks Rise On October 25, With The Dollar Not Far Behind

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

For specific platform feedback and suggestions, please submit it directly to our team using these instructions.

If you have an account-specific question or concern, please reach out to Client Services.

We encourage you to look through our FAQs before posting. Your question may already be covered!